Challenges and Future Prospects for Cypriot Banks

The presentation delves into the global challenges faced by Cypriot banks, including the economic impacts of the pandemic and the Russian invasion of Ukraine. It highlights advancements in anti-money laundering efforts, the adoption of ESG standards by Cypriot banks, and the importance of addressing

0 views • 34 slides

Understanding the Functions of Commercial Banks

Commercial banks play a vital role in the financial system by accepting deposits and providing loans to individuals, businesses, and companies. They offer various types of accounts such as current, saving, and fixed deposit, each with its unique features. Additionally, commercial banks make loans in

4 views • 10 slides

Evolution of Microcredit Regulatory Authority in Bangladesh

The Microcredit Regulatory Authority (MRA) in Bangladesh was established in 2006 to regulate and oversee the microfinance sector, following the vision of Bangabandhu Sheikh Mujibur Rahman. Since its inception, MRA has played a crucial role in issuing licenses, monitoring MFIs, and promoting financia

2 views • 22 slides

Understanding Banks and Mobile Banks in Financial Services

The concept of banks originates from the word "banco," meaning bench, which evolved to refer to a financial institution. Banks gather funds from the public as deposits and distribute them as credits to enhance people's living standards. Additionally, mobile banks, unlike traditional banks, provide l

7 views • 11 slides

Overview of Banking Institutions and Types

Banking institutions play a crucial role in the economy by accepting deposits from the public and providing financial services. They are classified into various types such as commercial banks, investment banks, cooperative banks, and central banks. Commercial banks cater to the working capital needs

1 views • 13 slides

Functions of Commercial Banks Explained

Commercial banks provide a range of services beyond their primary functions, acting as agents for customers in collection and payment of credit, purchase and sale of securities, trustee and executor roles, remittance of money, and representation and correspondence. Additionally, they offer general u

0 views • 7 slides

Understanding the Banking Sector Fundamentals

Banks play a vital role in the economy by accepting deposits and providing loans, aiding in capital formation and accumulation. The word "bank" originates from the French term for a bench. The Banking Regulation Act of 1949 defines banking activities. Banks deal with money deposits, credit, and comm

0 views • 20 slides

Understanding the Importance of Seed Banks in Ecosystems

Seed banks, categorized into soil and aerial types, serve as essential reservoirs for viable seeds and propagules. Soil seed banks are natural storage areas for seeds within ecosystems and play a crucial role in plant regeneration. They can persist for varying durations, influencing plant diversity

1 views • 16 slides

Understanding Different Types of Banks in India

Explore the various types of banks in India, including Scheduled Banks, Non-Scheduled Banks, Commercial Banks, and Cooperative Banks. Learn about their classifications, regulations, and primary functions as detailed by experts in the field. Discover the significance of banking operations as governed

0 views • 18 slides

Biography of Muhammad Yunus: Nobel Laureate and Microfinance Pioneer

Muhammad Yunus, born in 1940 in Bangladesh, is a renowned banker, author, and economist known for his pioneering work in microfinance. His efforts led to the establishment of Grameen Bank and earned him the Nobel Peace Prize in 2006. Yunus's journey from academia to poverty reduction initiatives in

0 views • 9 slides

Overview of Development Banks and Their Functions

Development banks, including national and foreign entities, play a crucial role in promoting economic, social, and environmental development by financing projects that may not receive adequate private funding. These banks are typically government-owned but may have mixed or private ownership. They a

0 views • 37 slides

Challenges Faced by Banks in Adopting IBC

Banks face challenges in adopting the Insolvency and Bankruptcy Code (IBC) due to stringent provisioning norms, additional costs, and complexities in referring cases to the National Company Law Tribunal (NCLT). Secured NPA accounts older than 2 years, unsecured NPA accounts in the second year, and c

0 views • 20 slides

Efficiency Analysis of Microfinance Institutions in Papua: A Study by Dr. Muneer Babu

Analysis of the performance and efficiency of Microfinance Institutions in Papua New Guinea, focusing on the provision of financial services to the underbanked population. The study evaluates the resource utilization and efficiency of MFIs, comparing less efficient and highly efficient institutions.

0 views • 18 slides

Role of Securities Firms and Investment Banks in Financial Markets

Securities firms and investment banks play a vital role in facilitating the transfer of funds between suppliers and users in financial markets with efficiency and low costs. Investment banks assist businesses and governments in raising funds through securities issuance, while securities firms aid in

0 views • 26 slides

Functions of Commercial Banks

Primary functions of commercial banks include acceptance of deposits such as fixed deposit, current deposit, saving deposit, and recurring deposit. Banks also advance loans for productive purposes, including call money, overdraft, cash credit, and discounting of bills. Another crucial function is cr

0 views • 6 slides

Mitigation and Conservation Banks: A Comprehensive Overview

This content presents insights from Wayne White, President of the National Mitigation Banking Association, regarding the concept of mitigation/conservation banks, their evolution, benefits, agency requirements, and the principles behind their establishment. It emphasizes the importance of market-dri

0 views • 28 slides

Ensuring Responsible Treatment of Microfinance Staff: ILO Guidelines

The International Labour Organisation (ILO) emphasizes the importance of treating microfinance employees responsibly through the USSPM framework. Improving staff welfare benefits the microfinance industry by attracting talent, enhancing productivity, and avoiding negative publicity. Key aspects incl

0 views • 7 slides

Understanding Microfinance: A Case Study of Kiva's Social Enterprise Impact

Microfinance, a banking service offering small loans to individuals and businesses, plays a vital role in empowering communities. Kiva.org, founded in 2005, focuses on building self-sufficiency through small loans and education. Investors support borrowers, emphasizing business success and loan repa

0 views • 12 slides

Banking Ethics and Cultural Evolution in Financial Institutions

Commercial banks face ethical challenges, with smaller banks generally maintaining higher ethical standards. The ethical practices of banks include good customer service, transparency, and sustainable lending. Banks have a dual nature of profit-making and ethical obligations. The marketization of so

0 views • 21 slides

Transforming Islamic Co-Operative Model into Ethical Fintech Solution

Indonesian farmer Ziyaad Mahomed's case study highlights challenges in livestock farming, rice plantations, and more due to theft, capital, and manpower issues. Market survey suggests microfinance, co-operative restructuring, waqf, and zakat solutions with emphasis on risk-sharing over debt-based Is

0 views • 12 slides

Understanding the Real Effects of Resolving Distressed Banks

This study delves into the lasting impact of resolving distressed banks on the economy, showcasing significant compliance with regulatory thresholds and persistent adverse effects on local economies post-resolution. Findings suggest a notable drop in employment and establishments, with effects inten

0 views • 18 slides

Implications of Global Standing Instructions (GSI) and Sandbox Policies for MFBs

This presentation by Samuel Oluyemi delves into the crucial aspects of Global Standing Instructions (GSI) and Sandbox Policies, emphasizing the significance of regulatory sandboxes for Microfinance Banks (MFBs). The talk covers the background, requirements, basics of sandbox, GSI elements and proces

0 views • 9 slides

Understanding Banking Institutions and Their Types

Banking institutions play a vital role in the financial sector by mobilizing public savings and providing funds to meet various financial needs. Commercial banks, investment banks, co-operative banks, and central banks are some examples of banking institutions. Scheduled banks enjoy certain benefits

0 views • 17 slides

Role and Functions of Commercial Banks in the Financial Sector

Commercial banks are profit-seeking financial institutions that accept deposits from the public and provide loans for investment purposes. They specialize in financing trade and commerce through short-term loans, utilizing the interest rate difference between borrowers and depositors as a primary in

0 views • 6 slides

Evolution of the Chinese Banking System: A Historical Overview

The evolution of the Chinese banking system from a mono-bank to a tripartite system comprising central, development, and commercial banks is explored. The transition to market-based banking, equitization of state-owned banks, and the role of regulatory bodies in managing bad loans are discussed. The

0 views • 25 slides

iQ-Banks Security and Operations Solutions Overview

iQ-Banks offers a range of advanced solutions for ATM security, branch operations, face recognition, and mobile agent communication. These solutions include features such as detecting theft, vandalism, skimming devices, and intrusions, as well as providing access control, license plate recognition,

0 views • 6 slides

Overview of Commercial Banks in the Financial Industry

Commercial banks play a crucial role in the financial industry by accepting customer deposits, providing loans, and facilitating the transmission of monetary policy. They differ from nonfinancial firms in their balance sheets, with assets mainly composed of loans and other financial assets. Regulate

0 views • 23 slides

Understanding the Role of Commercial Banks in Financial Systems

Commercial banks play a vital role in the financial system by accepting deposits and providing loans to individuals, firms, and companies. They offer various types of accounts like current, savings, and fixed deposit accounts, each with specific features. In addition, commercial banks make loans to

0 views • 10 slides

Analysis of State-owned Commercial Banks Ownership Patterns

Data analysis of ownership histories for over 27,000 commercial banks in 184 countries from 1995-2018, focusing on state-owned banks. The study reviews state ownership trends, correlations with bank performance, industry-level evidence, and lending to governments. The research also delves into perfo

0 views • 28 slides

Update on Direct Cash Settlement Implementation in Nigerian Capital Market

The update on Direct Cash Settlement (DCS) in the Nigerian Capital Market as of November 2016, by Ade Bajomo, covers progress on DCS account set-up requests to settlement banks, BVN validation by brokers, analysis of rejected DCS account set-up requests, major challenges faced, and recommendations f

0 views • 10 slides

Sustainable Financial Inclusion through Islamic Microfinance

CEO Abdul Ammar Mun'am presents an innovative approach to tackle poverty worldwide by addressing reasons such as high illiteracy rates, wealth concentration, and interest-based economic systems. He emphasizes the need for sustainable financial solutions like Islamic microfinance to empower the under

0 views • 23 slides

The Polish Banking Sector 2013/2014 Overview

The data provides insights into the Polish banking sector for the years 2013 and 2014, including information on the number of banks, ownership structure, assets, profits, and the percentage of assets belonging to loss-bearing banks compared to other EU countries. There is a visible trend of increasi

0 views • 17 slides

Prady MFI System Overview: Enhancing Microfinance Operations

Prady MFI System is a web-based ERP system tailored for microfinance institutions, providing a comprehensive solution for all operational needs. It offers features such as loan management, accounting, system setup, and communication tools. With capabilities like multi-level access, bulk SMS integrat

0 views • 20 slides

Agricultural Finance and Banking System Overview

Agricultural finance encompasses various services to support farm activities, with sources including institutional and non-institutional channels. In India, agricultural credit is available from sources like moneylenders, co-operatives, and commercial banks. Commercial banks play a crucial role in p

0 views • 12 slides

Understanding the Evolution of Danish Banks: Past, Present, and Future

Explore the fascinating journey of Danish banks through the past, present, and future at the FRIC Practitioner Seminar. Delve into topics such as insolvency regulation, bank resolution, investor roles, and the concentration of financial institutions in Denmark. Gain valuable insights into the essent

0 views • 30 slides

Microfinance in Africa: Lessons and Experiences from Selected Countries

Exploring the role of Microfinance Institutions (MFIs) in Africa, this study delves into the challenges faced by small enterprises and households in accessing formal financial services. Through case studies in Benin, Ghana, Guinea, and Tanzania, the report highlights the significance of MFIs in prov

0 views • 18 slides

Microfinance Ireland - Empowering Microenterprises with Access to Finance

Microfinance Ireland, set up by the government, provides loans to new and growing microenterprises that do not meet traditional bank criteria. These loans support businesses with less than 10 staff and turnover under €2m, offering flexible terms, co-funding with banks, and a focus on job creation.

0 views • 12 slides

Understanding Microfinance: Empowering the Poor Through Financial Inclusion

Microfinance, a mainstream financial service, provides small loans to the poor to enhance their income and resilience. This chapter explores the impact, challenges, and trends in microfinance, focusing on interest rates, women empowerment, responsible credit usage, and effectiveness of this financia

0 views • 8 slides

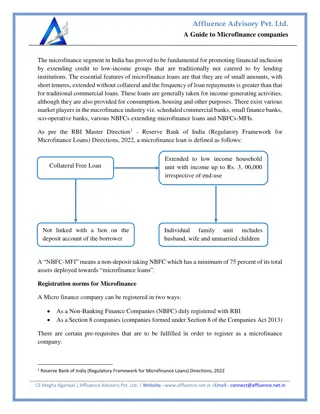

Microfinance Companies Explained: A Simple Guide

Microfinance in India plays a crucial role in promoting financial inclusion by offering small, collateral-free loans to low-income groups, typically for income-generating activities. Microfinance companies can be registered as NBFCs. The registration

0 views • 6 slides

Microfinance: Empowering the Poor Through Financial Inclusion

Microfinance has become mainstream, providing financial services such as small loans to empower the poor in developing countries. Through microfinance institutions (MFIs), individuals can access capital, increase income, and decrease vulnerability to unforeseen circumstances. Despite criticisms of h

0 views • 8 slides