Analyzing Small Firms' Health Insurance Decisions

Explore how local competitive factors and competitors' decisions impact small firms' choices to offer health insurance, using tax data analysis. The study considers workforce characteristics, firm characteristics, and labor market conditions to understand the influence on employer incentives and federal deficits.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

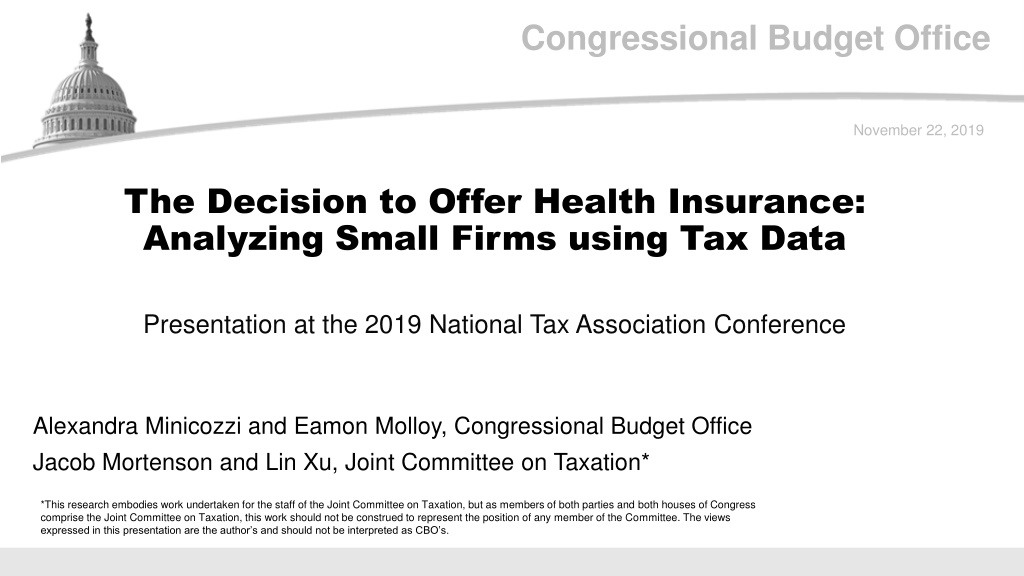

Congressional Budget Office November 22, 2019 The Decision to Offer Health Insurance: Analyzing Small Firms using Tax Data Presentation at the 2019 National Tax Association Conference Alexandra Minicozzi and Eamon Molloy, Congressional Budget Office Jacob Mortenson and Lin Xu, Joint Committee on Taxation* *This research embodies work undertaken for the staff of the Joint Committee on Taxation, but as members of both parties and both houses of Congress comprise the Joint Committee on Taxation, this work should not be construed to represent the position of any member of the Committee. The views expressed in this presentation are the author s and should not be interpreted as CBO s.

CBO To What Extent Do Local Competitive Factors Affect a Small Employer s Decision to Offer Health Insurance? Relevance: As competitive factors change so may the share of employers offering insurance (affecting federal deficits). If firms are highly responsive to competitors offering insurance, then a tipping point response to policies that cause a large change in employer s incentive to offer is more likely. Labor markets are mostly local (e.g., Moretti, 2011). Moretti, Enrico. "Local Labor Markets." In Handbook of Labor Economics, vol. 4, pp. 1237-1313. Elsevier, 2011. 1

CBO Do Local Competitors Decisions to Offer Affect a Small Firm s Decision to Offer Health Insurance? We allow the probability a firm offers health insurance to depend on workforce characteristics firm characteristics labor market conditions outside options for subsidized insurance Main contribution: explore the role played by labor market competitors offer rate of firm (i), weighted by employees (n), where ??? are competing firms in Core-Based Statistical Area (CBSA) j and industry k: ? ???\? (???? ?????{???}) (?{??} ??) ?????????? ????? ?????= Our competitor offer rate is firm-specific: it is calculated within a given CBSA and industry, leaving out the firm in question. 2

CBO Tax Data Universe of four tax filings from 2015: Forms 1095-B and 1095-C, Form 941, and Form W-2 Small firms in 350 randomly selected CBSAs Approximately 150,000 firms Offer decision from the following forms: Form 1095-B: filed by health insurance providers Form 1095-C: filed by employers Form W-2: filed by employers (codes DD and W) Code DD is for health insurance, Code W is for HSA. 3

CBO CBSAs Included in the Sample 4

CBO CBSAs Included in the Sample - Examples CBSA San Francisco-Oakland-Hayward, CA Baltimore-Columbia-Towson, MD Nashville-Davidson--Murfreesboro--Franklin, TN Dayton, OH Winston-Salem, NC Modesto, CA Atlantic City-Hammonton, NJ Fargo, ND-MN Rochester, MN Plattsburgh, NY Nacogdoches, TX Sheridan, WY CBSA Population Ranking 11 21 36 72 83 102 179 192 206 442 498 816 5

CBO Restrictions on Firms in the Analysis Sample Unit of analysis is a small firm Small firms: between 10 and 199 employees employee: W-2 filing where earnings exceed $5,000 only the CBSA where the majority (80%) of firm s employees work Dropped state, local, and federal government employers Dropped payroll companies from the sample Our definition of a firm is a parent company. This means that a firm could have multiple establishments and be comprised of multiple EINs. 6

CBO Comparing Tax Data and MEPS-IC Offer Rates Firm Size (# of Workers) 10-24 Tax Data MEPS-IC Difference 39.3 53.1 -13.8 25-49 58.4 70.3 -11.9 50-99 78.0 85.7 -7.7 100-499 93.6 95.0 -1.4 500-9,999 97.6 96.9 0.7 >10,000 98.7 98.5 0.2 Total 88.9 92.1 -3.2 7

CBO Sample Statistics Sample Statistics Mean 46.8 0.75 0.99 0.24 0.25 0.24 0.42 0.21 0.31 0.14 0.05 0.25 0.02 Std. Dev. 49.9 0.15 0.05 0.43 0.44 0.43 0.21 0.18 0.16 0.12 0.08 0.21 0.04 Min 0.0 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 Max 100.0 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 0.89 1.00 0.60 Analysis Firm Offer Rate Firms with 10-199 employees Firm with 200+ employees 25-49% Female 50-74% Female 75-100% Female Pct. Married Pct. <26 Years Old Pct. 27-39 Years Old Pct. 55-64 Years Old Pct. >64 Years Old Pct. Female <40 Years Old Pct. <26 Years Old & Married Pct. 27-39 Years Old & Married Pct. 55-64 Years Old & Married Pct. >64 Years Old & Married 25th Earnings Percentile ($000) Earnings Interquartile Range ($000) Competitor Offer Rate Firm Workforce Characteristics 0.12 0.09 0.03 14.7 0.10 0.09 0.06 14.9 0.00 0.00 0.00 3.8 1.00 0.90 0.75 2285.6 25.7 29.8 0.0 2636.3 Firm Size <100 Workers Firm Size (# of Workers) Firm Size Squared Turnover Index Number of Marketplace Insurers Unemployment Rate Medicaid Expansion 0.96 0.20 0.00 1.00 29 29 10 100 0.00 1.00 2.40 0.00 199 39601 2.03 12.00 11.60 1.00 1654 0.12 4.89 4.89 0.57 4217 0.15 1.73 1.15 0.48 CBSA Characteristics Turnover index is defined as the standard deviation of a firm s quarterly employment divided by its mean employment. 8

CBO Number of Competing Firms for Analysis Sample Firms Number of Competing Firms for Analysis Sample Firms Percent Competitors with <200 Employees Number of Competing Firms 2-9 N Total Percent 141 0% 83% 10-49 4,219 3% 95% 50-99 8,039 5% 96% 100+ 139,143 92% 96% Total 151,542 100% 96% 9

CBO Baseline Model Specification Baseline Model Specification Linear Probability Model Pr (??????= 1) = + ????+ ????+ ???? + ?4??+ ????+ ???? Dependent variable: Offer at firm i (W-2, Box 12, Codes DD & W; 1095-B; 1095-C) Variables of interest: C: Two competitor offer rates (firm-specific): small and large competitors Competitors defined as firms in the same CBSA and industry as firm i Control variables: W: Workforce characteristics (age, marital status, sex, wage distribution) F: Firm characteristics (firm size, worker turnover) L: Labor Market Conditions (CBSA unemployment rate) O: Outside HI options (Medicaid expansion, # insurers in nongroup market) Bolded items indicate vectors. 10

CBO Model Model Specification (Continued) Specification (Continued) Estimate four different model specifications: 1. CBSA controls: unemp. rate, number of insurers, Medicaid expansion 2. CBSA controls + Industry Fixed Effects (based on 2-digit NAICS code) 3. CBSA Fixed Effects instead of CBSA control variables 4. CBSA + Industry Fixed Effects 11

CBO Regression Results Industry FE Coef. 0.784 0.026 -0.007 -0.001 -0.038 0.341 0.072 0.205 0.233 -0.130 -0.013 -0.391 -0.161 -0.194 0.116 0.003 0.001 -0.117 -0.529 0.002 0.000 0.014 0.000 -0.004 -0.002 0.042 Industry + CBSA FE Coef. 0.024 0.026 -0.005 0.003 -0.034 0.341 0.064 0.195 0.222 -0.134 -0.020 -0.320 -0.146 -0.191 0.132 0.003 0.001 -0.121 -0.514 0.003 0.000 0.014 0.000 P>|t| P>|t| Firms with 10-199 employees Firm with 200+ employees 25-49% Female 50-74% Female 75-100% Female Pct. Married Pct. <26 Years Old Pct. 27-39 Years Old Pct. 55-64 Years Old Pct. >64 Years Old Pct. Female <40 Years Old Pct. <26 Years Old & Married Pct. 27-39 Years Old & Married Pct. 55-64 Years Old & Married Pct. >64 Years Old & Married 25th Earnings Percentile ($000) Earnings Interquartile Range ($000) Turnover Index Firm Size <100 Workers Firm Size (# of Workers) Firm Size Squared Firm Size <100 Workers x Firm Size Firm Size <100 Workers x Firm Size Sq. Number of Marketplace Insurers Unemployment Rate Medicaid Expansion 0.000 0.293 0.064 0.838 0.000 0.000 0.000 0.000 0.000 0.000 0.320 0.000 0.000 0.000 0.007 0.000 0.000 0.000 0.001 0.272 0.430 0.000 0.000 0.000 0.041 0.000 0.644 0.322 0.171 0.595 0.000 0.000 0.000 0.000 0.000 0.000 0.107 0.000 0.000 0.000 0.002 0.000 0.000 0.000 0.001 0.251 0.400 0.000 0.000 Competitor Offer Rate Firm Workforce Characteristics CBSA Characteristics Turnover index is defined as the standard deviation of a firm s quarterly employment divided by its mean employment. 12

CBO Competitor Offer Rates: Strongly Correlated with Firm Offer Rates 13

CBO Discussion Competitor offer rate strongly predictive of small firm offer rate across all 4 model specifications As anticipated, predicted probability of offering increases with age (up to age 65), earnings, more married workers (except when they are predominantly female or young). increases with firm size and decreases with turnover. decreases with number of insurers in the nongroup market and with unemployment rate. Surprisingly, firms in states that expanded Medicaid eligibility have a higher predicted probability of offering. 14

CBO Future Work Better exploit geographic variation to identify parameters of interest Small group rules regarding premiums vary by state Interact Medicaid expansion with fraction of workers eligible for Medicaid Improve definition of worker turnover and seasonality Repeat for 2016 and 2017 No sampling: use data from all CBSAs Reduce measurement error in offer variable by improving match to 1095-Bs 15

CBO Industry Groups Used to Define Labor Market Competitors NAICS 11 21 22 23 42 51 52 53 54 55 56 61 62 71 72 81 92 31-33 31 32 33 44-45 44 45 48-49 48 49 Description Agriculture, Forestry, Fishing and Hunting Mining, Quarrying, and Oil and Gas Extraction Utilities Construction Wholesale Trade Information Finance and Insurance Real Estate and Rental and Leasing Professional, Scientific, and Technical Services Management of Companies and Enterprises Administrative and Support and Waste Management and Remediation Services Educational Services Health Care and Social Assistance Arts, Entertainment, and Recreation Accommodation and Food Services Other Services (except Public Administration) Public Administration Manufacturing Food, Beverage, & Textiles Manufacturing Wood & Chemical Manufacturing Metal & Machinery Manufacturing Retail Trade Share of Sample 0.4% 0.2% 0.1% 9.3% 3.2% 0.9% 1.9% 2.3% 8.7% 0.2% 4.2% 2.6% 15.0% 2.1% 19.2% 8.3% 0.0% Offer Rate 41.7% 62.1% 64.9% 43.9% 64.0% 72.1% 70.0% 55.8% 69.1% 68.6% 37.6% 62.2% 51.2% 48.8% 22.5% 43.2% 1.2% 1.9% 4.7% 48.1% 66.2% 69.5% 9.3% 2.4% 41.6% 44.2% Transportation and Warehousing 1.7% 0.3% 42.2% 46.5% 16