Comprehensive Tax Structure and Comparison Analysis

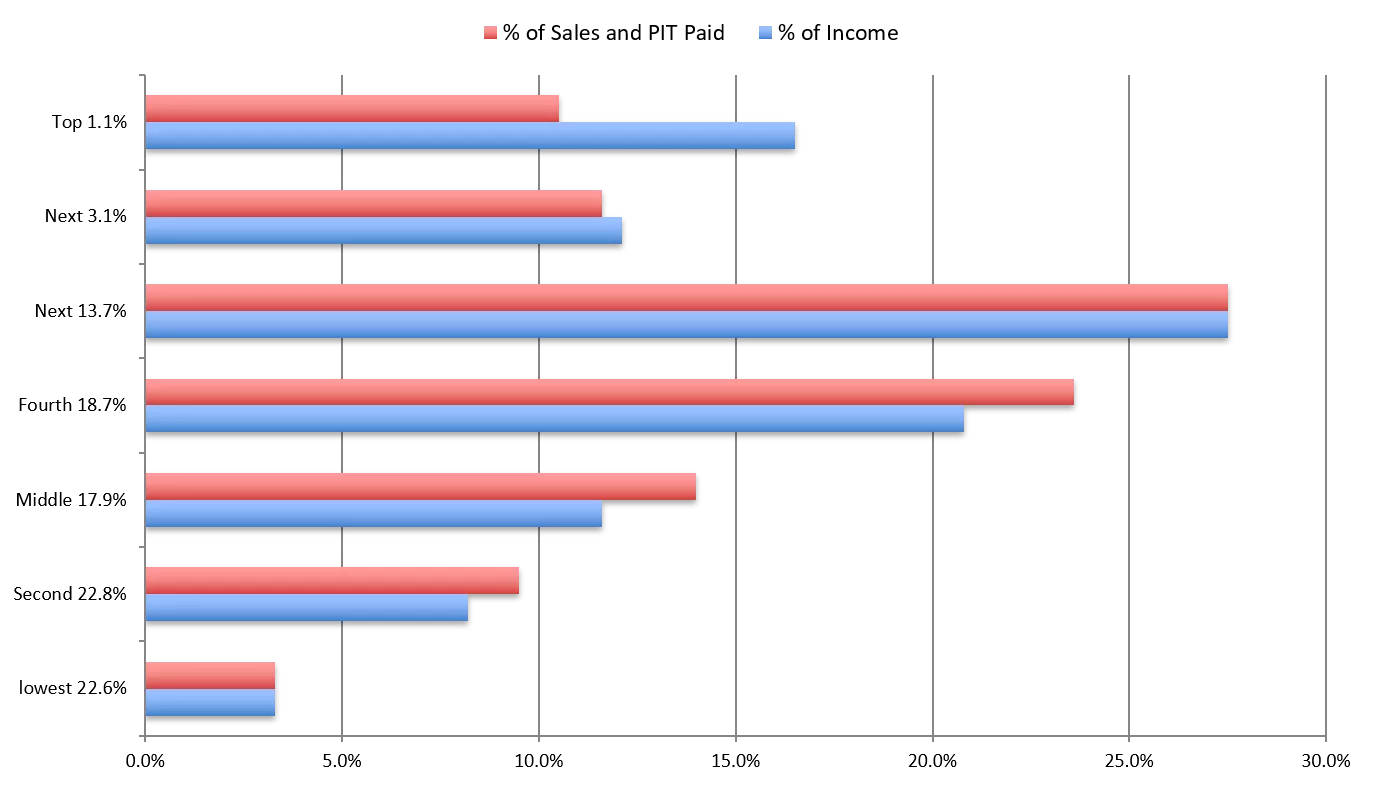

Explore a detailed comparison of current sales and income tax structures with a revenue-neutral alternative system, showcasing the percentages paid based on income levels. Delve into comparisons of tax liabilities for different scenarios involving similar taxpayers with and without excess itemized deductions, including retired couples and working individuals earning varying incomes.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Current Sales and Income Tax Structure % of Sales and PIT Paid % of Income Top 1.1% Next 3.1% Next 13.7% Fourth 18.7% Middle 17.9% Second 22.8% lowest 22.6% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0%

Revenue Neutral Alternative System with No exemptions, exclusions, deductions or credits and single rate of 3.1 for sales and 2.75 for income % of Sales and PIT Paid % of Income Top 1.1% Next 3.1% Next 13.7% Fourth 18.7% Middle 17.9% Second 22.8% lowest 22.6% 0.00% 5.00% 10.00% 15.00% 20.00% 25.00% 30.00%

Comparison of Similar Taxpayers Retired couple, no excess itemized deductions, drawing $60,000 per year State employees Private employees Working couple, no excess itemized deductions, making $60,000 per year Same comparisons but with excess itemized deductions on federal returns

Comparison of Similar Taxpayers Retired couple, no excess itemized deductions, drawing $100,000 per year State employees Private employees Working couple, no excess itemized deductions, making $100,000 per year Same comparisons but with excess itemized deductions on federal returns

Comparison of Similar Taxpayers Retired couple, no excess itemized deductions, drawing $150,000 per year State employees Private employees Working couple, no excess itemized deductions, making $150,000 per year Same comparisons but with excess itemized deductions on federal returns

![Town of [Town Name] Real Estate Tax Rates and FY 2024 Budget Summary](/thumb/62211/town-of-town-name-real-estate-tax-rates-and-fy-2024-budget-summary.jpg)