Linear SVMs for Binary Classification

Support Vector Machines (SVMs) with linear kernels are powerful tools for binary classification tasks. They aim to find a separating hyperplane that maximizes the margin between classes, focusing on support vectors closest to the decision boundary. The formulation involves optimizing a quadratic pro

0 views • 45 slides

NOT-FOR- PROFIT MAKING CONCERN

Not-for-profit organizations, such as educational institutions, public hospitals, and charitable trusts, operate with the main objective of providing services rather than making profits. These organizations rely on various sources of funding like contributions, donations, and grants. Accounting for

4 views • 4 slides

Radar Attenuation Tomography for Mapping Englacial Temperature Distributions

Radar Attenuation Tomography is used to map the temperature distributions within the ice sheet by analyzing the radio waves' attenuation properties. This study focuses on the Eastern Shear Margin of Thwaites Glacier, where fast-moving ice meets slower ice, impacting ice rheology influenced by temper

4 views • 18 slides

Non-Profit Leadership Development: Finance Essentials for Managers

Explore the key concepts of finance for non-financial managers in the non-profit sector. Learn about cost benefit analysis, measures of project worthiness, and essential financial tools such as NPV, IRR, and ROI. Understand how to assess project risks and make informed financial decisions to enhance

0 views • 47 slides

Understanding Cost-Volume-Profit Analysis and Break-Even Analysis

Cost-Volume-Profit (CVP) analysis is a valuable technique that examines the connection between costs, volume, and profits in business operations. By determining the break-even point, setting selling prices, optimizing product mix, and enhancing profit planning, CVP analysis aids in making informed d

0 views • 29 slides

Understanding Profit and Loss Account in Financial Management

Profit and Loss Account is a crucial financial statement prepared to determine the net profit or loss of a business during a specific accounting period. It involves transferring gross profit or loss from the trading account, recording indirect expenses, including administrative and selling costs, an

0 views • 9 slides

Understanding Profit Calculation on Incomplete Contracts

Learn how to calculate profit on incomplete contracts in profit and loss accounts. Discover the rules determining when to credit profits on unfinished contracts, including provisions for potential losses. Follow a practical example to understand the application of these rules.

0 views • 5 slides

Understanding Profit: The Entrepreneur's Reward

Profit is the reward for entrepreneurial functions and differs from returns on other factors due to its uncertain and residual nature. Various theories such as Frictional, Monopoly, Compensatory, and Innovation shed light on the complexities of profit generation in business.

0 views • 15 slides

Understanding Profit and Loss in Mathematics Class V

Explore the topic of profit and loss in Mathematics Class V through learning objectives, worksheets, videos, and explanations of cost price, selling price, profit, and loss. Practice solving real-world problems related to profit and loss to enhance your understanding. Embrace the concept that "Work

0 views • 29 slides

Understanding Profit and Loss in Business Transactions

Learn about cost price, selling price, profit, loss, profit percentage, loss percentage, marked price, discount, successive discount, goods and services tax. Explore the historical context of profit and loss statements from the barter system to modern business transactions. Practice calculating prof

0 views • 31 slides

Understanding Profit and Loss Accounts in Business

Profit and loss accounts provide a detailed overview of a business's trading income and expenditure over the previous 12 months. They involve calculating key figures like cost of sales and gross profit to assess the financial performance. This session aims to explain the concepts, answer common ques

0 views • 14 slides

Estimating Margin of Error in Statistics and Probability

The lesson focuses on estimating the margin of error for sample proportions and means using simulations. It explains the importance of random sampling in providing insights into population characteristics and how different samples can produce varying estimates. The margin of error is defined as the

0 views • 13 slides

Introduction and Preparation of Trading Account in Financial Management

Financial statements play a crucial role in understanding a firm's financial position and profitability. They include a Balance Sheet, Profit and Loss Account, and schedules. Trading Account is the initial step in final accounts preparation, focusing on gross profit or loss. It helps determine the p

0 views • 13 slides

Understanding Net Profit Calculation in Profit and Loss Accounts

Net profit, also known as the bottom line, is a crucial indicator of a business's financial performance. It is calculated by deducting total expenses from gross profit. In the provided example for Frying Tonite, the net profit is $30,110 after subtracting expenses of $38,590 from a gross profit of $

0 views • 11 slides

Understanding Musharakah in Islamic Finance

Musharakah is a partnership established through mutual consent for profit and loss sharing in joint ventures. Partners must be capable and enter into contracts freely. There are guidelines on profit distribution, non-working partners, capital contributions, and asset ownership in Musharakah. Avoid f

0 views • 17 slides

Understanding Enterprise: Types and Impact on Society

Explore the various types of enterprises such as financial, cultural, and social, and understand their key features and roles in society. Learn about local, national, and global organizations, financial enterprises' profit-making activities, and the societal contributions of both for-profit and not-

0 views • 18 slides

Understanding Non-Profit Financial Statements: Key Insights

Delve into the fundamental disparities between non-profit and for-profit financial statements, exploring key indicators, such as balance sheets, assets, liabilities, and net assets. Discover the distinct financial structures and reporting methods that differentiate non-profit organizations from thei

0 views • 16 slides

Windfall Profit Taxation: Past, Present, and Future

The presentation discusses windfall profit taxation measures in Europe, specifically in Italy, comparing the old Robin Hood tax with new contributions. It explores the aims, issues, tax rates, and bases of windfall profit taxation, highlighting its redistributive purposes and challenges in constitut

1 views • 14 slides

Importance of Accounting in Business Operations

An accounting system plays a crucial role in providing information about a business's profitability. For sole traders, preparing a Trading and Profit and Loss Account along with a Balance Sheet helps depict the financial status. The process of finalizing accounts involves steps like Trading Account,

0 views • 8 slides

ERCOT Public Resource Adequacy Reports Review May 2023

Review of ERCOT public reports highlights key findings such as reserve margin changes, new projects eligibility, and upcoming EPA regulations impacting fossil-fueled generation units. The reports cover capacity, demand, reserves, and seasonal assessment of resource adequacy for the summer of 2023. T

0 views • 12 slides

Understanding Costs and Revenues for Decision Making

This webinar covers various aspects of cost analysis and revenue calculation essential for decision-making, such as contribution margin, break-even analysis, target profit, contribution to sales ratio, margin of safety, and using break-even analysis in decision-making. Through examples like calculat

1 views • 39 slides

Understanding Cost-Volume-Profit (CVP) Analysis for Short-term Decision Making

Cost-Volume-Profit (CVP) analysis is a crucial technique for businesses to assess the impact of changes in sales volume on costs, revenue, and profit. It helps in determining break-even points, planning future operations, and guiding strategic decisions under uncertain conditions. Understanding cost

0 views • 34 slides

Complexity of Computing Margin of Victory in Voting Rules

The research delves into the computational complexity of determining the margin of victory for various voting rules, which is crucial for post-election audits and understanding the closeness of election outcomes. It explores how the margin of victory is calculated, provides examples illustrating the

0 views • 11 slides

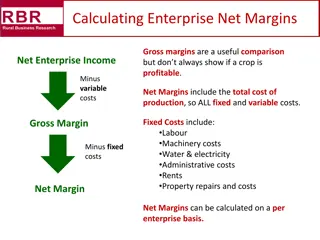

Understanding Winter Wheat Net Margins in England

Winter wheat net margins in England are calculated by subtracting total variable costs from total output to determine the gross margin. Fixed costs including labor, machinery, general costs, and property costs are then allocated to obtain the net margin. This analysis helps farmers assess the profit

0 views • 9 slides

Understanding Costs, Revenue, and Profit in Economics

Cost is the expenditure on goods or services, including opportunity cost. It can be explicit or implicit. Measuring opportunity cost involves factors of production and sacrifices. Economic profit considers opportunity cost while accounting profit does not. Production in the short run depends on inpu

0 views • 53 slides

Margin Protection Program for Dairy Producers: Overview and Insights

This article discusses the Margin Protection Program for Dairy Producers, how it works, the key operating rules, and the implications for dairy farmers. It also highlights the role of the National Program on Dairy Markets and Policy in providing educational resources and research materials. Addition

0 views • 26 slides

Understanding Cost Volume Profit (CVP) Analysis

Explore the concepts of CVP analysis including contribution margin, break-even analysis, margin of safety, and profitability changes. Learn how key factors affect profitability and how to compute required sales for desired profit levels. Discover the impact of different variables on costs and revenu

0 views • 44 slides

Issues and Trends in For-Profit Child Care: A Comprehensive Overview

The prevalence of for-profit child care centers in Canada is on the rise, with about 29% of center spaces dedicated to for-profit services in 2021. Ontario's childcare landscape shows a significant presence of both non-profit and for-profit multi-site groups. International examples from countries li

0 views • 13 slides

Understanding Viability and Development Economics in the Real Estate Sector

Explore crucial aspects of viability and development economics in real estate, including profit-making strategies, site identification, risk management, land valuation, and sustainable practices discussed in a seminar featuring guest speaker Ian Storey from Storey Homes. The event delves into the im

0 views • 14 slides

Understanding Non-Profit Accounting Essentials

Learn the basics of non-profit accounting, including what defines a non-profit organization, common types of non-profits, governance structures, and legal responsibilities. Discover key insights on IRS and state requirements for non-profits in this informative presentation by Jessica Sayles, CPA fro

0 views • 55 slides

Understanding Business Profitability and Income Statements

The concept of business profitability, illustrated through Mr. Seow's iPhone selling business, is explained in detail. The calculation of profit considering costs like rent and salaries is demonstrated. Gross profit, net profit, and their significance in measuring business success are discussed alon

0 views • 8 slides

Understanding Income Statements in Financial Accounting

An income statement, comprising of a Trading Account and Profit and Loss Account, is vital for assessing a company's financial performance. It helps determine profits, losses, and overall worth. The Trading Account specifically calculates the gross profit or loss from core activities, while the Prof

0 views • 18 slides

Understanding Ratio Analysis for Business Performance Evaluation

Ratios in ratio analysis are crucial for analyzing and comparing business performance over time and against other businesses. They are categorized into profitability, liquidity, and efficiency ratios. Profitability ratios like gross profit percentage, net profit percentage, and return on capital emp

0 views • 31 slides

Lincoln Academy Financial Report and Budget Review 2020-2021

Lincoln Academy's financial report highlights a positive margin in 2019-20 but projects operational margin declines in 2020-21 due to reduced student count and increased expenses. The report discusses revenue sources, staff additions, funding changes, COVID-19 expenses, and budget flexibility amidst

0 views • 5 slides

CADCAI Audited Financial Report 2016 Summary & Analysis

The CADCAI Audited Financial Report for 2016 reveals key insights into the organization's financial performance. CADCAI is a not-for-profit organization with income tax exemption and registered GST. The report showcases a current year profit of $14,067 and total retained profit since 1986 of $412,30

0 views • 19 slides

Understanding Sediment Dispersion along the Continental Margin

This content explores the influences and types of sediment dispersion systems along the continental margin. Processes affecting sediment supply, depositional environments, and different dispersal systems like Estuarine Accumulations Dominated and Marine Dispersal Dominated are discussed. Walsh and N

0 views • 8 slides

Understanding Financial Ratios for Business Analysis

Financial ratios like current ratio, quick ratio, inventory turnover ratio, asset turnover ratio, and profit margin ratio are crucial tools for assessing a company's financial health and performance. Current ratio measures short-term debt-paying ability, quick ratio assesses liquidity, inventory tur

0 views • 15 slides

Understanding Murabaha and Musawamah in Islamic Finance

Musawamah is a type of sale where the price is negotiated between the seller and buyer without disclosing the seller's cost. It differs from Murabaha where pricing formula is known. Islamic financial institutions use Musawamah for cash or credit sales, adding profit margin without disclosing cost de

0 views • 22 slides

Comparison of MPP-Dairy and Other Margin Risk Management Systems

MPP-Dairy enrollment does not impact using other risk management systems, with exceptions for Livestock Gross Margin for Dairy (LGM). You can still forward contract farm milk and purchase feed while using MPP-Dairy. Options-based strategies like Class III puts and feed-based calls can establish an I

0 views • 25 slides

Understanding the Costs of Production and Profit Maximization

Explore the concept of costs of production in business, distinguishing between explicit and implicit costs. Learn the difference between economic profit and accounting profit, and understand the importance of considering all costs in maximizing profit. Dive into examples and the production function

0 views • 36 slides