Understanding Financial Markets in India

Financial markets play a crucial role in connecting lenders and borrowers, providing avenues for investment and capital generation. In India, the financial system includes money markets and capital markets, offering diverse financial products and opportunities for investors. Money markets deal with

2 views • 106 slides

Managing Money Curriculum

This curriculum module delves into the essential aspects of applying for a loan, focusing on the 5 Cs of borrowing: character, capacity, capital, conditions, and collateral. It explores what lenders seek in borrowers, sources of money, and factors to consider before acquiring a loan. Key concepts in

1 views • 22 slides

Understanding Composite Fish Culture for Increased Productivity

Composite fish culture involves stocking different fish species with varying feeding habits in the same pond to optimize space and resources. This method allows for the utilization of all niches in the pond, leading to assured production and easy management. The article covers the species involved,

6 views • 16 slides

Direct Lender - Traditional Loan Solution - Short Term Loans UK

Short Term Loans Direct Lenders | Short Term Loans UK Direct Lender | Short Term Loans UK\nShort term loan are provided to borrowers on a short-term basis by lenders who are available around-the-clock. One handy aspect is that because the short term loans UK is unsecured, you don't have to pledge yo

0 views • 1 slides

Before getting the £1000 Short Term Cash Loans, how long will it take

Borrowers who own homes and are tenants have no obstacles. The benefits of short term loans UK direct lender are most pleasant to them! However, you must be a resident of the UK and an adult over the age of 18 in order to submit a subsequent application for these financial products.\n\n\/\/classicqu

1 views • 1 slides

Comprehensive Guide to OneRD Guarantee Loan Initiative

The OneRD Guarantee Loan Initiative offers funding opportunities for eligible rural and rural areas, with specific criteria and requirements for borrowers, lenders, and loan issuance. The program includes options for Loan Note Guarantee (LNG) issued prior to project completion, loan retention and fe

1 views • 14 slides

Cost-Effective Refinance Option in New York Real Estate Market Post Covid-19

Consolidation, Extension, and Modification Agreement (CEMA) is a smart solution for homeowners in New York looking to refinance their properties while saving on mortgage taxes. This refinance option allows borrowers to consolidate their prior loans into a new loan amount without releasing the previo

0 views • 16 slides

Understanding Off-Balance Sheet Items in Banking Activities

Off-balance sheet items refer to activities that are assets or liabilities of a company but do not appear on the balance sheet. In banking, these can include loans given to borrowers, securitization, guarantees, and other contingent facilities. Learn more about how off-balance sheet exposures impact

0 views • 6 slides

Essential Guide to Public Service Loan Forgiveness (PSLF)

Gain insights into the intricate process of navigating Public Service Loan Forgiveness (PSLF) program with key details on eligibility criteria, qualifying payments, and essential information to help borrowers maximize loan forgiveness benefits. Stay informed on loan types, repayment plans, and criti

0 views • 27 slides

Understanding Islamic Finance: An Overview of FIN 431 Course Content

This course overview delves into the essentials of Islamic Banking and Finance, covering tradable securities, regulatory frameworks, and Sharia principles guiding innovations in the field. Topics include contracts, Islamic financial market principles, and practical operations in Islamic finance. Ass

0 views • 27 slides

Exploring Auto Loan Data for Research Insights

Accessing rich auto loan data obtained by the CFPB, this potential research aims to prioritize key questions for analysis. The dataset includes a diverse sample of financial institutions and extensive variables related to loan originations and servicing. Research questions span from specific inquiri

0 views • 18 slides

Bridging Loan

Bridging loans offer useful solutions to borrowers looking to secure short term finance. Knowing when and how to apply for a bridging loan can be confusing. Therefore, consulting a mortgage broker can assist home buyers in securing the finance that i

4 views • 7 slides

Bridging Loan

Bridging loans offer useful solutions to borrowers looking to secure short term finance. Knowing when and how to apply for a bridging loan can be confusing. Therefore, consulting a mortgage broker can assist home buyers in securing the finance that i

0 views • 7 slides

Understanding Microfinance: A Case Study of Kiva's Social Enterprise Impact

Microfinance, a banking service offering small loans to individuals and businesses, plays a vital role in empowering communities. Kiva.org, founded in 2005, focuses on building self-sufficiency through small loans and education. Investors support borrowers, emphasizing business success and loan repa

0 views • 12 slides

Understanding Mortgage Arrears, Repossessions, and Legal Obligations in Ireland

Explore the laws surrounding mortgage arrears, repossession figures, key statistics, the Code of Conduct on Mortgage Arrears (CCMA), and legal standings in Ireland. Learn about the implications of arrears lasting over two years, the mandatory pre-litigation resolution process, and recent court rulin

0 views • 15 slides

ALCB Lending Index Presentation & Methodology Overview

Explore the ALCB Lending Index Presentation held on 01.02.2018, including methodology, results, and discussions on lending for economic growth. Discover the index development process, methodology, and factors impacting banks' ability and desire to lend, as well as borrowers' ability and desire to bo

0 views • 14 slides

Explore Kiva: Empowering Underserved Communities with Microcredit

Kiva is a non-profit organization that leverages crowdfunding to provide financial access to over 1.7 billion unbanked individuals globally. Founded in 2005 in San Francisco, Kiva facilitates loans for underserved communities, boasting impressive statistics like 4.6 million borrowers across 80 count

0 views • 11 slides

Role and Functions of Commercial Banks in the Financial Sector

Commercial banks are profit-seeking financial institutions that accept deposits from the public and provide loans for investment purposes. They specialize in financing trade and commerce through short-term loans, utilizing the interest rate difference between borrowers and depositors as a primary in

0 views • 6 slides

Understanding Loan Contracts: Legal Aspects and Financial Ramifications

Exploring the intricacies of loan contracts, this content delves into the rights and responsibilities of lenders and borrowers, including key clauses and scenarios such as renunciation due to a borrower's bad financial state. A case study is presented, questioning the course of action when a borrowe

0 views • 16 slides

Funding Program for Energy Efficiency Projects in Texas

A detailed overview of the LoanSTAR program in Texas, offering low-interest loans to eligible entities for energy efficiency upgrades. The program covers loan sizes, interest rates, application process, loan qualification criteria, phases of the loan process, loan recap statistics, and eligible borr

0 views • 15 slides

Financial Concepts Review in Jeopardy Style

Explore financial concepts through a Jeopardy-style game with categories like Short-term Assets, Long-term Assets, Liabilities, Equity, Financial Statements, and Ratio Analysis. Test your knowledge with questions on accounts receivable, borrowers, and more. Prepare for the final Jeopardy round as yo

0 views • 73 slides

Understanding Credit Instruments and Negotiable Instruments

Credit instruments play a crucial role in modern business by facilitating the transfer of money between lenders and borrowers. These instruments, such as Payroll Credit, Book Credit, and Documentary Credit, come in various forms like oral agreements and written documents. Negotiable instruments, on

0 views • 11 slides

RGC Capital Loan Program Overview

Explore the lending program offered by RGC Capital for loan officers and borrowers, facilitating loans from $100,000 to $6 million with credit scores of 600+, diverse loan purposes, and various borrower types. Benefit from competitive rates, flexible terms, and value-added benefits like no seasoning

0 views • 15 slides

Understanding Why Financial Institutions Exist

Financial institutions exist to provide crucial services like intermediation, risk management, and facilitating economic activities by connecting savers and borrowers. The global financial structure involves various institutions like banks, insurance companies, and securities markets. Key facts incl

0 views • 45 slides

Understanding Money Markets and Their Role in the Economy

Money markets are financial markets where short-term, low-risk securities are traded. Unlike banks, they offer distinct advantages such as liquidity, active secondary markets, and cost efficiency in providing short-term funds due to lower regulations. Despite the presence of banks, money markets pla

0 views • 33 slides

Understanding Money Market Instruments and Yields

Money market instruments are short-term debt securities with high liquidity, low risk, and issued by high-quality borrowers. These instruments offer a higher return than cash holdings, making them attractive for investors. Bond equivalent yields provide a way to compare different types of securities

0 views • 30 slides

Understanding International Banking and Its Impact: Evolution, Features, and Crucial Events

International banking plays a vital role in facilitating global financial transactions, reducing risks for both borrowers and lenders. This article delves into the features of international banking, motives behind banks expanding into new markets, the evolution of international banking institutions,

1 views • 27 slides

Guidelines for Bank Procurement Under World Bank Borrowers - January 2011

These guidelines outline the important aspects of procurement for goods, works, and non-consulting services under IBRD loans and IDA credits/grants by World Bank Borrowers. They cover the purpose, general considerations, methods of procurement, and the responsibilities of both the Borrower and the B

0 views • 15 slides

Difference Between Capital Market and Money Market: A Comprehensive Overview

The capital market and money market serve different purposes in the financial world. While the capital market provides funds for long-term investments in securities like stocks and debentures, the money market deals with short-term borrowing and lending of funds. The capital market acts as a middlem

0 views • 4 slides

Understanding Financial Markets: Mechanisms and Efficiency

Financial markets play a crucial role in connecting borrowers and lenders, facilitating the flow of funds for optimal allocation. Different financial phases involve borrowing, saving, and investing. Transfers of funds occur directly or through intermediaries. Efficiency in financial markets ensures

0 views • 15 slides

Florida Housing Program Overview for Industry Professionals

Overview of Florida Housing Loan Programs for industry professionals, including The Bond Alternative, The Bond Program, and Hometown Heroes. Details on eligibility criteria, income limits, credit score requirements, and property types supported. Restrictions on non-occupying co-borrowers emphasized.

0 views • 16 slides

Housing Opportunities for Tribal Communities

Bay Bank, owned by the Oneida Nation, is a prominent HUD 184 lender in the Great Lakes area, offering financial support to underserved tribal communities. The government-to-government relationships, unique land status, and limited housing supply pose challenges for accessing financing. However, oppo

0 views • 16 slides

Understanding Mortgages and Capital Market Instruments

Mortgages play a crucial role in lending for real estate properties, classified into categories such as home, commercial, and farm mortgages. They can be backed by specific property, offering security to lenders in case of defaults. On the other hand, capital market instruments involve contracts bet

0 views • 54 slides

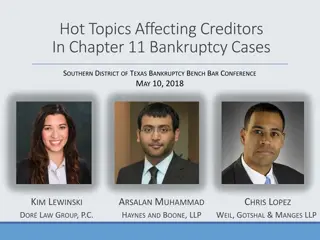

Understanding Make-Whole Provisions in Chapter 11 Bankruptcy Cases

Make-whole provisions are contractual clauses allowing borrowers to repay debts before maturity, while requiring payment based on future coupon values. This article explores the purpose, definitions, and examples of make-whole provisions in bankruptcy cases, with specific references to relevant lega

0 views • 32 slides

Understanding Make-Wholes in Chapter 11 Bankruptcy Cases

Make-wholes are contractual provisions in indentures that allow a borrower to redeem or repay notes early, subject to paying a lump sum based on the net present value of future coupon payments. They play a crucial role in determining the rights of borrowers and lenders in the event of early debt rep

0 views • 32 slides

Technology That Cares - How Kissht Uses Innovation to Simplify Lending

Kissht\u2019s approach ensures that technology serves everyone, including first-time borrowers unfamiliar with digital finance. The app is built to be intuitive, supporting seamless navigation and clear instructions at each step. This simplification,

0 views • 5 slides