Coffee Market Opportunity Analysis

Highlighting the potential in the global coffee market, this analysis discusses the shift towards a more fundamentally driven and volatile coffee market environment. With insights on recent market history and key factors influencing performance, it emphasizes the importance of agility and capital access for outperformance.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Coffee Market Opportunity This is not investment advice Past results are not indicative of future results / Proprietary and confidential information. Not for duplication or distribution 1

Disclaimer PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS This document is confidential and intended solely for the addressee and may not be published or distributed without the express written consent of Mileura Capital (UK) Limited, This document is not intended for public use or distribution. This document does not constitute either an offer to sell or a solicitation of an offer to buy any interest in any business, strategy or fund associated with Mileura Capital (UK) Limited. Any such offer would only be made at the time a qualified offeree receives the fund s confidential offering memorandum and related subscription documentation (together, the Offering Documents ). To the extent, therefore, there is any inconsistency between this document and the Offering Documents, the Offering Documents govern in all respects. The information contained in this document, including with respect to portfolio construction, risk management parameters and strategy-type information, is current only as of the date listed herein, supersedes any prior disclosures and is subject to change without notice. There is no secondary market for the sale of an investor s interest in any fund and none is expected to develop. In addition, there are restrictions on transferring interests in the funds. Mileura Capital has broad latitude with respect to risk management and is not subject to any formal diversification policies limiting the business, strategy or fund s portfolio investments or to policies restricting leverage, position size or duration of any position within any managed portfolio investment. Any information regarding portfolio characteristics contained herein is intended for general guideline purposes only and not as a limitation on the portfolio construction of any Mileura Capital managed fund at any time. Mileura Capital-managed assets could experience volatile performance from time to time depending on prevailing market conditions. Past performance results of a fund are not necessarily indicative of future results and future results could therefore materially vary. Neither Mileura Capital, nor its principals, officers, employees or associated funds or entities hereby makes any representation to any person or entity as to the suitability for any purpose of an investment in any fund or asset associated with Mileura Capital. Figures are rounded as applicable. Information contained herein is believed to be accurate and/or derived from sources which Mileura Capital believes to be reliable; however Mileura Capital disclaims any and all liability as to the completeness or accuracy of the information contained herein and for any omissions of material facts. Private and Confidential. 2

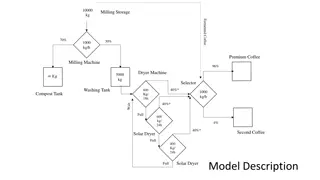

Mileura Capital Coffee Opportunity Market Background The purpose of this coffee piece is to highlight the opportunity that exists in the global coffee market. It will show that after a period of being a directionless, low volatility market we are now entering into a period where volatility is likely to be more fundamentally driven. In this type of environment being nimble and having access to capital will be unique and combination that should see a sustained period of outperformance vs piers and other soft commodity opportunities. Coffee Market A brief history of the last 5 years 2015 2020 After setting very high prices in 2014 and 2015 both in USD and domestic terms, coffee has been an oversupplied market with large visible stocks at destination. Fundamentally Driven Fundamentally Driven Independent Trade House Hedge Fund/Spec Large Merchant During 2016 and 2017 a large oversupply coupled with: a) Departure of a large pool of discretionary managed capital at funds and trade houses b) Large increase is risk premia strategies across the agricultural commodity complex that especially hit large carry markets like Arabica and Wheat Risk Premia/Carry/CTA Low Marginal Cost of Capital High Cost of Capital Low Marginal Cost of Capital High Cost of Capital Fundamentally Agnostic Fundamentally Agnostic This has left very few participants with robust fundamental analysis, capital to allocate and small overheads Past results are not indicative of future results / Proprietary and confidential information. Not for duplication or distribution 3

Coffee Fundamentals Start to Matter Fundamentals start to impact the Arabica Market Cash market basis starts to impact the spreads on Arabica for the first time in Q3/Q4 2019 Large risk premia funds become a target as fundamental buyers secure coverage in an off-cycle year With production uncertainties persisting and available supply depleting due to supply side constraints we have started to see more fundamentally driven volatility in futures and cash markets Can see Central American (CAM) and Colombia basis levels starting to rise. Correlations between Arabica spreads and basis starts increasing reflecting a fundamentally led rally in prices and spreads Past results are not indicative of future results / Proprietary and confidential information. Not for duplication or distribution 4

Coffee Stocks are Drawing Fundamentals start to impact the Arabica Market Not only are basis levels rising due to issues at origin, but we are seeing global stocks drawing down. This is not typical seasonal behaviour Below is a chart of Green Coffee Association stocks in the USA The heatmap shows the typical season pattern over the past 10 years As you can see Q1 and Q2 are not usually period of draws in stocks Past results are not indicative of future results / Proprietary and confidential information. Not for duplication or distribution 5

Certified Stocks are Changing Hands Fundamentals start to impact the Arabica Market We are now seeing the movement from and to the exchanged certified stocks In late 2019 this was because the terminal market was your cheapest source of coffee. This helped drive a move from 90c to 140c in a matter of weeks This has continued to cause issues in Q1 and Q2 in 2020 This present great trading opportunities from both sides a certified stocks move from being the cheapest to most expensive source of coffee As stocks decline it creates more volatility in spreads, physical basis and outright futures Past results are not indicative of future results / Proprietary and confidential information. Not for duplication or distribution 6

Mileura - About Mileura (Mile u rah) The name Mileura comes from the name of Mileura Station, a broadacre cattle and sheep grazing property founded in the 1880 s by the Walsh Family. It is located about 100km s west of Meekatharra W.A. Literally in the middle of nowhere. The property was named Mileura after the name of the highest elevation in the area and it literally means to see a long way . The hill was named this by the local Indigenous people of the Wadjarri Yamatji community. Today, at Mileura, we like to think we offer the same long-term perspective when working with clients and partners. Henry Walsh founded Mileura Capital in 2019 as a boutique commodities investment and advisory firm. It is focused on financing, investing and trading in global commodity markets. We believe on focusing on: Managing Risk Optimising Capital Allocation Creating Long Term Sustainable Businesses Find out more at www.mileura.com Past results are not indicative of future results / Proprietary and confidential information. Not for duplication or distribution 7