Rental Management Companies

Find the perfect rental property with Bodewell.ca, the leading rental management company in Vancouver. With our personal, attentive service and commitment to providing the best rental experience, you can trust us to make your search easy and stress-free.

2 views • 1 slides

Vacation Rental Business Plan Example

The vacation rental business plan is like your trusted guide for navigating the rental property world. It helps you understand your market, find ways to attract guests, manage day-to-day tasks, and handle finances smartly. With it, you're set to flourish in the vacation rental business.

0 views • 32 slides

Hire Self Driven Car Rental Goa Airport

Looking for the ultimate freedom to explore the picturesque landscapes and vibrant culture of Goa at your own pace? Look no further than our premier Goa Self Drive Car Rental services. With a fleet of well-maintained vehicles and hassle-free booking options, we offer the perfect solution for travele

3 views • 4 slides

Salvation Army Shallow Subsidy Program Overview

The Salvation Army Shallow Subsidy Program offers time-limited rental assistance to individuals facing severe rent burden, aiming to prevent homelessness through case management and rental support. Eligibility criteria, program updates, and fixed income sources are detailed, emphasizing the importan

1 views • 24 slides

Understanding Concepts of National Income in Economics

Explore the concepts of national income presented by Dr. Rashmi Pandey, covering key indicators such as Gross National Product (GNP), Gross Domestic Product (GDP), Net National Product (NNP), Net Domestic Product (NDP), Personal Income, Disposable Income, Per Capita Income, and Real Income. Gain ins

0 views • 22 slides

Understanding National Income and Its Importance in Economics

National income is a crucial measure of the value of goods and services produced in an economy. It provides insights into economic growth, living standards, income distribution, and more. Concepts such as GDP, GNP, Personal Income, and Per Capita Income help in understanding the economic health of a

5 views • 14 slides

Car Rental System

Travelopro car rental system services offer an end-to-end online car booking engine that allows car service providers as well as agencies, tour operators and travel companies across the globe to sell rental cars online through various business models such as B2C and B2B. Our car rental system servic

2 views • 15 slides

How Does MacBook Rental Support Rapid Scaling for Start-ups?

In this PDF, We discuss about MacBook rental aids start-ups' rapid growth by offering flexible, cost-effective access to latest technology, maintenance, and scalable solutions. Techno Edge Systems LLC offers the best MacBook Rental in Dubai. For More info Contact us: 971-54-4653108 Visit us: \/\/ \

4 views • 2 slides

Understanding the Income Approach to Property Valuation

The income approach to property valuation involves analyzing a property's capacity to generate future income as an indication of its present value. By considering income streams from rent and potential resale, commercial property owners can convert income forecasts into value estimates through proce

8 views • 49 slides

Why Choose iPad Rental for Corporate Presentations?

iPads are Portable, user-friendly, versatile, interactive, customizable, cost-effective, with tech support. Ideal for engaging corporate presentations. This PDF discusses about choosing of iPad rental for corporate presentations. Techno Edge Systems LLC occupies the most effective services of iPad R

2 views • 2 slides

Optimize Virtual Attendance with Laptop Rental Services

Dubai Laptop Rental offers a wide range of high-performance laptops tailored to meet your needs for online meetings, webinars, and virtual events. Our flexible rental plans ensure you have the right technology, whether for short-term or long-term use. With prompt delivery and 24\/7 technical support

0 views • 2 slides

Understanding Income Tax in India: Gross vs Total Income

In India, income tax is calculated based on the total income or taxable total income. The gross total income includes earnings from all sources like salary, property, business, and capital gains. Various additions such as clubbing provisions, adjustments for losses, unexplained credits, investments,

0 views • 7 slides

Understanding Tax Obligations and Assessable Income in Australia

In Australia, residents are taxed on worldwide income while non-residents are taxed only on Australian-sourced income. The tax liability is calculated based on taxable income, tax offsets, other liabilities like Medicare levy, and PAYG credits. Assessable income includes employment income, super pen

0 views • 13 slides

Understanding Sri Lanka's Inland Revenue Act No. 24 of 2017

This content delves into the key aspects of the Inland Revenue Act No. 24 of 2017 in Sri Lanka, covering chargeability of income tax, imposition of income tax, definitions, sources of income, assessable income for residents and non-residents, income tax payable, and income tax base. It provides valu

0 views • 93 slides

EIV Income Validation Tool (IVT) Overview for PHA Training 2018

EIV Income Validation Tool (IVT) plays a crucial role in identifying and reducing errors, fraud, and abuse in HUD's rental assistance programs. The tool validates tenant-reported wages, unemployment, and Social Security benefits to enhance accuracy and reduce improper payments. Through pilot testing

0 views • 16 slides

Understanding Income from House Property in Taxation

House property income refers to rent received from properties owned by an individual, charged under income tax. It is based on the concept of annual value, representing the expected rental income or market value of the property. The annual value is taxable under the head "Income from House Property.

1 views • 12 slides

Overview of Income Tax Authorities in India

The Income Tax Act in India empowers the Central Government to levy taxes on all income except agricultural income. The Income Tax Department, governed by the Central Board of Direct Taxes, plays a crucial role in revenue mobilization. Understanding the functioning, powers, and limitations of tax au

0 views • 14 slides

Which Property Gives Higher Rental Income, Residential or Commercial

Compare the rental income potential of residential and commercial properties in San Diego, CA. This analysis helps investors decide which real estate option yields better returns.\n

0 views • 1 slides

Understanding Residuary Income and Taxable Sources

Residuary income, under section 56(1), includes all income not excluded from total income and subjected to income tax under "Income from other sources." Certain specific incomes listed in section 56(2) are taxable, such as dividends, winnings, employee contributions, interest on securities, and inco

0 views • 9 slides

Understanding Clubbing of Income in Taxation

Clubbing of income refers to including another person's income in the taxpayer's total income to prevent tax avoidance practices like transferring assets to family members. This concept is addressed in sections 60 to 64 of the Income Tax Act. Key terms include transferor, transferee, revocable trans

1 views • 16 slides

Rental Housing Study Advisory Committee Kickoff Meeting in Montgomery County

The Rental Housing Study Advisory Committee Kickoff Meeting in Montgomery County, Maryland took place on April 27, 2015. This meeting focused on the comprehensive approach to rental housing issues, especially for low and moderate-income households. The study included an overview of existing conditio

0 views • 10 slides

Evolution of Progressive Income Tax Systems

The concept of modern progressive income tax, developed in the early 20th century in countries like the UK, US, France, India, and Argentina, is based on the principle of a comprehensive tax base encompassing various income categories. The system involves effective vs. marginal tax rates, different

0 views • 19 slides

Exploring Immigration's Impact on Income Inequality

The presentation delves into the relationship between immigration and income inequality, analyzing data on income distributions among voters, non-voting citizens, and non-citizens in PA. It discusses the log-normal distribution as an approximation for income distribution and examines the ratio of me

0 views • 16 slides

Rental Housing Advisory Board - Act 188 Overview

The Rental Housing Advisory Board established under Act 188 in Vermont focuses on improving rental housing conditions through various initiatives such as composition of the board, ongoing charges, recommendations for system improvement, and more. The board aims to provide guidance, support landlords

0 views • 11 slides

Comprehensive Guide to Rental Housing Protections in Seattle

This presentation covers a wide range of topics related to renting in Seattle, presented by the Seattle Department of Construction and Inspections. It includes an overview of city rental housing laws, enforcement, rental registration, economic displacement, relocation assistance, and more. The conte

0 views • 14 slides

Analysis of Irish Farmer Incomes Based on Income Tax Returns

This paper presents an analysis of Irish farmer incomes in 2010 using self-assessment income tax returns from the Revenue Commissioners. The study focused on various income sources such as trading income, rental income, employment income, social welfare transfers, and pension income. The dataset com

0 views • 12 slides

Accrual Recording of Property Income in Pension Management

The accrual recording of property income in the context of liabilities between a pension manager and a defined benefit pension fund involves accounting for differences in investment income and pension entitlements. This process aims to reflect the actual property income earned by the pension fund, c

0 views • 17 slides

Understanding Retirement Income for Low-Income Seniors in Ontario

Exploring the income system for retirees in Ontario, including Old Age Security, Canada Pension Plan, and private pensions. Addressing the concept of low income, eligibility for Guaranteed Income Supplement, and debunking common misconceptions with a top 10 list of bad retirement advice. Highlightin

0 views • 11 slides

Understanding Imputed Rental of Owner-Occupied Dwellings in Economic Activity

Explore the significance of treating owner-occupied dwellings as an economic activity, including methods like the rental equivalent method and user costs method. Discover why imputed rental is included in GDP calculations for consistency and how different countries' data compare. Learn about measure

0 views • 17 slides

Rental Sector Trends and Policy Evolution in Slovenia and Serbia

Explore the evolution of the rental sector in Slovenia and Serbia, from the socialist order to privatization and the current challenges faced in providing social housing. Key events, documents, and legislative acts have shaped the rental landscape in these transition countries, impacting ownership r

0 views • 16 slides

Rental Tenures in Slovenia: Insights from Post-Socialist Countries

Slovenia exhibits a unique tenure structure with a high percentage of home ownership and specific regulations governing rental tenures. The 2003 Housing Act defines various rental types, including non-profit and market-based rentals, while legislation outlines rules on contracts, rent regulation, an

0 views • 13 slides

Exploring Various Facets of Rental Housing Environment

Diving into the world of rental housing, this collection of images covers a wide range of topics such as learning outcomes, myths, urban statistics, family houses, and more. Delve into the extent, supply, and access to rental housing, along with discussions on why it tends to be invisible and who th

0 views • 30 slides

Valuation Using the Income Approach in Real Estate

The income approach to appraisal in real estate involves converting future income into a present value through income capitalization. This method utilizes direct capitalization and discounted cash flow techniques to estimate property value based on net operating income. Estimating net operating inco

0 views • 17 slides

Understanding Taxation in Australia: Income Declaration and Assessment

Australian taxation laws require residents to declare worldwide income while non-residents are taxed on Australian-sourced income. The tax liability calculation involves taxable income, tax offsets, other liabilities such as Medicare levy, and PAYG credits. Assessable income includes various sources

0 views • 13 slides

Understanding Set-off of Losses in Income Tax

Set-off of losses in income tax allows taxpayers to reduce their taxable income by offsetting losses from one source against income from another source. This process helps in minimizing tax liability and optimizing tax planning strategies. There are specific rules and exceptions regarding the set-of

0 views • 4 slides

Understanding Income Tax Basics

Income tax is a fundamental part of contributing to a civilized society, with various taxes like sales tax, gas tax, and alcohol tax playing a role. This guide explains how income tax works, including taxable income calculations and refund processes. It also covers what amounts are taxable, such as

0 views • 14 slides

King County Eviction Prevention & Rental Assistance Program Overview

The King County Eviction Prevention & Rental Assistance Program aims to help households at risk of eviction, especially due to COVID-19 impacts. The program focuses on preventing evictions, serving those likely to become homeless, and promoting equity in assistance distribution. Lessons learned incl

0 views • 26 slides

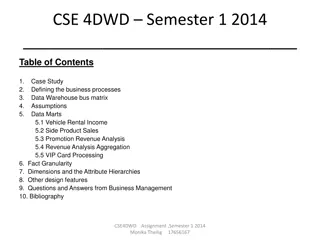

Vehicle Rental Oz Data Analysis for Business Optimization

Vehicle Rental Oz, a large vehicle rental company with over 500 stores in Australia, aims to enhance business performance through detailed data analysis. By focusing on historical rental and sales data, revenue streams, and promotion revenue analysis, the company plans to optimize resource utilizati

0 views • 17 slides

Understanding Source of Income Laws in Housing: California Regulations

California laws protect tenants from discrimination based on their source of income, including rental assistance programs. Landlords in California cannot refuse tenants solely based on receiving rental assistance. Various assistance programs are considered lawful sources of income, promoting fair ho

0 views • 18 slides

Income Eligibility Determination Training for PY 2023

Explore the key changes and considerations in income eligibility determination for the upcoming program year 2023, including the use of State Median Income and Federal Poverty Guidelines. Learn about the refined definition of the income eligibility period and the importance of monitoring household i

2 views • 34 slides