Cash Flow Management Essentials

Learn about key terms and concepts related to cash flow, such as Price Set, Man Types, Able Can, Forecasting Cash Flows, multiple choice scenarios, and cash flow problems. Understand the importance of managing cash flow effectively for business success.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

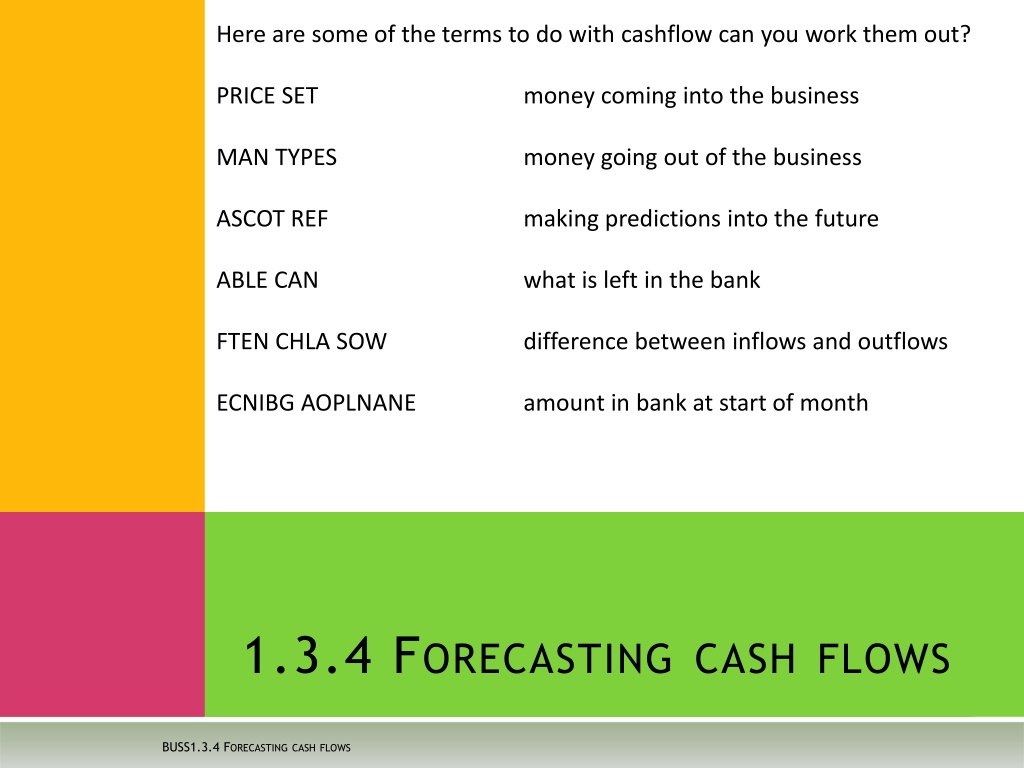

Here are some of the terms to do with cashflow can you work them out? PRICE SET money coming into the business MAN TYPES money going out of the business ASCOT REF making predictions into the future ABLE CAN what is left in the bank FTEN CHLA SOW difference between inflows and outflows ECNIBG AOPLNANE amount in bank at start of month 1.3.4 FORECASTINGCASHFLOWS BUSS1.3.4 FORECASTINGCASHFLOWS

How much will I earn? We had haggled over my monthly salary for ages. My employer offered me 4500. As a challenge I said that I would be happy if he would pay me all of the numbers 1 to 100 added together. OK he said, and we shook hands. Was he right to accept my offer? Add up all of the whole financial numbers 1 to 100 i.e. 1, 2, 3 how much will I get paid? No calculators allowed and as quickly as possible. 3.3.1 HOWTOIMPROVECASH FLOW 3.3.1. HOWTOIMPROVECASHFLOW

FILLINGINACASHFLOW FORECAST YOURTURN You may be asked to fill in the blanks on a cash flow forecast. See if you can do it here. Jan Feb Mar Receipts ( ) 8000 6000 e Payments Raw materials 3000 c 4000 Fixed Costs 2500 2500 2500 Other costs 4000 3000 3500 Total Payments a 8000 10000 Net cash flow b (2000) (500) Opening Balance 1000 (500) (2500) Closing Balance (500) d (3000)

MULTIPLE CHOICE Jan ( ) Feb ( ) Mar ( ) Cash inflow (a) 8000 12000 Cash outflow 8500 9000 (c) Net Cash Flow (1500) (b) 2000 1. Use the table to calculate (a)-(c) 2. What is the most appropriate way to deal with the negative cash flow in January ABank loan BOverdraft CSell shares to friends and family DIncrease sales revenue BUSS1.3.4 FORECASTINGCASHFLOWS

CASH FLOW PROBLEMS Businesses need to have sufficient cash to meet day to day finances Buying stock Paying wages Utility bills Insufficient liquid cash funds may mean an inability to meet short term debts Bank overdraft Trade creditors Limited cash may result in missed opportunities 3.3.1. HOWTOIMPROVECASHFLOW

CASH FLOW PROBLEMS A key consideration should be whether the cash flow problem is short term or long term A firm may be able to survive short term cash flow problems Long term cash flow problems may be insurmountable What were the key factors leading to the collapse of XL airlines? 3.3.1. HOWTOIMPROVECASHFLOW

CAUSESOFCASHFLOW PROBLEMS Credit Sales Long payment terms Poor credit control Overtrading Additional overhead and day to day expenses Increased capital expenditure Internal management Stock control Relationship with suppliers Poor or inaccurate planning Seasonality What advice would you give to businesses on managing credit sales? 3.3.1. HOWTOIMPROVE CASHFLOW Unexpected events

IMPROVING CASH FLOW Increasing the volume of the inflow of cash Reducing the volume of the outflow of cash Speeding up the timing of the inflow of cash Slowing down the timing of the outflow of cash Inflows Outflows Capital invested Loan repayments Loans Day to day running expenses Cash sales Debtor payments Interest payments 3.3.1. HOWTOIMPROVECASHFLOW

IMPROVING CASH FLOW - INFLOWS Using financial institutions e.g. banks Overdraft an arrangement with the bank allowing the business to withdraw money above the amount available Provides some financial peace of mind Backed by a cash flow forecast to show ability to repay Read more at Business Link Allows flexibility Incurs interest and possible arrangement fee Can be ordered to repay immediately Short-term loan an arrangement with a bank to lend money for a set period of time What might a business be able to use as collateral? Pre agreed repayment terms Incorporated into budget and cash flow Interest rate may be lower than an overdraft Read more at Business Link Interest is paid on the total value of the loan May need to be backed by collateral 3.3.1. HOWTOIMPROVECASHFLOW

IMPROVING CASH FLOW - INFLOWS Factoring Debt Factoring the process of selling a business debts to a factor house at a reduced amount in order to receive immediate payment Immediate payment of debt Reduced risk of non payment (bad debt) Factor house takes a % as their profit May alter customer s image of business Read more at Business Link 3.3.1. HOWTOIMPROVECASHFLOW

3.3.1. HOWTOIMPROVE CASHFLOW IMPROVING CASH FLOW - INFLOWS Sale of Assets What is meant by the term asset? Sale of Assets turning an obsolete asset into cash Potentially quick cash injection Asset must be no longer needed What assets will a business have? Loss of future use or value of asset Possible low value received One off action Does your school have any assets it could sell? Sale and Leaseback turning an asset into cash whilst still being able to use it through a lease agreement Quick cash inflow in the short term Reduced value of business assets Larger cash outflow in the long term

3.3.1. HOWTOIMPROVE CASHFLOW IMPROVING CASH FLOW - INFLOWS Cash payments from customers Reducing credit terms credit terms refers to the amount of time a customer is given to pay for their goods and services. Some businesses offer customers a discount for immediate or quick payment Quick cash inflow Reduced risk of bad debt May need to offer a discount May lose customers Credit control the process of chasing payments from debtors (people who have bought from you on credit) Brings cash into the business Full amount received The Credit Control Guru May alienate customers Administratively demanding

IMPROVING CASH FLOW - OUTFLOWS Delaying payment to suppliers Negotiating longer payment terms May incur penalties Need to maintain positive relationship De-stocking Reducing money tied up in stock by lowering the amount of stock held Reduce overhead spending Cut unnecessary expenditure Should not have negative impact on productivity Consider any knock on effect on sales Read more at Business Link 3.3.1. HOWTOIMPROVECASHFLOW

CASHFLOWTERMINOLOGY TEDDABB Can you identify some of the terminology you have used this lesson? LACE ALL ROT CONCERT LORD IT SEATS CABLE SAKE Once you have identified all the terms write a clue to help others work out the terms. 3.3.1. HOWTOIMPROVE CASHFLOW

IMPROVING CASH FLOWWHAT CANTHEMANAGERCONTROL? Not all cash flow is within the control of managers. Go back over this unit. Look at all of the cash inflows and cash outflows. For each inflow or outflow consider how easy it is for the manager to control. Give a rating from 1 to 10 with 10 being easy to control and 1 difficult to control. Justify your ratings by stating why you believe this to be the case. 3.3.1. HOWTOIMPROVECASHFLOW

ACTIVITY DAVES DIRECT 3.3.1. HOWTOIMPROVE CASHFLOW DELIVERIES Dave started his courier business 3D Ltd 5 years ago. It currently operates with a fleet of 8 trucks and 2 bikes. Over the past year however things have got tough: rising fuel prices, increased road tax and falling customer numbers have meant he has had to reduce his drivers from 8 to 5, all of whom are paid on a weekly basis. Dave already has a bank loan for 50000, the repayment on which has also gone up recently due to a rise in interest rates. Last month two of his regular customers cancelled their contracts, one of whom still owes him 6000. Both explained that they were moving to cheaper competitors who offered 45 day payment terms compared to Dave s 30 days. Dave s wife Doris helps out on a part time basis in the office where she answers the phone, sends invoices and keeps the financial records of payments and expenditure. Dave is worried, his bank balance is nearly zero and if things don t improve in the next 3 months he is anxious he will have serious cash flow problems and not be able to meet his day to day running costs. Identify the possible steps Dave could take to help solve his cash flow problem. 1) For each step identify an argument for and against taking that step. 2) Recommend 3 proposals to Dave. You should prioritise and justify your proposed solutions. 3)