A Comprehensive Overview of Level 2 Finance and Accounts Assistant Apprenticeships

Explore the Level 2 apprenticeships in Finance and Accounts Assistant roles, covering qualification details, job roles, required behaviors, skills, and the learner journey. Delve into the different aspects of the apprenticeship program, including development, on-programme training, end point assessment, and essential knowledge areas. Gain insights into the importance of personal effectiveness, teamwork, accounting systems, and professionalism in this sector. Discover the mandated qualifications, duration, entry requirements, and the critical skills needed for success in financial roles.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

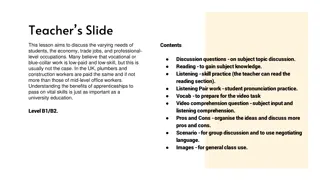

The perfect storm? New qualification No exam exposure Lockdown

Level 2 development Development started 2016 Involved Employers, SMEs and educational experts Research industry, surveys, job vacancies, job descriptions Approved for delivery July 2019

Finance/Accounts Assistant Apprenticeship Job roles Accounts Payable Clerk / Accounts Receivable Clerk Accounts Administrator Accounts Assistant Business Accounts Administrator Finance Assistant Junior Assistant Bookkeeper Junior Cashier Junior Credit Control clerk Data input clerk General Administrator/ / Finance Administrator

Finance/Accounts Assistant Apprenticeship Finding band: 6,000 Qualification mandated Duration 13 months Apprentices without Level 1 English and maths will need to achieve this level and taken the test for level 2 prior to taking their end point assessment.

Finance/Accounts Assistant Apprenticeship Behaviours Knowledge General Business Teamwork Understanding your organisation Personal development Accounting systems and processes Professionalism Basic accounting Customer focus Ethical standards End Point Assessment Skills Attention to detail Structured interview based on a portfolio evidence In-Tray assessment Communication of Uses systems and processes Personal effectiveness

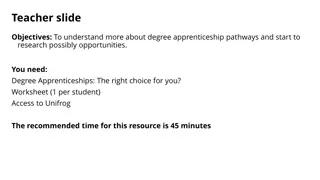

A level 2 learner journey 12 months on-programme End Point Assessment Induction and welcome to the world of work AAT Level 2 qualification: Impact skills Producing and communicating quality information Personal effectiveness Bookkeeping Basic costing Accounting software/Business environment Effective working practice Working effectively in a team Working in the business environment

Internal accounting systems and controls Options: 2/5 Business tax, personal tax, audit and assurance, cash management, credit management Applied management accounting Drafting and interpreting financial statements Level 4 Management accounting techniques Business awareness Tax processes for business Level 3 Final accounting Principles of bookkeeping controls The business environment Principles of costing Introduction to bookkeeping Level 2 Technology Communication Ethics Sustainability

Detail of our ISP programme Our ISP Producing and communicating quality information Personal effectiveness Working effectively in a team Working in the business environment Xero certification.

Entry point Recruitment If no prior learning accounting If no prior learning Business studies Fast track Top up Entry point Recruitment Level 2 from booking keeping units to the full qualification Level 2 Apprenticeship for those new to accounting and new to the world of work Fast track Top up

1 START AT LEVEL 3 including LEVEL 2 Bookkeeping Recommend apprenticeship High achiever A Level Business Studies (or equivalent) START AT LEVEL 3 including LEVEL 2 Bookkeeping and other units based on Skills Check Recommend apprenticeship 2 General level achievement YES High achiever also with A Level Business Studies and/or Economics START AT LEVEL 3 Fast track into Level 4 Apprenticeship might be appropriate 3 4 A Level Accounting (or equivalent) START AT LEVEL 3 Recommend apprenticeship Grade A-C START LEVEL 3 including LEVEL 2 Bookkeeping and other units based on Skills Check Recommend apprenticeship A Level Accounting or Business Studies (or equivalent) 5 Grade D F Grade A-C START LEVEL 3 Including LEVEL 2 Bookkeeping and other units based on Skills Check Recommend apprenticeship Grade D F START FULL LEVEL 2 commercial and fast-track to LEVEL 3 apprenticeship 6 GCSE Accounting YES Grade A-C START LEVEL 3 Including LEVEL 2 Bookkeeping and other units based on Skills Check Recommend apprenticeship Grade D F START FULL LEVEL 2 commercial and fast-track to LEVEL 3 apprenticeship 7 GCSE Business Studies GCSE Accounting or Business studies NO START FULL LEVEL 2 Recommend apprenticeship 8 NO

Entry point Recruitment Fast track Top up Will need: Additional support in role Additional learning time Additional learning and support from FI Current perfectstorm Current incentives Entry point Recruitment Fast track Top up

Why utilise this apprenticeship? Is L2 a solution? Knowledge Progression First professional exams No exam exposure Lockdown Incentives Confidence World of work and introductory level of skill