Understanding Trust Basics and Types for Wealth Planning in New York City

Explore the fundamentals of trusts, including the roles of grantors, beneficiaries, and trustees, reasons to utilize trusts for wealth planning, and the different types of trusts such as testamentary trusts and irrevocable trusts. Discover how trusts can help with financial decision-making, estate t

2 views • 36 slides

Trust Laws in Malta: A Comprehensive Overview

Malta has integrated trusts into its legal framework, providing rules for the governance and administration of trusts. The proper law of a trust determines its validity and interpretation. The Hague Convention on Trusts plays a significant role in regulating trusts governed by foreign laws.

0 views • 57 slides

Understanding Trusts and Gifts in Family Law

Dive into the intricacies of trusts and gifts in family law, exploring topics such as beneficial interests, equitable remedies, trust types, and their significance in property division for common law relationships. Gain insight into the legal complexities surrounding asset ownership and division in

0 views • 69 slides

Understanding Infrastructure Investment Trusts (InvITs)

Infrastructure Investment Trusts (InvITs) are like mutual funds that pool money from investors to own and operate operational infrastructure assets such as highways, pipelines, and power plants. They offer regular income and long-term capital appreciation. This presentation covers the overview, stru

0 views • 19 slides

An Introduction to Real Estate Investment Trusts (REITs)

Real Estate Investment Trusts (REITs) function like mutual funds by pooling money from multiple investors to invest in income-generating real estate assets. This presentation covers the overview, structure, constituents, cash flow, benefits, taxation, and considerations for investing in REITs. It ex

0 views • 21 slides

Understanding Forum, Firewall, and Fights in Foreign Courts

This legal overview delves into the jurisdiction and governing laws of Cayman Islands trusts, the enforcement of foreign judgments, and the application of firewall provisions to determine trust matters. It discusses the common law position, the implications of Section 90 of the Trusts Act, and elabo

0 views • 28 slides

Community Project Implementation Structures in Gulf of Guinea Northern Regions

The Gulf of Guinea Northern Regions Social Cohesion (SOCO) Project involves the selection and role of community facilitators and Community Project Implementation Committees (CPICs) to facilitate project implementation in clusters of communities. Various committees and structures at national, regiona

2 views • 14 slides

Understanding the Governance of Pension Schemes and Trusts

Explore the concept of trusts within pension schemes, as legally defined entities separate from employers, where funds are held for beneficiaries. Delve into the history and key elements of trusteeship, highlighting the importance and legal aspects of trusts in managing pension funds.

0 views • 26 slides

Understanding Taxation and Assessment of Charitable Trusts

Explore the complexities and nuances of taxation and assessment for charitable trusts and institutions. Learn about key issues such as tax rates, income computation, tax audits, capital gains, registration surrender, and more. Discover the basic rules to follow, including exemptions, income categori

0 views • 46 slides

Recent Amendments in Charitable Trusts: A Comprehensive Overview

Recent amendments to charitable trusts, as outlined by CA Sudhir Baheti, cover important aspects such as registration sections, creating new trusts, and changes in Section 10(23C) of the Income Tax Act, 1961. The amendments impact income exemptions for educational institutions, application procedure

0 views • 40 slides

Understanding Special Needs Trusts and Planning Options

Special Needs Trusts, also known as Supplemental Needs Trusts, are essential for protecting assets while maintaining eligibility for government benefits for individuals with disabilities. Learn about the types of Special Needs Trusts and important planning options to secure the future of your loved

0 views • 28 slides

Comprehensive Guide to Post-Confirmation Trusts and Plan Agents

Learn about the importance and necessity of post-confirmation trusts and plan agents in bankruptcy cases, the selection process for trustees/fiduciaries, choosing the right post-confirmation vehicle, creating trusts through agreements, and understanding the role of litigation/liquidation trusts in m

0 views • 32 slides

Trust Income Computation and Application Guidelines

Learn about income computation of trusts using ITR-5 vs. ITR-7, types of institutions, components of income, application of income, and important guidelines including amendments by FA2022 for charitable and religious trusts.

0 views • 47 slides

Federal Fiduciary Income Tax Returns Overview

Form 1041 is an income tax return for trusts or estates reporting income earned by the assets. Understand filing requirements, types of returns, and deadlines for Form 1041, Form 706, and Form 1040. Learn about calendar year vs. fiscal year options for estates and trusts.

0 views • 15 slides

Legal Considerations for Affordable Housing Land Trusts

Explore legal issues and regulations surrounding Community Land Trusts in DC, Virginia, and Maryland. Learn about the implications of ground leases, ownership rights, and separation of land and improvements in affordable housing initiatives. Discover the responsibilities and restrictions imposed on

0 views • 13 slides

Understanding Special Needs Trusts for Benefits Preservation

Special Needs Trusts, also known as Supplemental Needs Trusts, are set up to safeguard government benefits while allowing individuals with disabilities to benefit from contributed funds. Properly managed trust funds do not count as income or resources, helping to maintain eligibility for SSI, Medica

2 views • 34 slides

Understanding Small Area Fair Market Rents (SAFMR) Implementation Webinar

This webinar recording discusses the implementation of Small Area Fair Market Rents (SAFMR), which offer a more refined approach to housing choice voucher subsidy implementation by replacing Metropolitan Area Fair Market Rents. It covers the background, reasons for the 2019 implementation, options f

1 views • 26 slides

Insights into Family Law and Estates/Trusts by Robbi Rizzo

Robbi Rizzo delves into the intricate complexities of family law and estates/trusts, covering topics such as premarital agreements, separate property distinctions, fiduciary duties, transmutations, legal separation versus separated status, and more. The discussion includes key aspects like premarita

0 views • 23 slides

SaFE Barking, Havering & Redbridge University Hospitals NHS Trust Report

The report discusses the challenges faced by the NHS in London due to increasing demand, funding shortfalls, and the need for service reconfiguration. It highlights the necessity for achieving clinical sustainability and financial viability to ensure Trusts can attain Foundation Trust (FT) status. T

0 views • 22 slides

Insights on Investment Strategies and Trusts in Q1 2016

Delve into the world of investment with insights on market trends, risk assessment, ideal investments in equities and funds, and a focus on closed-end investment trusts in the UK. Explore expert opinions on long-term strategies, asset value discounts, governance principles, and more, all presented i

0 views • 36 slides

Overview of NHS Long Term Plan and Operational Guidance

NHS Long Term Plan outlines healthcare priorities for the next decade, with operational guidance for NHS trusts, foundation trusts, and CCGs. Focus areas include boosting out-of-hospital care, redesigning emergency services, personalized care, digital healthcare, and integrated care systems. Increas

3 views • 45 slides

The Importance of a Chief Quality Officer in Healthcare Trusts

The need for a Chief Quality Officer (CQO) in healthcare trusts in England is emphasized due to the complexities of managing quality, the significance of quality alongside finance, and the call for a new approach to address quality issues. The CQO plays a crucial role in overseeing and improving qua

0 views • 11 slides

Understanding Trust and Equitable Charges in Property Law

Trust and equitable charges in property law involve a legal obligation where the property holder manages the property for the benefit of another person. This trust relationship consists of elements like legal title, trust property, and beneficiaries. The creators of a trust can be referred to as set

0 views • 25 slides

The Impact of Russian CFC Rules on Asset Protection Trusts

The absence of trust regulation in Russia poses challenges for asset protection and trust structures. Russian tax residents controlling foreign structures like trusts and foundations are now subject to income tax in Russia under the new CFC rules. Historical facts reveal the initial intent to differ

0 views • 37 slides

PBN Planning and Implementation Status in Ukraine

The PBN Planning and Implementation status in Ukraine involves initiatives such as the implementation of Precision Area Navigation (P-RNAV) and Approach Procedures with Vertical Guidance (APV). Ukraine is working on national RNAV1 implementation for standard instrument procedures at various aerodrom

1 views • 17 slides

Pet Trusts and Estate Planning: Implementation Insights

Explore the implementation of special needs, pooled disability, pet, and gun trusts, along with estate planning for companion animals. Learn about Massachusetts pet trust law history, comparisons with the Uniform Trust Code, roles of attorneys and trustees, federal legislation, and public policy con

0 views • 21 slides

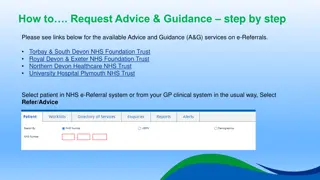

How to Request Advice and Guidance Step by Step in NHS Trusts

Follow a step-by-step guide to request advice and guidance through the e-Referrals system from NHS Trusts in Torbay, South Devon, Royal Devon, Exeter, Northern Devon, and University Hospital Plymouth. Learn how to select services, search criteria, specialty, clinic type, and submit your request effi

0 views • 4 slides

Taxation of Trusts in India: Exemptions and Provisions

The taxation of charitable organizations in India is governed by specific sections of the income tax law, providing exemptions to trusts serving the nation's welfare. Various provisions and entities involved in trust formations are discussed, along with the purpose and differences among trusts, soci

0 views • 36 slides

Community Land Trusts: Empowering Communities through Collective Ownership

Community Land Trusts (CLTs) are legal entities run by local volunteers to collectively own and manage property/land, undertake development projects, and secure assets for the community. With priorities set by communities to address local issues like affordable housing and recreation, CLTs provide a

0 views • 13 slides

Implementation Planning for Health Innovation in Clinical Settings

Dive into the experiential opportunity of preparing for the implementation of a health innovation in clinical settings with Allison Cole, MD, MPH. Explore options for operationalizing implementation and understanding your intervention. Engage in discussions on project progress, challenges, and next

0 views • 21 slides

An Overview of Trusts: Classification, Living Trust, and Special Trusts

This comprehensive guide delves into the classification of trusts, including express and implied trusts, active versus passive trusts, cy-près doctrine, inter vivos trust, testamentary trust, and the rule against perpetuities. Explore the nuances and characteristics of each trust type and gain insi

0 views • 19 slides

Developments in Commercial Fraud Litigation: Freezing Orders, Discretionary Trusts, and Enforcement

This content discusses recent developments in commercial fraud litigation, focusing on freezing orders, discretionary trusts, and enforcement measures. It covers key cases and issues related to protecting assets, piercing the corporate veil, and the enforcement of court decisions. The content emphas

0 views • 22 slides

Understanding Central Register of Beneficial Ownership of Trusts (CRBOT) AMLU Webinar

CRBOT, established in accordance with EU AML regulations, aims to increase transparency in beneficial ownership of trusts. Trustees must maintain two registers with identical information and ensure due diligence in disclosing trust ownership. Designated persons have access to the register for checks

0 views • 10 slides

Enhancing Clinical Academic Collaboration Between Universities and NHS Trusts

Clinical academics play a crucial role in integrating clinical practice, research, and education within the NHS. Collaboration between universities and NHS trusts is key to ensure clinical academics address the right questions for patient care and societal benefit. Challenges include an aging clinic

0 views • 29 slides

Understanding Tax Consequences of Decanting Trusts

Delve into the intricacies of decanting trusts, exploring the potential income tax implications alongside federal wealth transfer tax considerations. Learn how decanting statutes allow trustees to transfer trust assets for the benefit of beneficiaries, while also discovering the non-tax consideratio

0 views • 15 slides

SWAG Cancer Services National Cancer Patient Experience Survey Results 2021 Overview

The SWAG Cancer Services National Cancer Patient Experience Survey Results for 2021 provide insights into the experiences of skin cancer patients in Somerset, Wiltshire, Avon, and Gloucestershire. The survey, commissioned by NHS England, aims to monitor progress in cancer care, drive local quality i

0 views • 27 slides

Understanding Trust, Property Division, and Insurance Issues

Explore the interconnected principles of trust, property, and insurance, starting with how a trust works and its application in lodges. Learn about winding up trusts in family and charitable contexts, and the implications in Masonic trusts. Discover rules for avoidance of doubt as per the Book of Co

0 views • 64 slides

Understanding Special Needs Trusts: Types, Functions, and Limitations

Special Needs Trusts (SNTs) play a crucial role in preserving eligibility for benefits like SSI, managing assets, and ensuring separation from beneficiaries. There are different types of SNTs such as Self-Settled and Pooled, each with specific guidelines and provisions. SNTs have limitations on asse

0 views • 8 slides

Understanding Wispact Special Needs Trusts in Wisconsin

Wispact is dedicated to improving the lives of individuals with disabilities in Wisconsin through the management of special needs trusts. These trusts provide more opportunities and a better quality of life by preserving resources while maintaining eligibility for means-tested public benefits. Eligi

0 views • 22 slides

Overview of NJC Pay Award 2018-2020 for Academy Trusts

The NJC Pay Award 2018-2020 briefing outlines key features of the pay and grading structures, including pay points, increases, and implications for academy trusts. The award covers a two-year period with adjustments to the pay spine and aims to address compression issues, providing stability and str

0 views • 14 slides