FHA 232 Single Asset Mortgagor Guidelines Overview

Guidelines for FHA 232 Single Asset Mortgagor/Borrower Non-Recourse loans cover security interest, interest rates, full amortization, participant experience, regulatory agreements, replacement reserves, tenant income restrictions, and property eligibility criteria. Insurance requirements, loan positioning, licensing, and professional liability insurance are also detailed.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

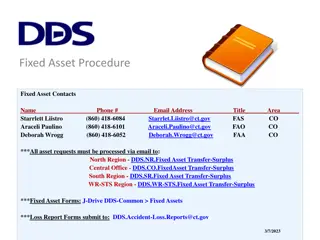

General Guidelines- Apply to all Types of 232 Single Asset Mortgagor/Borrower Non-Recourse: Property = Security Interest Rate: between Mortgagee/Mortgagor Loans Must Fully Amortize: No Balloons 2

General Guidelines- Apply to all Types of 232 (continued) Projects with Services for the Frail Elderly Nursing Homes/Intermediate Care Facilities Board and Care Homes Assisted Living Facilities Independent Living up to 25% of units Can be combination of the above Experience of Participants Participants must demonstrate that they are experienced in operating the type of facility insured. 3

General Guidelines- Apply to all Types of 232 (continued) Regulatory Agreement HUD/Mortgagor: Regulatory Agreement for Multifamily Projects If Lease, HUD/Leasee: Regulatory Agreement Nursing Homes 4

General Guidelines Replacement Reserves Required: New Const/Sub. Rehab: formula based Existing Construction: Based upon Property Capital Needs Assessment (PCNA) Initial Deposit: typically required (unless brand new) Annual Deposit requirement New PCNA required every 10 years 5

General Guidelines Our Insurance does not mandate any income restrictions on tenants there may be restrictions brought on by other sources (e.g. tax credits, TIF) Ineligible facilities: Those with founders fees, life care fees, etc. Those not meeting program intent: hospitals, clinics, diagnostic/treatment centers, halfway houses. Those not providing continuous protective oversight or minimum assistance required. Independent Living only up to 25% of units (30% with waiver) 6

General Guidelines Unless FHA Insured Loan is a Second Mortgage, the FHA Insured Loan must be in first position. Mortgage must be on real estate held: In fee simple, or Under a lease: 99+ years, which is renewable or Maturity date of FHA Mortgage + 10 years. 7

General Guidelines Professional Liability Insurance is required Notice 04-15 has details If owner/affiliate emerged from bankruptcy in past five years, not eligible. Licensing: regulated by State, city or political subdivision. Exception: Board and Care (own rules Keys Amendment) and Independent Units 8

Accounts Receivable Financing Housing Notice 08-09 Review by: OHP Underwriter A/R Punchlist OGC Closing Attorney A/R Punchlist 9

Deposit Account Control Agreement (DACA) Newly established for Lean Transactions Required on all new loans (new to portfolio and refinances) Protects HUD s interest in Operator s cash flow in case of Operator default Gives FHA Lender and Asset Management ability to direct funds to mortgage payment/Operator expenses while seeking Operator turnaround or replacement 10

Portfolio Reviews Required on Mid/Large Size Portfolios: Review of Portfolio as a whole prior to submittal of individual Firm Applications for UW review. Mortgagee Letter in process (also deals with Master Lease requirements) 12

Master Leases Risk Mitigation for HUD on portfolios Cherry Picking Problem: Default on one HUD facility owned/operated by individuals whose affiliates own/operate other HUD facilities. Generally required if 3 or more facilities under common ownership submitted in 18 month window. 13

Loan Types and FY 2012 Volume*: Section 223(a)(7): 52% of Total Section 232/223(f): 45% of Total Section 232 New Construction: 2% of Total Section 232 Substantial Rehabilitation: 1 Loan Section 241(a): 1% of Total Section 232 Blended Rate: 1 Loan Section 223(d): No Loans since FY 2011 Section 232(i): 1 Loan * Based upon Firm Commitments issued 15

Section 223(a)(7) Refinance of FHA-Insured Projects Only Any Section of the Act is eligible Term = Remaining Term of Existing Mortgage; May be Increased by 12 Years if Inures to Benefit of FHA Insurance Fund New PCNA only required if requesting term extension or if 10 years since latest PCNA. Can be combined with TPA 16

Section 223(a)(7), Continued 10 year payback benchmark (savings must cover costs of transaction in 10 years or less) Loan limited to original principal amount No cash out loan limited to loan payoff plus costs of transaction. Minimum DSCR of 1.11 Debt Service Coverage (1.05 Non Profits) 17

Section 232/223(f) Purchase or Refinance Max. Term = Lesser of 35 years or of Remaining Economic Life Project Must be > 3 Years Old: Additions smaller in size and units ok @ <3 years Critical repairs completed before endorsement; all others may be escrowed at 120% NOI used in UW generally in accordance with historical operations. 18

232/223(f), Continued No equity take out allowed On Purchase, mortgage limited to 85% (90% for N/P) of the total acquisition cost (with closing costs). Mortgage limited to 80% of Value (85% for N/P) Minimum 1.45 debt service coverage ratio (including MIP) 19

LTVs on Non-Profits Not-for-Profit Owners and Operators: To achieve the more liberal LTV benchmark, must demonstrate: A successful operating track record Significant project operating and management experience A solid financial track record 20

Section 232 NC and Sub. Rehab. Max. Term = Lesser of 40 years or of Remaining Economic Life Must comply with Davis Bacon Wage Rates Analysis of anticipated Initial Operating Deficit not mortgagable Possible debt service reserve (if applicable released only after meets UW DSCR) Generally looking for 20-30% equity 21

232 NC and Sub. Rehab. Loan Sizing Sizing Based Upon Lesser of: Minimum Debt Service Coverage Ratio with MIP 1.45 90% of Replacement Cost (95% for N/P) 75-80% of Value (80-85% for Non-profit) Sub. Rehab. also has a test of Existing Value plus a portion of rehabilitation cost 22

Substantial Rehab vs. 223(f) 221(d)(3)/(d)(4) and 232 Following 3.10 B. of MAP Guide Sub. Rehab if meets either 1 or 2 below: 1. Hard cost of rehab. exceeds 15% of after rehab value 2. 2 + major bldg. components substantially replaced (additions not counted) 223(f) if doesn t meet Sub. Rehab tests 23

Section 241(a) Supplemental Loans 2nd Mortgage on Existing FHA-Insured Loan For Financing Improvements/Additions Max. Term = Remaining term on 1st Mortgage If 1st Mortgage required Davis Bacon, Section 241a also will require Value of work must = or exceed cost 24

Section 232 Blended Rate Existing construction with a new construction addition. Davis Bacon wage apply Maximum term is a blended term (existing and new construction). Maximum LTV is a blended rate (existing and new construction). Minimum DSCR with MIP of 1.45 25

Section 223(d) Operating Loss Loans Second Mortgage on projects with an FHA Insured new construction loan that experienced losses that were covered by participants. Cover operating losses that occur during any 24 month period within 10 yrs. of completion Property must have reached sustaining occupancy and minimum DSCR of 1.45 applies Audit performed on losses 26

Section 223(i) Fire Safety Equipment Loans Second Mortgage on projects with an FHA Insured First Mortgage Generally covers sprinkler updates to meet the upcoming CMS sprinkler requirements 27

Insurance Upon Completion 1 Closing (Initial/Final Endorsement) Non-Critical Repairs done out of escrow within 12 months of closing. Rarely used option on New Construction, Substantial Rehabilitation see next slide 29

Insurance Upon Completion, Continued New Construction, Substantial Rehabilitation: Project underwritten and Firm Commitment issued Project constructed without FHA Insured Proceeds HUD inspects and Davis Bacon compliance After construction complete and cost certified, project closes. 30

Insured Advances Option on only NC, Sub. Rehab, and 241a 2 Closings (Initial & Final Endorsement) See next slide for description of this process. 31

Insured Advances, Process Underwritten and Firm Commitment Issued Project Initially Endorsed Project constructed with payouts from FHA Insured loan proceeds upon HUD inspection Project completed and cost certified Project Finally Endorsed Release of Initial Operating Deficit and Debt Service Reserve (if applicable) upon lease up. 32

Section 232 Fees: Application Fee: One time fee payable upon receipt of application 30 basis points on all loan types On Section 223a7 s, 50% of this fee refunded after closing Mortgage Insurance Premium: Payable each year there is an FHA insured Mortgage. Generally ranges from 55 basis points to 77 basis points of outstanding mortgage amount - depending upon the program (projects with LIHTC have lower MIP s also). 33

Section 232 Fees: Inspection Fees: One time fee payable at closing on certain loan types New Construction = 50 Basis Points of Loan Amount Section 223f: $30 per bed or 1% of cost of repairs (depending upon the amount of repairs). Transfer of Physical Assets Application Fee: $.50 per $1,000 of Original Mortgage Amount 34