Evolution of Valuation Perspectives: Looking Beyond P/E Multiples

Evolution of valuation perspectives over time, moving from focusing solely on P/E multiples to considering factors like true earning power, margin fluctuations, and growth potentials. Understanding why looking beyond P/E multiples is crucial in assessing business value accurately.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Looking beyond P/E Multiple Evolution of my views on valuation

Thinking on Valuation- has changed/evolved over time Started as deep value guy- 2010-12- leaning towards Graham style It worked well as there were such bargains available in market- at the same time realized that in Indian market, there are more value traps than bargains Started appreciating growth and business quality- however was very reluctant to pay- price anchoring bias- Growth at reasonable price was the flavour during 2011-2014 Cera/Amara Raja/Atul Auto/Fluidomat stuck to buying decent quality businesses at reasonable price- P/E multiples of 15 was the upper limit As I spent more time in market, read and understood about how great businesses create wealth over time- started appreciating importance of buying great businesses AND pay fair price for the same- ENIL/MCX/Ajanta- still stuck in thinking ONLY through P/E multiple- though was willing to pay P/E of 20-25 times for high quality business However, over last year, the realization has dawned that it is important to look beyond P/E multiples- not to miss out on some great opportunities

Why should we look beyond P/E multiples One of the key reason why P/E becomes less relevant is because E does not represent the true earning power over time Why would E may not represent true earning power During business lifecycles businesses do go through years where margins fluctuate Businesses need to invest in single shot. While benefits from the investment accrue over period of time The business model- is fixed cost heavy- while the demand/top-line may fluctuate based on external environment In few cases, future business earnings can grow exponentially because of the small base with respect to extremely large opportunity size When business models are in transition. Where past may not mirror the future When earnings are not present or too little to be meaningful

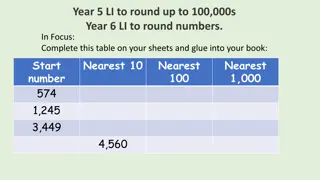

Example- Margin fluctuation- current margins may not reflect normalized margins Jubilant food-works Jubilant Foodowrks 2012 2013 2014 2015 2016 SSG(%) 30 16.2 1.6 0.05 3.2 Key thing to figure out is what is the normalized margin- on steady state basis peer set analysis/similar business model- margin profile GM(%) 74.32 73.84 73.89 74.78 76.21 EBIDTA( %) 18.07 17.09 14.37 12.19 11.37 Dominos USA 2012 2013 2014 2015 2016 Why/How the margin trajectory may change? And which are the key variables that will trigger the change? SSG(%) 3.1 5.4 7.5 12 10.5 EBIDTA( %) 16.8 17.4 17.3 18.3 18.4 Dominos Australia 2012 2013 2014 2015 2016 On normalized margin basis- how does the valuation look? SSG 6.3 11.3 14.8 EBIDTA 18.2 19 16.2 18.2 19.3

Disproportionate upfront investment is done..cost of which passes through P&L while the revenue is yet to be realized This happens in business models where capacities have to be created ahead of demand which requires large upfront investment Example of ENIL P/E of 83 on TTM basis In 2015- had more than 550 Crore of cash on balance sheet- earning 35- 40 crore of interest income Not only such business models incur large capex, but also it incurs substantial operating cost which is disproportionate to incremental revenue generation Phase III bidding and renewal of existing license meant incurring cape of 700+ crore on gross block of 53 crore 2015 2016 2017 % Change Moreover, if significant part of capex is funded through debt, even interest cost will dampen the bottom line Revenue from Operations 439 509 557 27% Depreciation 33 36 54 63% Advt/Mktg 76 100 130 71% Employee 83 94 105 27% Interest (Net) -32 -25 -6 81%

Fixed cost heavy business model- combined with soft demand leads to negative operating leverage There are many business models where inherently majority of operating expenses are fixed cost Higher the fixed cost in the operating expense, higher the operating leverage Operating leverage is a double edged sword- it cut both ways Any reduction in top line will have magnified impact on bottom line however the assessment is to be made, whether the demand drop is transient or not Examples: Typically most of high gross margin businesses fall into this category ENIL, MCX, Wonderla Holidays Case 1: 60% operating expense is fixed Case 2: 70% operating expense is fixed Base Case 10% drop in topline 20% drop in topline Base Case 10% drop in topline 20% drop in topline 100 22.5 90 20.25 80 18 Revenue 100 30 90 27 80 24 Revenue Operating expense- variable Operating expense- variable 52.5 52.5 52.5 Operating expense- fixed 45 45 45 Operating expense- fixed -31% -46.5% -39% -28% 25 17.25 9.5 EBIDTA 25 18 11 EBIDTA

When revenue base is too small compared to opportunity size AND the business model has lot of entry barriers and limited competition First of all, not all situations where revenue base is small and opportunity size is large, P/E is irrelevant. Two critical ingredient for P/E to be less relevant are High entry barrier to the business Limited competition Can we find such examples in Indian context? Repro-Ingram tie up Ingram is the largest aggregator of books in the world with 14 million titles all these titles will be available for Repro for putting up on market place model Total size of online book market is 800-1000 Crore- 2.5-3% of physical book market and can reach 10% of total book market size- while the book market itself in India is growing at 20% CAGR- Total potential opportunity can expand to 10-15 times from here on. Repro- the largest book printer in India- has perfected one book model where they print- one book at a time and deliver to end customer within 48 hrs With access to large set of title and one-book model- there is virtually no competition It has disrupted existing book distribution model by eliminating inventory/stock-out cost while zero returns for publishers Works on negative working capital

When business models are in transition- both quality and quantum of earning may change dramatically There are many variants of business model transition that can lead to disproportionate earning growth and improve the quality of earning Symphony: transition to asset light- single product model Moving towards value added products Garware Wallropes: Margin improved from 8% to 15% from 2014-2017 Navin fluorine: margins improved from 12% range to 25% from 2008 to 2011 In all the above cases and many more Had one understood the transition right and had even paid up significantly above historical average valuation, one would have made disproportionate money

When businesses go through troubled times, especially due to industry/economic headwinds, In many cases the there is no earning present. However, that may not represent the earning power of the company This is valid for peculiar situations and is not true for all the businesses going through down cycles At first it is important to choose quality business that has the capacity (technological/product/know how/industry standing etc)to bounce back when cycle turns and has the tenacity (low debt, unutilized capacity, strong cash flows) and management has run a tight ship during the troubled times Key questions to ask what was the earning power when the business was not facing down cycle? When the cycle turns, will the earning power revert to earlier normalized level and why? Will they fall prey to same cycle again or are they doing something different to come out better next time? TD Power Systems-?