Understanding the Corporate Transparency Act: Reporting and Compliance

The Corporate Transparency Act mandates businesses to submit Beneficial Ownership Information (BOI) reports to FinCEN to combat illegal activities like money laundering and terrorist financing. Non-compliance can lead to severe penalties, but safe harbor provisions offer protection for correcting in

1 views • 33 slides

Understanding the Corporate Transparency Act: Key Requirements and Deadlines

The Corporate Transparency Act aims to enhance national security and combat illicit activities by requiring reporting companies to disclose information about their entity, beneficial owners, and company applicants to FinCEN. This article provides insights into why the act is necessary, what it entai

3 views • 38 slides

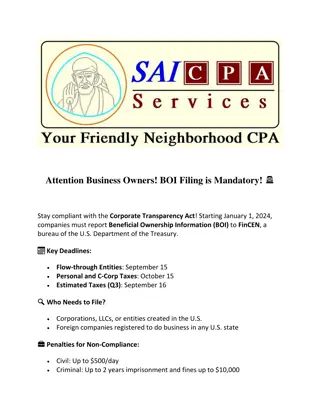

Attention Business Owners! BOI Filing is Mandatory!

Stay compliant with the Corporate Transparency Act! Starting January 1, 2024, companies must report Beneficial Ownership Information (BOI) to FinCEN, a bureau of the U.S. Department of the Treasury.

4 views • 2 slides

Corporate Transparency Act (CTA) Beneficial Ownership Reporting Requirements

The Corporate Transparency Act (CTA) mandates companies to report information about their beneficial owners to FinCEN starting January 1, 2024, to combat illicit activities. Reporting companies include U.S.-based corporations, LLCs, and foreign companies registered to do business in the U.S. Exempt

0 views • 10 slides

Understanding Customer Due Diligence and Proposed Federal Legislation

Explore the importance of Customer Due Diligence (CDD) for financial institutions in verifying beneficial owners and monitoring transactions. Learn about the requirements and deadlines set by the FinCEN and Department of Treasury. Additionally, delve into the details of the proposed Federal Legislat

0 views • 11 slides

Impact of Corporate Transparency Act on Businesses

The Corporate Transparency Act (CTA), part of the Anti-Money Laundering Act of 2020, aims to prevent money laundering and other illegal activities by disclosing beneficial owners of US entities. The act mandates reporting companies to provide ownership information to the US Treasury's FinCEN. Exempt

0 views • 37 slides