RBI Directions on Filings of Supervisory Returns

RBI issues new Master Directions on 'Filing of Supervisory Returns,' emphasizing NBFCs. Timelines, revised applicability, and online portals introduced for streamlined filing. Physical submission required for Form A Certificate.

1 views • 5 slides

Blended Finance in India

Blended finance in India combines development finance, philanthropic funds, and private capital to drive social, environmental, and economic progress while providing financial returns. The market has seen steady growth with USD 5.6 billion deployed across transactions. Annual investments show a posi

2 views • 19 slides

Responsibilities of the NBFCs registered with RBI, with regard to submission and compliances

India's regulatory framework for Non-Banking Financial Companies (NBFCs) under the RBI, covering prudential norms, compliance, penalties, and the shift to online filing via XBRL, highlighting the sector's emphasis on transparency, risk management, and technological integration.

1 views • 6 slides

Responsibilities of the NBFCs registered with RBI

India's regulatory framework for Non-Banking Financial Companies (NBFCs) under the RBI, covering prudential norms, compliance, penalties, and the shift to online filing via XBRL, highlighting the sector's emphasis on transparency, risk management, and technological integration.

2 views • 6 slides

Scale Based Regulation 2023 - Non-Banking Financial Company (NBFCs)

On October 19, 2023, the Reserve Bank of India (\u201cRBI\u201d) has issued \u2018Master Direction \u2013 Reserve Bank of India (Non-Banking Financial Company \u2013 Scale Based Regulation) Directions 2023\u2019 (\u2018SBR Master Direction\u2019). The SBR Master Direction aims to harmonize the Previ

0 views • 9 slides

NBFCs and IT Governance-Ensuring Future Readiness

The RBI's regulations aim to ensure NBFCs uphold strong cybersecurity standards, safeguarding consumers and enhancing trust in the financial sector, particularly in light of recent incidents such as Paytm Payment ban (Jan 2024) due to significant KYC irregularities, deficiencies observed in loan san

6 views • 8 slides

RBI Compliance Regulations and the Role of Advanced Technologies in Bank

Technological solutions play a pivotal role in enhancing compliance management for NBFCs. By leveraging tech solutions for suspicious transaction detection, RPA for automating compliance tasks, blockchain for secure record-keeping, NLP for regulatory

0 views • 5 slides

Understanding the Growth of Shadow Banking in Emerging Markets: Insights from India

Investigating the rapid expansion of nonbank finance corporations (NBFCs) in India reveals insights into the incentives driving the development of shadow banking institutions. Key factors explored include economic considerations, regulatory disparities, and asset-liability structures. The concept of

0 views • 18 slides

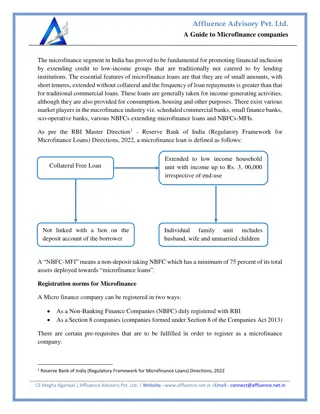

Microfinance Companies Explained: A Simple Guide

Microfinance in India plays a crucial role in promoting financial inclusion by offering small, collateral-free loans to low-income groups, typically for income-generating activities. Microfinance companies can be registered as NBFCs. The registration

0 views • 6 slides

Best detailed project report

Generate a detailed project report for Mudra Loan and PMEGP in minutes. Our reports are accepted by all nationalized banks and NBFCs in India.\nBest Project report writing tool for a bank loan\n\u200eProject report \u00b7 \u200eProject report for Res

0 views • 1 slides