Managing Money Curriculum

This curriculum module delves into the essential aspects of applying for a loan, focusing on the 5 Cs of borrowing: character, capacity, capital, conditions, and collateral. It explores what lenders seek in borrowers, sources of money, and factors to consider before acquiring a loan. Key concepts in

1 views • 22 slides

Course Overview: E/Digital Government at UIN SUSKA Riau

Explore the E/Digital Government course offered by the Saide Dept. of Information Systems at UIN SUSKA Riau. The course covers topics such as digital government landscape, historical perspectives, e-government evolution, and digital transformation. Gain insights into digital government maturity mode

2 views • 24 slides

Ways of Enlarging the Vocabulary of a Language Word-Formation and Borrowing in Modern English.

Explore various types of word-building processes in Modern English, including morphological, syntactic, and mixed methods like affixation, composition, conversion, and borrowing. Understand the classifications of affixes, techniques in morphological word-building, and the diversity of the English vo

2 views • 31 slides

The Etymology of Modern English Vocabulary: A Detailed Analysis

The etymology of modern English vocabulary explores words of native Anglo-Saxon origin, Germanic borrowings, and English elements, examining their characteristics and assimilation into the language. It delves into the ways borrowing occurs, criteria for assimilation, and the distinct layers comprisi

8 views • 15 slides

Comparison of Government Systems: Unitary, Confederation, and Federal

The comparison of unitary, confederation, and federal government systems highlights how power is distributed between central and local authorities. In a unitary system, the central government holds most power, while local governments have limited autonomy. In confederation, local governments retain

0 views • 37 slides

Government Jobs for Civil Engineers In Tamil Nadu Mkce

Government Jobs for Civil Engineering:\nGovernment Jobs for Civil engineering is a versatile field that offers a plethora of career opportunities,\nincluding lucrative options in the government sector. In India, various government departments and agencies actively recruit civil engineering graduates

0 views • 2 slides

Association Between Friendship-Relative Network and Credit Borrowings in Indian Households

This study by Dr. Pallabi Chakraborty explores the impact of friendship-relative networks on borrowing from market lenders in Indian households. It examines the role of social connections in accessing formal and informal credit, and how these networks influence borrowing choices. The study aims to u

0 views • 14 slides

Incremental Borrowing Cost Analysis in Mortgage Decision Making

Explore the concept of incremental borrowing cost in the context of mortgage financing decisions. Learn how slight increases in interest rates can impact the overall borrowing cost and affect your financial choices when selecting between different loan options. Dive into a practical example comparin

1 views • 62 slides

Various Word Formation Processes in Professional English

Coinage, Borrowing, Compounding, Derivation, Blending, Backformation, and Acronym are key mechanisms for forming new words in Professional English. Coinage involves inventing new words, Borrowing uses words from foreign languages, Compounding combines words to create new ones, Derivation adds prefix

0 views • 11 slides

Understanding the Foundation of US Government: The Constitution and its Principles

The Constitution of the United States outlines key principles governing the government, including popular sovereignty, republicanism, limited government, federalism, separation of powers, checks and balances, and individual rights. It establishes six goals for the US government and delineates the po

2 views • 12 slides

Insights on Borrowing and Spending Among the Economically Vulnerable

Discussion by David Low from CFPB on consumer finance challenges, borrower behaviors regarding borrowing and repayment, and the impact of overdraft fees on financial inclusion. Key insights on payday loans, borrower amortization, and daily spending modeling are explored. Recommendations are made to

0 views • 13 slides

Efficient Cash Flow Forecasting for Government Financial Management

Efficient cash flow forecasting is vital for government financial management to ensure budget targets are achieved, expenditures are smoothly financed, and potential problems are detected early. By forecasting daily cash flows, governments can manage their cash efficiently, optimize cash balances, r

1 views • 36 slides

Understanding Government Support Agreements in Infrastructure Projects

Government support agreements play a crucial role in infrastructure projects by outlining various forms of support provided by the government to ProjectCo. These agreements help allocate risks appropriately, ensure credit enhancement, and provide direct or indirect support. However, hindrances such

1 views • 15 slides

Enhancing State Revenue Generation Through Effective Taxation Strategies

State governments rely on taxation to finance their expenditures, prioritizing revenue generation over borrowing. By engaging taxpayers in voluntary compliance, taxation strengthens government accountability and citizen participation in governance. Understanding the tax landscape, including federal,

0 views • 27 slides

Understanding Levels of Government in Canada

A representative democracy in Canada consists of various levels of government, including federal, provincial, municipal, and Indigenous governments. Elected representatives at each level make policy decisions and pass laws on behalf of the citizens. The federal government is led by the Prime Ministe

0 views • 18 slides

Understanding National Debt and its Implications

National debt refers to the total money owed by the government to financial institutions and individuals. Managing national debt, measured through the Debt/GDP ratio, is crucial as it impacts future taxpayers and national wealth. Borrowed money comes with the burden of interest repayment, posing cha

0 views • 49 slides

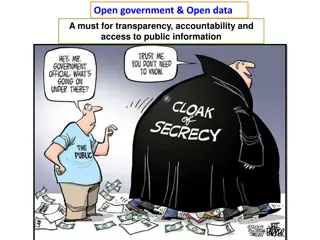

Open Government Data and Sustainable Development Goals

Open government data and sustainable development goals go hand in hand, promoting transparency, accountability, and access to public information. Openness in data allows for universal participation, interoperability, and value creation. By striving for sustainable development and embracing open gove

2 views • 24 slides

Understanding Different Types of Borrowing and Overdrafts

Explore the differences between various types of borrowing such as loans, overdrafts, credit card borrowing, and payday loans. Learn how to differentiate between quoted interest rates and effective annual rates, secured and unsecured borrowing, and how to calculate effective annual rates. Discover t

2 views • 17 slides

Understanding Borrowing and Credit: Key Concepts and Considerations

Explore the world of borrowing and credit, including types of borrowing, terminology, reasons for borrowing, alternatives, benefits, factors to consider, risks, and ways to mitigate them. Activities highlight real-world examples and offer insights on responsible borrowing decisions.

0 views • 12 slides

Understanding Word Formation: Processes, Neologisms, and Borrowing

Delve into the fascinating world of word formation processes, from coinage and eponyms to borrowing and compounding. Explore how new words enter languages, the study of word origins (etymology), and the dynamics of creating and adopting new linguistic terms.

0 views • 16 slides

Insights on Sovereign Credit Ratings: A Study on European Countries' Borrowing Costs

This paper discusses the impact of sovereign credit ratings on European countries' borrowing costs, emphasizing that while ratings do affect costs, the influence is limited except at junk thresholds. It identifies macro fundamentals and global risk as key determinants of credit ratings and suggests

0 views • 22 slides

Enhancing Lending and Borrowing Dreams: OCUL's Collaborative Initiatives

Explore how the Ontario Council of University Libraries (OCUL) is revolutionizing library services through radical collaboration, shared resources, and streamlined fulfillment processes. The presentation highlights OCUL's mission to standardize borrowing policies, improve user experience, and maximi

0 views • 21 slides

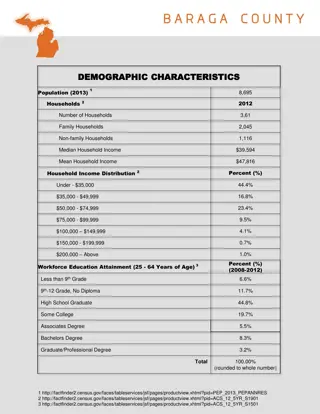

Demographic and Government Overview of L'Anse and Baraga, Michigan

An overview of the demographic characteristics and government structures of L'Anse and Baraga, Michigan. The population, household statistics, income distribution, and workforce education levels are highlighted for L'Anse. The city government structures of L'Anse and Baraga, including village truste

1 views • 10 slides

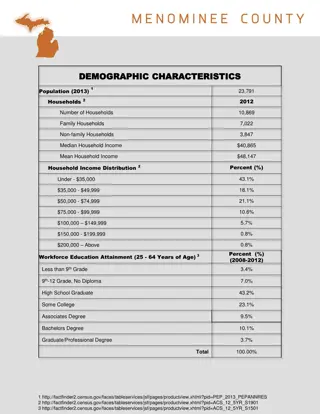

Demographic and Government Overview of Menominee, Michigan

Menominee, Michigan, has a population of 23,791 as of 2013, with a median household income of $40,865. The city government is structured with a mayor and city council, while the county government is led by a board chairman and commissioners. The state government representation includes state senator

1 views • 11 slides

Promoting School Autonomy in Centralized Structures: Implications for Policy Borrowing

Centralized educational structures face implications when promoting school autonomy. Policy borrowing highlights the need for change, initiation of educational policies, and international differences in implementation. The benefits and costs of buying in a shop versus going to a tailor parallel the

0 views • 26 slides

Exploring Sociolinguistics: Dialects, Varieties, and Language Borrowing

Sociolinguistics delves into the study of language variations within different social contexts. This includes examining concepts such as regional dialects, language borrowing, and the development of distinct linguistic varieties. From analyzing Basic English to exploring objections to Anglicisms and

0 views • 130 slides

Understanding Eurostat Classification and Government Guarantees in Financial Institutions

In this case study, Eurostat's classification of the MDB outside the general government sector is explored. The focus is on government guarantees, financial intermediary risks, and the implications outlined in the Eurostat Manual on Government Deficit and Debt under ESA 2010. The MDB's position rega

1 views • 30 slides

Understanding LRBA for SMSFs – Benefits and Considerations

Trustees of SMSFs can benefit from Limited Recourse Borrowing Arrangements (LRBAs) by leveraging them to purchase assets, such as property, under certain conditions. This includes following borrowing rules, obtaining necessary documentation, understanding stamp duty and capital gains tax implication

0 views • 43 slides

Understanding Government Borrowing and National Debt

Explore the reasons why governments borrow money, such as meeting temporary shortfalls, funding public services, and managing economic fluctuations. Learn about the history and key indicators of national debt, including government deficit measures. Gain insights into the economic significance of man

0 views • 10 slides

Understanding Accounting for Borrowing Costs in Financial Management

Borrowing costs in financial management refer to interest and other expenses incurred when borrowing funds. These costs are crucial to account for correctly to ensure accurate financial reporting. Borrowing costs directly attributable to acquiring, constructing, or producing a qualifying asset are c

0 views • 8 slides

Sri Lanka Accounting Standards LKAS 23: Borrowing Cost Overview

This document provides an overview of Sri Lanka Accounting Standards LKAS 23 on borrowing costs, covering its introduction, scope, definition, and accounting treatment. It explains how borrowing costs are recognized, the scope of the standard, and the classification of borrowing costs. Additionally,

0 views • 12 slides

Understanding Government Fraud: Impacts and Prevention

Government fraud is a serious issue that impacts public trust and financial stability. This type of fraud involves intentional acts to deceive the government and can occur internally or externally. The public perception of government organizations is affected by fraud, and entities such as the U.S.

1 views • 50 slides

Understanding Borrowing Powers of Companies under Companies Act, 2013

The term "Borrowing" in the Companies Act, 2013, pertains to the power granted in Section 180(1)(c) for companies to borrow money with the consent of the company by a special resolution. This includes provisions on limits, definitions of temporary loans, necessary board resolutions, and validity of

1 views • 8 slides

Understanding the Borrowing Power of Companies

Companies rely on borrowing to operate effectively, with specific provisions in their memorandum or articles governing this power. Directors have the authority to borrow within defined limits, and statutory regulations prescribe borrowing limits. However, borrowing beyond the company's legal capacit

0 views • 10 slides

Understanding Debt, Interest, and Borrowing Money

Explore the concepts of debt, interest, and borrowing money in this informative presentation. Learn about the types of debt, reasons people borrow money, average debt per person in various countries, costs of personal loans, the time value of money, and how interest rates affect the value of debt ov

0 views • 19 slides

Exploring Word Formation: Etymology, Borrowing, Compounding, and More

Explore various processes of word formation including etymology, borrowing, compounding, blending, clipping, backformation, conversion, acronyms, derivation, prefixes, suffixes, and infixes. Learn about the origins and history of words, the creation of new terms, and how different morphemes are adde

0 views • 8 slides

Recent Changes in Debt Sustainability Framework and Non-Concessional Borrowing: MDB Meeting Highlights

Discussion on debt sustainability and non-concessional borrowing at the MDB Meeting in Washington, May 2014. Topics covered include diagnostics, responses, and the impact of debt relief on recipient countries. Insights provided on accessing international capital markets and the challenges faced by p

0 views • 18 slides

Challenges and Solutions in Article Licensing and Library Availability Management

This collection of images depicts the current challenges faced by IDS systems administrators in managing article licensing information and library availability. The images highlight the complexities involved in maintaining e-journal databases, the manual processes required for updating licenses, and

0 views • 22 slides

Household Debt Repayment Prospects Amid Rising Interest Rates

As interest rates rise, the total household debt is projected to approach 2 trillion by 2018. Despite a slight increase in the debt-to-income ratio, continued low borrowing costs are expected to keep the debt repayment ratio flat. Six scenarios are considered, based on different paths for income gro

0 views • 17 slides

Understanding Fiscal Deficit and Government Financing

Fiscal deficit occurs when a government's expenses exceed its revenue, leading to deficit financing through borrowings or printing more currency. Borrowings from the market are preferred over printing money to avoid inflation. However, excessive borrowing can also have limitations due to market cons

0 views • 9 slides