Life Insurance Business

Life insurance is a crucial financial tool providing peace of mind and security. It involves a contract between a policyholder and an insurance company, where the company pays a sum to the insured's family upon death in exchange for premium payments. Key features include the policyholder, premium, m

1 views • 21 slides

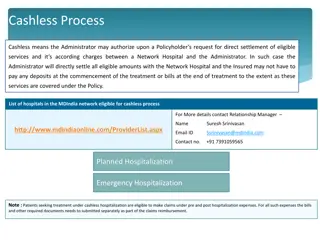

Cashless Hospitalization Process and Claim Settlement Guide

Cashless hospitalization process allows a policyholder to avail eligible services without paying upfront at network hospitals. The administrator settles bills directly, reducing financial burden on the insured. Learn about planned and emergency hospitalization procedures, necessary documents, claim

0 views • 7 slides

Understanding the Meaning and Principles of Insurance

Insurance is a contractual agreement where the insurer agrees to compensate the insured for losses. Key principles include utmost good faith, insurable interest, indemnity, proximate cause, subrogation, contribution, and mitigation. Life insurance provides financial security to beneficiaries in case

0 views • 9 slides

Understanding Mobile Phone Insurance Scenarios

This comprehensive guide explores the basics of mobile phone insurance, including an introduction to common insurance areas, a scenario involving the analysis of selling warranties, and perspectives from both the policyholder and the insurance company. Key considerations such as pricing premiums, ex

0 views • 29 slides

Policyholder IRR Publication: A Case Study in Actuarial Innovation

As a young actuary proposing the publication of policyholder IRR in benefit illustrations, challenges arise from marketing and committee concerns. The idea aims to enhance transparency, empower policyholders, but faces resistance due to sales difficulties and setting precedents. Strategic decisions

0 views • 27 slides

Challenges in Cyber-Loss Insurance Coverage Market

The cyber-loss insurance market faces issues such as broad exclusions, physical-digital conundrums, publication and access hurdles, and mismatches in coverage with modern policyholder expectations. These challenges stem from imperfect segmentation, unexpected gaps, and outdated approaches, highlight

0 views • 15 slides

Understanding Common Insurance Terminology for Lowering Costs

An insurance policy is a legal agreement between a policyholder and an insurance company, outlining coverage, benefits, premiums, deductibles, and exclusions. By understanding these terms, individuals can make informed decisions to potentially lower insurance costs, such as adjusting deductibles or

0 views • 22 slides

Challenges and Trends in India's Health Insurance Industry

The Health Insurance Regulatory and Development Authority of India faces various challenges and trends within the health insurance industry. The content discusses issues such as trends in health insurance premiums, stakeholder involvement, policyholder protection, and perspectives from insurers and

0 views • 22 slides

Addressing Concerns Regarding Reduction of Policyholder Bonus Rates

The Appointed Actuary recommended a reduction in policyholder bonus rates for a big life insurance company with significant participating business. An Independent Director expressed dissatisfaction over the reduction compared to previous years and urged the Actuary to at least maintain last year's r

0 views • 23 slides

New Terms for Settlement through the Natural Perils Pool

The Norwegian Natural Perils Pool has approved new terms for settlement, effective from 1 January 2016. These terms supersede the Common Terms and Conditions for Insurance Contracts covering damage from natural events since 2012. The new terms regulate settlement processes and set limits on company

0 views • 7 slides