Federal Work Opportunity Tax Credit Program Overview

The Work Opportunity Tax Credit (WOTC) is a federal hiring incentive program that rewards employers for hiring individuals from specific target demographics. Created in 1996, it encourages hiring individuals facing employment barriers, such as SNAP recipients and veterans. Employers can earn tax credits ranging from $2,400 to $9,600 per qualified employee. Learn how to participate, qualify, and claim credits through this program.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

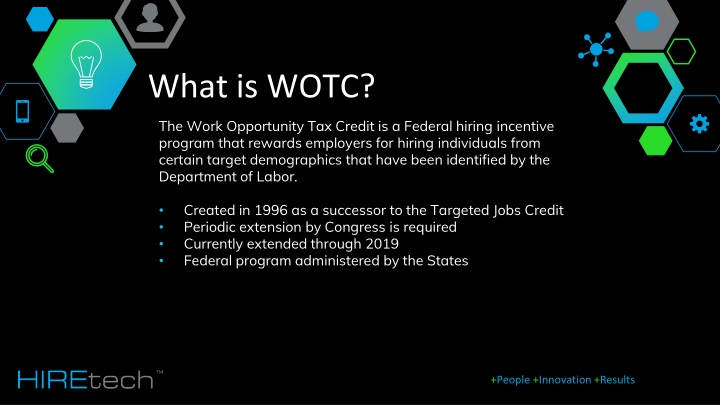

What is WOTC? The Work Opportunity Tax Credit is a Federal hiring incentive program that rewards employers for hiring individuals from certain target demographics that have been identified by the Department of Labor. Created in 1996 as a successor to the Targeted Jobs Credit Periodic extension by Congress is required Currently extended through 2019 Federal program administered by the States +People +Innovation +Results

Fact: SNAP (food stamp) recipients are the most commonly qualified category. Why WOTC? ROI Employers may earn up to $2,400-$9,600 per qualified employee. WOTC is a dollar for dollar reduction of your federal tax liability. Purpose The WOTC program encourages employers to hire and retain individuals from target groups facing significant barriers to employment. Availability The credit is available to tax paying businesses in the United States, U.S. Virgin Islands, and Puerto Rico. There is no limit on the number of employees that can be claimed for the credit. +People +Innovation +Results

The Program Employee must be screened for eligibility on or before the day the job offer is made. Employee must self-identify as part of a target group. Employer or their agent must submit Form 8850 (Pre-Screening Notice and Certification Request for the Work Opportunity Credit) and Form 9061 (Individual Characteristics Form) to the State Workforce Agency within 28 days of the job start date. Employees must meet a minimum of 120 hours worked to begin generating a credit. Credits carry forward 20 years or back one year. Can offset Alternative Minimum Tax (AMT). +People +Innovation +Results

Target Groups Veterans Food Stamp (SNAP) Recipients Temporary Assistance for Needy Families (TANF) Summer Youth Ex-Felons Vocational Rehabilitation Agency Referrals Long-Term Family Assistance Recipients Supplemental Security Income (SSI) Recipients Designated Community Residents (DCR) Long-Term Unemployed Most categories have a maximum credit amount of $2,400 per certified hire. The maximum tax credit available for qualified veterans is $9,600 per new hire. +People +Innovation +Results

Maximum Credits CATEGORY MAX. CREDIT AVAILABLE SNAP (food stamp) Recipient $2,400 Disabled Veteran Hired within 1 year of leaving service Unemployed for at least 6 months $4,800 $9,600 Unemployed Veterans Unemployed for at least 4 weeks Unemployed for at least 6 months $2,400 $5,600 Long-Term TANF $9,000 All other WOTC categories $2,400 +People +Innovation +Results

Income and Employment Verification Obtaining a mortgage Buying a car Renting an apartment Applying for public assistance Applying for a credit card All of these events require income/wage and employment verifications. +People +Innovation +Results

Getting Started The sign-up process is simple, and we can get your program up and running the same day so that you can start screening for WOTC right away! We work on a success-based fee structure! Here s what we need: Signed Agreement POA Used to talk to the state agencies on your behalf. Location Information Sheet We upload your location(s) into our system and get them set up for screening. And that s it. Once you send us your forms, HIREtech will handle the rest. Our implementation team immediately begins your account set-up and manages the rollout process from start to finish. No introductory charges or hidden fees. +People +Innovation +Results

Pricing and Fees WOTC WAGEverify I-9/E-Verify UCM 15% of certified credits No Cost Starting at $9 per * Starting at $35/claim * * Fees may be lower on case by case basis +People +Innovation +Results