Indirect Rate Strategies

Learn from experts Donna Dominguez and Tram Vo on developing competitive budgeted indirect rates and structuring for success in government contracting. Discover the importance of indirect rate structures and ways to optimize your pricing strategies. Join the webinar to enhance your financial complia

1 views • 36 slides

Advanced Analytics in Indirect Taxation by Central Board of Indirect Taxes & Customs

The Central Board of Indirect Taxes & Customs in India leverages technology through ADVAIT to provide near real-time data capture, predictive analytics, and fraud detection in the realm of indirect taxation. This initiative enhances taxpayer service with cutting-edge data visualization, mobile acces

2 views • 28 slides

Understanding EVE Model for Indirect Taxes Using Household Data

The EVE model developed by PBO analyzes household expenditure to estimate taxes paid on goods and services, facilitating the assessment of policy proposals' cost and impact. Utilizing microsimulation, EVE covers a range of indirect taxes like VAT, excises, and carbon tax, providing valuable insights

0 views • 19 slides

PROPERTY TAXES 101

Property taxes in Ohio are levied in mills, with a mill equaling $1 in taxes for every $1,000 of assessed property value. The base tax of 10 mills is applied to all residents, with additional taxes requiring voter approval. House Bill 920 controls property tax growth, ensuring revenue remains steady

0 views • 10 slides

Understanding the Purpose of Taxation: Financial, Social, Legal, and Ethical Perspectives

Taxation is a crucial method governments use to collect funds for public services. This chapter delves into the principles of a fair tax system, exploring how taxes should be related to income, predictable, cost-effective to collect, and convenient for taxpayers. It also discusses the redistribution

0 views • 19 slides

Taxing the Wealthy in Lower-Income Countries: Research Evidence and Policy Implications

The world is facing various crises, with lower-income countries disproportionately affected. To boost revenue without new wealth taxes, effective taxation of the wealthy is crucial. Existing taxes in LICs are inadequate compared to HICs. Wealth inequality is stark in LICs and Sub-Saharan Africa. Imp

0 views • 20 slides

Understanding Tax Tables, Worksheets, and Schedules for Federal Income Taxes

Explore the concept of tax tables, worksheets, and schedules for calculating federal income taxes. Learn how to express tax schedules algebraically and compute taxes using IRS resources. Examples featuring single and married taxpayers provide practical insights into determining taxable income and ca

0 views • 11 slides

Understanding Indirect Speech Acts in Semantics

Speech acts can be direct or indirect, with indirect speech acts relying on implicature rather than literal meaning. This concept can lead to confusion, especially in cross-cultural communication. Explore the theories of J.L. Austin and John Searle regarding speech acts and performative utterances,

1 views • 16 slides

Mastering Direct and Indirect Speech: A Comprehensive Guide

Explore the world of direct and indirect speech with this in-depth lesson on narration. Learn how to speak using both methods, transform sentences from direct to indirect, and discover the nuances of backshift of tenses and adverbs. Gain a better understanding of how grammatical changes occur betwee

2 views • 31 slides

Understanding Taxes and Government Spending: A Comprehensive Overview

This comprehensive overview delves into the fundamental concepts of taxes and government spending. It covers topics such as the definition of taxes, the power of Congress to tax, limits on taxation, tax structures, characteristics of a good tax, and the burden of taxes. Exploring these concepts prov

1 views • 29 slides

Understanding Principles of Taxation

Principles of taxation, including concepts such as public revenue, sources of revenue, types of taxes (direct and indirect), and non-tax revenue, are essential for students of commerce to grasp. Taxation serves as a means for the government to collect revenue for the common good through compulsory c

0 views • 12 slides

Understanding Direct and Indirect Questions in English

Direct questions are straightforward inquiries we pose to people we know well, while indirect questions are used for politeness and softening the inquiry. This article provides examples, explanations, and practice exercises for mastering the use of direct and indirect questions in English communicat

0 views • 12 slides

Understanding Mediation Analysis in SEM Models

Mediation analysis in structural equation modeling (SEM) explores how the influence between two constructs can take an indirect path through a mediator. Key concepts include direct effect, indirect effect, and total effects. The process involves testing for significant relationships between variable

0 views • 18 slides

Understanding Direct and Indirect Speech in English

Direct speech involves reporting exact words spoken, while indirect speech conveys the same message using different words. Learn about the rules for changing pronouns and key aspects of both direct and indirect speech. Master the art of transforming sentences from direct to indirect speech with ease

2 views • 15 slides

Overview of Gross Receipts Taxes in Louisiana and Other States

Gross Receipts Taxes, a resurgence in state revenue-raising mechanisms, are examined in Louisiana and other states, highlighting similarities and differences in approaches. The presentation delves into the structure and implications of gross receipts taxes, providing insights on legislation and fisc

0 views • 27 slides

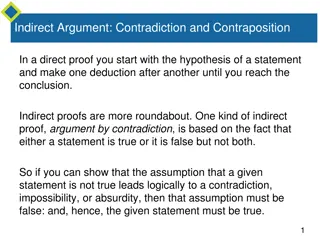

Understanding Indirect Proofs: Contradiction and Contraposition Examples

Indirect proofs offer a roundabout approach to proving statements, with argument by contradiction and argument by contraposition being the main techniques. Argument by contradiction involves supposing the statement is false and deriving a contradiction, while argument by contraposition relies on the

1 views • 18 slides

Direct and Indirect Speech in English Grammar Exercises

Study the concept of direct and indirect speech through examples and rules explained in the given content. Learn how to change sentences from direct to indirect speech by understanding reporting verbs and tense changes. Practice converting words indicating nearness to words showing distance for bett

3 views • 16 slides

Understanding Taxes and Income in India

Explore the concepts of taxes and income in India, including direct and indirect taxes, the Income Tax Act of 1961, government revenue, and the administration of income tax. Learn about the various components of income, tax laws, and the importance of proper tax administration for the country's fina

0 views • 12 slides

Withholding Taxes and Revenue Regulations Overview

The content delves into the concept of withholding taxes, particularly final and creditable withholding taxes, as per Revenue Regulations No. 02-98. It explains the responsibility of withholding agents, the distinction between final and creditable withholding tax systems, and the implications for pa

0 views • 20 slides

Corporate Tax Association 2018 GST & Indirect Tax Corporate Intensive Conference

This year's Corporate Tax Association 2018 conference in Melbourne focuses on providing corporate indirect tax professionals with technical updates and hands-on experience of the latest in indirect tax technology and robotic process automation. The event includes sessions on GST cases, international

1 views • 4 slides

Understanding Income Tax: Overview and Application

The Income Tax Act covers three modules - administration, taxes, and general provisions. It distinguishes between direct and indirect taxes, and outlines various types of taxes like income tax, VAT, and customs duty. Tax revenue funds government departments, and the taxation scheme calculates taxabl

0 views • 58 slides

Understanding Direct and Indirect Objects in Grammar

Direct and indirect objects are essential components of sentences, helping clarify the action and recipients involved. Direct objects receive the action directly, answering the questions "Whom?" or "What?" Indirect objects indicate to whom or for whom the action is done, always appearing between the

0 views • 12 slides

Understanding Federal Taxes in the United States

Explore the key aspects of federal taxes in the United States, including individual and corporate income taxes, Social Security, Medicare, and unemployment taxes. Learn about tax brackets, withholding, tax returns, and more. Discover the economic importance of taxes and how they support the function

1 views • 15 slides

Maryland Revenue Estimates & Economic Outlook March 2022

The revenue estimates and economic outlook for Maryland in March 2022 show growth in income taxes, sales and use taxes, and other revenues. Detailed figures for fiscal years 2021-2023 indicate estimates and actual data for various tax types like individual and corporate income taxes. The changes in

0 views • 17 slides

Evolution of Legal Process Taxes in County Clerk Offices

Explore the historical progression of legal process taxes related to marriage licenses, property conveyance, and other transactions as mandated by KRS 142.010. Delve into the changes in tax rates and base over time, along with the reliance on these taxes for revenue generation. The receipts of legal

0 views • 9 slides

The Impact of Cigarette Taxes and Indoor Air Laws on Prenatal Smoking and Infant Death

This study examines the effects of cigarette taxes and indoor air laws on prenatal smoking and infant death. It discusses how cigarette taxes can increase smoking cessation during pregnancy and reduce the probability of smoking, while comprehensive smoking bans can decrease the likelihood of smoking

1 views • 27 slides

Direct and Indirect Characterization in Literature

The concept of direct and indirect characterization in literature is explored through examples from popular books such as "Artemis Fowl: The Eternity Code" and "The True Confessions of Charlotte Doyle." Direct characterization involves explicit statements about a character's personality, while indir

0 views • 8 slides

Understanding Indirect Speech Acts in Communication

Indirect speech acts involve utterances that appear as simple statements but are intended to convey a different meaning such as requests or commands. This form of communication can be seen in various cultural contexts, requiring the listener to interpret the intended illocutionary force behind the w

0 views • 12 slides

Understanding Direct vs Indirect Characterization in English Literature

Development of characters, known as characterization, is crucial in storytelling. There are two main ways to characterize: direct and indirect. Direct characterization involves explicitly stating the character's traits, while indirect characterization uses actions, thoughts, and interactions to reve

0 views • 15 slides

Understanding Characterization in Literature

Exploring the differences between direct and indirect characterization in literature, this content explains how authors convey character traits through actions, dialogue, thoughts, and interactions. It provides examples and types of indirect characterization, with a focus on speech, thoughts, effect

0 views • 34 slides

Composition of Ohio's State and Local Taxes Revealed

Ohio relies heavily on sales taxes for state and local government tax revenue. In FY 2019, Ohio's combined state and local tax revenue sources included property taxes, individual income tax, and sales taxes. Sales taxes accounted for the highest percentage of revenue, followed by property taxes and

0 views • 4 slides

Understanding State and Local Sales and Income Taxes

Delve into the intricacies of state and local sales and income taxes in Lecture 10 of State and Local Public Finance. Explore topics such as efficiency, equity, administrative issues, design of federal tax, link to state income taxes, and design of local income taxes. Uncover how sales taxes create

0 views • 42 slides

Understanding Indirect Speech: Examples and Practice

Indirect speech involves reporting what someone else has said without quoting them directly. In this content, you will find examples and exercises on how to convert direct speech into indirect speech, covering statements, commands, and requests. Practice transforming sentences like "My parents are v

0 views • 8 slides

Understanding Indirect Cost Concerns Under the Uniform Guidance

Overview of the indirect cost concerns under the Uniform Guidance issued by the U.S. Department of Education. The content covers the definition of indirect costs, typical expenditures, cognizant agency determination, and specific guidance for state and local education agencies. Important aspects suc

0 views • 41 slides

Importance of Recurrent Property Taxes for Fiscal Sustainability

Recurrent property taxes play a crucial role in enhancing fiscal sustainability by reducing dependency on inter-governmental transfers, increasing local government accountability, and promoting equity in taxation. This article discusses the benefits of recurring property taxes, emphasizes the need f

0 views • 19 slides

Understanding Export Distribution Channels and Factors

Explore the complex world of export distribution channels, comparing direct and indirect exporting methods, logistics components, selection criteria for transport modes, and the importance of insurance in international trade. Learn about the advantages and disadvantages of different distribution str

0 views • 15 slides

Enhancing Elderly Care: Direct and Indirect Support Strategies

Implementing a care strategy for the elderly involves integrating both direct, personal care activities and indirect care tasks. This approach benefits two key target audiences, including millions with varying levels of dependency and informal carers. The positive impacts of indirect care include we

0 views • 7 slides

Understanding Taxes, Charitable Giving, and Legislative Impacts

Explore the intersection of taxes, charitable giving, and pivotal legislative acts such as the Tax Cuts and Jobs Act of 2017. Learn about key considerations, planning tools, and changes in federal income taxes under the Biden Tax Plan. Discover how estate taxes, donor-advised funds, and retirement a

0 views • 59 slides

Property Taxes and Local Decision-Making in Texas

Texas relies on property taxes and sales taxes as major revenue sources for state and local government funding. The majority of property taxes fund public schools, with the burden increasing due to unfunded mandates from the Texas Legislature. Student funding is impacted by property value growth, be

0 views • 24 slides

Trends in Iowa Property Taxes: Past and Future

Property taxes in Iowa have decreased as a source of local revenue over the years. The decline is more significant when looking at own-source revenue excluding state and federal grants. Other revenue sources like charges and sales taxes have become more important. Different trends are observed for c

0 views • 18 slides