Relevance of Countercyclical Fiscal Policy and Fiscal Acyclicality

This literature review examines the effectiveness of countercyclical fiscal policies in stabilizing output and enhancing welfare, with a focus on the correlation between public spending cycles and GDP cycles. The study analyzes examples from Sweden and Argentina to showcase the impact of fiscal poli

2 views • 29 slides

Emergency Response Proposed Rule - Worker Safety and Health Conference

The Emergency Response Proposed Rule aims to update regulations for worker safety and health, expanding coverage to include technical search and rescue and emergency medical service entities. The rule proposes replacing the existing Fire Brigades standard with an Emergency Response standard. Federal

2 views • 23 slides

Emergency Long Life Food (Emergency Long-Life Food Supplies: Sustenance)

There is no way of foreseeing when an emergency or disaster may hit. It is important to be prepared for any such situation, be it a crisis on an adventure, natural calamity, pandemic, or bad health. In such times, food and water are indispensable survival essentials, and with this understanding, Sur

1 views • 1 slides

Overview of Utah's Budget for FY 2024-2025

Utah's budget for the fiscal year 2024-2025 is outlined with details on revenue sources, budget priorities, special funding, long-term fiscal health, and budget process changes. The budget allocations cover various sectors including education, transportation, law enforcement, social services, and mo

0 views • 32 slides

Emergency Medical Technician Program Details

This program offers a one-year Emergency Medical Technician (EMT) education with courses in College/Career Readiness, CPR/Basic Cardiac Life Support, Emergency Medical Responder, Basic Emergency Medical Technology, Applied Practical Studies, and Emergency Medical Technology Practicum. The schedule,

0 views • 33 slides

Emergency Procurement Procedures and Definitions for Public Safety

Understanding emergency procurement procedures is crucial in situations where immediate action is required to address threats to public health, welfare, or safety. This includes making emergency procurements for equipment, supplies, services, construction items, or professional/consultant services u

0 views • 12 slides

Principles of Public Participation in Fiscal Policy

The work by GIFT focuses on developing principles for public participation in fiscal policy, emphasizing the importance of citizen engagement beyond mere disclosure. These principles aim to enhance accountability, uphold citizens' rights, and improve policy quality through inclusiveness and openness

0 views • 17 slides

Gender-Responsive Fiscal Policies and Female Labor Force Participation

Despite persistent gender gaps in labor force participation and wages, various fiscal policy measures have been adopted globally since the mid-1980s to address these disparities. Understanding the impact of gender-responsive fiscal policies on female labor force participation, economic growth, incom

0 views • 23 slides

Fiscal Responsibility Act & Sustainable Development Nexus

Sustainable development integrates environmental health with economic progress. Achieving SDGs requires fiscal responsibility at all levels of governance. Subnational fiscal irresponsibility impacts national growth. It is crucial to manage public resources effectively to attain sustainable developme

0 views • 48 slides

Emergency Planning and Response in Shelby County

Shelby County Emergency Management Agency (EMA) Hub, under the supervision of Supervisor Harvey, plays a crucial role in local emergency planning and response. The Local Emergency Planning Committee (LEPC) focuses on building strong relationships to ensure local success. Recent amendments to the Eme

0 views • 5 slides

Financial Responsibility and Procurement Training Overview

This overview covers key aspects of financial responsibility, procurement training, and fiscal roles within a university setting. It emphasizes protecting university resources, ensuring compliance with laws and regulations, and upholding ethical standards. It discusses the responsibilities and roles

0 views • 33 slides

Enhancing Fiscal Policy Planning through Public Participation and Transparency

Explore the importance of public participation and meaningful transparency in fiscal policy planning and public expenditure management. Learn about the GIFT Network, its champions and stewards, and how fiscal transparency and public participation can lead to improved fiscal and development outcomes

0 views • 22 slides

Emergency Contraception Overview: Types, Usage, and Effectiveness

This presentation by Dr. Shumi Negesse provides an in-depth look at emergency contraception, including its definition, types of emergency contraceptives available, when to prescribe them, common side effects, and their effectiveness. The audience will learn about different emergency contraceptive pi

0 views • 23 slides

Fiscal Policy Guidance for State Long-Term Care Ombudsmen

Overview of the fiscal management responsibilities for State Long-Term Care Ombudsmen under the Older Americans Act requirements. Covers topics such as fiscal management, funding allocations, state plan requirements, and fiscal responsibilities. Details the OAA and LTCOP rule provisions related to f

6 views • 22 slides

Principles of Fiscal Deficits and Debt Management According to Kalecki

Economist Kalecki advocated for a permanent regime of fiscal deficits to manage public debt, emphasizing the importance of debt management for liquidity in the financial system. His principles involve splitting the government budget into functional and financial parts, each influencing aggregate dem

0 views • 6 slides

Emergency Provisions in the Indian Constitution: A Historical Overview

The emergency provisions in the Indian Constitution, including National/War Emergency under Article 352 and Constitutional Emergency in States under Article 356, have had significant historical implications. The period of Emergency declared from June 25, 1975, to March 21, 1977, during Indira Gandhi

0 views • 7 slides

Enhancing Emergency Communication Access Plan at Virginia School for the Deaf and the Blind

Virginia School for the Deaf and the Blind (VSDB) is taking steps to improve its emergency communication access plan to ensure all individuals on campus, including those who are deaf, hard of hearing, blind, or vision impaired, have full access to emergency alerts and instructions. The plan includes

2 views • 14 slides

Ohio Revised Code Sections on Emergency Vehicle Regulations

Explore the Ohio Revised Code sections pertaining to emergency vehicles, covering exemptions for emergency vehicle drivers in response to emergency calls, procedures for proceeding past red signals, and speed limit exceptions. These regulations ensure that emergency vehicles can navigate safely whil

0 views • 21 slides

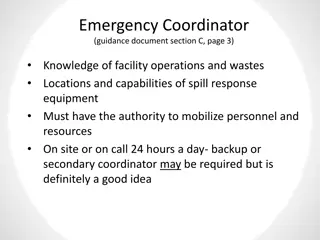

Essential Emergency Coordinator Guidelines for Facilities

This guidance document outlines the key responsibilities and requirements for an emergency coordinator at a facility. It covers the knowledge needed for facility operations, spill response equipment, authority to mobilize resources, and protocols for handling fire, spills, and other incidents. Addit

0 views • 7 slides

Examination of Interim Fiscal Policy Paper for Financial Year 2019-2020

An independent auditor's report on the interim fiscal policy paper laid before the Houses of Parliament, confirming compliance with the requirements of the FAA Act. The report assesses the components, conventions, and assumptions underlying the paper for fiscal responsibility, macroeconomic framewor

1 views • 15 slides

Butte County Office of Education Fiscal Oversight Role Overview

The Assembly Bill (AB) 1200 provides insights into the fiscal oversight role of Butte County Office of Education (BCOE). It outlines the responsibilities of local boards of education, BCOE as an intermediary agent, and the creation of the Financial Crises and Management Assistance Team (FCMAT) in 19

0 views • 12 slides

Analysis of Emergency Engines and Ozone Levels in Demand Response Events

Use of emergency engines in demand response (DR) events does not correlate with high ozone levels, as shown by a study conducted from 2005 to 2011 across various regions like PJM, ISO NE, NYISO, and ERCOT. The analysis reveals that emergency DR events do not align with high ozone days, indicating no

0 views • 12 slides

Understanding National Emergency Declarations and Emergency Powers Laws

This content delves into the legal aspects of national emergency declarations, emergency powers laws, and judicial review of emergency declarations. It covers the purpose, termination, historical context, congressional oversight, and impact on presidential powers. It also explores the complexities o

0 views • 6 slides

Emergency Location Working Group Initiatives and Standards

The Emergency Location Working Group focuses on securely providing accurate location information for emergency calls in the UK. They address standards, publications, and current focus areas such as ETSI architecture review and protocols for locating VoIP emergency calls. The group collaborates with

0 views • 6 slides

California's Fiscal Outlook Presentation to California School Boards Association

California's fiscal outlook was presented to the California School Boards Association by the Legislative Analyst's Office in December 2016. The report highlights a decrease in revenues and expenditures for the 2016-17 fiscal year, leading to a revised reserve down by $1 billion. However, the state i

0 views • 22 slides

AmeriCorps California Volunteers Fiscal Training Conference 2017 Details

In July 2017, the AmeriCorps Grantee Training Conference took place, focusing on fiscal procedures, compliance, desk reviews, and monitoring. The conference covered topics such as improper payments elimination, common audit findings, and the fiscal desk review process implemented by California Volun

2 views • 22 slides

A-29 Emergency Landing Gear Procedure

This emergency procedure outlines steps to follow in case of low pressure in the landing gear accumulator of the A-29 aircraft. It details actions to take for the emergency gear situation, including the response for low emergency brake accumulator pressure and the procedure to follow when the landin

0 views • 4 slides

Fiscal Year 2023 Budget Overview

The content presents detailed information on the fiscal year 2023 budget, including budget cycles, comparisons between fiscal years, source of funds, expenditure plans, and top projects for the Consolidated Municipal Agency (CMA). It covers budget development processes, funding sources, expenditure

0 views • 11 slides

Emerging Markets Investors Alliance and GIFT: Promoting Fiscal Transparency

The Emerging Markets Investors Alliance, in partnership with GIFT (Global Initiative for Fiscal Transparency), aims to educate institutional investors about fiscal transparency and facilitate investor advocacy with governments. Through roundtable discussions and engagements with finance ministers, t

0 views • 5 slides

Understanding Fiscal Reports and Budgeting Process

Dive into the world of fiscal reports and budgeting with a presentation led by Stephanie Dirks. Explore the Budget Code Story, different types of reports, and examples of Fiscal 04 & Fiscal 06 reports. Learn about Fund allocations, Object Codes, and responsible oversight of funds. Get insights into

0 views • 17 slides

Building Financial Systems Around Fiscal Data in Early Childhood Programs

Understand the importance of fiscal data in program management, identify key fiscal data elements, address policy questions, and learn from a state's cost study design. Explore the significance of fiscal data for decision-making, policy development, and program management, with a focus on revenue so

0 views • 31 slides

Global Practices in Fiscal Rule Performance

The study explores the implementation and impact of fiscal rules on macro-fiscal management, focusing on international experiences. It discusses the presence and compliance with fiscal rules, highlighting differences in pro-cyclicality among small and large countries. The rise in adoption of nationa

0 views • 23 slides

Understanding Fiscal Notes in Government Legislation

Fiscal notes are essential documents accompanying bills affecting finances of state entities. They detail revenue, expenditure, and fiscal impact, requiring a 6-day processing timeline. The need for a fiscal note may be determined by legislative services, committees, sponsors, or agencies. The proce

1 views • 30 slides

Fiscal Note Preparation Process and Guidelines

Fiscal notes are essential for bills affecting state finances. This includes the total processing time, exceptions, and what to do if there is disagreement on the fiscal note. The process involves multiple steps, including drafting, review, and resolution of disagreements. The President of the Senat

0 views • 29 slides

Alabama State Emergency Response Commission (SERC) and Local Emergency Planning Committee (LEPC)

Alabama's State Emergency Response Commission (SERC) and Local Emergency Planning Committee (LEPC) are key agencies responsible for disaster preparedness, response, and recovery. The SERC, formed by Executive Order Number 4, appoints agencies like the Alabama Emergency Management Agency (AEMA) and A

0 views • 14 slides

Essential Guide to Emergency Room Care for Older Persons and Caregivers

Older persons and their caregivers need to be well-informed about emergency room care. This guide covers key aspects such as services provided in emergency departments, differences between emergency, inpatient, and outpatient care, observation billing, what to bring to the ED, and the CARE Act for c

0 views • 14 slides

Understanding Government Tools for Economic Stability

The government uses fiscal and monetary policies to stabilize the economy. Fiscal policy involves Congress's actions through government spending or taxation changes, while monetary policy is driven by the Federal Reserve Bank. Discretionary fiscal policy involves new bills designed to adjust aggrega

0 views • 36 slides

Understanding North Carolina Emergency Management Law 101

The North Carolina Emergency Management Law 101, presented by Will Polk, Assistant General Counsel, delves into the measures taken by governments and the populace at various levels to minimize the adverse effects of emergencies. The law covers the planning, prevention, mitigation, warning, movement,

0 views • 46 slides

Michigan Transportable Emergency Surge Assistance Plan Overview

Michigan Transportable Emergency Surge Assistance (MI-TESA) Plan is a state resource established for emergency preparedness, featuring a mobile field hospital with various facilities and equipment stored strategically in Michigan. The primary healthcare mission of MI-TESA is to augment existing heal

0 views • 14 slides

Virginia Office of EMS Division of Emergency Operations

The Virginia Office of EMS Division of Emergency Operations is a crucial entity responsible for coordinating responses to various emergencies, including natural disasters, man-made incidents, and public health crises. Led by dedicated staff members, the division focuses on strategic initiatives to e

2 views • 21 slides