Comparative Analysis of Business Entities: Sole Proprietorship, Partnership, and Joint Stock Company

This detailed content provides an in-depth comparison of sole proprietorship, partnership, and joint stock companies, highlighting their features, differences, and examples. It explains the characteristics of each business structure, such as liability, government intervention, decision-making processes, and profit distribution. Useful for understanding the nuances of different forms of organization in the business world.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

ENTREPRENEURIAL DEVELOPMENT DR.D.GNANA RANI SARAL ASSISTANT PROFESSOR DEPERTMENT OF ECONOMICS

DIFFERENCE BETWEEN SOLE PROPRIETORSHIP , PARTNERSHIP & JOINT STOCK COMPANY

CONTENTS Sole Proprietorship Features of Sole Proprietorship Partnership Features of Partnership Joint Stock Company

Features of Joint Stock Company Differences Examples for forms of organization Bibliography

SOLE PROPRIETORSHIP The sole proprietor is an unincorporated business with one owner who has unlimited liability & is the sole recipient of the profit or loss incurred by the firm. It is the simplest form of business with least government intervention . This is because of the fact that it is not a legal entity.

FEATURES OF SOLE PROPRIETORSHIP Unlimited liability No government intervention Quick decision making Flexible

Single handed Secrecy maintained Sole receiver of profit / loss (if any) Can be operated from home

PARTNERSHIP Section 4 of the Indian Partnership Act , 1932 defines Partnership as the relation between presents who have agreed to share the profits of the business carried on by all or anyone of them working for all. The minimum members in a partnership firm are 2 and maximum 10(Banking) & 20(General)

FEATURES OF PARTNERSHIP Sufficient Capital Divided Liability Risk Sharing

Profit distributed Easy expansion Specializes skills present Profit motive

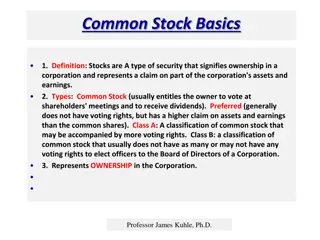

JOINT STOCK COMPANY A Joint Stock Company has to go through a series of steps before it commences, viz., Formation, Incorporation, Capital Subscription & Commencement of Business. In case of public company, it has to complete all the four stages whereas in case of private company,it can start with its operations after the incorporation stage.

FEATURES OF JOINT STOCK COMPANY Artificial person Separate legal entity Limited liability of members

Perpetual existence Common seal Risk bearings

DIFFERENCE BASIS Partnership Joint Stock Company Sole Proprietorship Minimum legal Formalities,easiest formation Registration is optional ,easy formation Regisitration compulsory, lengthy and expensive formation process Formation Minimum Private-2 Public Company-7 Private Company-50 Public Company-unlimited Members Minimum- 2 Maximum: (Banking-10 Others-20) Single owner Capital Contribution Limited finance Limited but more Large financial resources Liability Unlimited Unlimited and joint Limited Owner takes all decisions ,quick decision making Partner takes decision ,consent of all partner is needed Separation between ownership and management Control and Management Continuity Stable because of separate legal status Unstable ,business and owner regarded as one More stable but affected by status of partners

EXAMPLES FOR FORMS OF ORGANISATIONS Sole Proprietorship- Ashoka , Gandevikar Jewellers,C H Jewellers, Partnership-Neptune Trading Company Joint Stock Company-Reliance Industries Pvt.Ltd.,TATA,BSNL