Delhi High Court Ruling on Section 153C of Income tax act

Discover the Delhi High Court's crucial ruling on Section 153C of the Income Tax Act, emphasizing the necessity of possessing unearthed material for tax assessments on non-searched individuals. Stay informed on the legal intricacies of tax law interpretations.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

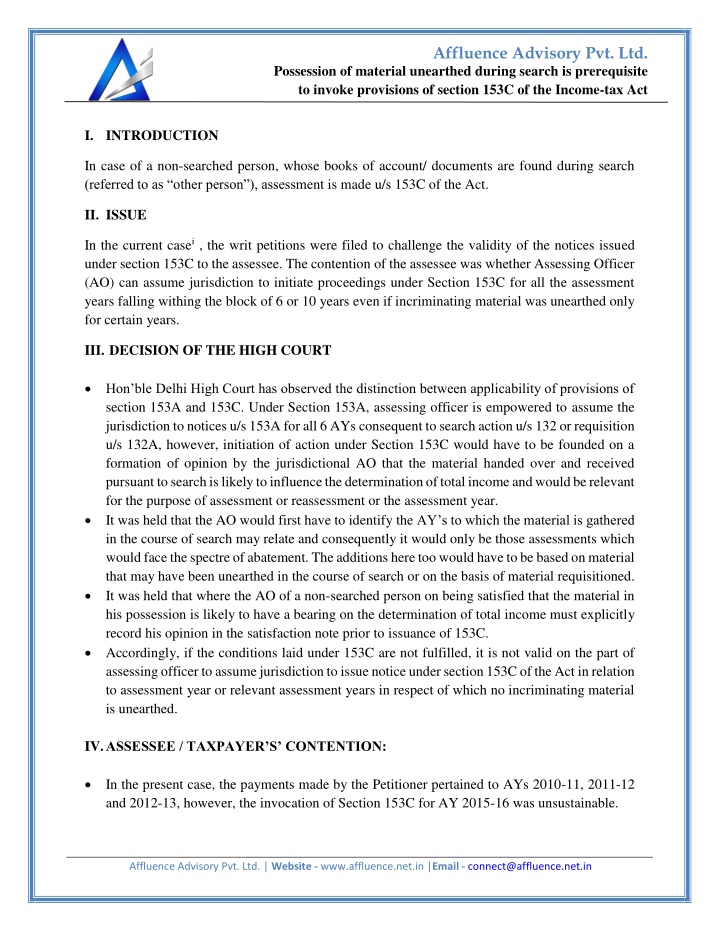

Affluence Advisory Pvt. Ltd. Possession of material unearthed during search is prerequisite to invoke provisions of section 153C of the Income-tax Act I.INTRODUCTION In case of a non-searched person, whose books of account/ documents are found during search (referred to as other person ), assessment is made u/s 153C of the Act. II.ISSUE In the current casei , the writ petitions were filed to challenge the validity of the notices issued under section 153C to the assessee. The contention of the assessee was whether Assessing Officer (AO) can assume jurisdiction to initiate proceedings under Section 153C for all the assessment years falling withing the block of 6 or 10 years even if incriminating material was unearthed only for certain years. III. DECISION OF THE HIGH COURT Hon ble Delhi High Court has observed the distinction between applicability of provisions of section 153A and 153C. Under Section 153A, assessing officer is empowered to assume the jurisdiction to notices u/s 153A for all 6 AYs consequent to search action u/s 132 or requisition u/s 132A, however, initiation of action under Section 153C would have to be founded on a formation of opinion by the jurisdictional AO that the material handed over and received pursuant to search is likely to influence the determination of total income and would be relevant for the purpose of assessment or reassessment or the assessment year. It was held that the AO would first have to identify the AY s to which the material is gathered in the course of search may relate and consequently it would only be those assessments which would face the spectre of abatement. The additions here too would have to be based on material that may have been unearthed in the course of search or on the basis of material requisitioned. It was held that where the AO of a non-searched person on being satisfied that the material in his possession is likely to have a bearing on the determination of total income must explicitly record his opinion in the satisfaction note prior to issuance of 153C. Accordingly, if the conditions laid under 153C are not fulfilled, it is not valid on the part of assessing officer to assume jurisdiction to issue notice under section 153C of the Act in relation to assessment year or relevant assessment years in respect of which no incriminating material is unearthed. IV.ASSESSEE / TAXPAYER S CONTENTION: In the present case, the payments made by the Petitioner pertained to AYs 2010-11, 2011-12 and 2012-13, however, the invocation of Section 153C for AY 2015-16 was unsustainable. Affluence Advisory Pvt. Ltd. | Website - www.affluence.net.in |Email - connect@affluence.net.in

Affluence Advisory Pvt. Ltd. Possession of material unearthed during search is prerequisite to invoke provisions of section 153C of the Income-tax Act The Petitioners submitted that reopening of all AYs which may form a part of the block of six or ten AYs would not be justified merely on the grounds of incriminating material having been discovered pertaining to a particular AY. The Petitioners placed reliance on the decision in the case of Commissioner of Income Tax v. Sinhgad Technical Education Society reported at [(2018) 11 SCC 490] wherein the Hon ble Supreme Court affirmed the view of the ITAT and Hon ble High Court and held as follows: 18. We, thus find that the ITAT the ITAT rightly permitted the additional ground to be raised and correctly dealt with the same ground on merits as well. Order of High Court affirming this view of the tribunal is, therefore, without any blemish. Before us, it was argued by the respondent that the notice in respect of Assessment year 2000-01 and 2001- 02 was time barred. However, in view of our aforementioned findings, it is not necessary to enter into this controversy/ Reliance was also placed on various decisions that laid emphasis on material gathered in the course of search impacting the computation of income for each particular AY as being determinative of the question which stands posited. Reliance was placed on the decision in case of Principal Commissioner of Income Tax, Central 3 v. Abhisar Buildwell Private Limited reported at (2024) 2 SCC 433 wherein the Supreme Court had affirmed the judgment in the case of Kabul Chawla Kabul Chawla and Saumya Constructions Private Limited wherein it was held that no addition can be made in respect of completed assessment in absence of any incriminating material. It was submitted that given the decision in the aforementioned cases, in the absence of any incriminating material having been unearthed in the search, it would be impermissible for the respondents to initiate action under Section 153C for the Six preceding AYs preceding the year of search or for that matter, the relevant assessment year. It was submitted that merely because Section 153C empowers or enables the respondents to reopen a block of ten AYs , the same would not justify that recourse being adopted to in the absence of incriminating material that may have a bearing on the determination of the total income of such other person . V.REVENUE S CONTENTION: It was submitted that material found with respect to a particular AY out of the block of six or ten AYs would be sufficient to commence action under Section 153C and assess or reassess income for entire block of six or ten AYs , as the case may be. Affluence Advisory Pvt. Ltd. | Website - www.affluence.net.in |Email - connect@affluence.net.in

Affluence Advisory Pvt. Ltd. Possession of material unearthed during search is prerequisite to invoke provisions of section 153C of the Income-tax Act It was submitted that material found in the course of the search need not be required specifically tied down to each of the Six AYs or the relevant assessment year. Disclaimer:This article provides general information existing at the time of preparation and we take no responsibility to update it with the subsequent changes in the law. The article is intended as a news update and Affluence Advisory neither assumes nor accepts any responsibility for any loss arising to any person acting or refraining from acting as a result of any material contained in this article. It is recommended that professional advice be taken based on specific facts and circumstances. This article does not substitute the need to refer to the original pronouncement iHon ble Delhi High court in the case of Saksham Commodities Ltd. vs. ITO W.P. (C) 1459/2024 & CM Appl 6031/2024 & Ors. Affluence Advisory Pvt. Ltd. | Website - www.affluence.net.in |Email - connect@affluence.net.in