Understanding Low Income Housing Tax Credits (LIHTC)

LIHTC is a federal program established in 1986 to promote private investment in affordable housing, providing financing for the construction and renovation of affordable rental units. Developers receive credits which can be used or sold to investors, reducing debt and allowing for lower rents. The c

0 views • 35 slides

Understanding Low-Income Housing Tax Credit (LIHTC) Program

The LIHTC program subsidizes housing for individuals with incomes below 60% of the area median income. It benefits tenants by providing affordable housing and reduces debt for developers. Investors receive tax benefits and adhere to governing rules such as Code Section 42 and Regulations. The progra

0 views • 41 slides

Understanding Utility Allowances for Affordable Housing Programs

Utility allowances play a crucial role in determining rents for affordable housing properties financed with federal and state funding sources. This article covers the concept of utility allowances, determining the correct UA to use, LIHTC and HOME programs, responsibilities, implementation, document

0 views • 21 slides

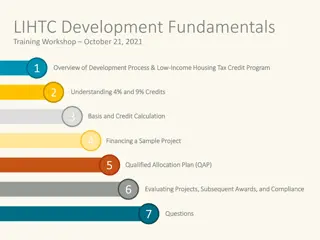

LIHTC Development Fundamentals Training Workshop Overview

This workshop covers the key aspects of the Low-Income Housing Tax Credit (LIHTC) program, including an overview of the development process, understanding 4% and 9% credits, basis and credit calculation, financing a sample project, qualified allocation plan (QAP), evaluating projects, subsequent awa

0 views • 70 slides

IRS 8823 Guide and OHCS LIHTC Compliance Training Overview

In this comprehensive training, the IRS 8823 Guide and OHCS LIHTC Compliance process are discussed by Jennifer Marchand, a technical advisor. The training covers the basics of tax credits, 8823 process, compliance tips, and more. Participants learn about reporting requirements, IRS processing, corre

0 views • 58 slides

Understanding Fair Housing Laws and LIHTC Basics

Explore the basics of Fair Housing laws and Low Income Housing Tax Credit (LIHTC) properties, including applicable regulations, reasonable accommodations, and key issues. Learn about protected classes, exemptions, and guidelines for ensuring compliance in housing provision.

0 views • 22 slides

HUD Meeting Updates and Clarifications

Updates and clarifications discussed at a recent HUD meeting include changes to specifications and MAT guide regarding LIHTC and RAD programs, adjustments in assistance calculations, and procedures for handling negative assistance scenarios. Specific examples and calculations were provided to illust

0 views • 27 slides

Legislative Update: Statutory Issues in Tax for Affordable Housing Solutions

In 1997, the Texas Legislature enacted Tax Code Sec. 11.182, providing a 100% property tax exemption for affordable housing. The exemption was later expanded to include Low Income Housing Tax Credit (LIHTC) projects, with additional terms added in 2001. To qualify for this exemption, organizations m

0 views • 6 slides

Affordable Housing Development in Michigan: Understanding LIHTC and Housing Initiatives

Explore the key aspects of Low-Income Housing Tax Credits (LIHTC) in Michigan administered by MSHDA. Learn about the Qualified Allocation Plan, funding priorities, PSH requirements, and the development process to address homelessness and support affordable housing initiatives.

0 views • 16 slides

Understanding LIHTC and HOME Compliance for Affordable Housing

Learn about the importance of combining LIHTC and HOME programs, key rules for compliance, the 5 Rs of compliance, differences in determining household size, and considerations for selecting the right people for affordable housing projects.

0 views • 53 slides

Compliance Requirements for HOME Assisted Units in LIHTC Projects

Review the key compliance requirements for HOME assisted units in LIHTC projects, including initial occupancy differences, ongoing compliance standards, rent limits, property standards, and affordability periods. Understand the rules related to income limits, occupancy percentages, rent calculations

0 views • 40 slides

Celebrating a Successful Year of NVHousingSearch.org

NVHousingSearch.org marks a successful first year with 76% of LIHTC units listed, nearly 36,000 housing units, and over 43,000 searches. The platform offers free advertising for properties, quick and easy listing options, and detailed listings with pictures and map links. Vacancy rates for LIHTC uni

0 views • 5 slides

Understanding LIHTC Extended Use Compliance

Explore the nuances of LIHTC compliance, including the Extended Use Period, Credit Period, and Compliance Period. Learn about the history, changes, and consequences of noncompliance. Gain insights into the documentation requirements and monitoring processes. Discover how Oregon Housing and Community

0 views • 23 slides