Challenges and Strategies for TransferWise in the Remittance Services Industry

TransferWise is facing challenges such as imbalance in outflow vs. inflow, threat of blockchain technology, and reaching zero transfer charges. The presentation suggests strategies like customer scale, new technologies, and developing a student customer strategy to tackle these challenges. Internal analysis highlights TransferWise's strengths like cost efficiency and strong partnerships but also points out weaknesses like limited service offerings.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

KILOMETRES OF INTERNET BROADBAND LINES > KILOMETRES OF COUNTRY BORDERS

Nanyang Consulting N TransferWise Sustainable Disruptor in the Remittance Services industry? Presented to: Kristo K rmann and Taavet Hinrikus, Co-Founders at TransferWise Presented by: Daniela, Minghao, Victor, Vishnu 10 January 2019

Agenda Agenda Page 3 1 Problem 2 Recommendation 3 Internal & External Analysis 4 Strategic Alternatives 5 Implementation 6 Financial Analysis 7 Contingency Plan 8 Conclusion

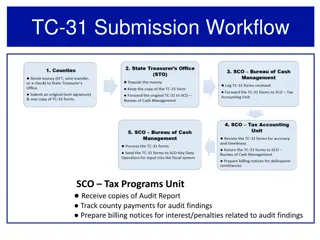

Problem: Problem: TransferWise is facing three key challenges that question whether it can remain the disruptor it is today Page 4 Imbalance of Outflow vs. Inflow Threat of Blockchain Getting to Zero How can you manage scalability when inflows and outflows of certain countries are imbalanced? How can you stay a disruptor despite rapid developments in Blockchain? How do you reach operational scale to reach the goal of zero transfer charges? Problem Recommendation Analysis Alternatives Implementation Financials Contingencies Conclusion

Recommendation: Recommendation: Three strategies will enable TransferWise to tackle the key challenges it is facing Page 5 Customer Scale New Technologies New Customers Student Customer Strategy Business Customer Strategy New Technologies Development Imbalance of Outflow vs. Inflow Threat of Blockchain Getting to Zero Problem Recommendation Analysis Alternatives Implementation Financials Contingencies Conclusion

Internal Analysis: Internal Analysis: TransferWise exhibits strong core competencies and an impressive growth story while being stretched for money Page 6 Strengths Weaknesses Cost efficiency Profitability since 2017 Limited to bank account transfers Strong partnerships with banks No physical outlets Large customer base (4 million) with $4 No significant difference to competitor s billion transactions per month satisfaction rating Bank of England settlement Problem Recommendation Analysis Alternatives Implementation Financials Contingencies Conclusion

External Analysis: External Analysis: TransferWise operates in a challenging environment with technology offering key opportunities Page 7 Opportunities Threats 10% international market share (2018) with Blockchain 30% market share by 2026 $574 billion remittance market Loss of reputation due to partnerships Technological advancements Security, hacking Increased globalization Highly regulated market Urbanization and mobile connectivity Problem Recommendation Analysis Alternatives Implementation Financials Contingencies Conclusion

Competitor Analysis: Competitor Analysis: The following table illustrates the competitive landscape in which TransferWise operates Page 8 Traditional Banks TransferWise Western Union OFX WorldFirst + Speed + Costs + + Accessibility + + + + + Electronic Transfer + + Offline Transfer + + Min. Transfer Problem Recommendation Analysis Alternatives Implementation Financials Contingencies Conclusion

Strategic Alternatives: Strategic Alternatives: Six strategies have been considered that tackle the challenges TransferWise is facing Page 9 Strategic Fit Customer Experience Risk Level Innovation Level STRATEGY DECISION Scalability Feasibility + + + M&A Develop Blockchain technology + + + Establish physical outlets + Student customer strategy Chosen strategies + + + + + + Business customer strategy + + + + + + New technology development + + + + + + Problem Recommendation Analysis Alternatives Implementation Financials Contingencies Conclusion

Implementation (1/3): Implementation (1/3): Student Customer Strategy Page 10 What Target Chinese and Indian students in Europe (UK, Germany, Switzerland) and USA Why Large Chinese and Indian overseas student application to address imbalance in remittance inflows Problem Recommendation Analysis Alternatives Implementation Financials Contingencies Conclusion

Implementation (1/3): Implementation (1/3): Student Customer Strategy Page 11 How Operations & HR Marketing Hire 2 Directors (India & China) from Exploit N26 s entry in the UK in 2018 to partner on targeting students government background, e.g. MoF or Nominate student ambassadors 3 per University MoT to identify local partnerships with Sponsor student events organized by ethnic student associations, e.g. BOC and SBI LSE Chinese Society Appoint University coordinators across Provide referral bonuses for students via WeChat links (Chinese regions, starting with London, Berlin, students) and WhatsApp links (Indian students) Zurich and Boston Offer a free $1,000 transfer amount to students when they sign-up Identify periods of heavy imbalance, e.g. Offer cheaper transaction rates during periods of heavy imbalance Chinese New Year and Deepavali Problem Recommendation Analysis Alternatives Implementation Financials Contingencies Conclusion

Implementation (2/3): Implementation (2/3): Business Customer Strategy Page 12 What Target SMEs and large corporations to build the client base Why Achieve critical mass, i.e. increase cash flow amounts, to reduce transfer fees approaching zero Problem Recommendation Analysis Alternatives Implementation Financials Contingencies Conclusion

Implementation (2/3): Implementation (2/3): Business Customer Strategy Page 13 How SMEs Large Corporates Identify insurance companies, e.g. LIC (India) that Sponsor business/application competitions for have reimbursement products top MBA institutions, e.g. CEIBS, IIM Work with international Expat communities, e.g. Approach start-ups, incubators and accelerators, Expat Wine Society e.g. Mahindra, WeWork, TenCent Offer a free $10,000 transfer amount when Target entrepreneurs with small businesses, e.g. signing-up EntrepreneurFirst partnership Offer discounted remittance rates for corporate Partner with POS system providers, e.g. iZettle employees (acquired by IntelligentPOS in 2018) Problem Recommendation Analysis Alternatives Implementation Financials Contingencies Conclusion

Implementation (3/3): Implementation (3/3): New Technologies Development Page 14 What Invest in new technologies development, i.e. AI, analytics Why Increase competitive edge and customer experience Problem Recommendation Analysis Alternatives Implementation Financials Contingencies Conclusion

Implementation (3/3): Implementation (3/3): New Technologies Development Page 15 How Customer Experience Acquire an AI start-up (up to $20m valuation) specializing in algorithms to enable exchange rate forecasting for customers to allow better planning, i.e. similar to CheckFelix s price forecasting algorithms Hire 2 UX/UI designers to offer simple customer interface through A/B testing and reduce bugs for real- time exchange rates Promote customer success stories of overseas students and entrepreneurs, i.e. video content (Instagram, website) Track customer satisfaction level continuously to identify pain points early Increase customer support team as number of clients increases Problem Recommendation Analysis Alternatives Implementation Financials Contingencies Conclusion

Key Performance Indicators: Key Performance Indicators: The following metrics will allow TransferWise to track the success of the suggested strategies Page 16 Key Performance Indicator Target Number of students transferring money 1 10,000 in India and China Number of new SME clients 2 850 p.a. Number of new corporate clients 3 150 p.a. Customer satisfaction level 4 Improve from 9.1 to 9.5 Number of new technological features introduced 5 per year 5 Imbalance ratio for China and India 6 Reduce by 20% p.a. Reduce to 10 minutes for key markets Speed of transfer 7 Transaction costs of transfers 8 Reduce by 0.03% p.a. Problem Recommendation Analysis Alternatives Implementation Financials Contingencies Conclusion

Timeline: Timeline: The following timeline illustrates how the strategies should be executed over time Page 17 ACTION ITEM 2019 2020 2021 2022 2023 H1 H2 H1 H2 H1 H2 H1 H2 H1 H2 STUDENT CUSTOMER STRATEGY Government lobbying University activities, e.g. ambassadors Recruit Events Hire region coordinators Marketing strategy BUSINESS CUSTOMER STRATEGY Sponsor MBA competitions Target entrepreneurs POS partnership Marketing strategy NEW TECHNOLOGY DEVELOPMENT Acquire AI start-up in analytics and integrate Screen Acquire Integrate Hire 2 UX/UI designers Customer success stories Customer support team expansion Problem Recommendation Analysis Alternatives Implementation Financials Contingencies Conclusion

Financial Analysis: Financial Analysis: Current Market Share is 9.6% Page 18 2015/16 2016/17 2017/18 in Mil US$ Revenue 48.5 97 2 151 1.56 143 Cost Profit 81.5 -33 87.4 9.6 8 Volume of Transaction Avg Commission 48000 0.31% Market Share % 9.60% Problem Recommendation Analysis Alternatives Implementation Financials Contingencies Conclusion

Financial Analysis: Financial Analysis: If continuing in the current trajectory, a 19% market share can be achieved in 5 years Page 19 2015/16 2016/17 2017/18 2018/19 2019/20 2020/21 2021/22 2022/23 in Mil US$ Revenue 48.5 97 2 151 1.56 143 196 1.3 186 10 216 1.1 204 11 238 1.1 225 13 261 1.1 247 14 287 1.1 272 15 Cost Profit 81.5 -33 87.4 9.6 8 Volume of Transaction 48000 65433 71977 79174 0.30% 0.30% 87092 95801 0.30% Avg Commission 0.31% 0.30% 0.30% Market Share % 9.60% 17.42% 19.16% 13.09% 14.40% 15.83% Commission Rate does not reduce Number of customers cannot increase in current rate Challenges Problem Recommendation Analysis Alternatives Implementation Financials Contingencies Conclusion

Financial Analysis: Financial Analysis: New investment required to execute the recommendations Page 20 Cost Student Customer Acuqisition Business Customer Acuqisition Training for Business Acquisition Cost Salary Increases Increased Cost 2018/19 2019/20 2020/21 2021/22 2022/23 1.3 4.8 1.3 5.6 1.3 6.6 0.5 1.3 6.6 0.5 1.3 6.6 0.5 1 1 0 4 20 4 0 4 0 4 0 4 31.1 11.9 12.4 12.4 12.4 Problem Recommendation Analysis Alternatives Implementation Financials Contingencies Conclusion

Financial Analysis: Financial Analysis: 33% Market share achievable in 5 years, while % commission is progressively reduced to 0.21% Page 21 In Mil $ Volume of Transaction 2018/19 65433 0.30% 0.30% 0.27% 0.24% 2019/20 71977 2020/21 93570 2021/22 124448 2022/23 168004 0.21% Trends Avg Commission Revenue Cost Profit 196.3 185.9 10.4 215.9 204.5 11.4 252.6 224.9 27.7 298.7 247.4 51.2 352.8 272.2 80.6 Market Share % 24.89% 33.60% 13.09% 14.40% 18.71% Problem Recommendation Analysis Alternatives Implementation Financials Contingencies Conclusion

Financial Analysis: Financial Analysis: With profits increasing 10 times Page 22 Problem Recommendation Analysis Alternatives Implementation Financials Contingencies Conclusion

Contingency Plan: Contingency Plan: The following risks are underlying the suggested strategies and need to be mitigated timely Page 23 Probability Anticipated Risk Contingency 1 New government regulations Strong lobbying Medium 2 Reputation loss due to partners Be transparent in all dealings Medium Insufficient reach with students in China and India 3 Engage local student ambassadors Low 4 Poor take-up rate by businesses Share customer success stories Medium Liquidity risk 5 Prepare a financing pipeline Medium 6 Rapid Blockchain advancements Low Establish strong customer loyalty Replication by banks 7 Lower fees progressively Medium 8 Poor customer traction Strong customer feedback channels Low Problem Recommendation Analysis Alternatives Implementation Financials Contingencies Conclusion

Conclusion: Conclusion: Three strategies have been introduced that tackle the challenges TransferWise is facing an allow it to continue disrupting Page 24 Customer Scale New Technologies New Customers Student Customer Strategy Business Customer Strategy New Technologies Development Imbalance of Outflow vs. Inflow Threat of Blockchain Getting to Zero Problem Recommendation Analysis Alternatives Implementation Financials Contingencies Conclusion

Nanyang Consulting N THANK YOU FOR YOUR ATTENTION We now welcome any questions you may have. Kindly turn this slide for the appendix.

Nanyang Consulting N APPENDIX Please turn this page for supporting material.

Financial Analysis: Financial Analysis: Student Customer Strategy Page 27 Student Customer Strategy No of Students Transfer Amt /yr Total 100000 China 35000 3,500,000,000 India 100000 35000 3,500,000,000 7,000,000,000 2018/19 2019/20 2020/21 2021/22 2022/23 Conversion Number of Students Volume of Transaction 10% 2,000 20% 4,000 30% 6,000 40% 8,000 50% 700,000,000 1,400,000,000 2,100,000,000 2,800,000,000 3,500,000,000 10,000 Appendix

Financial Analysis: Financial Analysis: Business Customer Strategy Page 28 Business Customer Strategy No of Business Transfer Amt /yr Total 1000000 1000000 China India 120000 120,000,000,000 120000 120,000,000,000 240,000,000,000 2018/19 2019/20 2020/21 2021/22 2022/23 Conversion Number of Businesses Volume of Transaction 0.1% 1,000 1% 1% 2% 3% 240,000,000 1,200,000,000 5,000 2,400,000,000 10,000 4,800,000,000 20,000 7,200,000,000 30,000 Appendix

Financial Analysis: Financial Analysis: Direct Additional Revenue Page 29 Additional Transaction in M$ Students Businesses Total Avg Commission Direct Revenue Increase 2018/19 0.30% 2019/20 1,400 1,200 2,600 0.30% 2020/21 2,100 2,400 4,500 0.30% 2021/22 2,800 4,800 7,600 0.30% 2022/23 10,700 0.30% 700 240 940 3,500 7,200 3 8 14 23 32 Appendix