Efficient Fraud Management with Data Analytics

Learn the importance of data analytics in fraud management and how it can streamline risk assessment, prevention, detection, audit planning, and investigation processes. Discover key areas where data analytics can make a difference and avoid common mistakes in your fraud analytics plan. Embrace data

2 views • 33 slides

Understanding Grant Fraud: Insights from DOJ Office of the Inspector General

Explore the world of grant fraud awareness with insights from Special Agent Jason P. LeBeau of the United States Department of Justice Office of the Inspector General. Learn about the investigation of fraud, waste, and abuse in various sectors like bank fraud, money laundering, tax evasion, and more

2 views • 27 slides

2023 WV ASBO Conference

Dive into the world of ethics and fraud in education with Dr. Scott Fleming as he discusses the importance of instilling proper values to promote ethical behavior, the factors influencing trust violations, characteristics of fraud actions, and the evolution of fraud theory. Gain valuable insights in

0 views • 96 slides

Semi-Supervised Credit Card Fraud Detection via Attribute-Driven Graph Representation

Explore a novel approach for detecting credit card fraud using a semi-supervised attribute-driven graph representation. The technique leverages temporal aggregation and attention layers to automatically unify heterogeneous categorical attributes and detect fraudulent transactions without label leaka

1 views • 23 slides

Understanding Fraud, Waste & Abuse (FWA) Training Requirements

To maintain compliance with CMS guidelines, all UBMD providers and staff must complete Fraud, Waste & Abuse (FWA) training within 90 days of hire and annually thereafter. The training covers recognizing FWA, understanding laws and consequences, preventing FWA, reporting, and correcting issues. Failu

1 views • 27 slides

Understanding Ethical Conduct and Fraud Prevention in Institutions

Explore the nuances between ethics and fraud, famous fraud cases like Enron and Bernard L. Madoff Investment Securities LLC, and learn how to detect and prevent fraudulent activities within institutions. Recognize the importance of ethical behavior, early detection, and fraud prevention measures to

9 views • 36 slides

Understanding the Escalating Threat of Fraud in Financial Transactions

Rebekah Higgins, Vice President of Payments, delves into the alarming rise of fraud in financial transactions, revealing staggering statistics, emerging threats, and the critical need for prevention tools. The presentation covers fraud trends, common types of fraud, transaction flow, and the key pla

3 views • 30 slides

New England Fraud Trends

Explore the latest trends in fraud in New England, including statistics, common types of cyber fraud, primary targets, and successful recovery efforts by the IC3 Recovery Asset Team. Discover key information on reporting incidents, victim demographics, and financial losses, with a focus on prominent

0 views • 17 slides

Understanding Fraud in Financial Claims: Insights from Experts

Delve into the world of fraud and insurance claims with insights from renowned experts Ernest Patrick Smith and John Hoffman. Learn about the key elements of fraud, common definitions, and the intricacies of proving fraud, particularly in the challenging landscape of the California Department of Ins

0 views • 29 slides

Understanding Fraud, Waste, and Abuse in Healthcare Compliance

Healthcare fraud, waste, and abuse pose significant challenges to the healthcare system, leading to financial losses and potential harm. This overview emphasizes the importance of compliance programs in detecting and preventing fraudulent activities. By recognizing the signs of fraud, waste, and abu

7 views • 22 slides

Enhancing Fraud Awareness in Schools

Fraud Matters is a comprehensive program focused on increasing fraud awareness in schools. The initiative aims to educate staff, students, and stakeholders about the risks of fraud, preventive measures, and the detrimental impacts of fraudulent activities. By understanding what constitutes fraud and

1 views • 38 slides

School Treasurers Seminar 2020: Insights and Trends in Education Finance

Explore the School Treasurers Seminar 2020 held in Florida, organized by the Office of Education. Delve into enrollment trends, scholarship statistics, and insights on fraud prevention in educational institutions. Discover the impact of financial pressures and ethical considerations on fraud risk th

0 views • 19 slides

Conference on Adjudication and Compounding of Offences under Companies Act, 2013

The Two Days Regional Conference of ICSI WIRC focusing on the facilitation of corporate growth through discussions on adjudication and compounding of offences under the Companies Act, 2013. The event, presented by CS (Dr.) D.K. Jain, covers topics like fraud, wrongful gain and loss, punishment for f

0 views • 51 slides

Fighting Fraud in Agriculture: Member States' Experience - Key Findings

Explore the main findings in the fight against fraud in agriculture, focusing on Member States' experiences as presented by Katharina Herrmann Olaf. Discover key results, detection rates, modus operandi, anti-fraud work, and country fact sheets. Gain insights into irregularities, fraudulent activiti

0 views • 11 slides

Enhancing Fraud Prevention and Detection in EU Research Grants

Understanding the various aspects of fraud in research grants, this resource delves into the definitions, types, and preventive measures against fraud in the European Union's research and innovation programs. It emphasizes the importance of safeguarding EU financial interests, maintaining trust, and

0 views • 18 slides

Understanding Fraud in Real Estate Transactions: A Legal Perspective

Delve into the complexities of fraud in real estate transactions, particularly those involving identity theft. Explore various types of fraud, responsibilities, and liabilities of attorneys, as well as landmark legal cases that shed light on breach of contract and negligence in conveyancing. Learn a

0 views • 67 slides

Challenges to Enforcement in Arbitration: Immunity, Fraud, and Public Policy

Session 3 of the Arbitration Mini Series on May 25th discusses challenges to enforcement in arbitration, including issues related to immunity, fraud, and public policy. Topics such as extensions of time in fraud challenges, the 1996 Arbitration Act, the Kalmneft factors, and fraud cases in arbitrati

0 views • 20 slides

Recover Lost Funds From Binary Options Fraud Brokers

Are you a victim of a binary options fraud? You can fight back and recover your funds. Report to MychargeBack today! We have helped thousand of binary options fraud victims to get their money back. You can get your funds back from binary options scam

0 views • 15 slides

UNEP Support for Improving UNCCD Reporting Procedures

UNEP has been providing support since 2010 to enhance the reporting processes of the UNCCD, focusing on streamlined funding approaches, technical assistance, and capacity building. Key outcomes include the development of reporting tools, online reporting systems, and building credible data from coun

0 views • 14 slides

Understanding Fraud and Forensic Accounting

Fraud is defined as deception to gain an unlawful advantage. Various legal definitions of fraud under Indian law are discussed, including those under the Indian Penal Code, Indian Contract Act, and Companies Act. The concept of forensic accounting in detecting and investigating fraud is also introdu

0 views • 15 slides

Missouri Department of Labor and Industrial Relations (DOLIR) Fraud and Noncompliance Unit Overview

The Missouri DOLIR Fraud and Noncompliance Unit (FNU) was established in 1993 by the General Assembly to investigate fraud and noncompliance related to Chapter 287 RSMo (Workers' Compensation Law). The FNU is dedicated to promoting a safe work environment by upholding the integrity of Missouri's Wor

0 views • 35 slides

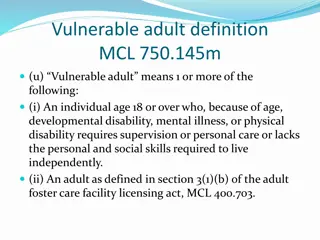

Risks of Financial Exploitation Faced by Vulnerable Adults

Vulnerable adults, including those with disabilities or cognitive impairments, are at risk of financial exploitation through scams like IRS fraud, family emergency scams, and healthcare insurance fraud. Elder financial abuse is on the rise, with billions of dollars lost annually. Recognizing these s

0 views • 32 slides

Understanding Forensic Accounting and Fraud - Types and Definitions

Forensic accounting plays a crucial role in detecting and investigating various types of fraud such as financial reporting fraud, asset misappropriation, and employee embezzlement. Fraud is defined as intentional deception resulting in a loss and involves misrepresentation of material facts. Types o

0 views • 19 slides

Understanding SAS 99 and Fraud Consideration in Financial Audits

This presentation delves into SAS 99, highlighting the importance of considering fraud in financial statement audits. It explains the impact of SAS 99 on auditors, emphasizes management's role in preventing and detecting fraud, and discusses the Fraud Triangle and types of fraud addressed by SAS 99.

1 views • 41 slides

Understanding Fraud in Auditing and Government

Fraud encompasses multifarious means of deception for personal gain and can significantly impact financial statements. Government fraud involves intentional acts to deceive, resulting in substantial losses annually. Auditors must diligently identify and address fraud risks to ensure the accuracy and

3 views • 68 slides

Preventing Healthcare Fraud, Waste, and Abuse: Why Training and Compliance Matter

Billions of dollars are wasted annually due to healthcare Fraud, Waste, and Abuse (FWA), impacting everyone. Training and implementing effective compliance programs are crucial to detecting, correcting, and preventing FWA, protecting Medicare enrollees and the healthcare system. Non-compliance risks

0 views • 5 slides

Simpler Systems Reporting Pilot for Financial Data Enhancement

The Simpler Systems Reporting Pilot is underway to enhance financial data reporting at the university campus. Led by Vice President Ryan Nesbit's team, this initiative aims to improve University-wide financial reporting mechanisms and accessibility to data through the Simpler tool. The pilot include

0 views • 5 slides

Direct Payments & Social Care Investigations Workshop Overview

Explore the key areas covered in the Direct Payments & Social Care Investigations Workshop, focusing on Direct Payments, social care fraud, applications, counter-fraud work, investigations, and overcoming cultural resistance. Delve into the risks associated with social care fraud and learn about the

0 views • 28 slides

Strategies for Handling Commercial Fraud Cases: Insights from Brick Court Chambers

Dive into the world of commercial fraud law and practice with key advice from Tim Lord QC of Brick Court Chambers. Explore topics such as disclosure issues, guiding principles, the importance of the 1st CMC, and expert tips for advising claimants in fraud cases. Learn how to navigate the complexitie

0 views • 54 slides

Ensuring Chemical Reporting and Preparedness at the DEQ

The Chemical Reporting and Preparedness section at the DEQ focuses on regulations under EPCRA, prompted by incidents like the Bhopal tragedy. EPCRA covers Tier II reporting, spill reporting, LEPCs, State Emergency Response Commission, and Oklahoma Hazardous Materials Emergency Response Commission. T

0 views • 17 slides

Healthcare Fraud and Abuse Compliance Training Overview

This comprehensive compliance training covers the prevention of Medicare and Medicaid fraud and abuse, the laws and penalties surrounding fraud, reporting methods, conflict of interest, billing and coding guidelines, and more. It emphasizes the importance of healthcare compliance in protecting organ

0 views • 50 slides

Healthcare Fraud, Waste, and Abuse Overview: General Compliance Training 2023

Healthcare fraud, waste, and abuse (FWA) pose significant challenges to the healthcare system, with billions lost annually to deceptive practices. Understanding FWA definitions - fraud, waste, abuse, and errors - is crucial to combatting them effectively. Compliance programs are essential to prevent

0 views • 24 slides

Fraud Risk Assessment and Internal Controls Overview

This presentation by Ron Smith & Karen Olivieri from RHR Smith & Co discusses fraud risk assessment, the definition of fraud, types of fraud, fraudster statistics, and the importance of internal controls in preventing and detecting fraud. They also delve into the responsibilities of auditors in prov

0 views • 42 slides

Fraud Awareness Training: Detection and Prevention

This comprehensive fraud awareness training covers the detection and prevention of fraud, including an overview of the Office of Inspector General, common types of fraud, red flags for detection, examples of cases, fraud prevention strategies, and reporting mechanisms. It delves into the elements of

0 views • 20 slides

Financial Fraud Against Older Adults: Steps to Protect Yourself and Others

Senior citizens are particularly vulnerable to various types of financial fraud, resulting in significant financial losses each year. Common scams include telemarketing fraud, in-person service scams, and exploitation through power of attorney. Factors like social isolation and cognitive impairment

2 views • 18 slides

Understanding Government Fraud: Impacts and Prevention

Government fraud is a serious issue that impacts public trust and financial stability. This type of fraud involves intentional acts to deceive the government and can occur internally or externally. The public perception of government organizations is affected by fraud, and entities such as the U.S.

1 views • 50 slides

Understanding German Criminal Fraud Law in the Context of the Corona Pandemic

Explore the intricacies of German criminal fraud law, particularly in the current Corona pandemic situation. Delve into the objective and subjective elements of the offense, characteristics of fraud, and subsidy fraud, along with detailed discussions on deception, error, disposition of property, and

0 views • 17 slides

Feedback Analysis on Medication Incident Reporting in Hospitals

Feedback received from IMSN members on NIMS and incident reporting revealed various issues affecting the rates at which staff report medication incidents/near misses within hospitals. Major themes included staffing numbers and turnover, pharmacist involvement in incident reporting, clinical pharmacy

0 views • 12 slides

Understanding Corporate Fraud in India: Recent Trends & Remedies

Corporate fraud in India has had a significant impact on the economy and businesses in recent years. This article explores the meaning, definition, and penalties associated with corporate fraud under the Companies Act, 2013. It discusses various fraud cases in India and the consequences for those fo

0 views • 29 slides

Fraud Protection and Awareness Workshop

Join us for a comprehensive workshop on fraud protection and awareness. Learn about common fraud schemes, how to identify warning signs, protect your finances, and what to do if you fall victim to fraud. Engage in interactive quizzes to test your knowledge and stay informed. Let's work together to p

0 views • 26 slides