CORPORATE PRESENTATION

Austrian-based Austriacard Group, a leading provider of secure payment solutions with a track record spanning 125 years, showcases robust financial performance and strong market presence. The company excels in offering innovative payment products and secure data management services, positioning itse

1 views • 27 slides

Understanding Strategic Alliances vs. Mergers & Acquisitions in Corporate Dynamics

Exploring the concepts of strategic alliances and M&As in the corporate world. Strategic alliances involve formal relationships between companies with shared goals, while M&As combine companies to varying degrees. Motivations for entering alliances include technology development, market access, and

0 views • 24 slides

Corporate Travel Solutions

Travelopro offers end-to-end corporate travel bookings and solutions, enabling smooth and cost-effective business and corporate executive travel by air. For corporate travelers, the corporate travel agent services must ensure that travelers face no difficulties during the entire duration of their tr

2 views • 15 slides

Corporate training for college students online training

Upgrade your career! Get ready for the workforce with online corporate upskilling programs for college students. \n\n Level Up Your Skills: Online Corporate Upskilling Programs for College Students \n\nThe transition from college to the corporate world can be daunting. You've spent years masterin

0 views • 2 slides

Foot Massage For Corporate Events

Elevate experience with our bespoke foot massage for corporate events . Our team of skilled therapists specializes in tailoring sessions to meet the unique needs of corporate gatherings. We understand the demands of professional settings and offer a perfect blend of relaxation and professionalism. W

0 views • 16 slides

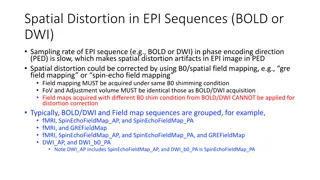

Spatial Distortion Correction in EPI Sequences: Field Mapping Examples

Spatial distortion artifacts in EPI sequences (BOLD or DWI) due to slow sampling rates in the phase encoding direction can be corrected using B0/spatial field mapping techniques. This correction requires obtaining field maps under the same B0 shimming conditions and with identical FoV and adjustment

0 views • 4 slides

Structuring Mergers, Acquisitions, and Private Equity Recaps: Tax Implications for S Corporations

Explore the tax implications for S Corporations in mergers, acquisitions, and private equity recaps, focusing on changes brought by the Tax Cuts and Jobs Act of 2017. Topics include income tax rate changes, dividends received deduction, and the Corporate AMT.

0 views • 95 slides

The Kill Zone Impact on Venture Capital Investments

Venture capitalists are hesitant to fund startups near large digital platforms due to the Kill Zone effect. Acquisitions by giants like Google and Facebook have significant implications on innovation and investment in the digital platform world. The data reveals insights into the dynamics of early-s

0 views • 19 slides

INCOSE Corporate Advisory Board Structure and Benefits

The INCOSE Corporate Advisory Board (CAB) plays a pivotal role as the voice of corporate stakeholders within INCOSE. The CAB advises on the organization's direction, priorities, and facilitates information exchange between member organizations and INCOSE. The structure includes membership tiers base

3 views • 9 slides

Understanding the Role of a Board of Directors and Company Secretary in Corporate Governance

Strong corporate governance is crucial for business performance, as it involves the system of rules, practices, and processes that direct and control a company. In Uganda, the Companies Act of 2012 governs corporate governance, with a voluntary code for private companies and mandatory for new public

1 views • 21 slides

Corporate Failures in Ghana: The Role of Auditors & Accountants

Corporate failure in Ghana is characterized by discontinuation of company operations due to poor management, incompetence, and bad marketing strategies. This leads to an inability to generate sufficient revenue to cover business expenses. The lecture by Dr. Seddoh outlines the basic symptoms and cau

1 views • 32 slides

Corporate Magic Entertainment by Ryan Goh

Looking to organize a Corporate Magic Show? Ryan Goh is the perfect choice to add elegance and charm to your corporate event. As an experienced corporate magician, Ryan delivers captivating performances that create an atmosphere of wonder and amazeme

1 views • 5 slides

What Are the Benefits of Choosing a Corporate Filmmaker?

KIS Media Works is a leading corporate video production agency in India offering top-notch corporate film making services, corporate promotional videos, and corporate video production solutions. Explore more @ \/\/kismediaworks.in\/

1 views • 8 slides

Municipality Branding Guidelines for Effective Corporate Identity Management

Municipality Branding Guidelines aim to ensure consistent and effective visual representation of the municipality by providing clear directives on logo usage, color schemes, font types, and design elements. These guidelines help maintain corporate identity continuity across all applications, promoti

0 views • 22 slides

Corporate Tax Association 2018 GST & Indirect Tax Corporate Intensive Conference

This year's Corporate Tax Association 2018 conference in Melbourne focuses on providing corporate indirect tax professionals with technical updates and hands-on experience of the latest in indirect tax technology and robotic process automation. The event includes sessions on GST cases, international

1 views • 4 slides

Corporate Image and Brand Management Overview

This chapter delves into the management of corporate image and brands, covering topics such as developing brand names and logos, the importance of packaging, brand positioning strategies, and the components of corporate image. It explores perspectives from both consumers and companies, highlights th

0 views • 32 slides

Understanding Mergers, Acquisitions, Affiliations, and Collaborations in Nonprofit Organizations

Explore the definitions of mergers, acquisitions, affiliations, and collaborations in the nonprofit sector along with reasons for merging. Delve into the history of successful nonprofit mergers like the IBS-FWI merger and gain insights from a video showcasing nonprofit mergers and acquisitions. Disc

1 views • 23 slides

Corporate Rehabilitation Act, 2018: A Comprehensive Overview

The Corporate Rehabilitation Act, 2018 aims to facilitate the recovery and restructuring of financially troubled corporate entities in Pakistan. It emphasizes the importance of revitalizing distressed businesses to foster economic growth and development. The Act defines key terms and outlines the ro

0 views • 21 slides

Enhancing Decision-Making with Location Intelligence in Water Industry Acquisitions

Delve into the pivotal role of location intelligence in the decision-making process for water industry acquisitions. Discover how accurate prediction of investment outcomes is achieved through the integration of environmental, geographic, census, and financial data. Explore the significance of data

0 views • 16 slides

American Imperialism in the Late 19th Century

Perception of manifest destiny, economic motives, and racial theories drove American expansionism in the 1890s, leading to overseas markets, acquisitions after the Spanish-American War, and debates over imperialism. Key figures, events, and ideologies shaped America's rise as a global power, includi

0 views • 13 slides

Tax Strategies for Corporate Acquisitions - Hedging FX Purchase Price of Target

Explore the intricacies of hedging foreign exchange purchase prices in corporate acquisitions, including forward contracts, integration rules, and IRS-initiated adjustments. The presentation delves into potential consequences, key requirements for taxpayers, and regulatory considerations. Gain insig

0 views • 28 slides

Effective Acquisitions Strategies for Libraries

Explore key insights from a meeting at the Fox River Valley Public Library District, focusing on handling duplicate records, potential causes of duplicates, vendor interactions, and fiscal year rollovers in libraries. Understand best practices for merging duplicates without disrupting acquisitions p

0 views • 15 slides

Polled Device Data Acquisitions Using SOIS on MIL-STD-1553B

Communicating and scheduling data acquisitions using the MIL-STD-1553B protocol has evolved from the old approach with no hardware support to the current implementation with hardware support. The process involves time synchronization, communication cycles, frames, pre-allocated bandwidth, and polled

0 views • 11 slides

Corporate Volunteering & CSR Programs in Financial Institutions

This presentation explores the significance of corporate volunteering and CSR programs in international financial institutions and private corporations, emphasizing the benefits for both employees and communities. It covers the rising trend of corporate volunteering, the impact of volunteer grants,

0 views • 11 slides

Evolution of Corporate Governance in Japan: A Contemporary Perspective

The evolution of corporate governance in Japan is examined with a focus on the relevance of outside directors, board independence, corporate fraud, and disclosures. The changing landscape includes the appointment of independent members, remuneration levels, share ownership structure, and XBRL taxono

0 views • 45 slides

Understanding Tax Aspects in Mergers & Acquisitions

This content provides an overview of recent M&A transactions, modes of M&A, taxation and regulatory aspects, as well as case studies in the field of mergers and acquisitions. It covers the need for M&A, various modes of M&A such as amalgamation, acquisitions, and restructuring, and key consideration

0 views • 40 slides

Corporate Briefing Session: Karam Ceramics Limited Highlights

Karam Ceramics Limited, a public company listed on the Pakistan Stock Exchange, is set to host a corporate briefing session on September 1, 2023. The session will cover an overview of the company, product portfolio, financial highlights, key challenges, and include a Q&A session. Learn about the com

0 views • 13 slides

Water Utilities Update - Low-Income Oversight Board Summary

Water Utilities Update Low-Income Oversight Board on June 24, 2019 discussed topics such as low-income OIR workshop, school lead testing, conservation, proposed legislation, acquisitions, and human right to water. The workshop focused on water rate design for a basic amount of water at a low quantit

0 views • 9 slides

Understanding Cross-Border Mergers & Acquisitions: Strategies and Opportunities

Explore the world of cross-border mergers and acquisitions with a focus on managerial strategies, global growth opportunities, regulatory frameworks, financial and operational strategies, drivers of M&A, and the natural progression for growth companies. Discover the benefits and challenges of M&A in

0 views • 22 slides

Defensive Tactics Against Hostile Takeovers in Mergers and Acquisitions

Hostile takeovers in mergers and acquisitions involve one company acquiring another directly from shareholders without board approval. Tactics include tender offers, proxy fights, poison pills, crown jewels defense, golden parachutes, and Pac-Man defense to deter or resist takeovers.

0 views • 15 slides

Understanding Mergers and Acquisitions: Price, Definitions, Tax, Synergy & Valuation

Explore the world of mergers and acquisitions through definitions, tax implications, synergy benefits, and valuation methods. Learn about different types of mergers, tax considerations for a merger to be tax-free, the concept of synergy in mergers, and how to value mergers and acquisitions.

0 views • 24 slides

Increasing SDVOSB Participation in Defense Contracting through Simplified Acquisitions

Research identifies a paradox in achieving SDVOSB goals despite predicted malfunction factors. It explores questions on program understanding, Contracting Officer discretion, and the impact of Simplified Acquisitions. Methodology involves reviewing academic assessments and applying a performance mod

0 views • 34 slides

Overview of Mergers and Acquisitions in Corporate Finance

Mergers and acquisitions (M&A) involve one company taking over or merging with another, with value creation achievable through synergies. The buying company is the bidder/acquirer, while the selling company is the target/acquired. M&A deals can be friendly or hostile and involve extensive due dilige

0 views • 28 slides

ADM Third Quarter 2015 Earnings Conference Call Highlights

ADM's third quarter 2015 earnings conference call covered financial highlights such as adjusted earnings per share, segment operating profit, and corporate results. The CEO provided insights on the company's performance, strategic advancements, and operational efficiencies in the face of various eco

0 views • 23 slides

Understanding Corporate Governance: Importance and Impact

Corporate governance plays a crucial role in preventing failures like mismanagement, lack of controls, and poor governance standards. Examples from global and Indian scenarios highlight the significance of effective governance practices in ensuring business success and societal trust. Various commit

0 views • 71 slides

Connecting with Corporate India: A Digital Revolution

Experience the advanced world of corporate connectivity at DivyaSree Technopark, where over 2.5 million professionals gather daily in 80+ business hubs across major Indian cities. Dive into the realm of Indian corporates, catering to a diverse workforce with high disposable income and a penchant for

0 views • 34 slides

Operations and Technology Due Diligence in Mergers & Acquisitions

This article discusses the critical role of operations and technology in the success of mergers and acquisitions (M&A) transactions. It emphasizes the importance of conducting thorough due diligence in these areas to identify challenges, opportunities, and potential synergies that can impact the out

0 views • 21 slides

Overview of Mergers and Acquisitions: Types and Examples

Explore the types of mergers and acquisitions, including mergers, acquisitions, consolidations, tender offers, acquisition of assets, and management acquisitions, with real-life examples such as Compaq and Hewlett-Packard, Manulife Financial, Citigroup, Johnson & Johnson, and more.

0 views • 16 slides

Corporate Governance in Mongolia: Key Insights and Recommendations

This presentation by Sebastian Molineus from the World Bank's Corporate Governance Group in Mongolia highlights the importance of good corporate governance. It defines corporate governance, explores the roles of various stakeholders, and discusses key themes such as enforcement regime, control struc

0 views • 28 slides

Latest Mergers and Acquisitions Updates in 2020

Explore the recent acquisitions and mergers in the business world of 2020, including notable deals involving companies like VWash, WhiteHat Jr, TikTok, and Bharti AXA General Insurance. Gain insights into the strategic moves and key players shaping the business landscape.

0 views • 25 slides