Understanding Anti-Money Laundering (AML) and Combating Financing of Terrorism (CFT) Framework

Learn about the essential components of Anti-Money Laundering (AML) and Combating the Financing of Terrorism (CFT) framework, including regulatory obligations, objectives, money laundering processes, stages, sanctions, and regulatory overview. Discover how money laundering, terrorist financing, and

1 views • 30 slides

Evolution of Anti-Money Laundering Regulations in the EU

Explore the history and milestones of Anti-Money Laundering (AML) regulations in the EU, from the initial directives in 1991 to the latest amendments. Learn about the obligations on private entities, enforcement of AML laws, and the focus on gatekeepers in the financial system. The directives have e

1 views • 14 slides

Challenges and Future Prospects for Cypriot Banks

The presentation delves into the global challenges faced by Cypriot banks, including the economic impacts of the pandemic and the Russian invasion of Ukraine. It highlights advancements in anti-money laundering efforts, the adoption of ESG standards by Cypriot banks, and the importance of addressing

0 views • 34 slides

Overview of Money Laundering and Prosecutions under Indian Laws

Learn about the offence of money laundering under Indian laws, including definitions, explanations, and the interplay of various acts such as PMLA, PBPT Act, Black Money Act, and Income Tax Act. Get insights into the definition of proceeds of crime and the associated legal implications.

1 views • 83 slides

FICA Presented by: Robert Krautkramer

FICA, presented by Robert Krautkramer, aims to create transparency in financial transactions to combat money laundering and terrorism financing. The content explains the concepts of money laundering, the risk-based approach for accountable institutions, and the specific requirements for AIs to compl

2 views • 33 slides

Firm-Wide Risk Assessment for AML Compliance

This content discusses the completion of a firm-wide risk assessment for anti-money laundering (AML) compliance, covering requirements, risk factors, good and bad practices, template guidelines, customer risks, and controls in place to mitigate money laundering and terrorist financing risks. It emph

1 views • 22 slides

Understanding the Quantity Theory of Money

The quantity theory of money posits a direct relationship between the supply of money in an economy and price levels, assuming a constant velocity of money and economic activity. Increases in the money supply lead to price inflation, devaluing currency and decreasing purchasing power. Two main versi

2 views • 6 slides

UK Anti-Money Laundering Solutions Market

The UK Anti-Money Laundering Solutions Market Size is Anticipated to hold a Significant Share by 2033, growing at a CAGR of 7.12% from 2023 to 2033. \n\n

0 views • 4 slides

Understanding the Quantity Theory of Money: Fisher vs. Cambridge Perspectives

The Quantity Theory of Money explains the relationship between money supply and the general price level in an economy. Fisher's Equation of Exchange and the Cambridge Equation offer different perspectives on this theory, focusing on money supply vs. demand for money, different definitions of money,

0 views • 7 slides

Evolution of Money: From Barter to Electronic Banking

Money has evolved from the barter system to electronic banking through various stages like animal money, metallic money, paper money, and credit money. The invention of money was crucial to overcome the limitations of barter, leading to the ideal utilization of resources and solving issues like the

0 views • 14 slides

Anti-Money Laundering Training Overview

This training example provides insights and tips on Anti-Money Laundering (AML), covering topics such as understanding money laundering, risks in the accountancy sector, criminal perspectives, predicate crimes, and more. It emphasizes the importance of tailored and comprehensive training to combat f

0 views • 39 slides

Understanding the Value of Money and Standards

The value of money refers to its purchasing power, which is influenced by the price level of goods and services. Different standards, such as wholesale, retail, and labor, help measure the value of money. Money can have internal and external value, affecting domestic and foreign transactions. The Qu

0 views • 62 slides

Money Laundering Offences and Investigations in Bangladesh

Bangladesh's Financial Intelligence Unit can authorize investigation agencies to investigate predicate offences, but who will investigate money laundering offences? The Money Laundering Prevention Act, 2012 outlines penalties and forfeiture of property for such offenses. Entities such as banks, fina

0 views • 12 slides

Updates on Financial Investigation Agency: Legislative Amendments and Mutual Evaluation Readiness

Ongoing preparations for the upcoming Mutual Evaluation, introduction of AMLive STR e-Reporting Portal, legislative amendments, and additions impacting the Financial Investigation Agency. The FATF Mutual Evaluation scheduled for July 2022 assesses the Territory's anti-money laundering measures. Enti

1 views • 12 slides

Advanced Financial Crime Investigations and Anti-Money Laundering Overview

Explore the world of advanced financial crime investigations, anti-money laundering, and the importance of estimating financial reporting errors. Delve into the role of internal audit and investigations, understand the significance of changes in accounting estimates, and learn why estimation is vita

0 views • 63 slides

Practical Tips for Managing Anti-Money Laundering Risks

Learn practical tips for managing Anti-Money Laundering (AML) risks, including the importance of getting it right, AML supervision techniques, basics to adhere to, and scenarios to consider when dealing with client funds. Stay informed about regulations and conduct firm-wide risk assessments to comb

0 views • 17 slides

Understanding Anti-Money Laundering and Terrorist Financing

Exploring the Irish AML/CTF legislative framework, definitions of money laundering and terrorist financing, elements of guilt, stages of money laundering, and the role of Designated Persons in combating financial crimes.

0 views • 94 slides

Understanding Money and Monetary Policy in Economics

Money serves as a medium of exchange, store of value, and unit of account in an economy. It is vital for economic transactions and stability. The quantity of money is measured using concepts like liquidity and monetary aggregates. The demand for money is linked to the Quantity Theory of Money, which

2 views • 12 slides

Enhancing Corporate Transparency and Compliance through Beneficial Ownership Regulations

The Companies (Amendment) Act, 2019 in Trinidad and Tobago has introduced regulations to enhance corporate transparency and compliance with CFATF recommendations by focusing on beneficial ownership. These regulations aim to combat money laundering and terrorist financing through requirements for com

0 views • 31 slides

Understanding the New Fifth Pillar of Customer Due Diligence

The Customer Due Diligence (CDD) Final Rule, effective from May 11, 2018, adds a crucial 5th pillar to Anti-Money Laundering (AML) Program requirements aimed at improving financial transparency and mitigating risks related to illicit transactions. The rule outlines key elements such as customer iden

4 views • 32 slides

Understanding Money Laundering: Detection, Prevention, and the Role of Financial Intelligence Authorities

Explore the practical aspects of detecting and preventing money laundering, with a focus on the role of the Financial Intelligence Authority in Uganda. Learn about the effects of money laundering, the obligations of accountable persons in anti-money laundering efforts, and the penalties associated w

4 views • 27 slides

Understanding Anti-Money Laundering & Terrorist Financing Training

Explore the essential aspects of anti-money laundering (AML) and terrorist financing, including the Irish legislative framework, definitions, and stages of money laundering. Learn about designated persons, key legislation, and the consequences of engaging in illegal financial activities.

7 views • 140 slides

Understanding AML Risk Assessments and Due Diligence Regulations

Anti-money laundering (AML) risk assessments and due diligence regulations are crucial for preventing money laundering and terrorist financing. This content discusses the importance of risk assessments, client due diligence, and regulatory compliance in the AML landscape. It emphasizes the need for

0 views • 13 slides

Understanding Prudential Regulations in Banking

Prudential regulations in banking are essential to reduce risks for creditors and protect depositors. The State Bank of Pakistan issues regulations covering risk management, corporate governance, anti-money laundering, and more to ensure the safety and soundness of the financial system.

0 views • 9 slides

Understanding Significant Beneficial Owners (SBO) Declarations in India

SBO Declarations were introduced under the Companies Act, 2013 to enhance corporate transparency by uncovering ultimate beneficiaries with significant control over companies. These rules aim to prevent money laundering, combat financial crimes, and address tax evasion. Section 90 mandates individual

0 views • 38 slides

Sound Money and the Future of Money by Nicolas Cachanosky

Sound money ensures monetary equilibrium where money demand equals money supply, essential for a stable economy. Explore the evolution of monetary institutions, cashless economies, and cryptocurrencies with Professor Nicolas Cachanosky's insightful perspective on the future of money.

0 views • 27 slides

Overview of Anti-Money Laundering Obligations for Notaries in Ireland

The Faculty of Notaries Public in Ireland hosted a session on Anti-Money Laundering Compliance Unit (AMLCU), emphasizing obligations under the Criminal Justice Act. Established in 2010, AMLCU plays a vital role in combating money laundering and terrorist financing. The event highlighted risk assessm

0 views • 14 slides

Supporting Member Countries' Anti-Money Laundering Efforts: IDB Initiatives

The Inter-American Development Bank (IDB) offers support to member countries in their anti-money laundering (AML) efforts through a demand-driven approach, policy dialogue, loan operations, and technical assistance. The focus is on strategic engagement areas, incremental approaches, and collaboratio

0 views • 4 slides

Modern Approaches to Anti-Money Laundering Technology

Explore the evolving landscape of anti-money laundering (AML) technology, focusing on electronic due diligence, regulatory frameworks, client perspectives, and technical advancements such as biometrics and cryptocurrency. Learn how the legal sector is embracing innovation and leveraging technology t

1 views • 13 slides

Understanding Money Laundering Regulations and Professional Integrity in Financial Services

Money laundering is the process of disguising criminal proceeds to make them appear legitimate. This illicit activity involves three stages - placement, layering, and integration. International cooperation is essential in combating money laundering, with organizations like the Financial Action Task

0 views • 9 slides

Enhanced Anti-Money Laundering and Corporate Regulation Framework

Ministry of Industry, International Business, Commerce, and Small Business Development has implemented new Anti-Money Laundering Guidelines and the Corporate and Trust Service Providers Act to strengthen regulatory frameworks. The guidelines address gaps identified in the previous evaluation and int

0 views • 16 slides

Combatting Money Laundering: Understanding the AMLA and BSA

The Anti-Money Laundering Act (AMLA) and Bank Secrecy Act (BSA) play crucial roles in preventing money laundering and illicit activities. The AMLA imposes liabilities on businesses and individuals, with low intent thresholds, while the BSA empowers the Treasury to enforce AML programs. Understanding

0 views • 32 slides

Understanding the Prevention of Money Laundering Act, 2002 in India

Exploring the provisions of the Prevention of Money Laundering Act, 2002 by Shaneen Parikh, a partner at Amarchand & Mangaldas. The act aims to prevent and control money laundering, provide for confiscation of assets linked to such activities, and establish various authorities and procedures to comb

0 views • 34 slides

Understanding Money Laundering: Implications and Stages

Money laundering, the illegal process of disguising illicit funds as legitimate, involves various types and stages such as structuring and integration. Legal implications in the UK and US include severe penalties for individuals and corporations. Recognizing these practices is crucial in combating f

0 views • 13 slides

FICA Awareness 2019: Understanding Money Laundering and Terrorist Financing Process

This module covers key areas related to money laundering and terrorist financing, including AML legislation in South Africa, obligations of accountable institutions, reporting requirements, and more. Explore the illegal processes of money laundering and terrorist financing, understanding placement,

0 views • 35 slides

A Practical Guide for Anti-Money Laundering Policies & Procedures

This comprehensive guide provides essential information on developing effective policies and procedures for anti-money laundering (AML) compliance. Covering topics such as risk assessment, customer due diligence, reporting suspicious activities, and integrating AML controls into daily transactions,

0 views • 13 slides

Impact of Corporate Transparency Act on Businesses

The Corporate Transparency Act (CTA), part of the Anti-Money Laundering Act of 2020, aims to prevent money laundering and other illegal activities by disclosing beneficial owners of US entities. The act mandates reporting companies to provide ownership information to the US Treasury's FinCEN. Exempt

0 views • 37 slides

Understanding Anti-Money Laundering & Terrorist Financing

Anti-Money Laundering & Terrorist Financing are processes used by criminals to hide the origins and ownership of illegal proceeds. This includes not only drug trafficking but also tax evasion, financial fraud, and theft. To combat these activities, designated persons must follow specified procedures

0 views • 73 slides

Understanding Anti-Money Laundering Regulations for Tax Advisers

Tax advisers need to be aware of Anti-Money Laundering (AML) regulations to ensure compliance. The webinar content covers background information, thematic areas, and guidance for tax advisers, including identifying red flags and understanding the boundaries of their work. It discusses the impact of

0 views • 11 slides

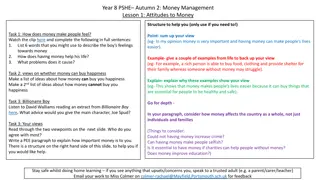

Money Management Lessons for Year 8 PSHE Students

Explore attitudes towards money, learn about budgeting, and consider the impact of money on happiness and life choices in this comprehensive PSHE lesson for Year 8 students. Activities include analyzing feelings towards money, discussing the relationship between money and happiness, budgeting hypoth

0 views • 9 slides