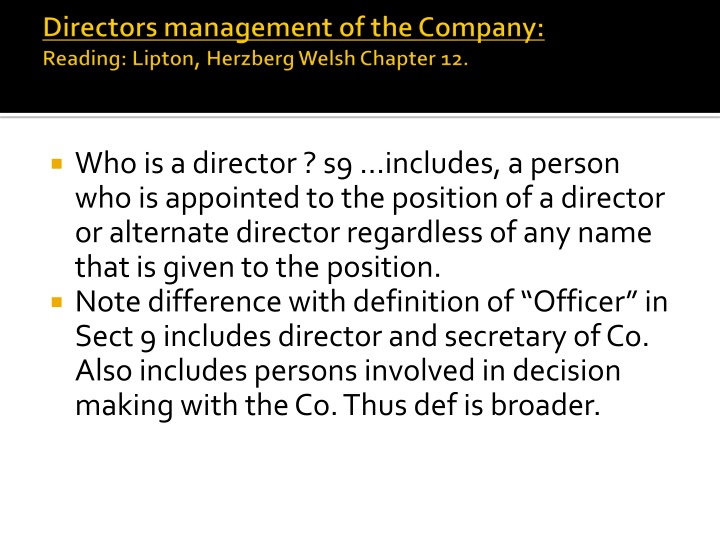

Definition of Director and Related Concepts

A director, as per section 9, is a person appointed to the position regardless of the title, with broad involvement in decision-making. This includes de-facto directors and shadow directors, as illustrated in legal cases. Boards hold the power of management under section 198A, overriding shareholder decisions. The appointment process and roles of directors, managing directors, and company secretaries are outlined.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Who is a director ? s9 includes, a person who is appointed to the position of a director or alternate director regardless of any name that is given to the position. Note difference with definition of Officer in Sect 9 includes director and secretary of Co. Also includes persons involved in decision making with the Co. Thus def is broader.

De-Facto Director: person exercises management functions thought not validly appointed: See NSW v Drysdale [1978] 22 ALR 161 Shadow Directors: their instructions are normally followed by other officer of Co; MistnormP/L v Yasseen[1996] 14 ACLC 1387 See recent case of: Shafronv ASIC [2012] HCA 18 Pl argued that he was acting as Co General counsel he was not an officer (Co Secretary). HC rejected this argument. Also see: Grimaldiv Chameleon Mining NL (No2) [2012] FCFC 6. Standard Chartered Bank of Australia v Antico[1995] 38 NSWLR 290. The case shows that Co may be a shadow director, despite the fact that a Co is not permitted to act as a formally appointed director.

Boards Power of Management s198A - (1) The business of a company is to be managed by or under the direction of the directors. (2) The directors may exercise all the powers of the company except any powers that this Act or the company's constitution (if any) requires the company to exercise in general meeting. ASX Corp Governance Principles see pg265 LH Listing Rules

Shareholder cannot override Board management decisions: Automatic Self Cleansing Filter Syndicate Co v Cuninghame [1906] 2 Ch34 John Shaw & Sons (Salford) Ltd v Shaw [1935] 2 KB 113 NRMA v Parker [1986] 4 ACLC 609 Replaceable rules: Statutory powers that can be exercised by directors. Pls see pages 266-267 of LH -s198A -management powers of directors -s198B -negotiable instruments -s198C -managing director -s198D & s190 -delegation to committees

appointment on registration, s120, 117(5) subsequent appointment -201G : shareholder s resoin GM Who May be Appointed as a Director? S201A -Proprietary Co : Min 1 must reside in Australia, Public : Min 2. s201B(1) : natural person s201C

Managing director -s201J Executive and Non executive directors - AIG Aust Ltd v Jaques [2014] VSCA 332 Alternate directors s201K(1) Nominee directors : Independent directors ASX good corp governance guidelines Casual Vacancy -s201H S201E Company Secretary s204A(1)

Offence for disqualified person to manage a corp s206A Meaning of Managing a Co Convicted persons s206B(1) Bankrupts s206B(3) Court Ordered Disqualification Breach of civil penalty provisions s206C Insolvency and Non-payment of Debts s206D Repeated Breaches of Corp Law s206E Sect 206EE person disqualified O/S Disqualification by the ASIC s206F : if previously an officer of 2 or more failed cos Leave to Manage the Co following disqualification-s206G: For principles applied by courts in granting leave see decision of Lindgren J, in Adams v ASIC [2003] 46 ACSR68 If s206A is breached person commits an offence and may be liable for Co s liabilities under s588Z. See Nilant v Shenton [2001] WASC 421

Re: George Newman & Co [1895] 1 Ch 674 Replaceable Rules see s202A -remuneration to be paid to directors as determined by Co resolution. Directors also may have a right to paid travelling and other expenses s202A(2). In single director Proprietary Co s See s202C

Disclosure of Directors Remuneration: Unlisted Cos : AASB Ruling 124 Listed Co s AASB Ruling 1017 AASB Ruling 1034 s300 s300A (from 1.7.04) to cover remuneration information of officers within Co group (ss4). The remuneration report must be part of the directors report:s300A(1A).

Contents of Remuneration report: Corporations Legislation Amendment (Simpler Regulatory System) Act 2007 amended Sect 300A to incorporate the provisions of AASB Ruling 124: -discussion of board policy in determining remuneration; -Relationship between policy and Co performance -whether remuneration is dependant on meeting performance conditions Accounting Standard AASB 1046 bring disclosure of officers remuneration in line with international standards AASB 1046 also requires disclosure of loans to directors in excess of $100,000. Under s250SA in a listed Co the chairman must also allow a reasonable opportunity ask questions or make comments about the remuneration report (of directors & others). s202B members right to seek details of remuneration

*Directors to allow shareholders to vote on a non-binding resolution to adopt the remuneration report s250R(2). Vote on the resolution is advisory only s250R(3). Note further: Corporations Amendment (Improving Accountability on Director and Executive Remuneration) Act 2011from 1.7.2011 introduced Div 9, Section 250U to 250Y. Two strikes policy. 1. If 25% or more of votes at the AGM are against the remuneration report in 1styear. 2. In the following year Board respond to no vote and explain if no response. In 2nd consecutive year if 25% more again vote against remuneration report then: a further meeting can be held within 90 days where a further vote will be put removing the existing directors and making them stand for relection.-s250V-250W Listing rule3.1 remuneration of CEO requiring disclosure as part of continuous disclosure regime

s200A-200J S200A benefits given on retirement. S200B retirement benefits given require shareholder approval. See Renshaw v Queensland Mining Corp Ltd [2014] FCAFC 172. Retirement benefit given without shareholder approval in breach of s200B. Under s200F certain exempt payments require shareholder approval is the payments exceeds value of 1 years remuneration based on formula under s200F(3) Under s200G no approval needed for lump sum or pension payments Strict liability for breach of s200B

See s207-230 generally Sect 208: Public Co s must get shareholder approval before they can give a financial benefit to a related party. Specific Benefits: s211-s216 Benefits approved by shareholders: s217-227 Consequences of breach of loans provisions.

S203A- Director can resign by giving notice s203C-removal of director in a proprietary Co. s203D -removal of director in a Public Co See Scottish & Colonial Ltd v Australian Power & Gas Co Ltd [2007] NSWSC 1266, Bryson J held that the requirements of section 203D were mandatory. Atlas Steels P/L v Atlas Steels P/L [1948] 49 RS (NSW) 157 Southern Foundries Ltd Vs Shirlaw [1940] AC 701

s286 -s291 set out the Cos obligations to keep and maintain proper financial records. s292 -sets out which bodies must prepare and maintain financial & directors reports s293 -sets out where shareholders in small proprietary Co can request preparation of financial statements. s295 -sets out contents of financial reports. ss(4) deals with directors declaration. s295A In ASIC v Healey [2011] FCA 717 (27 June 2011, Middleton J) the Centro Properties Case : the court found the directors had failed to request Declaration from CEO and CFO that complied with s295A and failed to meet requirements of section.

s295A In ASIC v Healey [2011] FCA 717 (27 June 2011, Middleton J) Directors breached their duty of care because the had failed to comply with , s180(1), s601FD(3) and s344

The Corporations Act provides that listed Public Cos, that is, disclosing entities , are subject to an enhanced disclosure regime which requires continuous disclosure of information. This involves a systematic periodic financial reporting regime. Disclosing entities are required to prepare and lodge half year financial reports as well as end of year reports. See s Pt 1.2A, ss 111AA-111AX on disclosing entity s See s674-678 on continuous disclosure requirement Also see ASX Listing Rule 4.10 Jubilee Mines NL v Riley [2009] WASCA 62 James Hardie Industries NV v ASIC [2010] NSWSCA 332

Financial Reporting Council Australian Accounting Standards Board s296 - sets out requirement to comply with proper accounting standards and regulations. s297 - all financial statements must give a true and fair view of the financial position of the Co. s298 - annual Directors report. s299 set out information to be contained in directors annual report. s300 set out specific information to be contained in the directors report. s300A - specific information of directors reports of listed Co s. s304 - compliance with accounting standards. s205 requirements that accounts give a true and fair view. s307 -s313 sets out audit requirements in respect of Co s financial statements. Annual Reports to Members and Lodgement with ASIC s314 -318 deals with giving financial statements to members. s319 requires annual reports to be lodged with the ASIC

Directors are in a Fiduciary Relationship to the Co Duties apply to directors and other officers of the Co sect 9. Directors Duties: Common Law duties: *Duty to act bona fide in the interests of the company Duty to exercise power for a proper purpose Duty to retain discretion Duty to avoid conflicts of interest *Duty of care skill & diligence

Statutory Duties S180 -care and diligence S181 -duty to act in good faith Duty to exercise power for a proper purpose S182 -improper use of position S183 -improper use of information Disclosure of directors interests -191-194 Sect 588G Director s liability for Insolvent Trading

Accountability and control mechanisms that a Co is subjected to. The accountability and control factors help set and determine objectives and policy of Co, how to implement and achieve these objectives, monitor performance and assess risk. ASX Listing Rule 4.10.3 requires listed Co s to state in their annual report the extent to which they have followed the Principles of Good Corp Governance and best Practice Recommendations. If the Co has not followed these principles they are required to explain to shareholders WHY? Corporate Governance Principles and Recommendations of 2007 which come into affect in 2008 replace the 2003 Good Corporate Governance Guidelines but still retain the comply or explain approach or if not why not approach . August 2013 a draft proposed 3rdedition of the Corporate Governance Principles and Recommendations See ASX website or Lipton Note that the OECD, EU, NYSX, UK Combined Code and Australian Institute of Co directors have all adopted corporate governance principles.

Stakeholder Theory: In whose interest should the directors act? Common Law duty; and Statutory Duty to Act in Good Faith and for a Proper Purpose. -s181 directors and officers must exercise their powers and discharge their duties in good faith and in the best interest of the Co and for a proper purpose Re Smith v Fawcett Ltd [1942] 1 All ER 542

Duty is owed to the Co: So Co may sue for breach Duty owed to shareholders; shareholder may sue with leave of court under s236 Directors must genuinely believe that they are acting in the best interest of the Co; An honest belief of acting in the best interest of the Co (subjective) is required as well as an objective test; Breaches duty if they act in a way that no reasonable director would say is in the best interest of the Co (objective test); Eg, takeover bid motivated by personal interest or such like and if no reasonable director would engage in that course of action; then director complies with subjective test but fails objective test; The onus is on the person alleging the breach

Acting in best interest of the Co as a whole means acting in the interests of shareholders as a collective group: See Greenhalgh v ArderneCinemas Ltd [1951] Ch 286 Darvall v North Sydney Brick & Tile Co [1989] 16 NSWLR 260 Can include acting in best interest of present and future shareholder Individual Shareholders: generally no duty to act for individual shareholders; though this duty may arise in special circumstances such as in a family Co or a particular takeover situation: See Percival v Wright [1902] 2 Ch 421 Coleman v Myers [1977] 2 NZLR 225 Galavanics v Brunninghausen [1999] 17 ACLC 1247: Handley JA, A fiduciary duty owed by directors to the shareholders where there are negotiations for a takeover ..would require the directors to loyally promote the joint interests of all shareholder Different Classes of Shareholders Mills Vs Mills [1938] 60 CLR 150

Duty to act in interest of creditors?When Co is solvent? When Co is insolvent? Duty to act in interest of Employees; See Park v Dailey News [1962] CH 927; Co made redundancy payments to employees. S/holders sought to stop payment. As payment was to employees leaving Co, the payment was not in the interest of Co thus invalid. Director Duties and Co Social Responsibility

Nominee Directors Scottish Co-operative Wholesale Society Ltd v Meyer [1958] 3 All ER 66 Piercy Vs Mills & Co [1920] 1 Ch 77 Duties affected by the Company Constitution Levin v Clark [1962] NSWLR 686

In Interest of Company Groups Walker Vs Wimborne [1976] 137 CLR Mernda Developments Pty Ltd v Rambaldi [2011] VSCA 392 Eqiticorp Finance (in liq) v Bank of New Zealand [1993] 32 Section 187 sets out when a director of a wholly owned subsidiary will have to act in best interest of subsidiary

Statutory Duty to exercise power for a Proper Purpose. -s181 Courts take into account two matters: 1. the objective purpose for which the power was granted; 2. the purpose that actually motivated the exercise of power - Directors honest belief may be irrelevant The duty and its application often arises in the following situations: Issue of share Use of co funds for improper purpose like director seeking re-election Refusal to register a transfer of shares Permanent Building Society v Wheeler [1994] 12 ACLC 674

The Issue of Shares to Maintain Control of Co Breach may occur where share issue is to; 1. maintain control of Co 2. defeat a takeover bid; 3. create or destroy the voting power of a majority shareholders. See: Piercy v Mills [1920] 1 Ch 77 Ngurli Ltd Vs McCann [1954] 90 CLR 425 Mills v Mills [1938] 60 CLR 150 Whitehouse Vs Carlton Hotels P/L [1987] 5 ACLR - Mixed purpose - But for test Crt concluded that "but for" the governing directors improper purpose of manipulating voting power, the share issue would not have been made - see Kokotovick Constructions P/L v Wallington [1995] 13 ACLC 1113.

Takeover Context: Howard Smith Vs Ampol Petroleum Ltd [1974] AC 821:Takeover of RW Miller (Holdings); Ampol owed 55% of shares and made a takeover bid to acquire rest of shares; Howard Smith white knight offered a higher price; Millers directors issued extra shares thereby reducing Ampol s holding to less that 50%; Court Held : Directors breached their duty in issuing shares directors were not simply raising further working capital. Also see: - Pine Vale Investments Ltd v McDonald & East Ltd [1983] 1 ACLR -Darvall v North Sydney Brick & Tile Co Ltd [1989] 16 NSWLR 260 Statutory Duty to Act in Good Faith and for a Proper Purpose. - s181 ASIC v Adler [2002] NSWSC 171 Directors who permit breach of Act may contravene s181. See ASIC v Maxwell [2006] NSWSC 1052

Duty to retain discretion: Thorby v Goldberg [1964] 112 CLR 597

Persons in a fiduciary relationship are not supposed to have an interest which conflicts or which may conflict with the one whom they are supposed to represent: See Aberdeen Railway Co Vs Blaike Bros [1854] 2 Eq Rep 1281 Directors do not have to act in a manner that is fraudulent, criminal or mischievous to breach this duty. If there is a conflict for whatever matter they may be in breach of their duty. Statutory Duties * s182 duty not to make improper use of their position and gain advantage for themselves or cause detriment to the Co * s183 duty of officer or employee (including persons formally holding those positions) from improperly using information obtained through their position to gain advantage for themselves or someone else or cause detriment to the Co.

Re Bright Pine Mills Pty Ltd [1969] VR 1002 Wilson Vs London Midland & Scottish Railway Co [1940] Ch 169 Transvaal Land Co v New Belgium (Transvaal) Land & Development Co [1914] 2 Ch 2 Ch 488. Samuel & Harvey directors of Transvaal Samuel also a director of New Belgium Both Samuel & Harvey owned shares in New Belgium Samuel persuaded Transvaal to purchase shares in New Belgium Transvaal discovered Samuel & Harvey s interests in New Belgium Transvaal sought to have contract rescinded Samuel s interests as both director & S/H of New Belgium conflicted with his duty to act in best interests of Transvaal Samuel breached his duty to Transvaal (even though he did not vote on the board s resolution to purchase)

Directors statutory duty to make disclosure of interest in transaction with Co: s191 -Directors duty to disclose material personal interest. -s191(1) exception -s191(2) exceptions for Proprietary Co s s192 Standing Notice of Directors interest s194 -disclosure by director in a proprietary Co. Duty to disclose material interest. s195 Disclosure by Directors in Public Co must not attend or vote at a meeting in matters where they have an interest.

Sect 182 duty not to make improper use of their position and gain advantage for themselves or cause detriment to the Co Meaning of Improper : conduct that is not consistent with proper performance of duties and obligations To cause detriment Cases: ASIC v Adler [2002] NSWSC 171 Adler used position to gain advantage for Adler Corp; ASIC v Soust [2010] FCA 68: Soust purchased shares indirectly which caused the Co share price to go up which meant he got bonus because the share price of the Co had reached a certain level. Also see R v Byrnes [1995] 13 ACLC 1488 Chew v R [1992] 10 ACLC 816 ASIC v Whitlam [2002] NSWSC

Cook Vs Deeks [1916] AC 554 Omnilab Media Pty Ltd v Digital Cimina Network Pty Ltd [2011] FCAFC 166 Mordecia v Mordecia [1988] 12 NSWLR 58 Pacifica Shipping Co Ltd Vs Anderson [1986] 2 NZLR Chan Vs Zacharia [1984] 154 CLR 178 Also Note s182-183

What if Co cannot take or does not want the opportunity? Regal (Hastings) Ltd VsGulliver [1967] 1 AC 134 What if directors makes disclosure and Co gives consent: Queensland Mines Ltd Vs Hudson [1978] 52 ALJR Peso Silver Mines VsCropper [1966] 58 DLR Canadian AreoService Ltd VsO'Malley [1973] 40 DLR 371 Southern Cross Mine Management P/P V Ensham Resourses P/L [2005] QSC 233

Co need not suffer Loss for Duty to be breached: Green v Bestobell Industries [1982] WAR 1 Misuse of Co Funds Paul A Davies(Aust) Pty Ltd Vs Davies & Anor [1982] 1 LC 66

Bribes & Secret Commissions Boston Deep Sea Fishing & Ice CO Vs Ansell [1888] 39 Ch 339 Furs Ltd Vs Tomkies [1936] 54 CLR 583

Sect: 183 duty of officer or employee (including persons formally holding those positions) from improperly using information obtained through their position to gain advantage for themselves or someone else or cause detriment to the Co. Artedomus v Del Casale[2006] NSWSC 146 Thomas Marshall (Exporters) Ltd v Guinle[1978] 3 WLR 116 Marsonv PressbankPty Ltd [1989] 7 ACLR RitewayExpress P/L v Clayton [1987] 10 NSWSR 238 Forkserve Pty Ltd v Jack & Aussie Forklift Repairs [2000] NSWSC 1064 ASIC v Vizard[2005] FCA 1037 Armstrong World Enterprises (Aust) P/L v Parma [2014] FCA 743

Hivac Ltd v Park Royal Scientific Instruments Ltd [1946] 1AII ER 350 Riteway Express P/L v Clayton [1987] 10 NSWSR 238 Holyoake Industries (Vic) Pty Ltd v V- Flow Pty Ltd [2011] FCA 1154 Industrial Development Consultants Vs Cooley [1972] 2 All ER 162 Sect 184 criminal liability when directors act reckless or are intentionally dishonest. It is in addition to Sects 181, 182 and 183

Sect 180 reads; A director or other officer of a Co must exercise their powers and discharge their duties with the degree of care and diligence that a reasonable person would exercise if they; a) were a director of a Co in the Co s circumstances; and b) occupied the office held by, and had the same responsibilities within the Co as, the director or officer.

Tort of negligence Equitable duty of care

Re City Equitable Fire Insurance Co Ltd [1925] Ch 407; Co was defrauded of funds, but because of the facts of the case there was no finding of misconduct or negligence. However, Romer J make following points: 1. directors need not exhibit a greater standard of skill and care is that may be reasonably expected from a persons in that position 2. not bound to give continuous attention to affairs of Co. see case of Marquis des Bute. But See: Vrisakis v ASIC [1993] 9 WAR 395 But Note s300(10) -requires directors attendance to be recorded in annual return. 3. directors allowed to rely on and put trust in officers of the Co

Change started with early insolvent trading cases: Commonwealth Bank v Friederick [1991] 9 ACLC 946 Statewide Tobacco Ltd v Morley [1990] 2 ACSR 405 AWA Ltd v Daniels t/a Delloitte Haskins & Sells [1992] 10 ACLR 933 Daniels & Ors v Anderson & Ors [1995] 13 ACLC 614

Daniels & Ors v Anderson & Ors [1995] 13 ACLC 614; AWA incurred significant loss due to inadequate supervision of foreign exchange transactions; AWA auditors informed Co of deficiencies; information not properly passed on to BoD and not acted upon till too late; AWA sued its auditors for negligence; Auditors argued contributory negligence; Court made following comments:

1. Directors owe a common law duty of care to their Co which overlaps with their equitable duty of care; 2 A director, whatever their background, has a duty greater than that of simply representing a particular field of experience. They have a duty to become familiar with the business of the Co and how it is run. The Crt approved of the US case of Francis v United Jersey Bank 432 A 2d 814 (1981) 3. Even though directors have a variety of skills and experience they must do more than merely represent their particular field of experience. They should be able to ensure the board has sufficient means to audit the management of the Co so it can satisfy itself that the Co is being run properly. 4. While directors need not have experience of every aspect of the Co s activities, they are required to make inquires and keep themselves informed about all aspects of the Co s business operations. 5. Directors must be allowed to make business judgements and take commercial risks, they cannot safely proceed on the basis that ignorance and a failure to inquire are protection for liability for negligence. 6. Directors cannot shut their eyes to corporate misconduct and then claim that they did not see the misconduct and did not have a duty to look Held: Director breached duty; non executive directors did not breach duty, they asked for info but it was denied to them, CEO failed to make sufficient inquiries.

Distinction for Executive and Non-executive directors and Officers: see ASIC v Plymin, Elliot & Harrison [2003] VSC 123 (Water Wheel case) ASIC v Hellicar [2012] HCA 17 HC held that 7 non-executive directors breached their duty of care as directors of James HardieIndustries Ltd by approving the Co srelease of misleading announcement to the ASX. Gold Ribbon [Accountants] P/L v Sheers[2006] QCA 335 ASIC v Rich [2003] NSWSC 85 South Australia v Clark [1996] 14 ACLC 1091 ASIC v Adler [2002] NSWSC 171 ASIC v McDonald (no.11) [2009] NSWSC 287

Vines v ASIC [2007] NSWSC 75 Vines was a CFO and was held to have breached S180. Shafron v ASIC [2012] HCA 18; HC said Shafron role as Co Secretary and general counsel were indivisible and that he was guilty of breaching s180(1) Also Note CAMAC Report: Corporate Duties Below Board Level (April 2006). It recommended that the statutory duties in s180 and s181 should extend to other officers or persons involved in the management of the Co.

Duty of Chairman: ASIC v Rich [2003] NSWSC 85: chairman (Greaves) in the Onetel collapse sued for breach of s180; ASIC argued he had a higher duty of care than non executive directors: Crt imposed ban of 4 years and $20M compensation order.