Consumer Duty Roles and Responsibilities Overview

Set out roles and responsibilities apportioned between RSA and brokers/intermediary in relation to key Consumer Duty requirements. Covers distribution chain, material influence, and regulatory responsibilities for activities and outcomes related to customer journey.

Uploaded on Feb 20, 2025 | 0 Views

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Consumer Duty RSA and Broker/ Intermediary roles and responsibilities

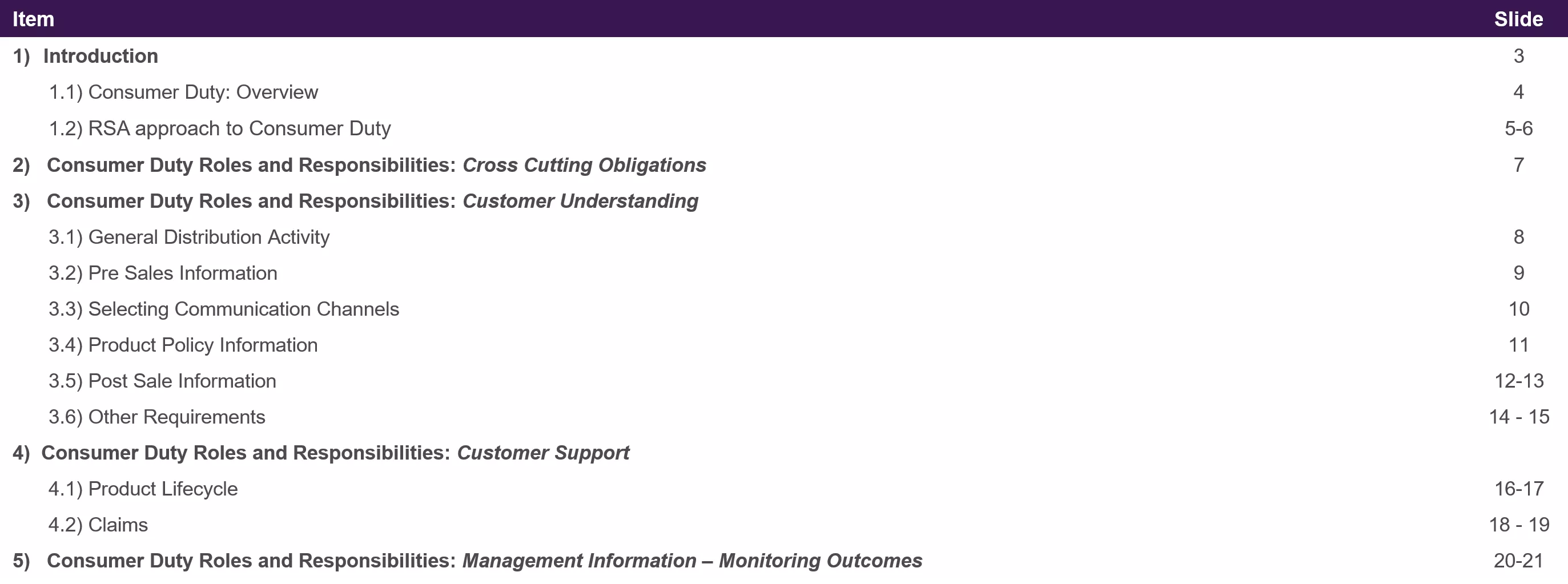

Agenda Item Slide 3 1) Introduction 1.1) Consumer Duty: Overview 4 1.2) RSA approach to Consumer Duty 5-6 2) Consumer Duty Roles and Responsibilities: Cross Cutting Obligations 7 3) Consumer Duty Roles and Responsibilities: Customer Understanding 3.1) General Distribution Activity 8 3.2) Pre Sales Information 9 3.3) Selecting Communication Channels 10 3.4) Product Policy Information 11 3.5) Post Sale Information 12-13 3.6) Other Requirements 14 - 15 4) Consumer Duty Roles and Responsibilities: Customer Support 4.1) Product Lifecycle 16-17 4.2) Claims 18 - 19 5) Consumer Duty Roles and Responsibilities: Management Information Monitoring Outcomes 20-21 2

1) Introduction Following publication of the FCA s final rules in relation to Consumer Duty the following slides set out our analysis of the proposed roles and responsibilities apportioned between RSA and brokers/ intermediary against the key Consumer Duty requirements across the customer journey (high level). The Consumer Duty applies (i) Distribution chain: across the distribution chain, from product and service origination, through to distribution and post-sale activities (ii) Material influence: firms that can determine or have a material influence over customer outcomes. Therefore, RSA has assessed our prospective roles and responsibilities and how they may be apportioned in relation to the following key themes: - Cross Cutting Obligations; - Customer Understanding; - Customer Support; and - Management Information Monitoring Outcomes Definitions: RSAhas allocated roles and responsibilities based on the following definitions (i) Responsible = the firm that carries out or implements the activity and has regulatory responsibility for the activity (ii) Accountable = the firm that delegates the activity ( where applicable) and retains regulatory responsibility for the activity (iii) Material influence = that firm can determine or has a material influence over customer outcomes and has Consumer Duty responsibilities Throughout this pack, the term broker and intermediary is used interchangeably. Disclaimer:This paper has been provided to facilitate engagement between Royal Sun Alliance Ltd (RSA) and its Partners in respect of the apportionment of roles and responsibilities against the key requirements of Consumer Duty. RSA is not providing regulatory or legal advice to Firms in respect of how regulatory and legal requirements may apply to their business and what actions should be taken to satisfy these requirements. Firm should seek independent, professional advice if they are uncertain as to how applicable regulatory and legal requirements applies to their organisation. 3

1.1) Consumer Duty: Overview Consumer Duty: Background Consumer Duty scope The Consumer Duty applies to (1) Distribution chain: across the distribution chain, from product and service origination, through to distribution and post-sale activities. The distribution chain, includes all firms involved in the manufacture, provision, sale and ongoing administration and management of a product or service to the end retail customer (2)Material influence: to all firms that have a material influence over, or determine, retail customer outcomes. RSA approach to Consumer Duty (roles and responsibilities) (1) Distribution chain: RSA is considering how the Consumer Duty applies across the end to end customer journey - if there are other parties in the distribution chain that help support, deliver . the RSA product/ service, we have also considered the roles and responsibilities of each party in the distribution chain. Distribution Chain Complaints Distribution Sales Service Claims Product Marketing Consumer Duty outcomes (1) Product and Service (2) Price and Value (3) Customer Understanding (4) Customer Support (2) Material influence: RSA has developed some principles / examples around whether other firms in the distribution chain have material influence over RSA customer outcomes. If another firm in the distribution chain has material influence, the Consumer Duty requirements apply to the firm (as relevant to each outcome) and there should be clear roles/ responsibilities between each party in the distribution chain. 4

1.2) Consumer Duty: RSA approach to Consumer Duty RSA has set up a dedicated programme to help ensure the FCA Consumer Duty expectations are met. The following provides a high level overview of the key activity, actions that RSA is focused on to ensure the Consumer Duty requirements are met. Activity/ action High level summary/ explanation TOP DOWN ACTIVITY- drafting, updating key frameworks to ensure processes, policies align to Consumer Duty requirements RSA already carries out customer testing/ research on areas/ factors that require further review and/or insight. The existing framework has been updated to reflect Consumer Duty requirements. The updated framework includes risk based testing methodology, approach to testing . Customer journey and communications framework (testing) RSA has drafted a customer journey framework that includes Customer Understanding/ Customer Support requirements including but not limited to: - Behavioural bias - Positive friction in customer journeys - Signposting in customer journeys - Communication standards - Sludge practices - Unreasonable barriers - Unreasonable delays Customer journey and communications framework (general) RSA has an existing vulnerable customer framework that outlines RSA approach to vulnerable customers. This includes but not limited to recognising vulnerable customers, recording reasonable adjustments, training, MI requirements . Vulnerable customer framework RSA has an existing product governance framework that aligns to PROD 4 requirements. The Consumer Duty provides additional high level expectations that has been incorporated into RSA s product governance framework. Product governance framework RSA has an existing customer outcome monitoring framework that helps identify trends, potential customer harm . The customer outcome monitoring framework is being updated to reflect Consumer Duty requirements. Customer outcome monitoring 5

1.2) Consumer Duty: RSA approach to Consumer Duty Activity/ action High level summary/ explanation BOTTOM UP ACTIVITY- targeted activity/ action to help ensure existing processes, issues meet Consumer Duty requirements (where required). RSA has reviewed the FCA examples on good / bad practice on sludge practice, unreasonable delays and each business area has provided potential gaps against the Consumer Duty. Potential issues raised by each business area has been reviewed and considered against whether the issue should be updated against Consumer Duty requirements. Deep dive against FCA Consumer Duty guidance RSA has reviewed existing issues e.g. incidents, product governance actions and considered against whether the issue should be updated against Consumer Duty requirements. Review of existing/ known issues/ actions e.g. incidents, product governance actions against FCA Consumer Duty guidance RSA is reviewing pricing methodologies and considering against Consumer Duty requirements e.g. pricing factors don t not exploit behavioural biases Review of pricing methodologies RSA is carrying out a review of call scripts and considering against Consumer Duty requirements e.g. confirming customer understanding (where appropriate) Review of call scripts In line with PROD 4 requirements, RSA carried out product approval/ fair value assessment and issued Target Market Statements (completed by October 2022). The product approval/fair value assessments align to Consumer Duty Product/ Service and Price/ Value requirements. No additional product approvals/ fair value assessments are required before April 2023. Product approval/ Product review (including fair value assessment) 6

2) Consumer Duty - Roles and Responsibilities: Cross Cutting The Consumer Duty applies across the distribution chain from product and service origination, through to distribution and post-sale activities. To help identify roles and responsibilities, RSA has mapped out the customer journey touchpoints (high level) and the key rules/ requirements that apply. CROSS CUTTING OBLIGATIONS Activity FCA rule Summary of regulatory requirement Responsible Rationale Material influence Additional comments PRIN 2A.2.1 Acting in good faith: Firms must act in good faith. Acting in good faith is a standard of conduct characterised by honesty, fair and open dealing and acting consistently with the reasonable expectations of retail customers. - RSA - Broker RSA and broker have Consumer Duty responsibilities N/A N/A All activity PRIN 2A.2.8 Avoid causing foreseeable harm: Firms must avoid causing foreseeable harm to retail customers. Foreseeable harm may be caused by both act and omission, in a firm s direct relationship with a retail customer or through its role in the distribution chain even where another firm in that chain also contributes to the harm - RSA - Broker RSA and broker have Consumer Duty responsibilities N/A N/A All activity PRIN 2A.2.14 Enable and support customers: A firm must enable and support retail customers to pursue their financial objectives - RSA - Broker RSA and broker have Consumer Duty responsibilities N/A N/A All activity 7

3.1) Consumer Duty - Roles and Responsibilities: Customer Understanding CUSTOMER UNDERSTANDING Broker generic branding, promotions Activity FCA Rule Summary of regulatory requirement Responsible Rationale Material influence Additional comments PRIN 2A.5.1 Scope: The customer understanding requirements applies to all interactions with the retail customer including interactions that do not relate to a specific product Broker promote . their brand, offerings and via their own regulatory permissions N/A N/A General distribution activity e.g. broker generic marketing, promotions Broker PRIN 2A.5.3 Customer Understanding: All customer communications including sales material, social media - must support the retail customers understanding and communications must be clear, fair and not misleading PRIN 2A.5.5 Support customer understanding: information should explained/ presented in logical format, avoid use of jargon, relevant . PRIN 2A.5.10 Communications testing: where appropriate, firms must test communications before communicating them to retail customers and regularly monitor the impact of communications once they have been communicated PRIN 2A.2.10 Behavioural biases: firm should avoid causing foreseeable harm to retail customer includes ensuring that no aspects of its business involves unfairly exploiting behavioural biases displayed by retail customers 8

3.2) Consumer Duty - Roles and Responsibilities: Customer Understanding CUSTOMER UNDERSTANDING Distribution Activity FCA rule Summary of regulatory requirement Responsible Rationale Material influence Additional comments PRIN 2A.5.5 Timely information: Information should be provided to customer on timely basis/ in good time to allow effective decision making: (1) Before the purchase/ sale of product (2) Throughout lifecycle of the product Broker sells/ distributes products under their own regulatory permissions N/A N/A Pre sales information e.g. demands and needs, quote and buy Broker PRIN 2A.5.3 Customer Understanding: All customer communications including product/ policy information - must support the retail customers understanding and communications must be clear, fair and not misleading PRIN 2A.5.5 Support customer understanding: information should explained/ presented in logical format, avoid use of jargon, relevant . PRIN 2A.5.10 Communications testing: where appropriate, firms must test communications before communicating them to retail customers and regularly monitor the impact of communications once they have been communicated PRIN 2A.2.10 Behavioural biases: firm shouldavoid causing foreseeable harm to retail customer includes ensuring that no aspects of its business involves unfairly exploiting behavioural biases displayed by retail customers 9

3.3) Consumer Duty - Roles and Responsibilities: Customer Understanding CUSTOMER UNDERSTANDING Distribution and service Activity FCA rule Summary of regulatory requirement Responsible Rationale Material influence Additional comments PRIN 2A.5.6 Communication channel: the customer communication channel must be appropriate and support customer decision making Broker sells/ distributes products under their own regulatory permissions N/A N/A Selecting communication channels e.g. online, telephony, live chat, letters * Broker * Via existing PROD 4 requirements, the manufacturer must specify the relevant channel that a product can be distributed via e.g. aggregators, online sale . The relevant channels are included in the Distribution Information (Target Market Statements). PRIN 2A.5.6 includes broader considerations around communication channels e.g. live chat, letters, telephony and firms must ensure all communications enables the customer to make an informed decision and supports effective decision making. For example, whilst the manufacturer may have stipulated that the product can be sold online, PRIN 2A.5.6 requires consideration towards ensuring the digital communications are compatible with different online mediums such as computers, tablets and smartphone and ensuring broader customer understanding requirements are met e.g. customer information needs are met, communication is clear, fair and not misleading . 10

3.4) Consumer Duty- Roles and Responsibilities: Customer Understanding CUSTOMER UNDERSTANDING Product Activity FCA rule Summary of regulatory requirement Responsible Rationale Material influence Additional comments PRIN 2A.5.3 Customer Understanding: All customer communications including product/ policy information must support the retail customers understanding and communications must be clear, fair and not misleading The sole or lead product manufacturer and produces product/ policy documentation N/A N/A Product/ Policy information e.g. policy wording, policy summary, endorsements, schedule Sole or Lead manufacturer* PRIN 2A.5.5 Timely information: Information should be provided to customer on timely basis/ in good time to allow effective decision making: (1) Before the purchase/ sale of product (2) Throughout lifecycle of the product PRIN 2A.5.7 Support customer understanding: information should explained/ presented in logical format, avoid use of jargon, relevant . PRIN 2A.5.10 Communications testing**: where appropriate, firms must test communications before communicating them to retail customers and regularly monitor the impact of communications once they have been communicated * If there is more than one manufacturer, the lead manufacturer is responsible for the Customer Understanding requirements that are applicable to the product e.g. policy wording, policy summary . Manufacturing responsibilities are outlined in relevant agreements for non-delegated business, the lead manufacturer is typically RSA. **PRIN 2A.5.11 states With regard to the firm s role, it would be more appropriate for the firm to: (1) test communications if the firm is or ought to reasonably be responsible for (a) the production of those communications or (b) adapting those communications after testing . The sole or lead manufacturer typically produces product documentation and if testing (where required)) indicates changes are required, the sole or lead manufacturer should adapt communications (as appropriate). 11

3.5) Consumer Duty - Roles and Responsibilities: Customer Understanding CUSTOMER UNDERSTANDING Post sales Activity FCA rule Summary of regulatory requirement Responsible Rationale Material influence Additional comments PRIN 2A.5.5 Timely information: Information should be provided to customer on timely basis/ in good time to allow effective decision making: (1) Before the purchase/ sale of product (2) Throughout lifecycle of the product RSA drafts/ produces key post sale documents to the customer that are passed to the customer via the broker N/A N/A (1) Post sales information e.g. Renewal letters, MTA, claims . RSA PRIN 2A.5.3 Customer Understanding: All customer communications including product/ policy information - must support the retail customers understanding and communications must be clear, fair and not misleading PRIN 2A.5.7 Support customer understanding: information should explained/ presented in logical format, avoid use of jargon, relevant . PRIN 2A.5.10 Communications testing: where appropriate, firms must test communications before communicating them to retail customers and regularly monitor the impact of communications once they have been communicated 12

3.5) Consumer Duty - Roles and Responsibilities: Customer Understanding CUSTOMER UNDERSTANDING Post sales Activity FCA rule Summary of regulatory requirement Responsible Rationale Material influence Additional comments PRIN 2A.5.5 Timely information: Information should be provided to customer on timely basis/ in good time to allow effective decision making: (1) Before the purchase/ sale of product (2) Throughout lifecycle of the product Broker is responsible for any additional communications (not /drafted produced by RSA) that are drafted/ issued to the customer or communications that are produced by RSA and adapted / altered by the broker N/A N/A (2) Post sales information any additional communications or changes to communications that are drafted by the broker e.g. covering letters to customers Broker PRIN 2A.5.3 Customer Understanding: All customer communications including product/ policy information - must support the retail customers understanding and communications must be clear, fair and not misleading PRIN 2A.5.7 Support customer understanding: information should explained/ presented in logical format, avoid use of jargon, relevant . PRIN 2A.5.10 Communications testing: where appropriate, firms must test communications before communicating them to retail customers and regularly monitor the impact of communications once they have been communicated 13

3.6) Consumer Duty - Roles and Responsibilities: Customer Understanding CUSTOMER UNDERSTANDING Individual interactions Activity FCA rule Summary of regulatory requirement Responsible Rationale Material influence Additional comments PRIN 2A.5.9 Customer interaction: If interacting with the customer on a one to one basis, where appropriate, confirm the customer understands the information provided particularly if the information is reasonably regarded as key information such as where it prompts that retail customer to make a decision Broker and RSA interacts with the customer on a one to one basis (where relevant) N/A N/A Individual customer interactions e.g. calls, face to face - Broker (as applicable e.g. sales) - RSA (as applicable e.g. claims) PRIN 2A.5.9 Vulnerable customers: where appropriate, tailor the communication to meet the information needs vulnerable customers - Broker (as applicable e.g. sales) Broker and RSA can interact with the customers that may require reasonable adjustments N/A N/A Responding to communication needs of vulnerable customer e.g. providing communications in braille - RSA (as applicable e.g. claims) 14

3.6) Consumer Duty - Roles and Responsibilities: Customer Understanding CUSTOMER UNDERSTANDING Distribution chain Activity FCA rule Summary of regulatory requirement Responsible Rationale Material influence Additional comments PRIN 2A.5.15 Customers typically direct queries to the broker. If the broker subsequently directs the query to RSA, RSA should ensure queries that are process/ handled in timely manner N/A N/A Providing information to other firms Providing information to other parties in the distribution chain: If a firm in the distribution chain (i) requests information from another firm, and (ii) the information will be passed to the customer; The information should be provided in a timely manner - RSA - Broker (as applicable e.g. sub broking) If there are sub brokers are in the distribution chain, the broker should provide information . in a timely manner PRIN 2A.5.14 Notification: if a firm identifies or becomes aware that a communication produced by another party does not deliver good outcomes, they must notify the third party Broker and RSA have Consumer Duty responsibilities N/A N/A Notification requirements - Broker - RSA 15

4.1) Consumer Duty - Roles and Responsibilities: Customer Support CUSTOMER SUPPORT Product lifecycle support Activity FCA rule Summary of regulatory requirement Responsible Rationale Material influence Additional comments PRIN 2A.6.2 Customer support: customer support should be designed to ensure: (i) customer needs are met including vulnerable customers (ii) customers can use the product as intended (iii) appropriate friction is included to mitigate customer harm (iv) customers do not face unreasonable barriers to cancel, switch their product (v) customers do not face unreasonable delays to engage with the firm (vi) appropriate monitoring of customer support is carried out (vii) they do not disadvantage particular groups of customers Broker has the primary contact/ relationship with the customer N/A N/A Customer support offered through the product lifecycle e.g. customer service, emails, live chat . to facilitate transactions such as sale, policy servicing, cancellation Broker PRIN 2A.6.3 Unreasonable additional costs: customers should not incur unreasonable additional costs to exit a product e.g. charges, fees Each party in the distribution chain has responsibility to ensure customer does not incur unreasonable additional costs N/A N/A Product cancellation/ exit fees -RSA -Broker 16

4.1) Consumer Duty - Roles and Responsibilities: Customer Support CUSTOMER SUPPORT Product lifecycle support Activity FCA rule Summary of regulatory requirement Responsible Rationale Material influence Additional comments PRIN 2A.6.6 Customers typically direct queries to the broker. If the broker subsequently directs the query to RSA, RSA should ensure the broker is appropriately supported . N/A N/A General customer queries e.g. responding to customer queries, processing policy changes . Dealing with queries/ requests from other firms in the distribution chain: a firm must deal with reasonable requests from another firm in an effective way and in good time to enable the other firm to support the customer. - RSA - Broker (as applicable e.g. sub broking) NB: customer queries are typically received via the broker If there are sub brokers are in the distribution chain, the broker should ensure the sub broker is appropriately supported . 17

4.2) Consumer Duty - Roles and Responsibilities: Customer Support CUSTOMER SUPPORT Claims Activity FCA rule Summary of regulatory requirement Responsible Rationale Material influence Additional comments N/A PRIN 2A.6.3 RSA has regulatory permissions to carry out contracts of insurance and this includes claims handling/ processing N/A Claims submission/ notification process e.g. customer submit claim, FNOL . Unreasonable barriers: customers should not face unreasonable barriers when submitting a claim e.g. onerous/ time consuming steps, asking for unnecessary information RSA 18

4.2) Consumer Duty - Roles and Responsibilities: Customer Support CUSTOMER SUPPORT Claims Activity FCA rule Summary of regulatory requirement Responsible Rationale Material influence Additional comments N/A PRIN 2A.6.2 Customer support: customer support should be designed to ensure: (i) customer needs are met including vulnerable customers (ii) customers can use the product as intended (iii) appropriate friction is included to mitigate customer harm (iv) customers do not face unreasonable barriers to cancel, switch . their product (v) customers do not face unreasonable delays to engage with the firm (vi) appropriate monitoring of customer support is carried out (vii) they do not disadvantage particular groups of customers RSA has regulatory permissions to carry out contracts of insurance and this includes claims handling/ processing N/A Claims handling e.g. review of claim, claim settlement . RSA 19

5) Consumer Duty - Roles and Responsibilities: Management Information MONITORING OUTCOMES Management Information Activity FCA rule Summary of regulatory requirement Responsible Rationale Material influence Additional comments PRIN 2A.9.8 Monitoring outcomes: firms must regularly monitor the outcomes customers receive from: (1) The products the firm manufactures or distributes (2) The communications the firm have with customers (3) The customer support the firms provides to retail customers Broker and RSA have Consumer Duty responsibilities (as relevant to each outcome) N/A N/A Management information - RSA - Broker 20

5) Consumer Duty - Roles and Responsibilities: Management Information MONITORING OUTCOMES Management Information Activity FCA rule Summary of regulatory requirement Responsible Rationale Material influence Additional comments PRIN 2A.5.10 Broker and RSA have Consumer Duty responsibilities (as relevant to each outcome) N/A N/A Management information Testing, monitoring and adapting communications: where appropriate, a firm should (1) Test communications before communicating them to retail customers (2) Regularly monitor the impact of communications once these have been communicated - RSA - Broker PRIN 2A.9.10 Monitoring outcomes: firms monitoring of customer outcomes must enable it to identify whether any groups of customers experience different outcomes compared to other customers of the same product. Groups of customers includes but is not limited to vulnerable customers, protected characteristics, customers from a geographical region and customers purchasing from different distribution channels Broker and RSA have Consumer Duty responsibilities (as relevant to each outcome) N/A N/A Management Information (groups of customers) - RSA - Broker 21

4. Next Steps If you have concerns with these expectations or if you believe you have material influence on any of the actions RSA will be undertaking, please contact your relationship manager in the first instance, or our dedicated mailbox prodgovdistribution@uk.rsagroup.com Thank you

undefined

undefined