CAPITAL STRUCTURE

Capital structure refers to the mix of a firm's capitalization, including debt, preference share capital, equity share capital, and retained earnings. Choosing the right components of capital is crucial based on the organization's function and risk level. Different patterns/forms of capital structur

1 views • 6 slides

Theories of Capital Structure and their Applications

The theories of capital structure explore the relationship between debt and equity in a firm's financing decisions. By optimizing the mix of debt and equity, a company can minimize its cost of capital and maximize its value. The Net Income Approach highlights the benefits of using debt to lower the

1 views • 7 slides

Factors Influencing Economic Growth: Human Capital and Capital Goods

Factors such as investment in human capital, capital goods, natural resources, and entrepreneurship play a crucial role in determining a country's economic growth. Human capital encompasses the skills and abilities of workers, while capital goods are the tools and equipment used to produce goods and

2 views • 28 slides

Aditya Birla Capital Scholarship for Classes 1 to 8.

The Aditya Birla Capital Scholarship is run by the Aditya Birla Capital Foundation and is designed to help students in Classes 1 to 12 and undergraduates with financial aid for their education. The program provides a one-time scholarship of up to INR 60,000 to cover academic expenses. \nTo Know More

0 views • 5 slides

Mutual Capital Investment Fund: Addressing Capital Needs in the Insurance Community

Mutual Capital Investment Fund, LLC, aims to provide capital to mutual insurance companies facing capital needs without converting to stock form or selling minority interests. Led by Mutual Capital Group, the Fund seeks commitments up to $100 million and offers a unique investment opportunity for mu

0 views • 8 slides

Database Normalization and Aggregation Concepts

Understanding the advantages and disadvantages of database normalization, the concept of aggregation in the ER model, and examples of creating ER diagrams using aggregation rules with related entities. Explore the benefits of smaller databases and better performance through normalization, and how ag

4 views • 11 slides

Modeling of Serials in IFLA LRM Module 12 by PCC

Serials in library cataloging are modeled as complex constructs in IFLA LRM with considerations for whole/part and aggregation relationships. This module explores the intricacies of serial manifestations, issue manifestations, and the concept of WEM lock, providing insights into collocating closely-

0 views • 15 slides

Features of an Appropriate Capital Structure and Optimum Capital Structure

While developing a suitable capital structure, the financial manager aims to maximize the long-term market price of equity shares. An appropriate capital structure should focus on maximizing returns to shareholders, minimizing financial insolvency risk, maintaining flexibility, ensuring the company

3 views • 5 slides

Understanding Risk, Cost of Capital, and Capital Budgeting in Corporate Finance

Explore the concepts of risk, cost of capital, and capital budgeting in corporate finance, including the Capital Asset Pricing Model (CAPM), cost of equity, beta estimation, and cost of capital. Learn how to reduce the cost of capital and understand the impact of reducing the Weighted Average Cost o

0 views • 20 slides

Understanding the Classification and Importance of Capital in Business

Capital is crucial for businesses, whether for promotion, functioning, growth, or expansion. It can be classified as promotional, long-term, short-term, or development capital. Factors influencing capital requirements include business activity, size, product nature, technology, business cycle, and l

2 views • 13 slides

Capital Gains and Assets Overview in Income Tax Law and Accounts

This content provides an overview of capital gains and assets in income tax law and accounts, covering topics such as types of capital assets, assets not considered capital assets, kinds of capital assets (short-term and long-term), transfer year of chargeability, computation of capital gains, and c

0 views • 15 slides

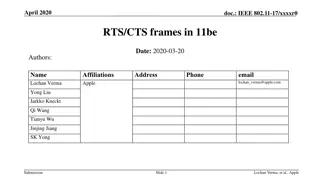

Implications of Large-size RU Aggregation on RTS/CTS in IEEE 802.11-17

Addressing implications of large-size RU aggregation on RTS/CTS in IEEE 802.11-17, focusing on the signaling of Enhanced High Throughput Format PPDU Bandwidth and puncturing in RTS/CTS frames. Proposing the use of HE MU-RTS Trigger frame to elicit CTS response from STAs, along with different CTS for

4 views • 17 slides

Understanding Price Index Formulas and Aggregation Methods

Exploring the significance of price index formulas and aggregation methods in economic analysis. Learn about simple and weighted aggregate indices, elementary index calculations, and why aggregation methods are essential for computing price changes accurately.

0 views • 30 slides

Privacy-Preserving Prediction and Learning in Machine Learning Research

Explore the concepts of privacy-preserving prediction and learning in machine learning research, including differential privacy, trade-offs, prediction APIs, membership inference attacks, label aggregation, classification via aggregation, and prediction stability. The content delves into the challen

0 views • 11 slides

Mortality Aggregation Examples at NAIC National Meeting

In August 2019, key concepts for mortality aggregation were discussed at the NAIC National Meeting. The examples presented covered approaches under VM-20 language, emphasizing the importance of informed mortality segment assumptions through credible aggregation methods.

0 views • 21 slides

Fiscal Year 2022 Capital Budget Presentation Overview

In the presentation to the Board of Finance, the Capital Committee outlines the Fiscal Year 2022 draft capital budget, emphasizing the importance of the Capital Improvement Program and the history of the capital program investments. The proposed budget addresses the critical need for reinvestment in

0 views • 11 slides

Agreements on FR2 Inter-Band Carrier Aggregation Requirements

Agreements have been reached on the RRM requirements and scaling factors for FR2 inter-band Carrier Aggregation, focusing on common beam and independent beam management. Discussions include alignment with Release 16 specifications, scenarios, and RF architectures. Interruption requirements for diffe

0 views • 8 slides

SYNERGY Reference Model for Data Provision and Aggregation

The SYNERGY Reference Model, developed by a team of respected contributors, outlines strategies for effective data provision and aggregation. Led by renowned experts from FORTH, the model offers valuable insights for enhancing research practices and data management processes.

0 views • 81 slides

Development of Methodologically Robust Agricultural Capital Stock Statistics by FAO

In November 2015, the Food and Agriculture Organization of the United Nations (FAO) initiated a project to enhance Agricultural Capital Stock statistics, focusing on inclusive and efficient agricultural and food systems. The project involves developing methodologies for measuring capital stock and m

0 views • 38 slides

Estimating the Cost of Capital in Corporate Finance

Explore the process of estimating the cost of capital essential for discounted cash flows models in corporate finance. Learn how to determine the cost of debt, equity capital, and the Weighted Average Cost of Capital (WACC) by combining different sources of financing. Gain insights into capital stru

0 views • 59 slides

Wander Join: Online Aggregation via Random Walks in Database Workloads

Wander Join is a technique for online aggregation using random walks, addressing challenges in efficiency and correctness in both transactional and analytical database workloads. It allows for complex analytical queries such as TPC-H queries and provides insights into revenue loss due to returned or

0 views • 27 slides

DER Aggregation in Monitoring and Control Operations

In the realm of energy grid operations, DER aggregation plays a crucial role from both short and long-term perspectives, focusing on transactive energy and autonomous devices. Communication and coordination are key for successful monitoring and control, with a need for a common framework supporting

0 views • 12 slides

Secure Outsourced Aggregation via One-way Chains - Research Overview

Exploring secure outsourced aggregation techniques using one-way chains for wide-area shared sensing and weather monitoring. The unique characteristics, challenges, and solutions for dealing with malicious aggregators are discussed. The research presents the contributions and advancements in optimiz

0 views • 30 slides

Understanding Net Investment in Capital Assets and Its Importance

Net Investment in Capital Assets is a critical component of an entity's financial position, reflecting the value of capital assets owned. It represents the portion of the net position that is not spendable as it is invested in assets. Calculating Net Investment in Capital Assets involves subtracting

1 views • 17 slides

IEEE 802.11-24/0386r0 Lower MAC Relay Protocol Details

Detailed discussion on supporting the relay protocol in IEEE 802.11bn, covering relay addressing, end-to-end BA, relay TXOP protection, beacon forwarding, security processing, non-UHR STA support, sounding procedure, A-MPDU aggregation, de-aggregation, and more. The relay operation involves relay de

0 views • 16 slides

Understanding SQL Aggregation and Grouping in Database Systems

SQL offers powerful aggregation functions like SUM, AVG, COUNT, MIN, and MAX to perform calculations on column data efficiently. By utilizing DISTINCT and GROUP BY clauses, you can manipulate and organize your data effectively in database systems while handling NULL values appropriately.

0 views • 54 slides

Understanding the Difference Between Aggregation and Composition in Object-Oriented Programming

Aggregation and Composition are two important concepts in object-oriented programming. Aggregation refers to a 'has-a' relationship where the contained object can survive independently, while Composition indicates that the member object is part of the containing class and cannot exist separately. Th

0 views • 15 slides

Manchester Township Community Energy Aggregation Program Overview

The Manchester Township Community Energy Aggregation Program, implemented under GEA and BPU rules, allows residents to pool together for better energy prices. The program involves a competitive bid process, with the contract awarded to TriEagle Energy. Residents benefit from reduced energy costs, co

0 views • 14 slides

3GPP TSG-RAN4 Meeting #97e Summary

During the 3GPP TSG-RAN4 Meeting #97e, discussions on Multi-RAT Dual Connectivity and Carrier Aggregation enhancements were held. A Work Item (WF) focusing on Idle mode Carrier Aggregation (CA) measurement Radio Resource Management (RRM) requirements was addressed. The meeting included topics such a

0 views • 17 slides

Constructing Price Index: General Procedure and Aggregation

The process of constructing a price index involves various steps such as computation of price relatives, aggregation at different levels, selection of base period, and designing data collection methods. Weighted arithmetic mean and simple ratio calculations are used in aggregating price indices. A t

0 views • 31 slides

Understanding Venture Capital: Key Concepts and Regulations

Venture capital is a form of financing provided to startup companies with high growth potential. It involves high risk and requires a long-term horizon, often coming in various forms like equity, conditional loans, and participation in management. The process includes stages such as seed capital, ex

0 views • 10 slides

Understanding Capital Adequacy Ratio (CAR) in Banking

Capital Adequacy Ratio (CAR) is a crucial metric in banking that measures a bank's capital against its risk. Also known as CRAR, it enhances depositor protection and financial system stability worldwide. The CAR formula involves dividing a bank's capital by its risk-weighted assets, comprising tier

0 views • 7 slides

Real-time Monitoring in Dynamic Sensor Networks: LiMoSense Study

This study delves into LiMoSense, a live monitoring approach for dynamic sensor networks, exploring challenges such as correctness, convergence, and dynamic behavior. The research focuses on sensors' communication, aggregation of read values, and the use of bidirectional and unidirectional communica

0 views • 45 slides

IEEE 802.11-19/0773r0 Multi-link Operation Framework Summary

The document discusses the multi-link operation framework for IEEE 802.11-19/0773r0, focusing on load balancing and aggregation use cases. It introduces terminology related to multi-link logical entities and provides examples of multi-link AP and non-AP logical entities. The framework considers stee

0 views • 16 slides

Advancing Scholarly Research Through Data Aggregation and Infrastructure Services

Enabling the creation of new scientific knowledge and discoveries, data aggregation platforms like CORE play a pivotal role in connecting repositories and facilitating structured data harvesting. These platforms contribute to the knowledge graph, support text and data mining, and offer valuable serv

0 views • 7 slides

Activities, Sectors, and Control Technologies in GAINS Research

The GAINS research by Janusz Cofala and Zbigniew Klimont focuses on aggregation criteria for emission sources, macroeconomic parameters such as population and GDP, aggregation of energy-related sources, transport sources, and process sources. It also covers specific VOC processes/sources like solven

0 views • 13 slides

SQL Aggregation and Group By: Understanding Concepts and Examples

Exploring SQL aggregation operations such as AVG, COUNT, and more, along with the GROUP BY clause for grouping data based on specific attributes. Examples illustrate how to use these features effectively in SQL queries to retrieve meaningful insights from databases.

0 views • 44 slides

Overview of Link Aggregation Simulator

This presentation provides an overview of a Link Aggregation Simulator designed to demonstrate and test LACP and DRCP operation. It guides users through creating devices, adding components, including link aggregation, and scheduling events. The simulator allows for testing of network components and

0 views • 20 slides

Distribution Algorithms in Link Aggregation Groups

In the context of IEEE 802.1ax standard, the distribution algorithms for Link Aggregation Control Protocol (LACP) are explained. The standard allows for flexibility in choosing distribution algorithms, with version 2 enabling explicit coordination. The problem of per-Aggregator distribution algorith

0 views • 15 slides

Publicly Verifiable Grouped Aggregation Queries on Outsourced Data Streams

Explore the challenges and solutions for publicly verifiable grouped aggregation queries on outsourced data streams, focusing on security, verification, and cloud computing. The research discusses how to handle large amounts of data using small memory components and emphasizes the importance of data

0 views • 34 slides