Coping with Inflation: Strategies for Small Businesses

Understanding and preparing for inflation is crucial for small businesses to maintain profitability and ensure survival. This article discusses the impact of inflation, provides strategies to cope with rising costs, and offers insights from a practical case study. By adjusting pricing, managing expenses, and optimizing cash flow, businesses can navigate inflationary pressures successfully.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

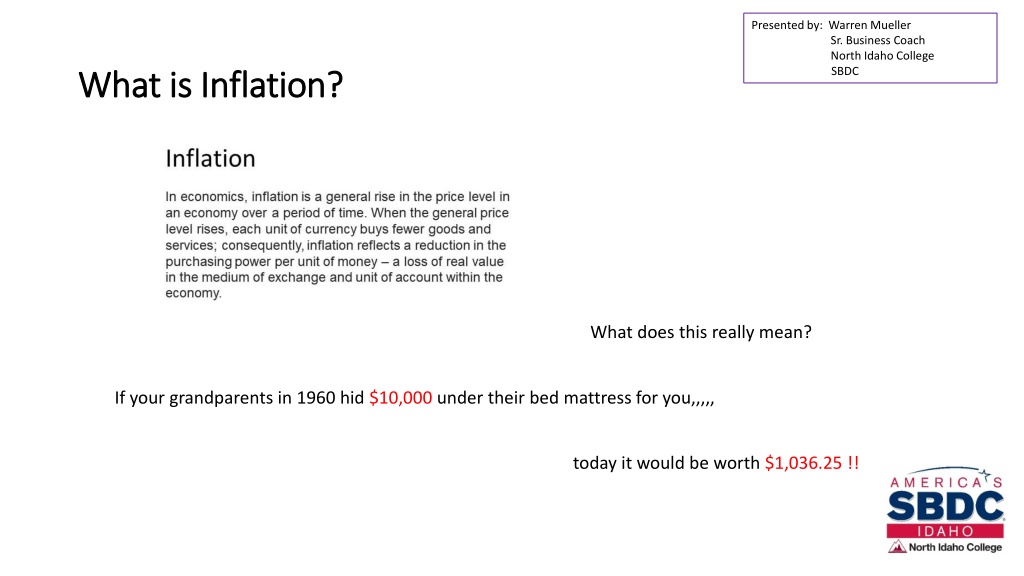

Presented by: Warren Mueller Sr. Business Coach North Idaho College SBDC What is Inflation? What is Inflation? What does this really mean? If your grandparents in 1960 hid $10,000 under their bed mattress for you,,,,, today it would be worth $1,036.25 !!

What can Small Businesses do to cope with Inflation? What can Small Businesses do to cope with Inflation? The key issue is to maintain profitability to generate enough cash to pay your bills! Look out for supplier price increases [COGS, OH] Factor Wage increases into cost of doing business [COGS, OH] Raise prices*, shift product mix to more valuable products/services to maintain profitability 80/20 analysis of customer profitability, product profitability [Pareto Chart] Business model pivots Why is all of this important? Profits = Generating Cash =Paying Bills = Survival!

Panhandle Fabrications & Design April 2020 P & L Statement Panhandle Fabrications & Design April 2021 P & L Statement Revenues Dollars Project Sales Parts Repair Work Design Total Revenues Revenues Dollars Project Sales Parts Repair Work Design Total Revenues 69,121 9,196 4,185 2,101 84,803 69,121 9,196 4,185 2,101 84,803 Cost of Goods Sold Raw Materials Parts Supplies Direct Labor Total COGS Cost of Goods Sold Raw Materials Parts Supplies Direct Labor Total COGS 23,255 5,768 452 21,592 51,067 21,335 5,768 452 18,776 46,331 Direct Labor +15% Raw Materials +9% Gross Profit -12.3% Gross Profit 33,736 Gross Profit 38,472 Overhead Expenses Lease Utilities Insurance Office Staff Accounting Bank Charges Legal Marketing Advertising Depreciation Total Overhead Overhead Expenses Lease Utilities Insurance Office Staff Accounting Bank Charges Legal Marketing Advertising Depreciation Total Overhead 4,000 775 427 6,027 452 84 480 176 531 1268 14,220 4,000 705 427 5,686 452 84 480 176 531 1268 13,809 Utilities +10% Office Staff +6% Net Income -20.9% Net Income 19,516 Net Income 24,663

What else? What else? Look at debt load, debt type Pay down variable interest debt [LOC], Credit Card debt, other debt If you sell on terms [net 30, etc] monitor slow pay, non-pay customers !!!!!!! Demand payment Cash in advance Cut off orders Slow pay, no pay, highest probability for bankruptcy!!!!! Minimize inventories; raw materials, work in process, finished goods; these all tie up cash Keep minimum inventories so you don t get caught with excess inventory if customer demand dries up

Pricing for Inflationary Times Pricing for Inflationary Times Increase prices to restore 2020 or 2021 Gross Margins [gradual increases better than one big jump] Going forward, consider holding prices steady on the most popular items, focus further increases on higher value items, or complimentary items [eg, a food business is holding salads at $12, raising prices on soups, breads] Once customers commit to the popular item they are more likely to accept higher prices on complimentary items Create attractive bundle deals around popular items; the price of the bundle is less than the separate items .people love deals, especially in inflationary times

How to Successfully Raise Prices How to Successfully Raise Prices assuming you are announcing the increase increase assuming you are announcing the Step 1. Justify the increase Increased raw material costs [how much % over the last year] Increased labor costs [how much % over the last year] Supply Chain disruptions, increased transportation costs Step 2. Sell the Value of the Increase So we can continue to provide the exceptional service you expect from us Because we won t ever compromise on quality Because you have asked for more internet speed, one-day shipping, etc Step 3. Hold Firm Model empathy for concerns, always refer back to the Justification and Value of the increase

Example Price Increase Announcement Example Price Increase Announcement PreppComm is announcing a price increase on Go Bags effective February 1, 2022 This price increase has been necessitated by increased component costs, shipping costs, supply chain disruptions, and labor costs over the last six months. The increased price which takes effect on February 1 will allow us to maintain our commitment to you our customers to supply the highest quality components in a multi-functional and durable bag for field use under a wide variety of field conditions. We sincerely appreciate the support of our customers and pledge to you to never compromise the quality of products which PreppComm is proud to supply. The new Go Bag price on February 1 will be $489. This announcement was made on January 17, giving customers nearly two weeks to place orders to beat the $100.00 increase customers appreciate a sense of fairness in an increase