Addressing the Debt-Equity Bias: DEBRA Initiative Overview

DEBRA initiative aims to mitigate the tax-induced debt-equity bias in corporate investment decisions, reducing risks of insolvency and fostering competitiveness. By neutralizing the bias, it seeks to create a harmonized tax environment, promoting equity-based investments and combating tax avoidance practices while taking into account the impact of excessive debt on financial stability.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

The Debt Equity Bias Reduction Allowance (DEBRA) initiative

What is DEBRA? An initiative to mitigate the tax induced debt-equity bias in corporate investment decisions. The Commission announced this proposal in the Communication Business Taxation for the 21stCentury.

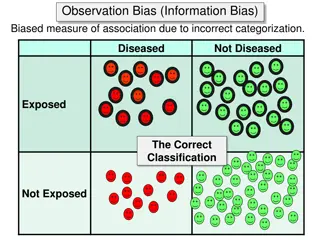

What is the tax debt bias? In many corporate tax systems: interest payments on debt-financing are tax-deductible the costs related to equity financing are not deductible This asymmetric tax treatment of financing costs induces a bias in investment decisions towards debt financing which can contribute to an excessive accumulation of debt for non-financial corporations

Risks Excessive debt levels => companies vulnerable => higher risk of insolvency. Insolvency => business restructuring => considerable social costs in the form of mass layoffs. A large number of non-performing loans can negatively affect financial stability.

Reasons to act now High levels of indebtedness of EU corporations [2019: total indebtedness non- financial corporations 99.8% of GDP in EU-27]. In 2016, proposal for an Allowance for Growth and Investment (AGI) in the Common Consolidated Corporate Tax Base (CCCTB) initiative. The COVID pandemic led to a global economic crisis and investment standstill. EU decision to move towards a green digital economy will require major investments. Companies with a solid capital structure are less vulnerable to shocks and more prone to make investments and to take risks. This can positively affect competitiveness, growth and ultimately employment.

Why act at EU level? The tax debt-equity bias is widespread across the EU. Some unilateral measures introduced by MS created opportunities for corporate tax planning and increased potentially harmful tax competition in the single market. Country specific rules can lead to misallocation of investments in the single market if companies base their investment decisions on tax planning grounds. Country specific rules also imply higher compliance costs for businesses active in cross border operations in the single market.

This initiative on neutralizing the debt-equity bias will provide for a common approach to mitigating the debt bias; alleviate distortions caused by potentially harmful tax competition in the internal market; create a harmonized tax environment for businesses that encourages equity-based investments; encompass a sound anti-abuse framework to tackle tax avoidance practices often linked to this type of measure; provide some level of tax harmonisation across the EU, which will help further remove distortions in the single market;

Timeline Inception Impact assessment published on 14 June Open Public Consultation to be launched soon Targeted consultations and bilateral meetings with relevant stakeholders (business organisations, NGOs, academics, Member States) will take place in Q2-Q3 2021. Simulation of economic and budgetary impact by the JRC using the CORETAX model Proposal to be tabled Q1 2022

Thank you very much for your participation The DEBRA team