Understanding Currency Exchange Rates in Financial Institutions

Explore the concept of currency exchange rates with a practical example involving Euro to US dollar exchange rates at a bank. Learn how to calculate the amount received or paid in different currencies, understand the bank's profit margins, and grasp the rationale behind financial institutions having two different exchange rates.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Discussion Time Discussion Time Chapter 8 : Arithmetic I Page: 172

Question posed: Question posed: Financial institutions show two different rates for currency exchange. On a given day, the exchange rates from Euro to US dollars at a particular bank, are as shown in the table. We buy We sell US Dollars 1 24 1 12 Work with a classmate to answer the following questions: 1. Jake has received a gift of $100 from his aunt in America. If he exchanges it in this bank, on this day, find how many euro he will receive. Give your answer to the nearest cent. 2. Susan wishes to get $100 to send to her niece in New York, as a gift. If she goes to this bank, on this day, how much will she have to pay, in euro, for the $100? Give your answer to the nearest cent. 3. Comment on your answers to questions 1 and 2. Consider the transactions from the bank s point of view. 4. Hence, why do you think that financial institutions have two different exchange rates? 2 Chapter 8 : Arithmetic I (page 172)

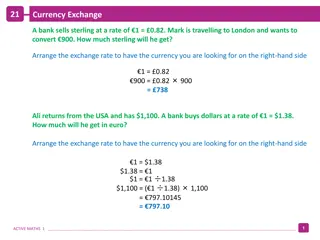

Suggested solution: Suggested solution: 1. Jake has received a gift of $100 from his aunt in America. If he exchanges it in this bank, on this day, find how many euro he will receive. Give your answer to the nearest cent. We buy We sell Jake wants the bank to buy his $100, so we must use the We Buy rate: US Dollars 1 24 1 12 $1 24 = 1 (we want euro, so we put euro on the right hand side) 1 1 24 $1 = (divide both sides by 1 24) 1 1 24 100 $100 = (multiply both sides by 100) $100 = 80 65 (simplify) Therefore, the bank will pay Jake 80 65 for the $100. 3 Chapter 8 : Arithmetic I (page 172)

2. Susan wishes to get $100 to send to her niece in New York, as a gift. If she goes to this bank, on this day, how much will she have to pay, in euro, for the $100? Give your answer to the nearest cent. We buy We sell Susan wants the bank to sell her $100, so we must use the We Sell rate: US Dollars 1 24 1 12 $1 12 = 1 (we want euro, so we put euro on the right hand side) 1 1 12 $1 = (divide both sides by 1 12) 1 1 12 100 $100 = (multiply both sides by 100) $100 = 89 29 (simplify) Therefore, the bank will charge Susan 89 29 for the $100. 4 Chapter 8 : Arithmetic I (page 172)

3. Comment on your answers to questions 1 and 2. Consider the transactions from the bank s point of view. The bank paid Jake 80 65 for the $100 The bank charged Susan 89 29 for the $100 Therefore, overall the bank made: 89 29 80 65 = 8 64 profit on these two transactions. 5 Chapter 8 : Arithmetic I (page 172)

4. Hence, why do you think that financial institutions have two different exchange rates? The bank use two different rates for buying and selling currency, this allows them to pay less and charge more for the currency. Thus the bank will make a profit overall on all currency transactions. This is true for all financial institutions that offer two different rates. 6 Chapter 8 : Arithmetic I (page 172)