Real Estate Investment Opportunities in Coquitlam and Surrounding Suburbs

The real estate market in Coquitlam and its neighboring suburbs is experiencing significant growth and development, particularly with the completion of the Evergreen Skytrain extension. Coquitlam, Port Moody, and Westwood Plateau are emerging as prime investment locations with new transit-linked developments, increased housing density, and attractive property prices. Investors can also explore opportunities in areas like Burnaby, New Westminster, and Surrey. The region is set to see a surge in new condominium projects, presenting ample investment options for prospective buyers.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

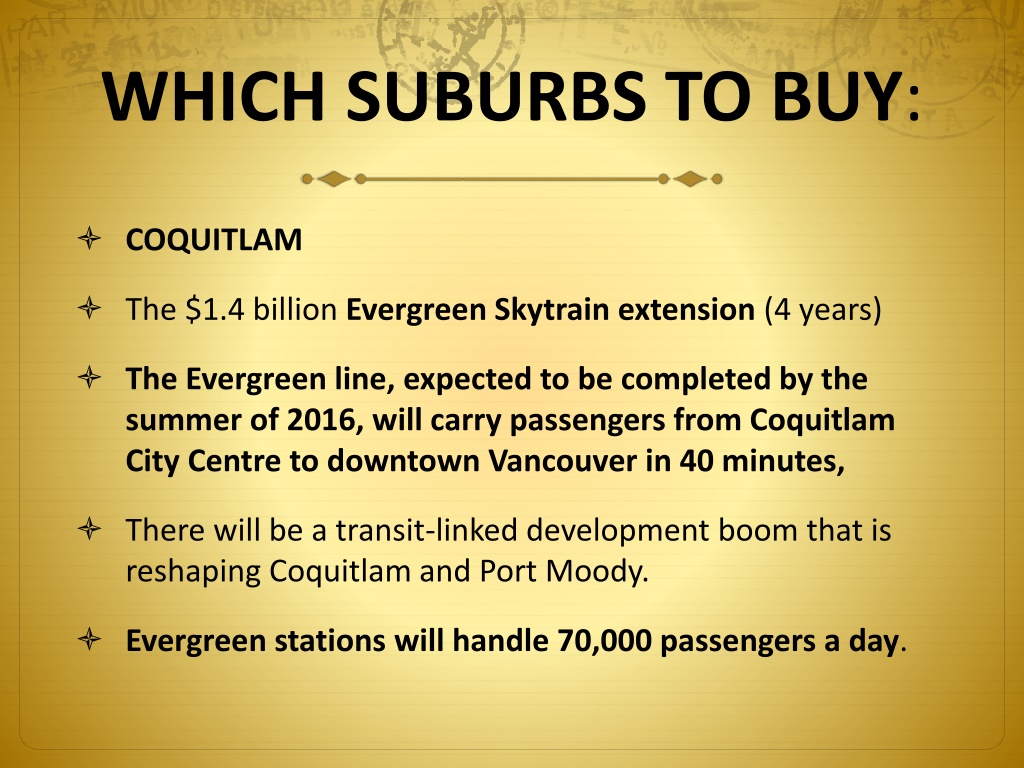

WHICH SUBURBS TO BUY: COQUITLAM The $1.4 billion Evergreen Skytrain extension (4 years) The Evergreen line, expected to be completed by the summer of 2016, will carry passengers from Coquitlam City Centre to downtown Vancouver in 40 minutes, There will be a transit-linked development boom that is reshaping Coquitlam and Port Moody. Evergreen stations will handle 70,000 passengers a day.

WHICH SUBURBS TO BUY: The City of Coquitlam increased density in Mallairdville and other established Central Coquitlam neighbourhoods The city also has passed a rule for the Southwest Coquitlam Area Plan that will allow carriage homes and garden cottages as well as triplexes and quadraplexes. The move will increase density in old neighbourhoods such as Austin Heights, Lower Lougheed and Burquitlam. Developers are starting to market more than 1,500 residential units along the Evergreen Line route, with many pushing pre-sales and aiming at investors.

WHICH SUBURBS TO BUY: Port Moody: Port Moody is lifting its no-growth restrictions and this spring will start a new official community plan to densify Moody Centre. The city had developed Newport Village and Klahanie (which we recommended investing in), but halted growth after it resulted in gridlocked traffic on St. John's, Murray and Clarke streets. Inlet view condos could be a prime investment.

WHICH SUBURBS TO BUY: WESTWOOD PLATEAU We have recommended the whole area for a number if years. The Westwood Plateau with its 5,000 sq foot homes under 1 million and 2 bedroom condos in Pt. Moody for under $250,000 will work out to be smashing investments. Burnaby - Deer Lake, Metrotown and also all of North Burnaby New Westminster has some excellent new condo buildings with great water views at $200 per sq. ft. less than downtown. The Quays have a great market and fine waterfront vistas.

WHICH SUBURBS TO BUY: Main and Broadway, proximity to the South Shore of False Creek, Canada Line and Sky train links ... condo prices still make sense. North Vancouver's Lower Lonsdale is transforming into 'Yale town North' minus the high prices. The $250 million Pier Project has added tremendous value. We like Richmond's Steveston 'Granville Island meets West Vancouver'. Great ambiance and still affordable. (First JREI- recommended condos in 2002 were $190,000.) Surrey, Whalley

CONDOS? 8,000 to come! A wave of 32 new concrete condominium buildings will deliver 8,000 units of pre-sale within in the next six months across Metro Vancouver. This is the highest level of new concrete product since 2006 when 8,700 high-rise units were launched, according to a survey by MPC Intelligence of Vancouver. As a comparison, 8,700 concrete presales began marketing in all of 2010 and 2011 combined. MPC estimates that 4,400 new concrete high-rise units were sold in 2011. There is an equal amount still for sale across the region.

CONDOS? 8,000 to come! THERE ARE ALSO 5,000 USED CONDOS FOR SALE RIGHT NOW.. HAGGLE HARD NO NEED TO RUSH! CASH FLOW EMERGING IN THE FRASER NORTH SURREY, WHALLEY, ABBOTSFORD

Sleeper: The North BC and Alta It is estimated that BC and Alberta have found extraordinary quantities of shale gas to meet its domestic needs for 200 years! Asia also eyes the oil and gas; and China has invested $10 billion in the oil sands. Royal Dutch Shell, Korean Gas, Japan's Mitsubishi Corporation and Malaysia's Petronas all interested in exploring the shipments of LNG from BC's West Coast to their markets. The Montney and Horn River natural gas fields in BC, responsible for making this province the third largest gas producer in the world, could be supplying 5.5 billion cubic feet of gas per day by 2020. Shell and Mitsubishi are considering floating offshore LNG plants.

Sleeper: Prince Rupert New potential site for another LNG Plant by BG GROUP PLC in Prince Rupert? ( entered into an agreement with the Port Authority) That makes it 6 big players (Apache Corp, Royal Dutch Shell, BC LNG Export Cooperative, Petronas and Nexen Inc.) that plan LNG Plants between Kitimat and Prince Rupert WHY? All near massive amounts of shale gas fields. Means real estate is going to do a lot better here, First step : SECURE THE LAND!

SleeperTerrace and north? BC Hydro announced it let contracts for construction of the new power line along Hwy 37 (starting at Kitwanga with a $30-40 million substation?) via BobQuinn Lake to Meziadin Junction. All that means - if it goes ahead jobs, jobs, jobs and with it needed housing. Interesting to us as real estate investors. Not much there now, but if it goes there will money be spent. Values grow where jobs go. SHIFTING POWER EAST TO WEST

KITIMAT? Kitimat House Sales Double As Pipeline Debated UP TO 30 MILLION FROM 14 MILLION Some investors are apparently confident in the future of Kitimat, the northern BC port town that would be the terminus for the $6 billion Gateway Northern Pipeline. The town is also near a new $4.2 billion liquefied natural gas plant and terminal that is expected to come on stream next year. Meanwhile, Alcan Inc. is proceeding with a billon-dollar expansion of its Kitimat smelter.

FORECLOSURES If you are looking to buy a B.C. resort this year, there is no shortage of properties for sale; many of them also in a financial bind. Some have prices slashed in half and all are open to offers. SECHELT : Now a new operator is being sought for the 18- hole facility, one of three golf courses on the Sunshine Coast. Any new operator would have to negotiate both the land lease and ownership of the existing buildings, which includes a restaurant. A prime example is the 18-hole Tower Ranch Golf Resort in Kelowna. Colliers International has it listed, with the original price slashed from $21.5 million to $14.5 million. This works out to about $25,000 per door, Colliers estimates, for the existing lots.

FORECLOSURES The 18-hole, high-end troubled Tobiano Golf Resort, at Kamloops has been on the market since last September. Saratoga Beach Golf Course on Vancouver Island just south of Campbell River is being offered under a court-ordered sale. Barnicke of Nanaimo has it listed for $1.49 million. Manning Park Resort near Hope, B.C., is also in receivership and up for sale. Sotheby's Canada has two Tofino waterfront resorts on the market: the 40-unit Clayoquot Orca Resort near Chesterman beach, listed under a court ordered sale at $2.95 million; and the 13-unit Duffin Cove Resort, at $2.35 million, according to Sotheby's agent Mark Lester.

FORECLOSURES Aviawest resorts is facing $97 million in debts on five B.C. resort projects and is under court protection until March 29. Aviawest owns the flagship Parkside Resort and Spa property in Victoria. Pinnacle Lodge at Sun Peaks Ski Resort near Kamloops; the Water's Edge Resort in Ucluelet; the Pacific Shores Resort and Spa at Parksville, and condominiums in downtown Vancouver. .

Small towns under pressure---may be deals here Chilliwack Gibson Kimberley ski condo $74,900 Revelstoke

Sunshine Coastsloooow HOUSES ON SC ON WATERFRONT .down 25% 30% LARGE LISTING INVENTORY BUT . POWELL RIVER very slow

Interior .Recovering KELOWNA/..OKANAGAN KOOTENAYS still slow Albertans not coming

Whistler - Whistler It is turning this summer... Many owners will be disappointed Phase II condos - same prices at 2000 THIS YEAR: worth a look!

Certain good market till Mayafter that uncertain The Vancouver Real Estate market will be strong through April/May If you re a seller, list now! If you re a developer with new product buy real estate ads in the Chinese newspapers now. If your target buyer is Asian learn about feng shui http://www2.jurock.com/articles/columnist.asp?id=7379) and how to market your real estate by applying it.

Certain good market til Mayafter that uncertain No Bidding Wars. A continued buyer's market without competitive bidding. Offers will be welcome. Make them! Offers over asking price will not be prevalent unless listings are underpriced. Sellers will not be insulted by a lower offer. Realtors will have more time . Today, buyers can take their time, look at several homes and think about their decision.

Certain good market till Mayafter that uncertain There will be fewer investors. Financing for investors has been tightened and is continuing to tighten. Bank of Canada Governor Mark Carney may bring in even new restrictions Investor/buyers. He has voiced concern four times in a month. INVESTORS: Refinance as soon as possible if you have mortgages coming due in the next two years. Money may be cheap but no one may be willing or able to lend.

Still buy: Trailer parks Mini Storage Strata offices Strata warehouses Resorts but only right kind of product!!!

USE NEW APPS: Realtor.ca Realtor.com Loopnet.com Zillow.net

Outcome We will muddle through Similar to Savings and Loans collapse in the nineties Similar to REIT and Mutual fund collapses the eighties Similar to Asian/Mexican/Russian currency crisis of the past