Understanding Entry and Exit Barriers in Industries

Entry and exit barriers play a significant role in shaping industry attractiveness and competitiveness. High entry barriers can deter new entrants, leading to stable returns but also higher risks. Conversely, low entry barriers may attract new players during economic upturns but result in intense rivalry. Exit barriers can trap companies in industries even when profitability is low, affecting their ability to leave. Various types of barriers, such as capital requirements, economies of scale, intellectual property rights, and government regulations, can impact industry dynamics. Recognizing and adapting to these barriers is essential for strategic decision-making in business.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

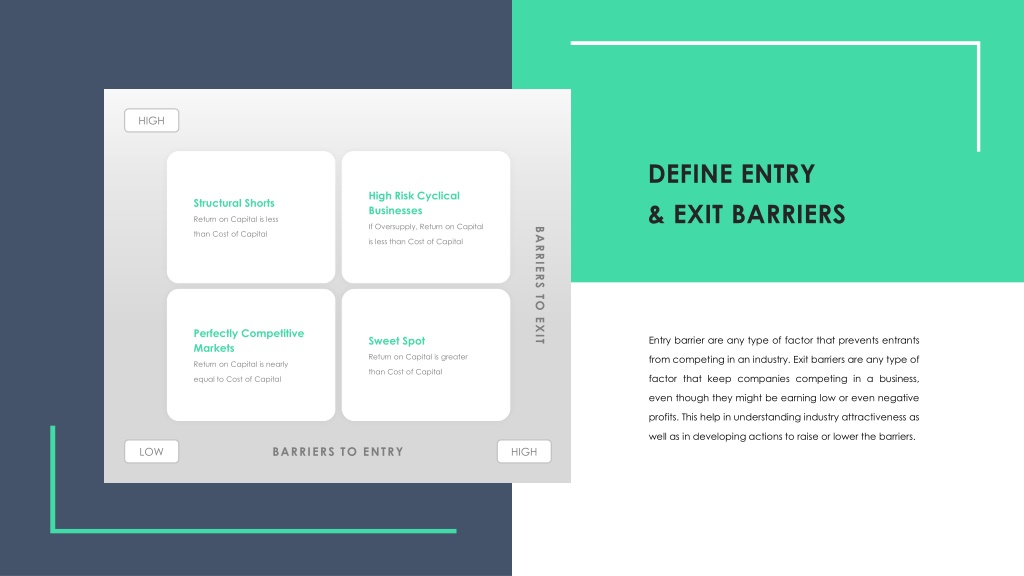

HIGH DEFINE ENTRY & EXIT BARRIERS High Risk Cyclical Businesses Structural Shorts Return on Capital is less If Oversupply, Return on Capital BARRIERS TO EXIT than Cost of Capital is less than Cost of Capital Perfectly Competitive Markets Sweet Spot Entry barrier are any type of factor that prevents entrants Return on Capital is greater from competing in an industry. Exit barriers are any type of Return on Capital is nearly than Cost of Capital factor that keep companies competing in a business, equal to Cost of Capital even though they might be earning low or even negative profits. This help in understanding industry attractiveness as well as in developing actions to raise or lower the barriers. BARRIERS TO ENTRY LOW HIGH

BARRIERS & PROFITABILITY Low High Low ENTRY BARRIERS Low, stable returns Low, risky returns High High, risky returns High, stable returns EXIT BARRIERS

POSITIONING OF INDUSTRIES IN TERMS OF BARRIERS When entry and exit barriers are high, profit potential is high but is usually accompanied by more risk. Although entry is deterred, unsuccessful companies will stay and fight. The most attractive segment - few new companies can enter and poorly-performing companies can easily exit. Local players Multinational players Dairy producers Manufacturing Pharmaceutical Aerospace ENTRY BARRIERS Here entry is relatively easy and will be attracted by upturns in economic conditions or other temporary windfalls. However, capacity will not leave the industry when result deteriorate. Food stands Grocery store The case of low entry and exit barriers is uncommon. Mining Financial services PC assembly EXIT BARRIERS

EXIT AND ENTRY BARRIERS EASY TO ENTER, DIFFICULT TO EXIT DIFFICULT TO ENTER, EASY TO EXIT INDUSTRY INDUSTRY Easy to Enter Difficult to Enter Intense Rivalry Difficult to Exit Limited Rivalry Easy to Exit DIFFICULT TO ENTER, DIFFICULT TO EXIT EASY TO ENTER, EASY TO EXIT INDUSTRY INDUSTRY Difficult to Enter Easy to Enter Changing Rivalry Difficult to Exit Moderate Rivalry Easy to Exit

COMMON TYPES OF BARRIERS TO ENTRY 01 The need for a large volume 02 A large capital investment 03 Economies of Size Capital Intensive Intellectual Property Patents and other types of of production & sales to per unit of output in facilities proprietary intellectual reach the cost level per unit tends to limit industry entry. property are very effectively of production for profitability in limiting industry entry. is a barrier to entry. 04 05 07 06 High Switching Costs Establish Identity Permitting Requirements Govt. Standards The tendency for buyers of an Industries dominated by branded Industries where permitting Industries where rigid industry s products to be reticent products are difficult to enter due and licenses are required industry standards exist about switching to a new supplier to the large amount of time & to establish production tend to have limited entry. tends to limit entry. money required to create a tend to have limited entry competing branded product.

ARTIFICIAL BARRIERS TO ENTRY PATENTS OWNERSHIP OF KEY RESOURCES 01 Restricts other companies Existing firms may own large from producing a product Amounts of vital resources BRANDING & ADVERTISING LARGE INITIAL CAPTIAL COSTS 02 Consumers may develop New firms may find it difficult brand loyalty To access enough finance SWITCHING COSTS NETWORK EFFECTS 03 Consumers wishing to switch firms Some products are only useful may incur costs and efforts because other people use them NATURAL BARRIERS TO ENTRY

type 01 type 03 type 05 Specialized assets Emotional barriers (career Strategic interrelationships (asset with values concerns, loyalty to (relationships of mutual linked to a particular employees, etc.) dependence between business or location) one business and other Government and Fixed Cost of exit such parts of a company s social restrictions as labor agreements operations) type 04 type 02 COMMON TYPES OF BARRIERS TO EXIT

ENTRY EXIT BARRIER FRAMEWORK Cost Barriers Government Policy Strategic Interrelationships Asset Specificity Switching Costs Access to Channel/IPR Exit Fixed Costs Emotional Barriers Economies of Scale Government/Social Restrictions Product Differentiation Capital Requirements BARRIERS TO ENTRY POTENTIAL BARRIERS MARKET BARRIERS EXIT BARRIERS

MARKET STRUCTURE OF BARRIERS PERFECT COMPETITION MONOPOLISTIC COMPETITION CONTESTABLE MARKETS COLLUSIVE OLIGOPOLY MONOPOLY OLIGOPOLY 1 firm with at least 25% market share 5 firm concentration ratio > 50% Several firms with brand loyalty Number of firms not important 100 s of firms A few firms fix prices Freedom of Barriers to entry A few large firms Low barriers to Freedom of entry A few firms fix entry/exit Higher prices dominate market entry and exit. Low prices and deter Homogenous than competitive Inter - Firms produce sunk costs. entry goods - perfect markets dependence of differentiate High profit like information Economies of firms products monopoly Normal profit scale Some barriers to Less profit than entry monopoly

EASY TO ENTER IF THERE IS DIFFICULT TO ENTER IF THERE IS Common technology Patented/proprietary know-how Little brand franchise Difficulty in brand switching Access to distribution channels Restricted distribution channels ENTRY AND EXIT BARRIERS Low scale threshold High scale threshold Barriers to exit work similarly to barriers to entry. Exit barriers limit the ability of a firm to leave the market and can exacerbate rivalry - unable to leave the industry, a firm must compete. Some of an industry s entry and exit barriers can be summarized as follows : Scalable assets Specialized assets Low exit costs High exit costs Independent businesses Interrelated businesses EASY TO EXIT IF THERE IS DIFFICULT TO EXIT IF THERE IS

STRATEGIES TO LIMIT COMPETITION When a firm sets price low enough to discourage new entrants into the market. Setting an artificially low price for a product in order to drive out competitors. Saturating the market with a huge range of similar products LIMIT PRICING TACTICS PREDATORY PRICING TACTICS BRAND PROLIFERATION

BARRIERS TO ENTRY IN RELATION TO PRODUCT LIFECYCLE MONOPOLY COMPETITION Barriers to entry are highest during introductory & growth stages where first movers with an industry look to earn supernormal profits by erecting barriers early on that prevent market entry & reduce competition. Promotion First Competitor Mass Production Decline Production IDEA STAGE 01 STAGE 02 STAGE 03 STAGE 03 Research & Development Product Growth Product Maturity Decline Product

STRUCTURAL VARIABLES & CONDITIONS OF ENTRY Structural Variables No. of Independent Sellers & Buyers Degree of Seller Concentration Product Differentiation Conditions of Entry Large Non-Existent Homogenous Free or easy Few Low Close Substitute Difficult Entry Two Medium Remote Substitute Entry Barred One High No Substitute

BARRIERS TO ENTRY IN RELATION TO PORTER S FIVE FORCES Threats of New Entrants Bargaining Power of Supplier Barriers to entry Economies of scale Number and size of suppliers Brand loyalty & Capital requirements Uniqueness of each supplier s product Cumulative experience & govt. policies Focal company s ability to substitute Access to distribution channels RIVALRY AMONG EXISTING COMPETITORS Threats of Substitute Products Bargaining Power of Buyers Number od substitute products available Number of customers Buyer propensity to substitute Size of customer order Relative price performance of substitute Differences between competitors Perceived level of product differentiation Buyer s ability to substitute and info. Availability Number and diversity of competitors Switching costs Switching costs and price sensitivity Industry concentration and growth Quality differences Barriers to exit and switching cost

BARRIERS TO ENTRY: EXAMPLE WITH NUMBERS 10 Year 01 Year 02 Year 03 8 6 4 2 0 Corruption Finance Taxes Policy Lack of Skilled Labour Non-competitive Practices Crime Infrastructure regulations Organised Crime Exchange Rate Instability Judiciary Uncertainity