Medicaid Managed Care Trends in Minnesota's Health Market

Explore the unique landscape of Minnesota's Medicaid managed care system, highlighting key trends for providers and health plans, financial analysis, hospital interactions, and a comparison with other states. Discover the differences in Minnesota's healthcare structure, including limited presence of

1 views • 19 slides

Multiple Point Lightning Protection Accessories, Multiple Point, Electrolytic Co

We are a leading manufacturer, exporter and supplier of a wide range of Multiple Point Lightning Protection Accessories, Multiple Point, Electrolytic Copper Multiple Point, Earthing and Lightning Protection at very cheap prices for our clients from Mumbai, India.

1 views • 3 slides

Insights on Enterprise Risk Management in the Non-Life Insurance Sector

Delve into the realm of enterprise risk management within non-life insurance, focusing on emerging risks, key regulations, and risk interfaces. Explore the challenges and complexities faced by insurers, including touch points, risk interfaces with partners/vendors/intermediaries, and the evolving la

3 views • 20 slides

Milliman Global Actuarial Initiative (GAIN)

The United Nations Development Programme (UNDP) and Milliman Global Actuarial Initiative (GAIN) are working together to enhance the actuarial profession in developing nations, fostering economic stability, and growth. The initiative aims to promote risk protection mechanisms through insurance contri

5 views • 27 slides

Comparative Analysis of Behavioral Health Services in Florida

This comparative analysis presents available behavioral health services across various Florida state agencies, third-party insurers, and health plans. The services cover assessment, treatment planning, therapy, psychosocial rehabilitation, supportive housing, mental health clubhouse services, case m

0 views • 6 slides

Improving Customer Service: Challenges and Strategies in 2024

Despite rising customer demands and declining staffing levels, efforts are underway to enhance customer service in SSA. Challenges include administrative funding constraints, increased retiree numbers, and staff attrition. Strategies involve leadership changes, increased onsite presence, and perform

1 views • 7 slides

Understanding Life Insurance: Definition, Benefits, and Importance

Life insurance is a contract providing financial protection in case of death. It serves various needs like income replacement, savings, investments, retirement planning, and risk transfer. Purchasing the right policy from registered insurers is crucial for tailored benefits.

0 views • 27 slides

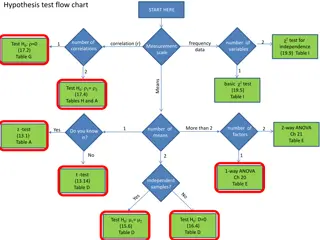

Understanding Analysis of Variance (ANOVA) for Testing Multiple Group Differences

Testing for differences among three or more groups can be effectively done using Analysis of Variance (ANOVA). By focusing on variance between means, ANOVA allows for comparison of multiple groups while avoiding issues of dependence and multiple comparisons. Sir Ronald Fisher's ANOVA method provides

0 views • 28 slides

Understanding Asset Shares and Estate Management in Insurance: Insights from the 35th India Fellowship Webinar

Delve into the complexities of asset shares and estate management in the insurance industry through the lens of the insightful 35th India Fellowship Webinar. Learn about historical paradigms, regulatory shifts, and available alternatives for insurers in managing asset shares and estate growth. Explo

3 views • 30 slides

Valuation Frameworks and Preparing for IPO in Indian Life Insurance Industry

Explore the differences between embedded valuation frameworks used by listed insurers in India versus internal frameworks, along with discussions on strategic decisions for IPO readiness, reasons for high valuations, and comparability issues. Dive into calculating Embedded Value and strategic consid

1 views • 45 slides

Understanding ICD-10-CM Coding for Seizure Disorders: A Comprehensive Guide

ICD-10-CM codes play a crucial role in diagnosing and managing seizure disorders, including epilepsy and non-epileptic seizures. This detailed guide covers the coding guidelines for various types of seizures, such as intractable epilepsy and conversion disorder with seizures. It also explains how th

0 views • 6 slides

Understanding Multiple Regression in Statistics

Introduction to multiple regression, including when to use it, how it extends simple linear regression, and practical applications. Explore the relationships between multiple independent variables and a dependent variable, with examples and motivations for using multiple regression models in data an

0 views • 19 slides

The Role of Actuaries in Addressing Environmental and Climate Changes

Actuaries play a crucial role in assessing and managing risks posed by environmental and climate changes, aiding the insurance industry in mitigating these challenges. They consider long-term risks with significant financial implications, such as physical, transitional, and liability risks. Actuarie

0 views • 20 slides

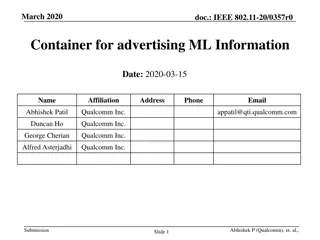

Framework for Advertising Multiple-Link Operations in IEEE 802.11

Proposed framework for advertising Multiple-Link Operations (MLO) capabilities in IEEE 802.11 networks classified into three categories: Common MLD Information, Per-Link Information, and Multiple BSSID features. Introduces a new element, Multiple Link Attribute (MLA) element, with profiles for each

0 views • 27 slides

Updates on Belamaf in Multiple Myeloma: ASH 2023 Highlights

Explore the latest findings from the American Society of Hematology (ASH) 2023 Hybrid Congress regarding Belamaf in multiple myeloma, including real-world outcomes, safety and efficacy analyses, long-term treatment impacts, infection risk, ocular toxicity prevention, and more. Key presentations cove

0 views • 35 slides

Key Principles of Insurance

Understanding insurable interest, utmost good faith, and material facts disclosure are essential principles in the insurance industry. Insurable interest requires a financial stake in the insured property, utmost good faith mandates honesty in the contract, and material facts disclosure ensures all

0 views • 22 slides

Understanding the Impact of the Insurance Act 2015 on Brokers and Insurers

The Insurance Act 2015 brings significant changes in insurance contract law, shifting from Duty of Disclosure to Fair Presentation. This Act influences both Brokers and Insurers, requiring clear and accessible disclosure of material circumstances. The remedies for misrepresentation and non-disclosur

0 views • 19 slides

Enhancing Resilience: US Insurers' Role in Combating Infrastructure Decay and Climate Challenges

Explore how US insurers can contribute to resilience-building efforts amid infrastructure decay and climate-related challenges. The discussion covers historical perspectives, public-private partnerships, notable climate disasters, and the imperative for proactive action by policymakers. Discover the

2 views • 21 slides

The Future of Motor Litigation - Navigating Change in the Legal Landscape

Exploring the shifting dynamics in motor litigation, from technological advancements to regulatory reforms. Delve into the evolving roles of insurers, handlers, and brokers in this ever-changing legal environment. Gain insights into the impact of Brexit and embrace the inevitability of change while

0 views • 13 slides

Role Expansion of Deposit Insurers in Crisis Management

In the realm of financial stability, the role of deposit insurers is evolving to encompass broader responsibilities, including risk analysis, crisis management, and cross-border resolutions. This transformation involves expanding mandates, enhancing resolution activities, and ensuring the protection

0 views • 24 slides

Partnering to Improve Tobacco Cessation Coverage in X State

This presentation focuses on addressing the issue of tobacco use and the gaps in cessation treatment for State employees. It discusses the costs of tobacco use, the benefits of tobacco cessation coverage, and the ACA requirements for insurers. It also explores opportunities for collaboration to expa

0 views • 29 slides

Understanding Fringe Benefits in Government Contracts

Fringe benefits in government contracts refer to additional compensations beyond wages, such as life insurance, health insurance, pension, vacation, holiday, and sick leave. Contractors must maintain records to show the enforceability and financial responsibility of providing these benefits. Funded

0 views • 20 slides

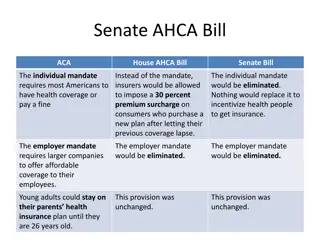

Comparison of Healthcare Provisions in Senate and House AHCA Bills

The Senate AHCA bill proposes major changes to healthcare provisions compared to the current ACA, such as removing the individual mandate and employer mandate. Tax credits would be based primarily on age rather than income, and cost-sharing subsidies may end in 2020. Insurers could charge older cust

0 views • 5 slides

Cyber Risk and Reinsurance Implications: A Comprehensive Analysis

This extensive content delves into the profound implications of cyber risks on the reinsurance industry, covering topics such as the magnitude of the threat, large loss examples, coverage issues, aggregation of cyber losses, events and causes, the Hours Clause, and more. It provides in-depth insight

0 views • 9 slides

Insights into Auto Insurance Rating Factors and Market Overview

Understanding the complexities of auto insurance rating factors is essential for both insurers and consumers. The National Association of Mutual Insurance Companies (NAMIC) plays a significant role in overseeing the $323B auto insurance market in the U.S. This includes aspects such as the mandatory

0 views • 18 slides

Challenges in Third-Party Liability Motor Insurance in Latin America

Understanding the complexities of third-party liability motor insurance in Latin America, where distinctions between voluntary and compulsory insurance present unique problems and challenges for insurers, policyholders, and intermediaries. Overcoming these issues is essential for a healthy insurance

0 views • 19 slides

Missouri Legislative Update 2019: New Rules for Suits Against Insurers

Missouri's legislative update in 2019 includes new rules for suits against insurers, focusing on venue determination and residency requirements. The changes aim to streamline processes and address historical challenges in insurance-related legal actions.

0 views • 26 slides

Missouri Department of Labor and Industrial Relations (DOLIR) Fraud and Noncompliance Unit Overview

The Missouri DOLIR Fraud and Noncompliance Unit (FNU) was established in 1993 by the General Assembly to investigate fraud and noncompliance related to Chapter 287 RSMo (Workers' Compensation Law). The FNU is dedicated to promoting a safe work environment by upholding the integrity of Missouri's Wor

0 views • 35 slides

Bermuda Economic Balance Sheet (EBS) Technical Provisions Overview

Detailed presentation on Bermuda Economic Balance Sheet Technical Provisions as presented at CAMAR Fall 2017. The contents cover the purpose, outline, evolution, components of Bermuda technical provisions, new requirements, actuarial methodology, and conclusion. It provides insights into the regulat

0 views • 23 slides

Introduction to Indiana's All-Payer Claims Data Base (APCD)

Indiana's All-Payer Claims Data Base (APCD) is a comprehensive state database comprising medical claims, pharmacy claims, eligibility information, and provider files from various health plans and insurers. The initiative aims to enhance healthcare policy-making, cost comparison, consumer information

0 views • 21 slides

Exploring Joint and Composite Insurance Policies

Dive into the world of joint and composite insurance policies, covering topics such as the composite nature of insurance, handling multiple insurers and assureds, the implications of late payment of claims, and the distinctive features of joint policies. Understand the complexities and nuances of in

0 views • 18 slides

Understanding Derivatives for Managing Interest Rate Risks in Indian Insurance Industry

Exploring the use of derivatives in hedging interest rate risks and their significance in the Indian insurance sector. The seminar delves into interest rate risk management, derivatives market dynamics, challenges, and the impact on insurers. Insights are provided on the investment strategies of ins

0 views • 45 slides

Insights from Nordic Association of Marine Insurers' Annual Seminars

Explore a collection of images and data revealing key trends and insights discussed at the annual seminars of the Nordic Association of Marine Insurers. Topics cover board members, claim frequencies, pricing challenges, vessel portfolios, volatile claim costs, and more.

0 views • 10 slides

Understanding Bad Faith Insurance Litigation in Ohio

Insurance bad faith is a serious issue where an insurer fails to act in good faith towards their insured. In Ohio, the Supreme Court has established the duty of good faith owed by insurers to policyholders. This duty includes the fair processing, payment, and settlement of claims. Failure to meet th

0 views • 47 slides

Challenges and Trends in India's Health Insurance Industry

The Health Insurance Regulatory and Development Authority of India faces various challenges and trends within the health insurance industry. The content discusses issues such as trends in health insurance premiums, stakeholder involvement, policyholder protection, and perspectives from insurers and

0 views • 22 slides

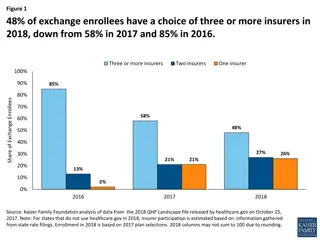

Trends in Exchange Insurer Participation and Choice for 2017-2018

The figures illustrate a decline in the number of insurers available through exchanges from 2017 to 2018, resulting in decreased choices for enrollees. The data shows a decrease in counties with only one exchange insurer, as well as differences in insurer options between metro and non-metro areas. T

0 views • 6 slides

Understanding Ethernet and Multiple Access Protocols in Computer Networks

Exploring the fundamentals of Ethernet and multiple access protocols in computer networks, this content discusses the two primary categories of multiple access protocols - contention access and controlled access. It delves into topics such as CSMA/CD, LANs, performance of multiple access schemes, ad

0 views • 7 slides

Effectiveness of Derivative Products in India for Hedging Investment Guarantees of Life Insurers

This seminar explored the use of derivative products in India to hedge investment guarantees of life insurers, along with challenges in pricing cyber and terrorism risks. It covered the history of life insurance in India, types of products, investment guarantees, and the role of derivatives in manag

0 views • 29 slides

Analysis of Proteasome Gene SNPs as Molecular Markers for Multiple Sclerosis in Latvian Population

This study by I. Trapina aims to investigate the prevalence and functionality of SNPs in proteasome genes to assess their potential as molecular markers for multiple sclerosis in the Latvian population. Multiple sclerosis is an autoimmune disease affecting the central nervous system, and the role of

0 views • 13 slides

Advancements in Non-Orthogonal Multiple Access (NOMA) Technology

Non-Orthogonal Multiple Access (NOMA) technology has revolutionized the way multiple users' messages are superimposed and transmitted over the same frequency simultaneously. NOMA offers enhanced spectral efficiency, massive connectivity, and increased throughput compared to traditional multiple acce

0 views • 5 slides