Algorithmic Game Theory Lecture

Divisible goods models in Algorithmic Game Theory explore market equilibriums and utility functions. Fisher Market Model, Competitive Market Equilibrium, and Arrow-Debreu Theorem are discussed in this content, focusing on the existence of equilibrium in different market settings.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

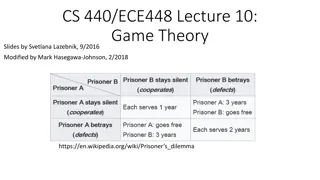

Comp 553: Algorithmic Game Theory Lecture 23 Fall 2014 Yang Cai

Exchange Market Model traders divisible goods trader i has: - utilityfunction non-negative reals consumption set for trader i specifies trader i s utility for bundles of goods - endowment of goods amount of goods trader comes to the marketplace with

Fisher Market Model n traders with: money mi ,and utility function ui k divisible goods owned by seller; seller has qj units of good j can be obtained as a special case of an exchange market, when endowment vectors are parallel: in this case, relative incomes of the traders are independent of the prices.

Competitive (or Walrasian) Market Equilibrium Def: A price vector is called a competitive market equilibrium iff there exists a collection of optimal bundles of goods, for all traders i = 1, , n, such that the total supply meets the total demand, i.e. total supply total demand [ For Fisher Markets: ]

Arrow-Debreu Theorem 1954 Theorem [Arrow-Debreu 1954]: Suppose (i) is closed and convex (ii) (all coordinates positive) (iii a) (iii b) (iii c) Then a competitive market equilibrium exists.

Fishers Model Suppose all endowment vectors are parallel relative incomes of the traders are independent of the prices. Equivalently, we can imagine the following situation: n traders, with specified money mi k divisible goods owned by seller; seller has qj units of good j Arrow-Debreu Thm (under the Arrow-Debreu conditions) there exist prices that the seller can assign on the goods so that the traders spend all their money to buy optimal bundles and supply meets demand

Utility Functions CES (Constant Elasticity of Substitution) utility functions: linear utility form Leontief utility form Cobb-Douglas form

Fishers Model with CES utility functions Buyers optimization program (under price vector p): Global Constraint:

Eisenberg-Gales Convex Program The space of feasible allocations is: But how do we aggregate the trader s optimization problems into one global optimization problem? e.g., choosing as a global objective function the sum of the traders utility functions won t work

Eisenberg-Gales Convex Program Observation: The global optimization problem should not favor (or punish) Buyer i should he Double all her uij s Split himself into two buyers with half the money Eisenberg and Gale s idea: Use the following objective function (take its logarithm to convert into a concave function)

Eisenberg-Gales Convex Program Remarks: - No budget constraints! - It is not necessary that the utility functions are CES; everything works as long as they are concave, and homogeneous

Eisenberg-Gales Convex Program KKT Conditions - interpret Langrange multipliers as prices - primal variables + Langrange multipliers comprise a competitive eq. 1. Gives a poly-time algorithm for computing a market equilibrium in Fisher s model. 2. At the same time provides a proof that a market equilibrium exists in this model. Linear case: proof on the board.

undefined

undefined