Office of the Consumer Protector: Ensuring Business Regulation in Western Cape

The Office of the Consumer Protector (OCP) plays a vital role in safeguarding consumer rights and regulating business practices in the Western Cape province. Established under legislative schemes, including the Western Cape Unfair Business Practices Act and the Consumer Protection Act, the OCP ensur

3 views • 27 slides

Understanding Concepts of National Income in Economics

Explore the concepts of national income presented by Dr. Rashmi Pandey, covering key indicators such as Gross National Product (GNP), Gross Domestic Product (GDP), Net National Product (NNP), Net Domestic Product (NDP), Personal Income, Disposable Income, Per Capita Income, and Real Income. Gain ins

0 views • 22 slides

Understanding National Income and Its Importance in Economics

National income is a crucial measure of the value of goods and services produced in an economy. It provides insights into economic growth, living standards, income distribution, and more. Concepts such as GDP, GNP, Personal Income, and Per Capita Income help in understanding the economic health of a

5 views • 14 slides

Understanding the Income Approach to Property Valuation

The income approach to property valuation involves analyzing a property's capacity to generate future income as an indication of its present value. By considering income streams from rent and potential resale, commercial property owners can convert income forecasts into value estimates through proce

8 views • 49 slides

Understanding Income Tax in India: Gross vs Total Income

In India, income tax is calculated based on the total income or taxable total income. The gross total income includes earnings from all sources like salary, property, business, and capital gains. Various additions such as clubbing provisions, adjustments for losses, unexplained credits, investments,

0 views • 7 slides

Understanding Tax Obligations and Assessable Income in Australia

In Australia, residents are taxed on worldwide income while non-residents are taxed only on Australian-sourced income. The tax liability is calculated based on taxable income, tax offsets, other liabilities like Medicare levy, and PAYG credits. Assessable income includes employment income, super pen

0 views • 13 slides

Understanding Consumer Behavior in Marketing

The design of a marketing program starts with understanding consumer behavior. Consumers, as the end users, play a crucial role in shaping market trends. Producers seek insights into consumer personas, market behaviors, and influencing factors. Management focuses on the consequences of consumer beha

2 views • 26 slides

Overview of the Consumer Protection Act, 2019

The Consumer Protection Act, 2019 aims to provide efficient resolution of consumer disputes and enforce consumer rights. It replaced the 1986 Act and includes new provisions such as online consumer protection, product liability, and expanded definitions of goods and services. The Act covers aspects

0 views • 25 slides

Consumer Council of Zimbabwe: Empowering Consumers for Fairness

The Consumer Council of Zimbabwe, founded in 1955, strives to advocate for consumer rights and promote fair trade practices. They work towards empowering consumers and ensuring their voices are heard in economic decisions. With a vision for fair deals and a mission for consumer protection, CCZ pushe

0 views • 19 slides

Understanding the Right to Representation in Consumer Protection

The Right to Representation in consumer rights allows consumers to be heard and ensures their interests are considered in various forums. In India, the Consumer Protection Act of 1986 recognized this right and established Consumer Protection Councils at different levels. These councils play a crucia

0 views • 13 slides

Understanding Consumer Protection Laws in Business with Dr. Samir Kumar Panigrahi

Gain insights into Consumer Protection Act 1986 and its significance in safeguarding consumer rights. Learn about the definition of a consumer, scope of the act, and the provisions for resolving consumer disputes. Explore how these laws aim to prevent consumer exploitation and promote fair trade pra

0 views • 15 slides

Understanding Sri Lanka's Inland Revenue Act No. 24 of 2017

This content delves into the key aspects of the Inland Revenue Act No. 24 of 2017 in Sri Lanka, covering chargeability of income tax, imposition of income tax, definitions, sources of income, assessable income for residents and non-residents, income tax payable, and income tax base. It provides valu

0 views • 93 slides

Challenges of Consumer Rights Protection in Zimbabwe

Zimbabwe faces challenges in protecting consumer rights due to the lack of definitive legal mechanisms. The absence of a Consumer Protection Act has led to unsustainable practices, arbitrary actions, and limited redress for consumers. The country lags in upholding consumer rights compared to regiona

0 views • 14 slides

Understanding Income from House Property in Taxation

House property income refers to rent received from properties owned by an individual, charged under income tax. It is based on the concept of annual value, representing the expected rental income or market value of the property. The annual value is taxable under the head "Income from House Property.

1 views • 12 slides

Understanding Consumer Access to Financial Records: Insights from Stakeholder Roundtable

Insights from a joint public roundtable on consumer access to financial records highlighted key points such as regulatory requirements under Dodd-Frank Act section 1033, market practices in leveraging consumer data, examples of use cases for consumer data, and stakeholder developments. The discussio

0 views • 12 slides

Overview of Income Tax Authorities in India

The Income Tax Act in India empowers the Central Government to levy taxes on all income except agricultural income. The Income Tax Department, governed by the Central Board of Direct Taxes, plays a crucial role in revenue mobilization. Understanding the functioning, powers, and limitations of tax au

0 views • 14 slides

Challenges and Progress in Consumer Protection in Zimbabwe

Zimbabwe currently lacks a definitive consumer protection mechanism at law, relying on the goodwill of service providers. The Consumer Council of Zimbabwe (CCZ) operates without legal enforcement powers, primarily focusing on consumer education. The country can benefit from adopting the UN Guideline

0 views • 20 slides

Understanding Residuary Income and Taxable Sources

Residuary income, under section 56(1), includes all income not excluded from total income and subjected to income tax under "Income from other sources." Certain specific incomes listed in section 56(2) are taxable, such as dividends, winnings, employee contributions, interest on securities, and inco

0 views • 9 slides

Understanding Clubbing of Income in Taxation

Clubbing of income refers to including another person's income in the taxpayer's total income to prevent tax avoidance practices like transferring assets to family members. This concept is addressed in sections 60 to 64 of the Income Tax Act. Key terms include transferor, transferee, revocable trans

1 views • 16 slides

Managing Debt and Protecting Client Assets in Victoria

Consumer Action Law Centre in Victoria focuses on assisting low-income clients in managing debt and protecting their assets. The presentation emphasizes assessing the need for debt payment, considering the client's financial position, and exploring options to handle debt where income and assets are

1 views • 29 slides

Understanding Consumer Duty in Mortgage and Protection

The Mortgage and Protection Event discussed the new FCA Consumer Duty rules and guidance, emphasizing the importance of good consumer outcomes. Mortgage intermediary firms need to assess their current practices against the new standards to ensure fair treatment and monitoring of outcomes. The scope

3 views • 12 slides

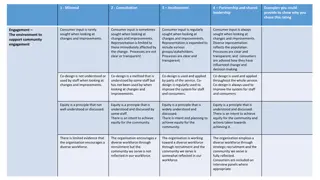

Consumer Engagement and Partnership Framework Assessment

Assessing consumer engagement levels within an organization based on consumer input, involvement, partnership, shared leadership, co-design practices, equity principles, workforce diversity, systems for capturing consumer views, and responsiveness to consumer feedback. The framework evaluates curren

0 views • 12 slides

Consumer Advocacy and Competition Policy in Seychelles

Located in Livingstone, Zambia, this organization advocates for sound competition and consumer protection policies to safeguard consumer interests. They enforce the Consumer Protection Act of 2010 and the Competition Act of 2009, aiming to promote fair trade practices and prevent abuse of dominance

0 views • 11 slides

Understanding Elasticity of Demand in Microeconomics

Elasticity of demand in microeconomics explores the qualitative and quantitative relationships between demand and price. It examines how changes in various factors affect consumer behavior and demand for goods and services. Factors such as price, consumer income, prices of related commodities, numbe

1 views • 8 slides

Evolution of Progressive Income Tax Systems

The concept of modern progressive income tax, developed in the early 20th century in countries like the UK, US, France, India, and Argentina, is based on the principle of a comprehensive tax base encompassing various income categories. The system involves effective vs. marginal tax rates, different

0 views • 19 slides

Exploring Immigration's Impact on Income Inequality

The presentation delves into the relationship between immigration and income inequality, analyzing data on income distributions among voters, non-voting citizens, and non-citizens in PA. It discusses the log-normal distribution as an approximation for income distribution and examines the ratio of me

0 views • 16 slides

Empowering Consumer Protection and Redress in South Africa

The National Consumer Tribunal in South Africa plays a crucial role in enforcing consumer protection laws and ensuring redress for consumers. The presentation outlines the genesis of the current consumer protection framework in South Africa, highlighting the need for empowering mechanisms and struct

0 views • 20 slides

Understanding the Consumer Protection Act: A Comprehensive Overview

Consumer protection laws play a vital role in safeguarding the rights of consumers and regulating interactions between consumers and businesses. The Consumer Protection Act, 1986, ensures strict liability for manufacturers and service providers in cases of defective goods or deficient services. This

0 views • 34 slides

Understanding the Consumer Protection Act of 1986: A Comprehensive Overview

The Consumer Protection Act of 1986 aims to safeguard the interests of consumers by imposing liability on manufacturers and service providers. This act holds significance in ensuring consumer rights, covering goods, services, and unfair trade practices. Learn about its history, features, and the imp

0 views • 21 slides

Consumer Privacy Rights and Regulations Act (CPRA) Overview

The Consumer Privacy Rights and Regulations Act (CPRA) addresses the asymmetry of information between consumers and businesses, aiming to empower consumers to control their personal data and ensure transparency and accountability in data use practices. It emphasizes the need for stronger laws to pro

0 views • 14 slides

Analysis of Irish Farmer Incomes Based on Income Tax Returns

This paper presents an analysis of Irish farmer incomes in 2010 using self-assessment income tax returns from the Revenue Commissioners. The study focused on various income sources such as trading income, rental income, employment income, social welfare transfers, and pension income. The dataset com

0 views • 12 slides

Competition and Consumer Rights in Botswana

Dr. Selinah Peters presented on the importance of competition for consumers in Botswana at the Second National Stakeholders Conference on Competition. The Botswana Consumer Coalition advocates for consumer rights, expecting fair competition to enhance consumer well-being and economic growth. However

0 views • 14 slides

Accrual Recording of Property Income in Pension Management

The accrual recording of property income in the context of liabilities between a pension manager and a defined benefit pension fund involves accounting for differences in investment income and pension entitlements. This process aims to reflect the actual property income earned by the pension fund, c

0 views • 17 slides

Understanding Retirement Income for Low-Income Seniors in Ontario

Exploring the income system for retirees in Ontario, including Old Age Security, Canada Pension Plan, and private pensions. Addressing the concept of low income, eligibility for Guaranteed Income Supplement, and debunking common misconceptions with a top 10 list of bad retirement advice. Highlightin

0 views • 11 slides

Valuation Using the Income Approach in Real Estate

The income approach to appraisal in real estate involves converting future income into a present value through income capitalization. This method utilizes direct capitalization and discounted cash flow techniques to estimate property value based on net operating income. Estimating net operating inco

0 views • 17 slides

Understanding Taxation in Australia: Income Declaration and Assessment

Australian taxation laws require residents to declare worldwide income while non-residents are taxed on Australian-sourced income. The tax liability calculation involves taxable income, tax offsets, other liabilities such as Medicare levy, and PAYG credits. Assessable income includes various sources

0 views • 13 slides

Improving Consumer Protection in Ghana: Insights from the Sixth Annual African Dialogue Consumer Protection Conference

The Sixth Annual African Dialogue Consumer Protection Conference held in Lilongwe, Malawi in September 2014 shed light on the challenges faced by Ghana's consumer protection policies. Irene Aborchie-Nyahe, a legal consultant, highlighted the gaps in Ghana's legislative framework, lack of effective i

0 views • 14 slides

Understanding Set-off of Losses in Income Tax

Set-off of losses in income tax allows taxpayers to reduce their taxable income by offsetting losses from one source against income from another source. This process helps in minimizing tax liability and optimizing tax planning strategies. There are specific rules and exceptions regarding the set-of

0 views • 4 slides

Understanding Income Tax Basics

Income tax is a fundamental part of contributing to a civilized society, with various taxes like sales tax, gas tax, and alcohol tax playing a role. This guide explains how income tax works, including taxable income calculations and refund processes. It also covers what amounts are taxable, such as

0 views • 14 slides

Income Eligibility Determination Training for PY 2023

Explore the key changes and considerations in income eligibility determination for the upcoming program year 2023, including the use of State Median Income and Federal Poverty Guidelines. Learn about the refined definition of the income eligibility period and the importance of monitoring household i

2 views • 34 slides