Efficient Working Capital Management in Businesses

Working capital management involves strategically balancing current assets and liabilities to ensure solvency and maximize asset returns. The main goals include optimizing liquidity, profitability, and resource utilization. Liquidity management is crucial for meeting short-term obligations, and sources of liquidity include cash balances, short-term financing, and effective cash flow management.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Chapter 15 Working Capital Management (WCM) IMAS 1

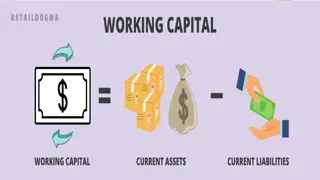

Working Capital Overview Working capital is a firm s investment in short-term assets--cash, marketable securities, inventory, and accounts receivable. Net working capital is current assets minus current liabilities. WC management is the management of all aspects of both current assets and current liabilities, to minimise the risk of insolvency while maximising the return on assets. Investing in WC has a cost which can either be expressed as: the cost of funding it, or the opportunity cost ** A company s ideal situation is to have what they consider sufficient working capital IMAS 2

Objective of WC The main objective of working capital management is to get the balance of current assets and current liabilities right Liquidity Profitability Low inventory Ensure sales with high stocks Trade discounts allowed High Payables Extend credit period Low receivables IMAS 3

WC Goals Adequate cash flow for operations Most productive use of resources Profitability Vs Liquidity IMAS 4

Managing and measuring Liquidity Liquidity is the ability of the company to satisfy its short-term obligations using assets that are readily converted into cash. Liquidity management is the ability of the company to generate cash when and where needed. Liquidity management requires addressing drags and pulls on liquidity. Drags on liquidity are forces that delay the collection of cash, such as slow payments by customers and obsolete inventory. Pulls on liquidity are decisions that result in paying cash too soon, such as paying trade credit early or a bank reducing a line of credit. IMAS 5

Sources of liquidity Primary sources of liquidity Ready cash balances (cash and cash equivalents) Short-term funds (short-term financing, such as trade credit and bank loans) Cash flow management (for example, getting customers payments deposited quickly) IMAS 6

Current assets and current liabilities components Current assets Current liabilities Inventory Payables Receivables Overdraft Marketable securities Cash IMAS 7

Examples of Marketable Securities Treasury Bills Short-term government notes issued at a discount with principal repaid at maturity Commercial Paper Short-term unsecured promissory notes issued by corporations with good credit Bankers Acceptances Short-term promissory notes issued by a firm and accepted (or guaranteed) by a bank IMAS 8

Liquidity Vs Profitability Discuss the advantages of keeping the following components of working capital high: Inventory Receivables Cash Current liabilities IMAS 9

Liquidity Vs Profitability Discuss the advantages of keeping the following components of working capital low: Inventory Receivables Cash Current liabilities IMAS 10

Operating cycle and the cash cycle Operating cycle Is the length of time it takes to acquire inventory, sell it, and collect the receivables resulting from the sale (describes how product moves through the current asset account) Inventory period + Accounts receivable period It describes how a product moves through the current asset accounts. It begins life as inventory, it is converted to receivables when it is sold, and it finally converted to cash when we collect the sale Cash Cycle Is the number of days that pass until we collect the cash from sale, measured from when we actually pay for the inventory Operating cycle payables period IMAS 11

Cash conversion cycle The operating and cash conversion cycle can be visualized as shown below: IMAS 12

Factors affecting length of working capital Liquidity versus profitability Management efficiency Industry norms Activity/sales Stays constant days in cycle Increase sales **The optimum level of working capital is the amount that results in no idle cash or unused inventory, but does not put a strain on liquid resources increase in proportion to: Length of cycle Funds needed increase Stays constant IMAS 13

Level of working capital is affected by the following factors: Nature of business (manufacturing VS service entities) Uncertainty in supplier delivery Overall activity Entity s credit policy Length of working capital cycle Credit policy of suppliers IMAS 14

Working Capital Policy Firms must set policy on following issues: How much working capital is used Extent to which working capital is supported by short- vs. long-term financing How each component of working capital is managed The nature/source of any short-term financing used IMAS 15

Short-Term vs. Long-Term Financing Short-term financing Cheap but risk Cheap short-term rates generally lower than long-term rates Risky because you are continually entering marketplace to borrow Borrower will face changing conditions (ex; higher interest rates and tight money) Long-term financing Safe but expensive Safe you can secure the required capital Expensive long-term rates generally higher than short-term rates IMAS 16

Permanent and Temporary Working Capital Working capital is permanent to the extent that it supports constant or minimum level of sales Temporary working capital supports seasonal peaks in business Temporary investments in assets include current assets that will be liquidated and not replaced within the current year. IMAS 18

Maturity Matching Principle Maturity (due date) of financing should roughly match duration (life) of asset being financed Then financing /asset combination becomes self-liquidating Cash inflows from asset can be used to pay off loan IMAS 19

Financing Net Working Capital According to maturity matching principle Temporary (seasonal) should be financed with short-term borrowing Permanent working capital should be financed with long-term sources, such as long-term debt and/or equity In practice, firms may use more or less short-term funds to finance working capital IMAS 20

Overtrading Overtrading a company is growing its sales faster than it can finance them ( transacting more than the firm s working capital can normally sustain) Typical indicators Rapid increase in turnover Rapid increase in the volume of current assets Most of the increase in assets being financed by credit A dramatic drop in liquidity rations Potential solutions Raising more long term capital Slowing down growth to reduce increase in working capital Improving working capital IMAS 23

Ratios Liquidity Ratios Current ratio Quick ratio IMAS 24

Efficiency ratios Inventory days material days Raw Receivables days days WIP Payable days IMAS 25

Turnover ratios Inventory turnover Discuss if the turnover ratios are useful? IMAS 26

Operating cycle and firms organisation chart It is useful to understand people involved in managing working capital before we go into further detail. Always bear in mind the potential conflict if managers concentrate only on one part of the picture Cash manager Marketing manager Production manager Financial manager Credit manager Purchasing manager Payables manager IMAS 27