The Crucial Role of Compliance in Payroll Management Software!

Payroll management software is essential for businesses of all sizes, automating processes like wage calculation and tax deduction. Compliance ensures adherence to legal frameworks, safeguarding against penalties and fostering trust. Key features include robust security measures, tax compliance capa

3 views • 9 slides

Understanding Inductive and Deductive Reasoning

Inductive reasoning involves drawing general conclusions from specific observations, while deductive reasoning starts with general premises to derive specific conclusions. Induction uses experience or experimental evidence to make broad conclusions, while deduction follows from general to specific.

5 views • 7 slides

Lowering the Burden: Tax Deduction Strategies for NRIs in England from India

Discover efficient tax deduction strategies tailored for Non-Resident Indians (NRIs) residing in England but originating from India. Our comprehensive guide, 'Lowering the Burden,' explores nuanced tax-saving approaches, ensuring NRIs maximize benefits while meeting legal obligations. From understan

4 views • 3 slides

Understanding Natural Resources and Resource Economics

Economics of natural resources focuses on the supply, demand, and sustainable allocation of the Earth's resources. It aims to develop a sustainable economy that protects natural resources for future generations. Natural resources are essential for human survival and include biotic and abiotic resour

0 views • 11 slides

Analyzing Inferences from Visual Cues

Explore a series of visual scenarios and make inferences about the individuals depicted based on their grocery lists, interactions, activities, and emotions. From discerning personal habits to predicting future events, each image provides a unique context for observation and deduction.

0 views • 57 slides

The Best Odie's Natural Oil for Enhancing Wood Furniture Beauty

Wood furniture has a timeless appeal, adding warmth and elegance to any space. To maintain and enhance its beauty, using the right oil finish is crucial. Among the various products available, Odie\u2019s Natural Oil stands out as one of the best natural oils for wood furniture. This blog will delve

1 views • 4 slides

section 16 (2)

When an individual earns a salary of more than Rs 2.5 lakhs per annum, Tax Deducted at Source or TDS is applied to the income received. This deduction is applied every time your salary is credited to you. Over the course of a financial year, there will be 12 TDS deductions on your salary only.

0 views • 7 slides

Estimation Mystery: How Many Discs in the Container?

Explore the mystery of how many discs are in a container by analyzing clues and narrowing down possibilities. Through estimation and deduction, arrive at the final answer of 44 discs. Test your estimation skills with this interactive challenge.

0 views • 6 slides

Structuring Mergers, Acquisitions, and Private Equity Recaps: Tax Implications for S Corporations

Explore the tax implications for S Corporations in mergers, acquisitions, and private equity recaps, focusing on changes brought by the Tax Cuts and Jobs Act of 2017. Topics include income tax rate changes, dividends received deduction, and the Corporate AMT.

0 views • 95 slides

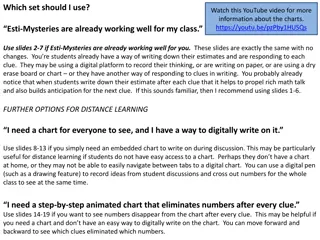

Interactive Esti-Mystery Chart Activity for Classroom Engagement

Engage your class with interactive Esti-Mystery charts to enhance math skills through estimation and deduction. Choose from different sets based on your classroom needs for in-person or distance learning. The activity involves narrowing down possibilities based on clues provided as students estimate

1 views • 19 slides

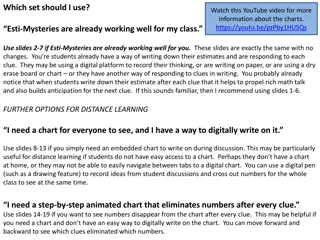

Engaging Math Activity with Esti-Mysteries: Interactive Charts and Clues

Dive into an engaging math activity utilizing Esti-Mysteries, where students work on narrowing down possibilities based on clues to determine the number of erasers in a vase. Choose from different sets of slides depending on your classroom setup, from traditional writing methods to interactive digit

0 views • 19 slides

Esti-Mystery: The Melting Ice Cubes Puzzle

Explore the Esti-Mystery of determining the number of ice cubes in a glass with a series of clues narrowing down the possibilities, leading to the final revelation of 41 ice cubes. Engage in estimation and deduction to solve this fun and challenging puzzle presented in a creative way with food color

0 views • 6 slides

Understanding Deductions in Taxation

Explore the essentials of tax deductions in Module 5, including how to calculate taxable income, lower taxable income plus income taxes, differentiate between Standard and Itemized Deductions, select the appropriate deduction for a client's return, and identify expenses covered by Itemized Deduction

0 views • 20 slides

Esti-Mystery: How Many Rings Are There?

In this Esti-Mystery activity designed by Steve Wyborney, participants are provided with clues to determine the number of rings present. Starting with a range between 1 and 20, narrowing down through clues like counting by 5s and the number being greater than 10, the final reveal showcases 15 rings.

0 views • 6 slides

Esti-Mystery Ribbon Length Challenge

In the Esti-Mystery Ribbon Length Challenge, participants use clues to narrow down possibilities and estimate the length of a ribbon when straightened. Through logical deduction and estimation, they arrive at a final estimate before the reveal of the solution, which turns out to be 26 inches. This e

0 views • 6 slides

Understanding Learning Theories in Instructional Design

Learning is defined as enduring behavior change resulting from experiences. Behaviorism, Cognitivism, and Constructivism are key theories in instructional design. Teachers must cater to learners' needs for effective behavior changes. Empiricism and rationalism have historically influenced epistemolo

2 views • 30 slides

Evolution of Computer Logic: From Axioms to Natural Deduction

Delve into the fascinating pre-history of computer logic, starting from David Hilbert's foundational problems in mathematics to the development of the Dedekind-Peano axioms for natural numbers. Explore Hilbert's finitist consistency program and the evolution of logic systems from Hilbert's axioms to

0 views • 26 slides

Esti Mysteries - Mystery #6: Foam Pieces in Vase Estimation

Engage in the excitement of Esti Mysteries as you estimate the number of foam pieces in a vase. With clues hinting at the quantity, apply your deduction skills to narrow down the possibilities. Use your estimation prowess to determine the most plausible answer and uncover the mystery revealed in thi

0 views • 6 slides

Impact of 2018 Tax Act: Key Changes Explained

Explore how the new 2018 tax act impacts taxpayers, including changes to deductions, tax brackets, and the SALT deduction. Learn about the standard deduction increase, personal exemptions elimination, new tax brackets, and more insights from a CPA.

0 views • 34 slides

Esti-Mystery Puzzle: How Many Dominoes in the Glass?

In this Esti-Mystery puzzle, you are challenged to figure out the number of dominoes in a glass through a series of clues. Narrow down the possibilities using estimation and logical deduction until you reach the final answer of 34 dominoes. Test your reasoning skills and enjoy this engaging mathemat

2 views • 6 slides

Fun Math Puzzle - Guess the Number of Tiny Dice in the Lid

Let's solve a challenging math puzzle to guess the number of tiny dice in the lid! Follow the clues provided to narrow down the possibilities and make your best estimate. Use logic and estimation skills to arrive at the correct answer. Enjoy the fun of deduction and number reasoning in this engaging

0 views • 6 slides

Learning from Fictional Detectives for Better Diagnostic Skills

Explore the application of lessons from fictional detectives like Sherlock Holmes to enhance diagnostic processes in medicine. Delve into problem representation, observation, deduction, and clinical reasoning strategies to improve diagnostic accuracy and patient care.

0 views • 68 slides

Economic and Revenue Review Update Briefing for Money Committees

Adjusting for timing issues and taxpayer rebates, general fund revenues grew 10.3% year-over-year in October. With one-third of the fiscal year completed, revenues are up 8.3% adjusted for policy and timing impacts. The impact of the increased standard deduction is expected to reduce withholding rat

0 views • 15 slides

Code Assignment for Deduction of Radius Parameter (r0) in Odd-A and Odd-Odd Nuclei

This code assignment focuses on deducing the radius parameter (r0) for Odd-A and Odd-Odd nuclei by utilizing even-even radii data from 1998Ak04 input. Developed by Sukhjeet Singh and Balraj Singh, the code utilizes a specific deduction procedure to calculate radius parameters for nuclei falling with

1 views • 12 slides

Residence Returning Scheme Points Allocation Guidelines

This document outlines the points allocation guidelines for the Residence Returning Scheme, covering categories such as Academic Excellence, University Contributions, Hall-Based Contributions, and Discipline Deduction. It provides detailed criteria for scoring in each category, including GPA points

0 views • 21 slides

Insights into Logic and Proof: A Historical Journey

Delve into the historical timeline of logic and proof, from ancient Egyptian mathematical activities to modern advancements in computational proof assistants. Discover the evolution of symbolic logic and the development of proof systems like natural deduction. Explore the significance of logical exp

0 views • 36 slides

Enhancing Decision-Making with Location Intelligence in Water Industry Acquisitions

Delve into the pivotal role of location intelligence in the decision-making process for water industry acquisitions. Discover how accurate prediction of investment outcomes is achieved through the integration of environmental, geographic, census, and financial data. Explore the significance of data

0 views • 16 slides

Efficient Management of Donations at Donation Bank

Donation Bank is a non-profit organization that collects gifts from private individuals. Gifts need to be certified for tax deduction purposes and attributed to specific projects. Donors receive acknowledgements and certificates for their contributions. The organization maintains archives for person

0 views • 19 slides

Understanding Deductive and Inductive Reasoning in Problem-Solving

Explore the differences between deduction and induction in problem-solving approaches. Deductive reasoning starts with a general statement and moves to specifics, offering certainty and objectivity, while inductive reasoning begins with specifics and arrives at a generalization, providing flexibilit

0 views • 11 slides

Overview of Association of Fundraising Professionals (AFP) and Charitable Act Impact

AFP comprises 27,000+ members across 180 chapters globally who raise over $115 billion annually for charitable causes. Members must adhere strictly to the AFP Code of Ethics, promoting honesty, integrity, and transparency in fundraising efforts. The Charitable Act (S.566/H.R.3435) aims to renew the

0 views • 5 slides

Understanding Logic in Research: Abduction, Deduction, and Induction

Explore the fundamental concepts of logic in research including abduction, deduction, and induction. Learn about hypothesis testing, material implication, and the relationship between theory and data. Gain insights into how knowledge is generated through accumulating data and the self-correcting pro

0 views • 28 slides

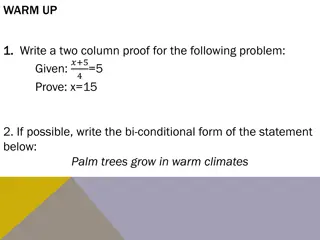

Logic in Mathematics and Deductive Reasoning

Delve into the principles of logical deduction in mathematics through examples of conditional statements, syllogisms, and proofs. Explore how deductive reasoning can lead to valid conclusions based on given premises.

0 views • 12 slides

Ohio Small Business Investor Income Deduction Overview

Ohio offers a 50% Small Business Investor Income Deduction for individuals, allowing up to $250,000 of small business investor income to be deducted at 50% for taxable years 2013 and beyond. This deduction is reported on Schedule IT SBD and Form IT1040 Schedule A. The deduction is favorable for busi

0 views • 46 slides

Methods of Proof in Mathematics

Understanding methods of proof in mathematics involves providing convincing arguments to show the truth of propositions. This involves logical deduction, implications, and establishing new facts from known ones. Different techniques like direct proof and specific logical rules such as modus ponens a

0 views • 21 slides

Updates and Reconciliation Information for WRS Central Benefits

This document provides updates on earnings codes, deduction remittance, and December 2019 remittance reporting for WRS Central Benefits. It outlines new processes, deadlines, and responsibilities related to annual reconciliation and reporting. Key points include the creation of new earnings codes, a

0 views • 18 slides

Enhancing Literature Analysis Skills Through Inference and Deduction

Explore a lesson plan focused on developing inference and deduction skills in literature analysis. Students will engage with texts, answer differentiated questions, and work collaboratively to analyze themes, characters, language, and structural features. The lesson includes practice in selecting qu

0 views • 17 slides

Deduction of Vendor's Title in Land Sale Contracts

In the post-contract stage of a land sale, it is crucial for the vendor to demonstrate the ability to transfer the contracted property. The purchaser must inspect the title for a specified period to ensure its validity, with rules varying across different regions. Noteworthy guidelines include ancie

0 views • 40 slides

Understanding Natural Language Data Processing

Exploring aspects of natural language data, covering topics like the differences between natural and formal languages, challenges in processing natural languages for machines, and examples of dealing with natural language data such as Yelp reviews. The content also touches on big data concepts, hash

0 views • 26 slides

Understanding the Impact of Mortgage Interest Deduction on the Housing Market

The Mortgage Interest Deduction (MID) is a significant tax expenditure in the U.S., often associated with promoting homeownership. However, research suggests that its impact on increasing affordability and homeownership is limited, particularly for high-income households. The regressive nature of th

0 views • 6 slides

IMF Statistics Department - Natural Resources Statistical Tools

IMF Statistics Department has developed two statistical tools, the Revenue Template and National Accounts Template, to help countries analyze government revenues and natural resources in national accounts. These tools are crucial for policymaking in countries heavily reliant on natural resource reve

0 views • 9 slides