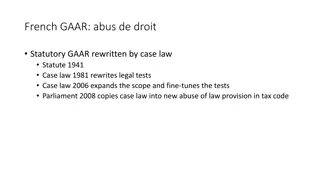

French General Anti-Abuse Rule (GAAR): Evolution and Application

The French General Anti-Abuse Rule (GAAR) has seen developments through statutory revisions and case law interpretations since 1941. This rule targets fictitious acts and acts aimed at reducing tax burdens through exploiting legal technicalities. The legitimacy of GAAR extends to tax treaties, with

0 views • 5 slides

Overview of GAAR in the Netherlands

GAAR in the Netherlands, including statutory GAAR, richtige heffing, and fraus legis. Learn about the requirements, limitations, and application of fraus legis in Dutch taxation law. Understand how the judge and tax inspector handle cases involving tax evasion.

0 views • 6 slides

Overview of Canadian and South African General Anti-Avoidance Rules (GAARs)

This review discusses the General Anti-Avoidance Rules (GAARs) in Canada and South Africa, focusing on the criteria for identifying avoidance transactions and impermissible avoidance arrangements. The Canadian GAAR targets transactions seeking tax benefits, while the South African GAAR focuses on bu

0 views • 15 slides

Analysis of Tax Avoidance Transactions in Case Study on GAAR Application

The case study explores the incorporation of a business into a corporation to realize tax benefits, including tax deferral and lower rates. It raises questions on whether the transactions were primarily for tax avoidance purposes, highlighting the complexities of tax planning and the application of

0 views • 47 slides

International Tax Conference Insights and Developments 2019

Explore key topics discussed at the International Tax Conference 2019, including anti-avoidance strategies, interpretation of tax treaties, GAARs following BEPS, and changes in the tax landscape. Insights on substance over form, GAAR/POEM experiences, and the impact of BEPS on tax treaties are highl

0 views • 32 slides