Understanding Concepts of National Income in Economics

Explore the concepts of national income presented by Dr. Rashmi Pandey, covering key indicators such as Gross National Product (GNP), Gross Domestic Product (GDP), Net National Product (NNP), Net Domestic Product (NDP), Personal Income, Disposable Income, Per Capita Income, and Real Income. Gain ins

0 views • 22 slides

Understanding National Income and Its Importance in Economics

National income is a crucial measure of the value of goods and services produced in an economy. It provides insights into economic growth, living standards, income distribution, and more. Concepts such as GDP, GNP, Personal Income, and Per Capita Income help in understanding the economic health of a

5 views • 14 slides

SBRP SUPPLEMENTAL RETIREMENT BENEFIT

Supplementation retirement benefit (SBRP) is a defined benefit providing lifetime income separately managed by SBCTC. Eligibility requirements include age, years of service, and disability retirement provisions. Calculations are complex and based on retirement age, years of service, goal income, and

0 views • 26 slides

Understanding the Income Approach to Property Valuation

The income approach to property valuation involves analyzing a property's capacity to generate future income as an indication of its present value. By considering income streams from rent and potential resale, commercial property owners can convert income forecasts into value estimates through proce

8 views • 49 slides

Analysis of Political Cartoons on Brown v. Board of Education (1954)

The analysis examines two political cartoons related to the Brown v. Board of Education case in 1954. The first cartoon symbolizes victory against segregation, portraying the Supreme Court's support for desegregation. In contrast, the second cartoon criticizes the forced progress of desegregation, a

2 views • 10 slides

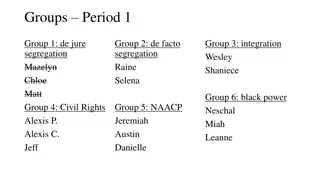

Understanding Civil Rights Movement Vocabulary

Explore key terms related to the Civil Rights Movement, including de jure segregation, de facto segregation, integration, NAACP, and black power. Learn about the significance of these concepts through group discussions and activities in different periods. Utilize T-charts to categorize known and unk

0 views • 15 slides

Latino Action Network v. New Jersey: Desegregation and Education Equity Case Overview

Latino Action Network et al. (LAN) filed a desegregation case against New Jersey, seeking educational equity for Black and Latino students. The Education Law Center (ELC) joined the case, highlighting the racial segregation and funding disparities in NJ schools. The lawsuit aims to enforce constitut

0 views • 7 slides

Gender Job Segregation and Its Impact on Labor Share of Income

The paper discusses the concerning trend of gender job segregation and its implications on the labor share of income. It highlights three key global gender trends, emphasizing the persistence of employment gaps between men and women. The analysis raises questions about the macro-structural causes of

0 views • 18 slides

Understanding Household Income: Sources, Types, and Management

Explore Chapter 2 on household income to learn about sources like wages, pensions, and benefits, differentiate between regular and irregular income, understand why taxes are necessary, interpret payslips, calculate gross and net income, manage deductions, and create an effective income plan.

0 views • 25 slides

Understanding Income Tax in India: Gross vs Total Income

In India, income tax is calculated based on the total income or taxable total income. The gross total income includes earnings from all sources like salary, property, business, and capital gains. Various additions such as clubbing provisions, adjustments for losses, unexplained credits, investments,

0 views • 7 slides

Understanding Tax Obligations and Assessable Income in Australia

In Australia, residents are taxed on worldwide income while non-residents are taxed only on Australian-sourced income. The tax liability is calculated based on taxable income, tax offsets, other liabilities like Medicare levy, and PAYG credits. Assessable income includes employment income, super pen

0 views • 13 slides

Understanding Sri Lanka's Inland Revenue Act No. 24 of 2017

This content delves into the key aspects of the Inland Revenue Act No. 24 of 2017 in Sri Lanka, covering chargeability of income tax, imposition of income tax, definitions, sources of income, assessable income for residents and non-residents, income tax payable, and income tax base. It provides valu

0 views • 93 slides

Understanding National Income Measurement in India

National income in India is the culmination of all economic activities valued in money terms. It plays a crucial role in determining the economic environment of a country and the demand for goods and services. Various measures of national income such as Gross National Product (GNP), Gross Domestic P

0 views • 20 slides

Understanding Income from House Property in Taxation

House property income refers to rent received from properties owned by an individual, charged under income tax. It is based on the concept of annual value, representing the expected rental income or market value of the property. The annual value is taxable under the head "Income from House Property.

1 views • 12 slides

Overview of Income Tax Authorities in India

The Income Tax Act in India empowers the Central Government to levy taxes on all income except agricultural income. The Income Tax Department, governed by the Central Board of Direct Taxes, plays a crucial role in revenue mobilization. Understanding the functioning, powers, and limitations of tax au

0 views • 14 slides

Understanding Income Tax: Overview and Application

The Income Tax Act covers three modules - administration, taxes, and general provisions. It distinguishes between direct and indirect taxes, and outlines various types of taxes like income tax, VAT, and customs duty. Tax revenue funds government departments, and the taxation scheme calculates taxabl

0 views • 58 slides

Understanding Residuary Income and Taxable Sources

Residuary income, under section 56(1), includes all income not excluded from total income and subjected to income tax under "Income from other sources." Certain specific incomes listed in section 56(2) are taxable, such as dividends, winnings, employee contributions, interest on securities, and inco

0 views • 9 slides

Overview of Development Economics and Goals

Development economics is a branch of economics that focuses on improving the economies of developing countries by targeting factors such as health, education, working conditions, and policies. It involves macroeconomic and microeconomic analysis to enhance domestic and international growth. Differen

1 views • 11 slides

Understanding Clubbing of Income in Taxation

Clubbing of income refers to including another person's income in the taxpayer's total income to prevent tax avoidance practices like transferring assets to family members. This concept is addressed in sections 60 to 64 of the Income Tax Act. Key terms include transferor, transferee, revocable trans

1 views • 16 slides

Proper Stowage and Segregation of Dangerous Cargo on Container Ships

Exercise caution when stowing dangerous cargo on board container ships. Ensure compliance with international regulations, IMDG code guidance, and vessel-specific requirements. Verify stowage and segregation of dangerous goods, manually check for compliance, and adhere strictly to segregation require

0 views • 13 slides

Evolution of Public Education in the United States

The evolution of public education in the United States dates back to 1647 when Massachusetts Bay Colony decreed elementary and Latin schools. From Thomas Jefferson's two-track system to the abolition of segregation in Brown v. Board of Education in 1954, the journey has been marked by milestones lik

0 views • 13 slides

Revised Level 2 Unit 6 Self-Assessment on Segregation and Citizenship

This self-assessment, developed by Millie Aulbur and Russ Sackreiter, focuses on de facto and de jure segregation definitions, along with concepts of citizenship like the social policy determining nationality through ancestry. Test your knowledge on these topics through interactive questions and det

0 views • 77 slides

Minnesota Housing Reform: Addressing Segregation and Affordable Housing Challenges

This content covers various aspects of housing reform in Minnesota, ranging from the Legalizing Affordable Housing Act HF2235, addressing Twin Cities housing segregation, challenges faced by cities in recovering infrastructure costs, and proposed reforms like enabling development impact fees and env

0 views • 18 slides

Evolution of Progressive Income Tax Systems

The concept of modern progressive income tax, developed in the early 20th century in countries like the UK, US, France, India, and Argentina, is based on the principle of a comprehensive tax base encompassing various income categories. The system involves effective vs. marginal tax rates, different

0 views • 19 slides

Exploring Immigration's Impact on Income Inequality

The presentation delves into the relationship between immigration and income inequality, analyzing data on income distributions among voters, non-voting citizens, and non-citizens in PA. It discusses the log-normal distribution as an approximation for income distribution and examines the ratio of me

0 views • 16 slides

Residential Segregation Patterns in Northern Ireland: A Study of Changing Trends

The study explores the evolution of residential segregation by religion in Northern Ireland from 1971 to 2001, emphasizing the fluctuations in Catholic population distribution and the limited changes observed post-1991. Insights from migration and population data post-2001 are also considered for fu

0 views • 15 slides

Understanding Segregation of Dangerous Goods in Transport

This presentation provides valuable information on the segregation of dangerous goods for transport, based on the Six Pillars of Dangerous Goods Transport. It covers topics such as what dangerous goods to segregate, how to segregate them, and includes practical examples. Important examples of incomp

0 views • 12 slides

Understanding Residential Segregation in the United States

Residential segregation in the US is a complex issue rooted in historical patterns of discrimination and inequality. It is perpetuated by factors such as white flight, redlining, and lack of capital. Measures of segregation, such as the segregation index, highlight persistent disparities in housing

0 views • 25 slides

Analysis of Irish Farmer Incomes Based on Income Tax Returns

This paper presents an analysis of Irish farmer incomes in 2010 using self-assessment income tax returns from the Revenue Commissioners. The study focused on various income sources such as trading income, rental income, employment income, social welfare transfers, and pension income. The dataset com

0 views • 12 slides

Accrual Recording of Property Income in Pension Management

The accrual recording of property income in the context of liabilities between a pension manager and a defined benefit pension fund involves accounting for differences in investment income and pension entitlements. This process aims to reflect the actual property income earned by the pension fund, c

0 views • 17 slides

Understanding Retirement Income for Low-Income Seniors in Ontario

Exploring the income system for retirees in Ontario, including Old Age Security, Canada Pension Plan, and private pensions. Addressing the concept of low income, eligibility for Guaranteed Income Supplement, and debunking common misconceptions with a top 10 list of bad retirement advice. Highlightin

0 views • 11 slides

The Civil Rights Movement and Jim Crow Laws in the Southern United States

The Jim Crow laws enforced racial segregation in the Southern United States from the late 19th century until 1965. These state and local laws mandated segregation in public facilities, perpetuating economic and social disadvantages for African Americans. The Civil Rights Movement gained momentum in

0 views • 6 slides

Understanding Early Racial Segregation in South Africa

Explore the historical background of racial segregation in South Africa before apartheid, focusing on the Land Act and the Colour Bar Act. Learn about the impact on the Black community, benefits to the White community, and how these laws shaped the socio-economic landscape. Gain insights into the in

0 views • 12 slides

Valuation Using the Income Approach in Real Estate

The income approach to appraisal in real estate involves converting future income into a present value through income capitalization. This method utilizes direct capitalization and discounted cash flow techniques to estimate property value based on net operating income. Estimating net operating inco

0 views • 17 slides

Understanding Taxation in Australia: Income Declaration and Assessment

Australian taxation laws require residents to declare worldwide income while non-residents are taxed on Australian-sourced income. The tax liability calculation involves taxable income, tax offsets, other liabilities such as Medicare levy, and PAYG credits. Assessable income includes various sources

0 views • 13 slides

Insights into School Segregation 70 Years After Brown

Explore the state of segregation in schools 70 years after Brown v. Board of Education through insightful analyses covering topics such as measuring segregation, historical changes post-Brown, recent trends in racial and economic segregation, impact on educational opportunities, and more.

0 views • 67 slides

Understanding Set-off of Losses in Income Tax

Set-off of losses in income tax allows taxpayers to reduce their taxable income by offsetting losses from one source against income from another source. This process helps in minimizing tax liability and optimizing tax planning strategies. There are specific rules and exceptions regarding the set-of

0 views • 4 slides

Reflections on Segregation and Freedom: A Poetic Perspective

Langston Hughes' poem "Long View: Negro" delves into the contrasting perspectives of emancipation and segregation, using the analogy of a telescope. Through vivid imagery, Hughes challenges the reader to contemplate the shifting perceptions of freedom and equality, ultimately questioning societal no

0 views • 13 slides

Understanding Income Tax Basics

Income tax is a fundamental part of contributing to a civilized society, with various taxes like sales tax, gas tax, and alcohol tax playing a role. This guide explains how income tax works, including taxable income calculations and refund processes. It also covers what amounts are taxable, such as

0 views • 14 slides

Income Eligibility Determination Training for PY 2023

Explore the key changes and considerations in income eligibility determination for the upcoming program year 2023, including the use of State Median Income and Federal Poverty Guidelines. Learn about the refined definition of the income eligibility period and the importance of monitoring household i

2 views • 34 slides