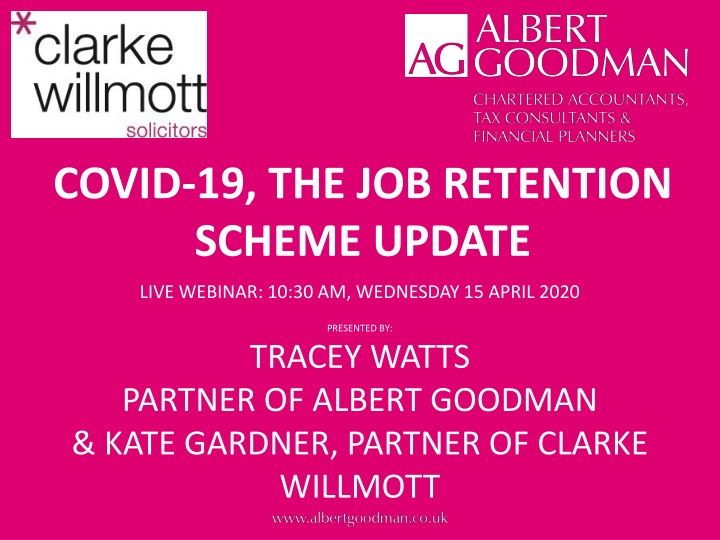

COVID-19 Job Retention Scheme Update Webinar Highlights

Essential details from a live webinar presented by Tracey Watts and Kate Gardner on the COVID-19 Job Retention Scheme. Topics covered include conditions for making a claim, covered workers, grant specifics, and eligibility criteria. Learn about the process to avoid redundancies and support furloughed employees. Stay informed to navigate the impact on your business effectively.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

COVID-19, THE JOB RETENTION SCHEME UPDATE LIVE WEBINAR: 10:30 AM, WEDNESDAY 15 APRIL 2020 PRESENTED BY: TRACEY WATTS PARTNER OF ALBERT GOODMAN & KATE GARDNER, PARTNER OF CLARKE WILLMOTT

COVID-19, JRS & YOUR BUSINESS Format of webinar: CV Job Retention Scheme update Conditions to make a claim Workers covered and claim period What pay? Examples Personal Service Companies ( PSC ) Kate Gardner employment law aspects and the furlough process Q&A/Chat support from Michael Evans Head of AG Payroll Team

COVID-19, JRS AND YOUR BUSINESS Job Retention Scheme ( JRS ) Taxable grant to cover wage costs Lower of 80% of regular wage costs & 2,500 furloughed wages Plus Employer s NIC and basic pension costs on the furloughed wages Backdated to 1 March Initially for 3 months to 31 May to be reviewed?

COVID-19, JRS AND YOUR BUSINESS Job Retention Scheme ( JRS ) Conditions to make a claim Created or started a UK Payroll on/before 28/02/20 Enrolled for PAYE online (click for link) UK bank account In order to avoid redundancies or where staff would otherwise be laid off Claim in respect of furloughed employees only

COVID-19, JRS AND YOUR BUSINESS Job Retention Scheme ( JRS ) Who is covered? Employees at 28/02/20 no new starters post or leavers pre Leavers post for whatever reason Full or part time workers Flexible or zero hour contracts Apprentices? Agency workers on your payroll Public sector off payroll workers? Directors of PSC? Salaried partners in LLPS Administrators Carluccios TUPEd workers

COVID-19, JRS AND YOUR BUSINESS Job Retention Scheme ( JRS ) Who is covered? (cont) Furloughed workers no services/generation of income for employer or any linked or associated party Can work for unrelated party Can be furloughed by more than one employer Not reduced hours/pay Minimum 3 weeks at a time can rotate Not currently on SSP/unpaid leave pre 28/02/20 Enhanced maternity and other parental leave

COVID-19, JRS AND YOUR BUSINESS Job Retention Scheme ( JRS ) How do you claim? New portal 20 April agent access? PAYE Online 10 days to set up Funding gap? Can claim up to 14 days before running payroll (claim to end of April?) Business Interruptions Loan Scheme VAT payment deferral Time To Pay arrangements for other taxes and PAYE July POA Pay employees later? FPS no later than payment date

COVID-19, JRS AND YOUR BUSINESS Job Retention Scheme ( JRS ) How do you claim - Portal Employer ePAYE reference number Number of furloughed employees Their NINOs and names Payroll/works numbers The business UTR or company registration number Claim period start and end Amount claimed Bank account and sort code Your name and contact number FORMAT? SELF SERVE Keep for 5 years audit and whistleblowing

COVID-19, JRS AND YOUR BUSINESS Job Retention Scheme ( JRS ) What is the process? Selection fair and documented (discrimination/equality rules) Contract changes? Written agreement of changes HR/legal advice and support Calculate reduced pay change in contractual pay Top up? Claim grant back (1 claim x 3 weeks)

COVID-19, JRS AND YOUR BUSINESS Job Retention Scheme ( JRS ) What pay? Full or part time salary @ 28/02/20 Variable hours higher of: o wages in same period in 2019; and o average of last 12 months Based on regular payments you are obliged to pay In - wages, past overtime, fees and compulsory commissions Out - discretionary bonuses, tips, commissions, non cash BIK, top ups, salary sacrificed amounts, additional pensions Gross x 80%, capped at 2,500 the new normal gross

COVID-19, JRS AND YOUR BUSINESS Job Retention Scheme ( JRS ) Example 1

COVID-19, JRS AND YOUR BUSINESS Job Retention Scheme ( JRS ) What pay - complications Furlough starts and ends in pay period? Will employer top up? Holiday? NMW and training? Moving from SSP to JRS? Top ups for maternity or other parental leaves? Payments for non qualifying items discretionary bonuses, fees, payrolled benefits? Payments into personal pension schemes Pension payments in excess of basic auto enrolment amounts? Salary sacrifice arrangements? Life event

COVID-19, JRS AND YOUR BUSINESS Job Retention Scheme ( JRS ) Example 2 Sarah also 40K per annum Works first week in April ( 833) Two weeks basic furlough pay ( 2,500/4 x 2 = 1,250) Takes last week in April as holiday paid at old full rate ( 833, but claim based on 625 only)

COVID-19, JRS AND YOUR BUSINESS Job Retention Scheme ( JRS ) Example 2

COVID-19, JRS AND YOUR BUSINESS Job Retention Scheme ( JRS ) Example 3 Sally, zero hours Laid off 1 March 2020 nil pay for month March 2019, pay was 1,200 Average pay to end of February 2020 was 1,667 Take the higher

COVID-19, JRS AND YOUR BUSINESS Job Retention Scheme ( JRS ) Example 3

COVID-19, JRS AND YOUR BUSINESS Rights under furlough? NMW not applicable except for any training (Low Income Tax Reform Group example) SSP SMP basic entitlement remains, but if top up, top up is covered under JRS Same for contractual adoption/paternity leave or shared parental pay Holiday?

COVID-19, JRS AND YOUR BUSINESS Rights under furlough? Can t work Volunteer/community work Accruing holiday? Possible 2 year c/fwd? Impact on business and working employees? Accrue other benefits and continuous service rights (redundancy)

COVID-19, JRS AND YOUR BUSINESS HMW example per LITRG Feb 20 rate for 150 hours = 8.21 x 150 = 1231.50 Furlough payment and claim @ 80% 985.20 = new gross pay No NMW issue unless training, paid at new rate of 8.72 per hour Needs to do at least 113 hours to be an issue 985.20/8.72 = 113 hours Unlikely to be an issue?

COVID-19, JRS AND YOUR BUSINESS Personal Service Companies ( PSC ) Director duties Minimal salary ( 8,628) + dividends Salary at 28/02/20 what is it? Employment Allowance interaction state aid Freelance?

COVID-19 JRS AND YOUR BUSINESS Kate Gardner Partner in Employment and HR Team at Clarke Willmott

COVID-19, JRS AND YOUR BUSINESS QUESTIONS & ANSWERS