Construction Industry Scheme Are You Paying Too Much Tax

Construction Industry Scheme Are You Paying Too Much Tax.pdf

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

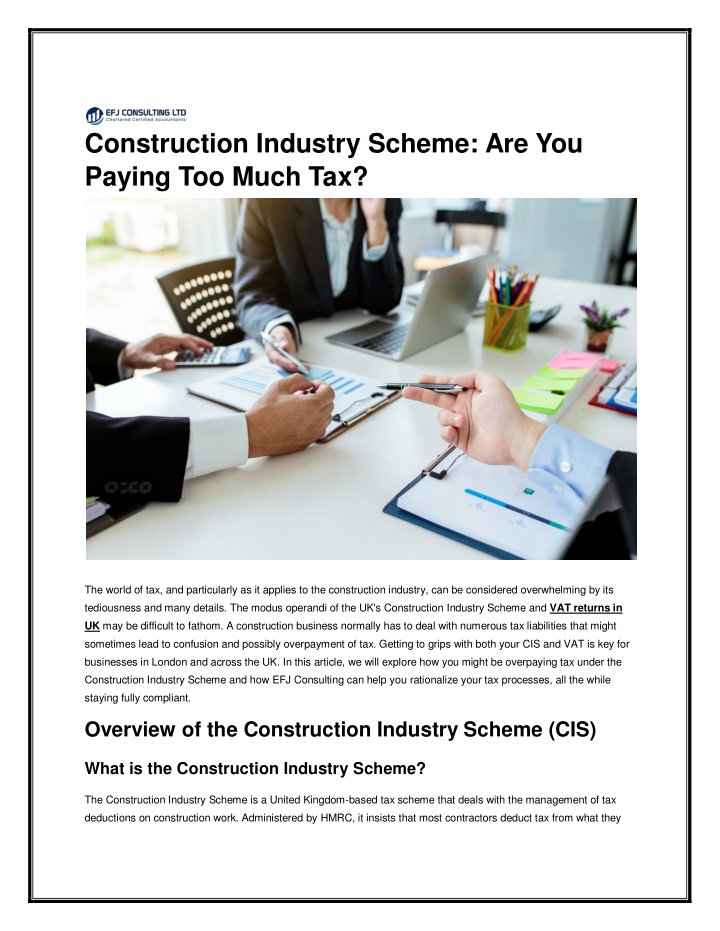

Construction Industry Scheme: Are You Paying Too Much Tax? The world of tax, and particularly as it applies to the construction industry, can be considered overwhelming by its tediousness and many details. The modus operandi of the UK's Construction Industry Scheme and VAT returns in UK may be difficult to fathom. A construction business normally has to deal with numerous tax liabilities that might sometimes lead to confusion and possibly overpayment of tax. Getting to grips with both your CIS and VAT is key for businesses in London and across the UK. In this article, we will explore how you might be overpaying tax under the Construction Industry Scheme and how EFJ Consulting can help you rationalize your tax processes, all the while staying fully compliant. Overview of the Construction Industry Scheme (CIS) What is the Construction Industry Scheme? The Construction Industry Scheme is a United Kingdom-based tax scheme that deals with the management of tax deductions on construction work. Administered by HMRC, it insists that most contractors deduct tax from what they

pay their subcontractors and then pay the deductions to HMRC. It is a system that strives to recover, effectively and as accurately as possible, taxes on the income made through this line of employment. Who Needs to Register? Both main contractors and subcontractors in construction must both register for the CIS monthly returns UK. These include the following: Contractor: Any individual or business that pays subcontractors for construction work is supposed to register with HMRC and is responsible for deducting tax from the payments payable to the subcontractors. Subcontractors: These are persons or firms doing construction work for contractors. Subcontractors are required to register with HMRC to ensure the correct tax is deducted from them. VAT Returns in the UK The Role of VAT in the Construction Industry Another important aspect of taxation for construction businesses in the UK is value-added tax (VAT). It is the tax levied on the value added to goods and services and is charged on most business transactions. The management of VAT returns in UK for reporting VAT charged to customers and that suffered on business purchases goes hand in hand with the construction businesses. How VAT Returns Interact with CIS Though CIS monthly returns in UK and VAT are two separate systems of taxation, each has very significant impacts on any construction business's accounting considerations. The main interfaces are as follows: VAT Invoicing: VAT is calculated on invoiced amounts subject to HMRC guidelines, regardless of CIS deductions. It is necessary to ensure that VAT is correctly charged on all construction invoices, even when CIS deductions are available. Recording: Good record-keeping is the basis of good VAT returns in UK and CIS reporting. Good and readable records of transactions should be kept by businesses for all transactions, whether the transactions entail CIS deductions or VAT charges. Common VAT and CIS Issues The common problems that may face construction businesses in taxes through VAT returns and CIS payments are: Confusing VAT and CIS Reporting: The business can amalgamate or confuse the VAT and CIS calculations and thus file incorrect returns for VAT and make incorrect CIS deductions. Incorrect VAT Invoicing: VAT invoicing mistakes due to misinterpretation of the impact of CIS due to VAT can lead to issues in compliance or financial discrepancies.

Are You Paying Too Much Tax? Identifying Potential Overpayments There are various reasons for overpayment of tax under the Construction Industry Scheme. Here's how you will know perhaps you are paying too much: Incorrect application of CIS tax rates: ensure that the correct tax rate is applied based on the subcontractor s registration status. Using the wrong rate can lead to overpayment. Misclassification of Workers: Properly classify workers as either employees or subcontractors. Misclassification can result in incorrect tax deductions and overpayments. Errors in Tax Calculations: Mistakes in calculating the amount of tax to be deducted can result in paying more tax than necessary. How to Check for Overpayments To determine if you are overpaying tax, follow these steps: 1. Review CIS Deductions: Verify that CIS monthly returns in UK deductions are accurately applied based on the subcontractor's registration status. Ensure that the correct rate is used for each subcontractor. 2. Audit Your Tax Records: Conduct a thorough audit of your tax records, including both CIS and VAT documentation. Look for any discrepancies or errors in tax deductions and payments. 3. Consult HMRC Guidelines: Compare your tax practices with HMRC s guidelines to ensure compliance and identify any areas where adjustments may be needed. EFJ Consulting: Expert Support for CIS and VAT Management Who is EFJ Consulting? They have a London-based tax consultation firm specializing in helping businesses get through the complexities of the Construction Industry Scheme and VAT Returns in UK. With an in-depth understanding of UK tax regulation and an emphasis on providing tailored solutions, EFJ Consulting is best positioned to assist businesses in construction optimize their tax strategies. Services Offered by EFJ Consulting They provide a range of construction business-oriented services, such as the following: CIS Compliance and Reporting: Making sure your business is CIS-compliant, with proper CIS deductions made and information properly reported to the HMRC. VAT Returns: Assistance in preparation and submission of VAT returns in UK to ensure VAT is being correctly applied and reported, and all compliance obligations are met.

Tax Optimization: Their experts do the research on your tax situation to find possible opportunities for you to save money and ensure you do not pay excess taxes. Audit and Review: They will provide a thorough review of your tax records to note any error or discrepancy, with the objective of correcting it and ensuring proper reporting. Benefits of Working with EFJ Consulting Benefits of Working with EFJ Consulting Expertise: With extensive experience in the construction sector and a thorough understanding of CIS and VAT regulations, They provide expert guidance and support. Accuracy: Their meticulous approach ensures that your tax deductions and VAT returns are accurate, reducing the risk of overpayment and compliance issues. Peace of Mind: By partnering with EFJ Consulting, you can focus on running your business while they handle the complexities of tax compliance and optimization. How to Get Started with EFJ Consulting Initial Consultation The first step for any taxpayer is to have an initial consultation with them. This consultation will give you a chance to go over your present situation regarding taxes by outlining your concerns and learning how EFJ Consulting can help you. Customized Strategy Following the initial consultation, they represent a tailor-made strategy to meet your needs. Specifically, it would consider any potential difficulties with your CIS and VAT returns in UK practices and outline actions to ensure your tax position was optimized. Ongoing Support EFJ Consulting ensures that there is continued, ongoing support to ensure that the tax strategy adopted is effective and complies with relevant regulations. They further ensure that there are continual reviews and updates if the regulation or the business scenario happens to change. Conclusion Proper CIS and VAT return management is vital for any UK-based construction business. Miscalculations or record- keeping errors may result in one overpaying the tax in most circumstances. Partner with them and give your CIS and VAT the best practices possible. By combining first-rate tax advisory services with personalized solutions, EFJ Consulting becomes the one-stop-shop solution guaranteed to provide help with your taxes. It offers you a variety of comprehensive services specializing in CIS compliance, management of VAT returns in UK, and tax optimization to ensure guaranteed passage through the hassle of taxes without the risk of overpaying.

Suspected overpayment to tax or any CIS monthly returns UK and VAT managementcome forward to them today. Their expert team is prepared to assist your organization in making regulating tax processes possible thus attaining clarity into your finances. With support from them, you can concentrate on expanding your business and ensuring success in a highly competitive marketplace for construction. Contact Us: Contact no. +02030072700 Email: info@efjconsulting.com Website:https://www.efjconsulting.com/

![Town of [Town Name] Real Estate Tax Rates and FY 2024 Budget Summary](/thumb/62211/town-of-town-name-real-estate-tax-rates-and-fy-2024-budget-summary.jpg)