Biofuel Coevolution of 1st and 2nd Generation: A Study

"Explores the synergy between 1st and 2nd generation biofuels, led by David Zilberman and team at UC Berkeley. Collaborative work shedding light on the sustainable evolution of biofuel technology."

Download Presentation

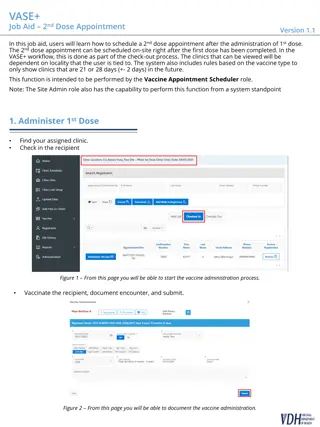

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Biofuel: The coevolution of 1stand 2ndgeneration David Zilberman UC Berkeley Collaborators: Kenny Bell, Gal Hochman, Justus Wesseler, and Scott Kaplan

Overview Lessons of 1stgeneration Expansion of 1stgeneration Brazil Biofuel and Biotech Coevolution of 1stand 2ndgeneration

Meta-analysis* Combine results from different studies in the hope of identifying repeating patterns and disagreement Studying trends Evaluated multiple criteria Greenhouse gases and land use changes Food and fuel prices Term of trade, welfare, and employment Learning by doing AAEA: Boston 2016

The ugly: GHG effect of ethanol-modest gains except sugarcane GHG savings/cost depends on location and land used to grow the crop: 1) Carbon debt of corn grown in US central grassland: 134 Mg CO2/ha 2) Carbon debt of corn grown in US abandoned crop land: 69 Mg CO2/ha Magnitude of ILUC calculations changed overtime, resulting in GHG declining overtime (Searchinger to Hertel) AAEA: Boston 2016

The bad: Food versus fuel On average, ethanol results in price of corn increasing by 24.5% Larger impact on short-run prices than long-run AAEA: Boston 2016

Biofuel and food commodity prices Introducing the oil and petroleum markets, in addition to gasohol markets, results in a smaller effect of biofuels on food commodity prices. More inelastic demand or supply for corn yields a larger effect on food commodity prices (recall that demand elasticity is negative while supply elasticity is positive, and more inelastic curves are those with elasticity closer to zero). During 2007/2008, the effect of corn ethanol on food commodity prices increases further AAEA: Boston 2016

When including all data points, the effect of the introduction of biofuels on gasoline prices increased over time AAEA: Boston 2016

Claims in the literature about the macro effect of biofuel: rural communities Farming in Asia is generally labor-intensive. The Government of Indonesia has stated the need to increase the farming land, or to use more intensive agricultural methods to grow sufficient biofuel crops to meet demand. Thousands more farm workers will be required. It has been observed in Brazil that biofuel production has led to a positive stimulation of rural economies and helped improve conditions for the production of other crops. In India, the sugarcane industry is a very big industry, employing 45.5 million people. AAEA: Boston 2016

Learning by doing A concept to measure and quantify the aggregated effect of technological development is the experience curve approach. This concept states that costs decline with a fixed percentage over each doubling in cumulative production. Mean PR production = 0.32 (1-0.32 = 0.68), but PR processing = 0.86 (1-0.86 = 0.14) AAEA: Boston 2016

Biofuel and the balance of trade Although in 2005, the US consumed 3.3 billion barrels of gasoline annually, in 2011 US consumption declined to 3.2 billion of barrels annually; A decline of 4%. The amount of ethanol consumed in the US in 2011 equaled 67.25% of the decline of finished motor gasoline consumption from 2005 to 2011. On the other hand, production of US gasoline in 2005 was 3 billion of barrels annually but it increased to 3.3 in 2011 an increase of 9%. the US payed 29.40 billion US$ for gasoline produced outside of the US in 2005 yet received 18.67 billion US$ from foreign countries in 2011. The US trade deficit of $558 billion in 2011 suggests the changes documented above are equivalent to more than 8% of this deficit. AAEA: Boston 2016

The meta analysis Biofuels resulted in A moderate increase of food commodity prices, yet a small impact on food prices A small reduction in fuel prices Although first generation biofuels did not yield much benefit to the environment, it did substantially impact the macro economy and rural development. Evidence suggests a small positive net effect on US welfare. Biofuel policy, similar to oil, natural gas and coal policies, result in political economic gains and impacts macro economic parameters. AAEA: Boston 2016

The unutilized potential of 1st generation Brazil has been a major producer of sugarcane ethanol, which can reduce GHG emissions substantially. Yet, we will show that Brazil underutilizes its biofuel potential It invested in pre-salt oil instead of biofuel Using mixed integrated linear programming (MILP) and maximizing net present value of investment in the open areas in grassland areas of Goiaz and other areas in Brazil, we showcase immense potential for sugarcane investment. AAEA: Boston 2016

Supply model explores the potential for profitable expansion of sugarcane ethanol into pasture land in Brazil under several scenarios Questions: How much new ethanol would be produced if all profitable first-gen investment opportunities were taken up? How does the answer change when considering a greenhouse gas price or equivalent policy, higher than historical yield increases (i.e. under aggressive investments in plant technology), when using a social discount rate, and when assuming much higher than historical maximum build rates?

Model solves an MILP that chooses refinery location and amount of pasture used. Key model features are: Spatially explicit freight costs and yields. Key non-physical constraints are: Maximum number of refineries built per year. Refineries are fixed in size. Key assumptions are: Fixed output prices before the effects of greenhouse gas prices. Fixed input prices. Capital is available for all investments. No hidden costs i.e. we only account for costs that are observable in public documents.

Potential yield is a key input variable obtained from FAO-GAEZ Predictions are for the 2020s using the Hadley CM3 A1F1 scenario, and rain fed systems. Omitted municipalities have either zero potential yield or zero pasture land available.

Freight is a key input variable estimated using empirical freight rates and a quadratic model in roading distance from the Paul nia hub (obtained from Google Maps) Model predicted freight rates per m 3 of ethanol

Scenarios Reference assumes the construction industry is able to produce double the historical maximum capacity installed (9000ML/year), Petrobras real WACC as the discount rate (6.1%), historical yield increases (0.3243t/year), recent land and operation costs. Ethanol price/BTU is an oil-equivalent price which adjusts the oil price/BTU upward to account for refining and ethanol s value as an oxygenate. GHG price assumes the US government values for the SCC as the carbon price, a simple global equilibrium model for the oil/ethanol market, CA LCFS (without iLUC) values for fluxes, soil carbon fluxes from pasture to sugarcane from Mello (2014, NCC). Social discount rate assumes a real discount rate of 3%. High yield increase assumes yield increases of 2t/year. High construction capacity assumes a maximum of 27000ML/year of installed capacity.

Profitability over space is highly dependent on potential yields and freight rates. NPV per refinery in the Reference scenario, for refineries constructed in period 0. Values are censored at the negative of the refinery construction cost.

Various model outputs Scenario Total NPV ($ billion) Investment Cost NPV ($ billion) Pasture Converted (Mha) Percentage of Global Agricultural Total Production Total Brazil Ethanol as Percentage of World Liquids in 30 in 30 Years (million m3/year) Area Years Reference scenario 30.01 96.99 31.59 0.84% 249.4 3.1% GHG price 351.4 101.9 31.51 0.84% 250 3.1% Social discount rate (3%) 128.7 132.1 31.51 0.84% 249.5 3.1% High yield increase (2 tonne/year) 84.26 114.6 24.25 0.69% 366.6 4.6% High construction capacity (108 refineries/year) 37.29 168.1 51.14 1.2% 385.8 4.6% All 3270 591.9 84.4 1.9% 1302 15%

Biotech and Biofuel While the adoption of GMOs increases supply of soybean and corn in the adopting countries, there is huge potential for adoption in other countries and other crops like rice. There is evidence of yield effects of GM whenever it is not adopted. China is considering GM corn With the introduction of gene editing (CRISPR) and other tools, the capacity to increase yields will rise. The issue is regulation

Economic losses from delay of decisions Average Annual Price, Quantity, and Welfare Effect of Adoption of GM Rice Elasticity Elasticity of Demand of Demand= =0.35 Quantity (millions of Tonnes) 0.35 Change in Welfare (billions USD) Elasticity Elasticity of Demand of Demand= =0.7 Quantity (millions of Tonnes) 0.7 Change in Welfare (billions USD) Price Price Original Supply $566.45 682.8 $0 $566.45 682.8 $0 10% Increase $494.34 716.1 $26.2 $517.30 727.6 $27.1 15% Increase $463.93 732.2 $37.7 $495.85 749.5 $39.4 20% Increase $436.56 748.0 $48.3 $476.16 771.0 $51.1 If there was a 20% increase in the global supply of GM rice over the past 10 years: Average annual price/tonne may have decreased as much as $129.89/tonne (from $566.45 to $436.56). Average annual quantity may have increased by as much as 88.2 million tonnes (682.8 to 771). Average annual social welfare may have increased by up to $51.1 billion.

Economic losses from delay of decisions Table 5: Discounted Net Benefits (in billions of $) of Adoption of GM Corn, Wheat, and Rice =0.35 =0.35 =0.8 =0.8 Elasticity Interest Rate Time Horizon Corn (7.5%) 4% 10% 4% 10% 30 Years 136 Infinite 214 30 Years 61 Infinite 67 30 Years 139 Infinite 220 30 Years 63 Infinite 69 Corn (15%) 254 402 115 126 268 423 121 $133 Wheat (10%) Wheat (20%) Rice (10%) 178 282 81 88 184 290 83 $91 328 518 148 162 347 548 157 $172 349 551 158 173 360 568 163 $178 Rice (20%) 641 1,013 290 318 679 1,073 307 $337 Total (low) $663 $1,047 $300 $328 $682 $1,078 $309 $338 Total (high) $1,223 $1,933 $554 $606 $1,294 $2,045 $586 $641 The aggregate benefits of adoption of GM corn, wheat, and rice over the next 30 years range from $300 billion to $1.29 trillion. The aggregate benefits of adoption of GM corn, wheat, and rice over an infinite time horizon range from $328 billion to $2.04 trillion.

Introducing new technologies will increase supply Access to GMOs and gene editing will increase supply, and agriculture will reach its traditional problem of excess supply. Even if 5% of rice cropland is devoted to sugarcane, there will be another major supply of sugarcane ethanol. India and Vietnam are the major candidates, but other countries may follow. Similarly, if we reach 5 tons/Ha of corn in developing countries, which is feasible, again we will have excess supply and will be able to produce corn ethanol in DDGs. This can be in countries like Ghana, Zimbabwe, and other African countries. If Europe moves to gene editing, then there may be a whole new source.

Biodiesel Today, there are 8 million hectares in cocoa producing 0.55 tonnes/Ha in Africa. With new technologies, actual yields can be 1.2-1.5 tonnes/Ha, while yield potential is 3 tonnes/Ha. There is already a thriving palm oil industry in Ivory Coast. Yields can double with adoption of drip irrigation. There is a feasibility to have 3 million HA of palm oil in West Africa Yields of 4-5 thousand liters/HA (500 gal/acre) Soybean biodiesel is not profitable, but genetic research will makea difference-especially with new tools

Coevolution of 1st and 2nd Generation We learned that there has been substantial learning by doing, and it will continue. First generation produced the cheapest and most accessible form of feedstock for 2nd generation (corn stover and bagasse). Drastic increases in sugarcane and corn production will provide cheap and abandoned feedstock. Gene editing and other technologies will improve the refining process. There is a way forward, but it is interdependent with 1st generation.

Conclusion Many biofuels do not sequester much carbon but sugar cane,palm oil and few second generation do There is learning by doing and it will continue 2nd generation started slowly. We have new knowledge and several prototypes Expansion of 1st generation can increase the capacity to utilize ethanol and other biofuels, and will pave the way for 2nd generation. The challenges are not technological, but regulatory. The blend wall Regulation of biotech Alternative energy sources are advancing slowly The electric car is the future, but biofuels are likely to be part of the future as well.

Conclusions The main challenges of biofuels are not technical- it is political and cultural Climate change policy and debate have been dominated by physicists-not biologist Environmental groups are suspect of modern plant biology Oil companies are threatened by biofuels The GMO debate is systematic People have a vision of sustaining small farmers in developing countries- and ecological agriculture But small farmers are poor ones With gene editing and other tools we can do much more Regulation stop us from developing the bioeconomy