Evolution of Microcredit Regulatory Authority in Bangladesh

The Microcredit Regulatory Authority (MRA) in Bangladesh was established in 2006 to regulate and oversee the microfinance sector, following the vision of Bangabandhu Sheikh Mujibur Rahman. Since its inception, MRA has played a crucial role in issuing licenses, monitoring MFIs, and promoting financia

2 views • 22 slides

Mothers Union in Malawi: Empowering Women and Strengthening Families

Mothers Union in Malawi is a passionate organization with over 13,300 members dedicated to caring for families. They focus on sustainable development, poverty reduction, and empowering women to contribute positively to society. Through various activities like literacy programs and microfinance, Moth

0 views • 10 slides

Biography of Muhammad Yunus: Nobel Laureate and Microfinance Pioneer

Muhammad Yunus, born in 1940 in Bangladesh, is a renowned banker, author, and economist known for his pioneering work in microfinance. His efforts led to the establishment of Grameen Bank and earned him the Nobel Peace Prize in 2006. Yunus's journey from academia to poverty reduction initiatives in

0 views • 9 slides

Evolution and Growth of Islamic Finance Industry in Africa

The Islamic Finance industry has witnessed significant evolution and growth since 1960, with the emergence of Islamic Financial Institutions (IFIs) in both Muslim-majority and Muslim-minority countries. The sector has seen a rise in assets, global market share, and the establishment of Islamic Credi

0 views • 23 slides

Efficiency Analysis of Microfinance Institutions in Papua: A Study by Dr. Muneer Babu

Analysis of the performance and efficiency of Microfinance Institutions in Papua New Guinea, focusing on the provision of financial services to the underbanked population. The study evaluates the resource utilization and efficiency of MFIs, comparing less efficient and highly efficient institutions.

0 views • 18 slides

Financial Systems Development (FSD) Supporting KPI Work in Off-Grid Energy Sector

Explore the initiatives of GIZ in promoting complex reform and change processes in the off-grid energy sector, including financial analysis and reporting. The Financial Sector Development (FSD) projects in various countries showcase efforts to support stability, green finance, microfinance, SME fina

2 views • 8 slides

Ensuring Responsible Treatment of Microfinance Staff: ILO Guidelines

The International Labour Organisation (ILO) emphasizes the importance of treating microfinance employees responsibly through the USSPM framework. Improving staff welfare benefits the microfinance industry by attracting talent, enhancing productivity, and avoiding negative publicity. Key aspects incl

0 views • 7 slides

Understanding Microfinance: A Case Study of Kiva's Social Enterprise Impact

Microfinance, a banking service offering small loans to individuals and businesses, plays a vital role in empowering communities. Kiva.org, founded in 2005, focuses on building self-sufficiency through small loans and education. Investors support borrowers, emphasizing business success and loan repa

0 views • 12 slides

Transforming Islamic Co-Operative Model into Ethical Fintech Solution

Indonesian farmer Ziyaad Mahomed's case study highlights challenges in livestock farming, rice plantations, and more due to theft, capital, and manpower issues. Market survey suggests microfinance, co-operative restructuring, waqf, and zakat solutions with emphasis on risk-sharing over debt-based Is

0 views • 12 slides

Implications of Global Standing Instructions (GSI) and Sandbox Policies for MFBs

This presentation by Samuel Oluyemi delves into the crucial aspects of Global Standing Instructions (GSI) and Sandbox Policies, emphasizing the significance of regulatory sandboxes for Microfinance Banks (MFBs). The talk covers the background, requirements, basics of sandbox, GSI elements and proces

0 views • 9 slides

Sustainable Financial Inclusion through Islamic Microfinance

CEO Abdul Ammar Mun'am presents an innovative approach to tackle poverty worldwide by addressing reasons such as high illiteracy rates, wealth concentration, and interest-based economic systems. He emphasizes the need for sustainable financial solutions like Islamic microfinance to empower the under

0 views • 23 slides

Financial Mastery Minor Program Overview

The Financial Mastery Minor Program equips students with essential knowledge and skills at the intersection of finance and technology. It offers courses covering financial markets, investment essentials, personal financial planning, microfinance, modern banking foundations, life insurance, fintech,

0 views • 19 slides

Prady MFI System Overview: Enhancing Microfinance Operations

Prady MFI System is a web-based ERP system tailored for microfinance institutions, providing a comprehensive solution for all operational needs. It offers features such as loan management, accounting, system setup, and communication tools. With capabilities like multi-level access, bulk SMS integrat

0 views • 20 slides

Microfinance in Africa: Lessons and Experiences from Selected Countries

Exploring the role of Microfinance Institutions (MFIs) in Africa, this study delves into the challenges faced by small enterprises and households in accessing formal financial services. Through case studies in Benin, Ghana, Guinea, and Tanzania, the report highlights the significance of MFIs in prov

0 views • 18 slides

Microfinance Ireland - Empowering Microenterprises with Access to Finance

Microfinance Ireland, set up by the government, provides loans to new and growing microenterprises that do not meet traditional bank criteria. These loans support businesses with less than 10 staff and turnover under €2m, offering flexible terms, co-funding with banks, and a focus on job creation.

0 views • 12 slides

Understanding Microfinance: Empowering the Poor Through Financial Inclusion

Microfinance, a mainstream financial service, provides small loans to the poor to enhance their income and resilience. This chapter explores the impact, challenges, and trends in microfinance, focusing on interest rates, women empowerment, responsible credit usage, and effectiveness of this financia

0 views • 8 slides

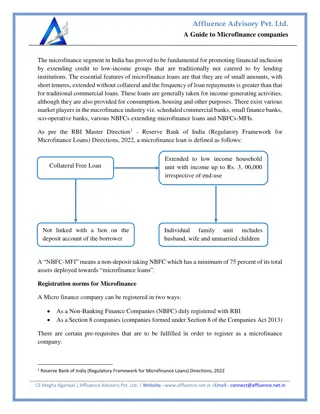

Microfinance Companies Explained: A Simple Guide

Microfinance in India plays a crucial role in promoting financial inclusion by offering small, collateral-free loans to low-income groups, typically for income-generating activities. Microfinance companies can be registered as NBFCs. The registration

0 views • 6 slides

Overview of InvestEU Guarantee Products by EIF

InvestEU, in collaboration with the European Investment Fund (EIF), offers over 12 billion euros across six guarantee solutions to facilitate debt financing for private individuals, micro, small, and midcap businesses. These guarantee products target various sectors like SME innovation, digitalizati

0 views • 7 slides

Microfinance: Empowering the Poor Through Financial Inclusion

Microfinance has become mainstream, providing financial services such as small loans to empower the poor in developing countries. Through microfinance institutions (MFIs), individuals can access capital, increase income, and decrease vulnerability to unforeseen circumstances. Despite criticisms of h

0 views • 8 slides