2022 Federal & State Tax Update - Allegheny Tax Society

"Stay updated on the latest tax updates for 2022, including federal legislation outlook, Pennsylvania, Ohio, and West Virginia tax changes, and key discussions on estate and gift matters. Explore the impact of the CHIPS and Science Act, Inflation Reduction Act, and more. Discover the Washington legislative outlook and partisan control trends."

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

2022 Federal & State Tax Update Allegheny Tax Society December 12, 2022

Place holder for colleague information 2

Introduction December 2022

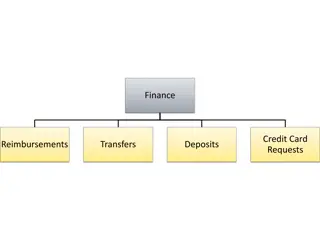

Federal and State Tax Update 2022 Federal Legislation Outlook For Remainder of 2022 2022 Federal Legislative Update CHIPS and Science Act Inflation Reduction Act Federal Tax Update 2022 Pennsylvania Tax Changes 2022 Ohio Tax Changes 2022 West Virginia Tax Changes Lease Accounting Change Section 174 Capitalized Research Costs Pass-through Entity Deduction Carried Interest Centralized Partnership Audit Regime Estate and Gift Questions and Discussions 4

Federal Legislative Update December 2022

Remaining 2022 Washington Legislative Outlook No clear timeline for significant federal legislation that could gain approval of both House and Senate 50/50 Senate Split and special interest caucuses Apparent public dislike between Republicans and Democrats (what communication is going on behind the scenes?) Is proposed legislation complicated by mid-term election results? 6

Washington Legislative Update/Watch CHIPS and Science Act (CHIPS) Inflation Reduction Act (IRA) Secure Act 2.0 Tax Extender Package 9

CHIPS and Science Act December 2022

The CHIPS and Science Act Overview The CHIPS Act was signed into law on Aug. 9, 2022. It provides billions of dollars in grants along with a new income tax credit to jump-start domestic semiconductor manufacturing., after it passed with bipartisan support in Congress. The CHIPS Act contains over $50 billion of incentives in the form of four new grants. These grants will serve to fund workforce development, the security of the domestic supply chain for semiconductors, and other programs dedicated to bringing semiconductor technologies from lab prototypes to fabrication through university collaboration and research and development. 11

48D Advanced Manufacturing Investment Tax Credit The CHIPS and Science Act creates an advanced manufacturing investment tax credit of 25% for an eligible taxpayer making a qualified investment in qualified property in a tax year with respect to an advanced manufacturing facility of an eligible taxpayer. An eligible taxpayer is one that is not a foreign entity of concern or made certain investments in China. Qualified investment is the tax basis of property placed in service by the taxpayer during the tax year (before reduction for the credit) excluding property that qualfieis for the rehabilitation credit. Qualified Property is eligible for the credit when if, among other requirements, it is integral to the operation of an advanced manufacturing facility which has a primary purpose of manufacturing semiconductors or semiconductor manufacturing equipment. Property includes buildings and structural components meeting the requirements Taxpayers may elect to treat the credit as a tax payment, which effectively makes it refundable. Special rules apply when refunded to partnerships and S corporations. Basis reductions and recapture provisions apply. Effective Date: property placed in service after December 31, 2022 (with certain exceptions for property beginning construction before 1/1/2023 and after 8/9/2022, and for property for construction beginning after 12/31/2026) 12

CHIPS For America Fund Grants Authorizes the Department of Commerce to provide funding to eligible applicants to incentivize investment in facilities and equipment in the United States for the fabrication, assembly, testing, advanced packaging, production, or research and development of semiconductors, materials used to manufacture semiconductors, or semiconductor manufacturing equipment. Funding documents, which will provide specific application guidance for the CHIPS for America program, will be released by early February 2023. Awards and loans will be made on a rolling basis as soon as applications can be responsibly processed, evaluated and negotiated. Additional information can be found at: https://www.commerce.gov/tags/chips-act https://www.nist.gov/chips 13

Inflation Reduction Act December 2022

Inflation Reduction Act (IRA) Summary Revenue Raising Provisions: Alternative 15% Corporate Minimum Tax Stock Repurchase Excise Tax Excess Business Loss Deduction Extension for 2 more years Increased IRS Enforcement Funding Excise taxes on pharmaceutical companies to compel lower prices Spending Provisions: Green Energy Credits Green Energy Grants Increased IRS Enforcement 15

15% Corporate Minimum Tax In General Impacts applicable corporations (public and private) Aggregation of entities required 15% of Adjusted Financial Statement Income (with certain adjustments) Effective for tax years after 12/31/2022 Unlimited carryforward of alternative minimum tax applied against regular tax in years regular tax exceeds the minimum tax Significant regulatory authority granted to interpret the law. 16

15% Corporate Minimum Tax Applicable Corporations Any corporation (excluding S corporations, RIC, REIT) Income Threshold (two types) Type 1 Corporation with average 3-year annual adjusted financial statement income exceeding $1 billion for 3 consecutive years Includes persons treated as a single employer under 52(a) or (b) aggregation rules Includes only U.S. corporations, controlled foreign corporations, certain partnerships Type 2 Corporation that is a member of an international financial reporting group with a foreign parent Average 3-year annual adjusted financial statement income exceeding $1 billion for 3 consecutive years for group coupled with $100 million or more annual adjusted financial statement income including only U.S. corporations, controlled foreign corporations, certain partnerships 17

15% Corporate Minimum Tax Calculation of Tax 15% of Adjusted Financial Statement Income Minus: creditable Foreign Tax Credits Minus: regular tax regular Foreign Tax Credits Minus: BEAT Liability Adjusted Financial Statement Income ( 56A) Net income per applicable financial statement (as defined and determined in the law) Various adjustments (complex) including: Tax depreciation allowed Certain taxes Certain pension adjustments Certain items of foreign income Adjustments for investments in partnerships Adjustments for related entities (inclusive or exclusive of consolidated return) Financial statement net operating loss carryovers 18

Excise Tax on Stock Repurchases New 4501 Non-deductible 1% tax assessed on covered corporations based upon FMV of repurchased stock (net of stock issuance) imposed after 12/31/2022 Applicable to corporations with stock traded on an established securities market. Repurchased defined in 317(b) and economically equivalent transactions Foreign corporation stock repurchases excluded Exception for foreign stock purchased by a domestic U.S. corporation Exceptions include repurchases part of 368(a) reorganization, by RICs and REITs, and for repurchased stock contributed to an ESOP 19

Individual Excess Business Loss Limitation Extended The new provision extends the application of 461(l) for two additional years now through 12/31/2028 (original TCJA expiration and 1-year American Rescue Plan Extension) QUERY: Will this provision be continuously extended or even made permanent? 20

Larger Payroll Tax Offset For Small Business for R&D Credit Increases from $250,000 to $500,000 the limit on the amount of research credit that qualified small businesses may elect to treat as a credit against their payroll tax liability. Applies to taxable years beginning after 2022. 21

IRS Resources Increased $78.9 billion increase over 10-year budget window $3.2 billion for taxpayer services (pre-filing assistance and education, filing and account services, taxpayer advocacy services) $45.6 billion for tax enforcement activities (determining and collecting taxes, providing legal and litigation support, conducting criminal investigations, providing digital asset monitoring and compliance activities, enforcing criminal statutes for violations of internal revenue laws) $25.3 billion for necessary expenses to support taxpayer service and enforcement programs (facilities services; headquarters and other IRS-wide administration activities; telecommunications; and information technology development, enhancement, operations, maintenance, and security) $4.8 billion in additional funding would provide for business systems modernization (development of callback technology and technology to provide more personalized customer service) IRS needs to recruit, train, and integrate large number of new employees (resulting from increase in overall employees plus replacement of significant number of retiring employees in the next 5-10 years), and modernize computer systems to address the so-called tax gap between theoretical total collectible taxes and actual collections. 22

Notable Tax Policy Proposals Excluded from IRA Increase in highest individual income tax brackets and addition of surcharges Change in taxation of capital gain rates for wealthy Increase in Corporate income tax rate from 21% Wealth tax SALT Deduction expansion Carried interest changes Limits on like-kind exchanges Changes in operation of excess business loss provisions Limitations on Donor Advised Funds Estate and gift tax modifications International taxation surrounding GILTI, BEAT, etc. Modification or research and development capitalization requirements QUERY: Will some of these proposals be included in future legislation? 23

Federal Tax Update December 2022

IRA - Residential Energy Credits December 2022

25C Non-Business Energy Property For Individuals The credit for non-business energy property, renamed the energy efficient home improvement credit for years after 2022, is extended and applies to qualified energy property through 2032. The credit rate is increased to 30 percent. The lifetime maximum for the credit is replaced with annual limits depending on the type of property. Select highlights: 2022 2023 - 2032 10% Tax Credit for qualified energy-efficient improvements and expenditures: non-refundable 30% Tax Credit for qualified energy-efficient improvements and expenditures; non-refundable $500 lifetime credit $1,200 annual limit on the credit $200 lifetime limit for new windows $600 limit for exterior windows & skylights $300 limit for certain water heaters & heat pumps $2,000 limit for electric/natural gas heat pump water heaters & biomass stoves $150 limit for qualified natural gas, propane, or oil furnace or hot water boiler $600 limit for natural gas, propane, or oil furnaces or hot water boilers; $2,000 limit for biomass boilers $300 limit for AC systems $600 limit for central AC units $200 limit for exterior doors $250 limit for an exterior door ($500 total) Under the new act, there is an annual, rather than lifetime, limit on the credit and there is no income limit for this credit. Spreading out qualifying home projects, taxpayers can claim the maximum credit each year. Form 5695 is used to claim the credit 26

25D Residential Clean Energy Credit for Individuals Residential energy efficient property credit renamed the residential clean energy credit under IRA Extends credit 2 years (now through 2034) for residential solar, wind, geothermal, and biomass fuel. Maintains the previous 30% credit rate but adjusts the project dates. 30% credit for projects started between 2022 and 2032. Credit decreases to 26% for projects started in 2033 and 22% for projects started in 2034. Qualified property includes solar electric property, solar water heating property, fuel cell property, small wind energy property, geothermal heat pump property; and for expenditures in tax years beginning after December 31, 2022, battery storage technology. Qualified expenditures for battery storage technology are eligible for the credit beginning after 2022. Qualified expenditures for biomass fuel property are not eligible for the credit after 2021 (but see 25C for potential biomass credit). Applies to a home that is used as taxpayer s residence. Vacation homes could qualify but there is a reduction when business use exceeds 20% (excludes fuel cell property) Credit is not refundable, but unused credit is carried over. Basis in property is reduced by the amount of the credit. Credit claimed on Form 5695 27

30D Clean Vehicle Credit For Individuals The IRA changed the IRC Section 30D "new qualified plug-in electric drive motor vehicles credit" to a "clean vehicle credit." The clean vehicle credit is a dollar-for-dollar reduction of federal income taxes by up to $7,500 for new clean vehicles placed in service by a taxpayer during the tax year before January 1, 2033. Though the maximum amount of credit is the same ($7,500), how the credit is calculated is substantially different between 2022 acquisitions and 2023 acquisitions. Essentially, a new qualified plug-in electric motor vehicle and new clean vehicle requirements are similar (original use, acquired not for resale, Clear Air Act vehicle, gross weight less than 14,000 pounds, propelled by battery, 4 wheels). One difference is batter capacity is larger (7 versus 4 kilowatts) and new seller reporting requirements Under IRA, the credit applies to any clean vehicle. So, a hydrogen fuel cell car, for example, or a plug-in hybrid vehicle with four to seven kilowatt hours of battery capacity, could qualify. Beginning in 2024, an election is available to take the tax credit as a discount at the time a vehicle is purchased. Essentially, this transfers the credit to the dealer, who would be able to lower the price of the vehicle by the amount of the credit. Is a personal credit when claimed by individuals and a business credit when claimed by a business. 28

30D Clean Vehicle Credit For Individuals Pre IRA (2022)/Post IRA Comparison (2023-2032) 2022 2023 -2032 Max $7,500 Credit. 10% credit up to $2,500 + $417 /kilowatt hour excess battery capacity up to $5,000 in total Max $7,500 Credit. $3,750 when satisfying sourcing of critical minerals used in battery and $3,750 Final assembly occurs in North America for purchases after 8/16/2022 generally. Qualified manufacturer and final assembly must be in U.S. No AGI limitations AGI limitations $300,000 MFJ, $150,000 S, $225,000 HOH No purchase price limitation Purchase price limitation of $80,000 for van, SUV, or pick-up truck: $55,000 for all other vehicles Basis reduction for amount of credit Basis reduction for amount of the credit No dealer reporting Seller (dealer) reporting requirements to buyer and IRS. VIN must be included in return. 29

25E Previously Owned Clean Vehicle Credit Qualified individuals meeting AGI limits may claim a tax credit equal on the purchase of certain used clean vehicles equal to the lesser of $4,000 or 30 percent of the vehicle's sale price not exceeding $25,000 during a tax year after 2022 and before 2033. The purchase must be from a licensed dealer under state (& other defined bodies) A qualified buyer is an individual not claimed as a dependent by another taxpayer and must not have claimed the previously-owned clean vehicle credit during the three-year period ending on the date of the vehicle s sale. Taxpayers with modified AGI for the current or the preceding tax year (whichever is lesser) exceeding $150,000 for MFJ or surviving spouse, $112,500 for head of household filers, or $75,000 for married individuals filing separately and single filers cannot claim the credit The purchase must be A qualified clean vehicle is: Previously owned and original use is not by the acquiring taxpayer; the model year is at least two years earlier than the calendar year in which the taxpayer acquires the vehicle; is acquired by the taxpayer in a qualified sale; has a gross vehicle weight rating (GVWR) of less than 14,000 pounds; Primarily for use on public streets, roads or highways and has 4 wheels, and meets certain battery capacity requirements A taxpayer may elect to transfer the credit to the registered dealer selling the vehicle. The election must be made by the date of the purchase of the vehicle. The taxpayer must include the vehicle's identification number (VIN number) on its tax return for the year to claim the credit Presumably Form 8936 will be updated to claim this credit 30

30C EV Charger Credit for Homeowners The Inflation Reduction Act extends through 2032 the tax credit for installing a home EV charger. The amount of credit remains at 30% of the cost of purchasing and installing a home charger (as non-depreciable property), capped at $1,000 per year. However, the credit now applies per charger for example, if you purchase two home chargers you can obtain a $2,000 credit. The credit is also extended to include bidirectional chargers that can be used to power a home and feed energy back into the electricity grid these are just becoming available and cost more than regular EV chargers. The credit also now applies to home chargers for two and three-wheeled vehicles. Starting in 2023, the credit will be available only to homeowners who live in one of the following low-income or nonurban areas: Low-income census tracts: You must live in a low income census tract that has a poverty rate of at least 20% or a median family income less than 80% of the statewide median. Nonurban areas: Alternatively, you must live in an area designated as nonurban by the U.S. Commerce Department. Less than 20% of the U.S. population lives in such nonurban areas. Example: Mary lives on a farm in rural Iowa and spends $2,000 to install a home EV charger unit in her home garage. She may claim a tax credit equal to 30% of the cost, or $600. 31

Tax Cuts and Jobs Act Expiring Provisions The expiration of many of the individual provisions enacted by the TCJA at the end of 2025 will be of particular importance in the next few years. There will likely be a need for a policy debate on whether to extend individual tax relief along with other structural reforms. Political and economic environments existing in 2024 and 2025 will influence the debate. Measurement of the costs and benefits directly related to the TCJA s impact on the economy and government revenue since the law s enactment will likely shape that debate. 32

Tax Cuts and Jobs Act Expiring Provisions Much of federal tax law reverts to rules existing prior to 2018, which may increase overall federal tax collections and result in overall tax increase for many individuals; > 20 expiring provisions including: Increased tax rates at lower tax bracket levels Reinstatement of personal exemptions Elimination of higher standard deduction Reinstatement of miscellaneous itemized deductions Reinstatement of SALT deduction Reinstatement of increased mortgage and home equity interest deductions Elimination of 199A qualified business income deduction Elimination of 461 excess business loss deduction Reduced child tax credits Decrease in estate and gift tax exemption 33

Tax Cuts and Jobs Act Permanent Provisions Select provisions Corporate income tax rate reduction to 21%; elimination of corporate alternative minimum tax Increased Section 179 Deduction to $1M (indexed for inflation) Section 163(j) business interest limitation Elimination of like-kind exchange treatment for personal property 34

Select Expiring Federal Tax Provisions 2022 Allowance of full deduction for business meals this was allowed in tax years 2021 and 2022. All indications from Congress point to the expiration of this provision after tax year 2022. 100% Business meals deduction will revert back to only 50% in 2023 Beginning in January 2022, businesses that conduct R&D must write off the costs over 5 years v. expensing immediately. Business net interest deduction limited to 30% of EBIT v. EBITDA 35

Bonus Depreciation For 2022 like 2021 businesses can elect to deduction 100% of the cost of qualified business property. This immediate deduction is available for eligible property placed in service before January 1, 2023 (and after September 27, 2017). After December 31, 2022, bonus depreciation is claimed against cost using the following percentages: 2023: 80% 2024: 60% 2025: 40% 2026: 20% 2027: 0% Takeaway: Review 2022 and 2023 capital expenditure plans to optimize deductions and taxable income subject to the highest tax rates 36

Section 179 Expense Limits 2022 2021 Maximum Deduction $1,080K $1,050K Phase-out Threshold $2,700K $2,620K Inflation adjusted limitations for 2023 will not be published until later in the year but should be substantially higher than the 2-3% increase from 2021 to 2022. 37

Excess Business Loss Limitation The 2017 Tax Cuts and Jobs Act (TCJA) introduced new 461(l) limiting business losses on individual income tax returns for tax years beginning in 2018. The limitation applies after other loss limitation provisions (basis, at-risk basis and passive activity). The CARES Act amended 461(l) to limit business losses after 2020 and before 2026. The Act repealed the limitation for tax years 2018 - 2020. For noncorporate taxpayers (individuals, estates, trusts and exempt organizations), business losses in excess of the loss limitation threshold are carried forward. The loss limitation thresholds are as follows: 2021: $524,000 MFJ and $255,000 all other filers 2022: $540,000 MFJ and $270,000 all other filers Business income defined as an activity that is engaged in with a profit motive and the activity is carried on in a regular and continuous basis. Wages not considered business income beginning in 2021 Losses from sale of capital assets are not considered business income, so capital losses not subject to threshold Capital gains from sale of business assets limited to lower of capital gains or 1231 gains The disallowed amount is carried forward as a net operating loss (NOL) to the next year. 38

Net Operating Losses Individuals For tax years beginning in 2021: There is no carryback period (limited exception for farming losses and non-life insurance companies) The carryforward period is unlimited For tax years beginning after 2017, an NOL may only offset 80 percent of taxable income in the carryforward year 39

Section 163(j) Business Interest Limitation Interest Expense Limitation In General Deduction for interest expense limited to 30% of Adjusted Taxable Income (ATI) CARES Act temporarily increased to 50% for 2019 & 2020 tax years Adjusted Taxable Income (ATI) 2021: ATI = taxable income before interest expense, NOLs, depreciation and amortization (e.g. EBITDA) 2022: No longer add-back depreciation & amortization to determine ATI (EBIT) Certain small businesses excepted Aggregated businesses with gross receipts less than $27 million in 2022 ($26 million for 2021); Tax shelters are not eligible (including partnerships and S corporations allocating 35% or more losses to limited partners or shareholders not actively participating in management) Electing out of limitation rules for real property trade or business Includes businesses in construction, real property development, redevelopment, reconstruction, acquisition and conversion Eludes ability to claim bonus depreciation (but not Section 179) Uses straight-line depreciation over longer ADS lives for real property with life over 20 years Non-deductible interest expense limited by the provision can be carried forward indefinitely Special rules for consolidated groups and acquisitions 40

Section 163(j) Business Interest Limitation General Background Limits the deductibility of business interest expense (BIE) to the sum of business interest income (BII), the prescribed percentage of adjusted taxable income (ATI), and floor plan financing interest expense. ATI is defined generally to be equal to taxable income w/o regard to NOLs, BIE, BII, and for years prior to 2022 including an add back for depreciation, amortization, and depletion deductions. Percentage of ATI ATI Definition 2018 30% EBITDA 2019 30% or 50% EBITDA 30% or 50% of 2019 ATI Or 30% or 50% of 2020 ATI 2020 EBITDA 2021 30% EBITDA 2022 30% EBIT Courtesy: TEI 41

Post 2021 Research Costs Require Capitalization Research and experimental expenditures paid or incurred in tax years beginning after 2021 generally must be capitalized and amortized ratably over five years (over 10 years if the 59(e) election is made). A 15-year amortization period applies to research or experimental expenditures attributable to foreign research. Software developmental costs are expressly included in the definition of R&D expenditures after 2021 Departure from GAAP which allows immediate expensing Mid-year convention applies The disposition, retirement or abandonment does not accelerate the expense deduction. Treated as a change in accounting method that is initiated by taxpayers and made with the consent of the IRS. Thus, taxpayers do not have to file an accounting method change and no section 481(a) adjustment is required or allowed. NOTE: Many tax professionals and taxpayers are hoping for an extension. Likelihood of an extension may be 50/50 at this time and likely will not occur until after election. 42

Charitable Contributions Select Provisions Individual Non-Itemizers $300 individuals and $600 joint filers for 2021, 2022 and 2023. Must be cash contributions (not property); excludes donations to donor advised Funds Individual Itemizers Cash contributions allowed at 100% of AGI ended in 2021 C Corporations 25% taxable income limitation in 2021 10% taxable income limitation in 2022 and forward 43

Pennsylvania Tax Update December 2022

Pennsylvania Tax Changes On July 8, 2022, Pennsylvania Gov. Tom Wolf signed the fiscal year 2022-2023 budget and supporting legislation adopting a number of corporate and personal income tax changes including (but not limited to): Corporate income tax rate reduction; Codification of the $500,000 receipts nexus threshold previously issued through Pennsylvania Department of Revenue guidance: Changes to intangible income sourcing rules; Federal conformity to sections 179; Federal conformity to sections 1031 and 1035. Overall, the text of the legislation is 49 pages with 25 different act sections. 45

Pa. Corporate Net Income Rate Reduction Pennsylvania currently imposes one of the highest corporate net income tax rates in the country at 9.99%. The first reduction is a full percentage point in 2023, followed by half-percentage point reductions each year after until the rate reaches 4.99% beginning Jan. 1, 2031. Tax years beginning on or after: Rate January 1, 2023 8.99% January 1, 2024 8.49% January 1, 2025 7.99% January 1, 2026 7.49% January 1, 2027 6.99% January 1, 2028 6.49% January 1, 2029 5.99% January 1, 2030 5.49% January 1, 2031 4.99% 46

Pa. Comparison Neighboring State Corporate Tax Rates State Corporate Tax Rate Year PA Rate Becomes Lower Delaware 8.70% 2024 Maryland 8.25% 2025 New Jersey 11.50% (9.00% after 2023) Currently New York 7.25% 2027 Ohio N/A Commercial Activity Tax (CAT) N/A West Virginia 6.50% 2028 47

Intangible Property Market Sourcing Rules The new legislation amends the sourcing for intangible sales and replaces the cost-of- performance rule for a market-based scheme that provides specific rules for sourcing revenues associated with various categories of intangible property. The new rules adopt comprehensive customer-based sourcing rules for a number of other types of gross receipts, including: The lease or license of intangible property Sales of intangibles Sale, redemption, maturity or exchange of securities held by a taxpayer primarily for sale to customers Lending activities involving real property and tangible personal property Interest, fees, and penalties from credit card holders Interest not otherwise addressed in the revised law The sourcing change for intangible property aligns the sourcing rules with those applicable for both tangible personal property and services. The revised sourcing provisions are effective tax years beginning after Dec. 31, 2022. Additional guidance is likely needed from Pa. in order to be able to implement the new rules. 48

Pennsylvania Economic Nexus Rules Codified Effective for tax years beginning after December 31, 2022, House Bill 1342 codified the rebuttable presumption that a corporation with $500,000 or more of receipts sourced to Pennsylvania will have substantial nexus with Pa., despite the lack of a physical presence. The $500,000 sales factor nexus presumption appears to codify the Department s Corporation Tax Bulletin 2019-04, which established a similar threshold. Substantial nexus means a direct or indirect business activity that is sufficient to grant the commonwealth authority under the Constitution of the United States to impose the CNIT. Such business activity includes: Leasing or licensing intangible property utilized in Pennsylvania Regularly engaging in transactions with Pennsylvania customers involving intangible property, including lending to unaffiliated entities or individuals Selling intangible property that was used by the corporation in Pennsylvania. An exception applies to an affiliated entity domiciled in a foreign nation that has in force a comprehensive income tax treaty with the U.S. providing for the allocation of all categories of income subject to taxation, or the withholding of tax, on royalties, licenses, fees and interest for the prevention of double taxation 49

Pennsylvania Personal Income Tax Changes IRC Sec. 1031 Like-kind Exchanges Allows deferral of tax due on gains from exchange of real property beginning January 1, 2023 Presumably applies to property exchanged both within and/or outside PA IRC Sec. 1035 Insurance Contract Exchanges Allows deferral of tax due on gains from exchange of certain insurance policies beginning January 1, 2023 in accordance with IRC Section 1035 IRC Sec. 179 Expensing Conforms to the IRC deduction beginning January 1, 2023. 2022 limit remains at $25,000 The 2022 federal limit is currently $1,080,000 and will increase in 2023 for inflation Dependent and Child Care Tax Credit Program Creates a refundable personal income tax credit calculated at 30% of the federal child and dependent care credit for those qualifying under federal rules Effective for tax years beginning after 12/31/2021 Federal Covid Assistance Codifies that certain federal COVID assistance is tax-free and expenses related to that income are deductible. 50