Challenges and Financing Needs in Water Investments

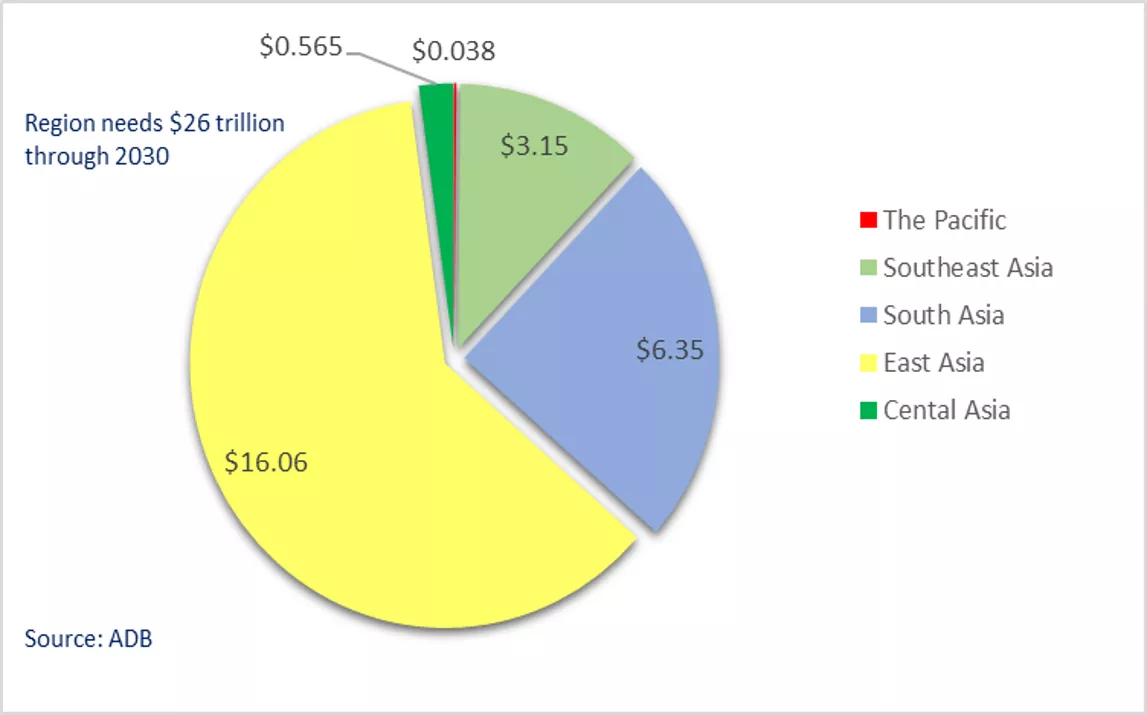

The World Bank highlights the widening funding gap in water and sanitation investments, with the region only funding 10% of its annual requirements. The sector faces a significant financing challenge, requiring $800 billion over a period, with millions still lacking access to safe drinking water and sanitation. Utilities in many countries struggle with low coverage, high growth needs, and limited financing capacity, leading to financial unsustainability. The issue is further exacerbated by mismanagement, high debt, and challenges in cost recovery.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Financing Challenges of Water Financing Challenges of Water Investments Investments The World Bank

The Widening Funding Gap The region is only funding 10% of their annual requirements. Water and Sanitation will require $800 billion over the period, or $53 billion annually. 300 million people still do not enjoy safe drinking water and 1.5 billion lack basic sanitation services.

Most WSPs in LDCs Dont Even Recover their O&M Cost *HIC High income countries, UMIC Upper middle-income countries, LMIC Lower middle-income countries, LIC Low income countries Source: World Economic Forum (2014).

The Financing Problem of Water Infrastructure Cost Average Cost LRMC Time

Many Utilities Struggle With: Low coverage High growth and investment needs Little Financing Capacity

Infant Utility Challenge DEVELOPING COUNTRIES DEVELOPING COUNTRIES DEVELOPED COUNTRIES DEVELOPED COUNTRIES Infant Utilities Low coverage High annual growth rates High investment needs Rely heavily on external financing Uncertainty of accessing external sources of funding Financially unsustainable Scarce owners equity financing Mature Utilities Full coverage or very close to full coverage Less expansion needs Lower expansion investment needs High investments to maintain the existing level of service Generate cash from internal operations

Utility is Inherently Unviable/Overextended Need for Operational and CAPEX Sustained Subsidies Oversized System Carrying Too Much Debt Are Cost Recovery Tariffs Fair? Why Utilities Get Into Financial Trouble Cost Structure and Balance Sheet Position Have Materially Changed External Shocks Utility is Fundamentally Mismanaged and Subject to Corrupt Practices Governance Combinations of the Above With No Corrective Intervention Taken Except Pressure to Reduce Costs

Whatever the reason utilities get into trouble, the end financial result tends to be same given the how each of the technical and financial variables interact with one another. If left unchecked utilities go into a Vicious Performance Spiral

The Vicious Performance Spiral Low tariffs, low collection Consumers use water inefficiently High usage and system losses drive up costs Investment, maintenance are postponed Services deteriorates Customers are ever less willing to pay Utility lives off state subsidies Managers lose autonomy and incentives Efficiency keep dropping Subsidies often fail to materialize Utility can t pay wages, recurrent costs or extend system Motivation and service deteriorates further System assets go down the drain Crisis, huge rehabilitation costs

Limited Involvement with Private Bankers - Finance Relationship is mostly with Local or Central Governments - Few sanctions for lenders in case of default on debt. Financial Accountability of Public Utilities Certain Remedies of Typical Workout Situations are Not Realistic for Utilities - Bankruptcy, Liquidation, Sale of Main Assets - Either a financial solution is found or the utility is relegated indefinitely to life support conditions. Financial and Strategic Incentives of Main Actors May Be Quite Different - Profit motives are typically not the overriding concern or objective. Lack of true ownership values. Resources May be Denied to a Utility Not Because of Its Own Limitations But Because of the Government s Overall Fiscal Position - The issue of fiscal space has important bearing on the amount of public debt a government can assume to clean up balance sheets or inject fresh capital or initiate expansion. How they Differs from Private Enterprises