Enhancing Agricultural Risk Protection: PMFBY 3.0 Scheme Highlights

The Pradhan Mantri Fasal Bima Yojana (PMFBY) 3.0 scheme aims to provide smart farming risk protection, showcasing significant growth in farmer applications, insured amount, and performance metrics over the years. The scheme has made strides in technology adoption, operational guidelines, and overall farmer participation, positioning itself as a globally acclaimed crop insurance program.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

PMFBY 3.0 PMFBY 3.0 Smart Scheme Smart Scheme for for Farming Farming Risk Risk Protection Protection 03rd May 2023, N Delhi

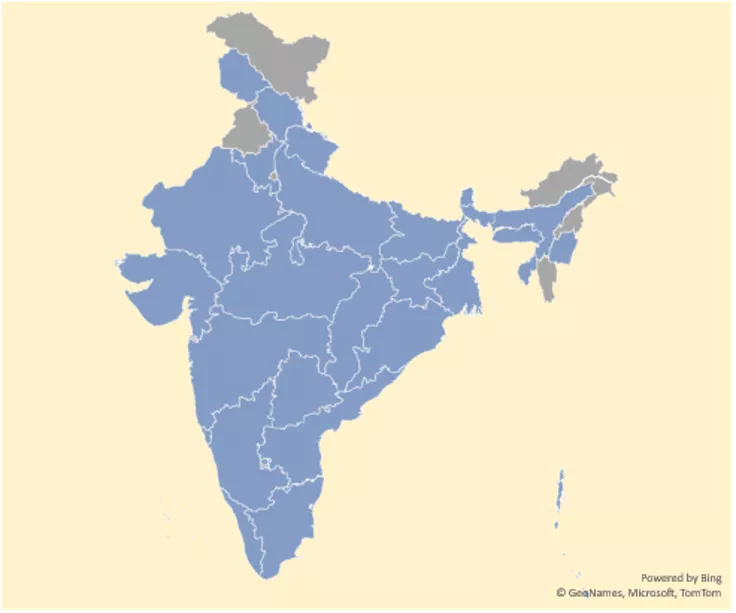

Scale of Implementation 15th Crop Season, Kharif 2023 States/UTs implemented in one of more seasons 27 >47 Crs. Farmer applications insured >14 L Crs. Value of total Sum insured Empanelled Insurance Companies (5 Public Sector Insurers and 13 Private Sector Insurers) 18 ICs >1.7 lakh Bank branches Multiple agencies involved in yield estimation MNCFC, NSSO, DE&S, Technology agencies >44000 CSC VLEs as channel partners

Tech Journey Over Last 7 Years 1. DigiClaim through NCIP 2. YES-TECH 3. WINDS 4. CROPIC 5. Krishi Rakshak Helpline 1. Revised Operational Guidelines 2. Launch of CCE-Agri App 1. Revamped PMFBY 2. Scheme made voluntary Launch of PMFBY 2021-22 2019-20 2017-18 2020-21 2018-19 2022-23 2016-17 1. NCIP- Enrollment & Subsidy 2. 1.16 Lakh Crore Claims Paid automation for 1. Tech-based yield estimation pilots 2. Launch of Crop-InsuranceApp 1. Advent of NCIP 2. Aadhar made mandatory for enrolment

Performance of PMFBY over Last Years Parameters Erst-while Scheme (2010 to 2015) PMFBY (2016-2022) Growth/ Increase Covered Loanee Applications (Lakh) 1,925 3,343 74% Covered Non-Loanee Applications (Lakh) 168 1,397 732% Total Covered Applications (Lakhs) 2,093 4,740 126% Insured Area (Lakh Ha) 2,616 3,494 34% Average Gross Premium (Rs. Crs.) 4,176 28,219 576% Average Sum Insured (Rs./Ha) 22,081 40,654 84% Average Claim per Benefitted Farmer (Rs.) 5,075 10,241 102% PMFBYhas grown to become globally: The Largest Crop Insurance Scheme in terms of Farmers participation and 3rd Largest Globally in terms of GWP PMFBY has become 3rd Largest Business line under General Insurance in the country 4

Key Key Highlights Highlights of PMFBY of PMFBY (FY 2016 (FY 2016- -22) 22) Interventions Initiated: Non-Loanee Farmer's Participation 17% Increase in Farmer s Enrolled in 2022-23 Meri Policy Mere Haath Outreach and Capacity Building campaign 218 204 Non-Loanee Farmers Insured (lakh) , Kharif 2018 , 60 Non-Loanee Farmers Insured (lakh) , Kharif 2019 , 68 177 171 Non-Loanee Farmers Insured (lakh) , Kharif 2022* , 62.16 152 Non-Loanee Farmers Insured (lakh) , Kharif 2020 , 57 Non-Loanee Farmers Insured (lakh) , Kharif 2021 , 46 Outreach-Awareness Media campaigns Loanee Farmers Insured (lakh) , Kharif 2018 , 157 Loanee Farmers Insured (lakh) , Kharif 2022* , 117.77 Loanee Farmers Insured (lakh) , Kharif 2019 , 136 Loanee Farmers Insured (lakh) , Kharif 2020 , 114 Non-Loanee %age , Kharif 2019 , 33%Non-Loanee %age , 89% increase in IEC & BCC Exp., Loanee Farmers Insured (lakh) , Kharif 2021 , 106 Non-Loanee %age , Kharif 2021 , 30% Non-Loanee %age , Non-Loanee %age , Kharif 2018 , 28% Kharif 2020 , 33% Enrollment through India Post introduced Kharif 2022* , 35% Loanee Farmers Insured (lakh) Non-Loanee Farmers Insured (lakh) Non-Loanee %age Achievements: Overall Enrollment Increased Non-Loanee Enrollment Increased 5

PMFBY Implementation Partners PMFBY Implementation Partners No. of States/UTs, 2016-17, 26 No of States/UTs, 2016-17, 26 No. of States/UTs, 2017-18, 26 No. of States/UTs, 2018-19, 26 No of States/UTs, 2017-18, 26 No. of States/UTs, 2019-20, 24 No. of States/UTs, 2023-24, 24 No of States/UTs, 2023-24, 24 No of States/UTs, 2018-19, 26 No. of States/UTs, 2022-23, 21 No of States/UTs, 2019-20, 24 No. of States/UTs, 2020-21, 20 No. of States/UTs, 2021-22, 20 No of States/UTs, 2020-21, 20 No of States/UTs, 2022-23, 21 No. of Implementing Insurers, 2018-19, 17 No of States/UTs, 2021-22, 20 No. of Implementing Insurers, 2016-17, 16 No of Implementing Insurers, 2016-17, 16 No. of Implementing Insurers, 2017-18, 16 No. of Implementing Insurers, 2019-20, 14 No. of Implementing Insurers, 2023-24, 14 No of Implementing Insurers, 2023-24, 14 No of Implementing Insurers, 2018-19, 17 No of Implementing Insurers, 2017-18, 16 No. of Implementing Insurers, 2020-21, 11 No. of Implementing Insurers, 2022-23, 11 No of Implementing Insurers, 2022-23, 11 No of Implementing Insurers, 2019-20, 14 No. of Implementing Insurers, 2021-22, 10 No of Implementing Insurers, 2020-21, 11 No of Implementing Insurers, 2021-22, 10 No. of States/UTs No. of Implementing Insurers No of States/UTs No of Implementing Insurers Prospects: Achievements: Jharkhand, Punjab & Telangana actively considering rejoining Two more Insurers have confirmed their plan for return 1 more insurer has applied for empanelment Andhra Pradesh re-joined United India (PSU) and ICICI Lombard re-entered 6

Growth of Crop Insurance under PMFBY Erst-while Schemes 2010-2015 PMFBY & RWBCIS 2016-2021 Series1, Other Misc., 13817, 6% Non-Life Segment-wise Gross Premium 2021-22 Non-Life Segment-wise Gross Premium 2015-16 Series2, Marine, 2984, 3% Series2, Health, 27457, 28% Series1, Marine, 4168, 2% Series2, Other Misc., 9299, 10% Series1, Health, 80502, 36% Series1, Fire, 21551, 10% Series2, Fire, 8731, 9% Series2, Crop Insurance , 5606, 6% Series1, Crop Insuranc e, 30229, 14% Health Series2, Motor, 42301, 44% Health Series1, Motor, 70433, 32% Other Misc. Motor Crop Insurance Fire Marine Other Misc. Motor Crop Insurance Fire Marine Crop Insurance contributed only 6% of Gross Premium Crop Insurance contribution grew to 14% of Gross Premium 7

Improvement in Out-standing Premium and Claims upto Kharif 2022 Total Claims Pending, Under Process, 44, 1% Total Claims Pending, Other, 300, 10% Total Claims Pending (Rs. Crores) Total Claims Pending, Rajasthan, 1,493 State wise Pending Subsidies & Claims (Rs. Crores) State Subsidy Pending* (Rs. in crore), Maharashtra, 1,218 State Subsidy Pending* (Rs. in crore), Andhra Pradesh, 1213 Outstanding Claims Reduced from Rs. 3,700 Cr to Rs. 3,100 Cr Total Claims Pending, State Subsidy, 2759, 89% Pending State Subsidy- Reduced from Rs. 11,000 Cr to Rs. 4,000 Cr State Subsidy Pending* (Rs. in crore), Gujarat, 860 Total Claims Pending, Maharashtra, 547 Total Claims Pending, Other States, 643 State Subsidy Yield Data Other Under Process Total Claims Pending, Maharashtra, 547 , 18% Total Claims Pending State Subsidy Pending* (Rs. in crore), Other States, 207 Pending, Odisha, 83 State Subsidy Pending* (Rs. in crore), Rajasthan, 203 State Subsidy Pending* (Rs. in crore), Madhya Pradesh, 168 Andhra Pradesh, 0 Total Claims Pending, Odisha, 83, 3% Total Claims Pending, Gujarat, 259 State Subsidy Pending* (Rs. in crore), Odisha, 166 Pradesh, 78 Total Claims Pending, Madhya 643 , 21% Total Claims Pending, Gujarat, 259 , 8% Total Claims Pending, Total Claims Total Claims Pending, Madhya Pradesh, 78, 2% Total Claims Pending, Rajasthan, 1,493 , 48% Total Claims Pending, Andhra Pradesh, 0, 0% Madhya Pradesh Maharashtra Gujarat Odisha Rajasthan Other States Andhra Pradesh State Subsidy Pending* Total Claims Pending *AY data and payable claims for Kharif 2021, Rabi 2021-22 & Kharif 2022 are yet to be finalized for Madhya Pradesh # as on 31st Mar 2023

Challenges Challenges Which were Identified . Which were Identified .

Issues of Farmers & States Delay in subsidy release & furnishing of AY data by States Disputes by Insurance Company Negative Impression 01 Delay in Claim Settlement Moral Hazard High losses leading to high premium Unreliable crop yield estimation Financially Unviable High Financial Liabilities on States 02 Information access is limited Unaware of benefits, processes & query resolution Mis-information 03 Lack of Information Access Mechanism for small grievances No monitoring of resolved & unresolved cases Trust Deficit Imperfect Grievance Redressal 04

Other Implementation Issues Loss assessment reports are disputed Crop Yield estimation through CCEs is often disputed All lead to delay in claim settlement Stakeholder Exit from PMFBY 01 Loss assessment reports are disputed Crop Yield estimation through CCEs is often disputed All lead to delay in claim settlement Unreliable Loss & Yield Assessment 02 Implementation, e.g. NHA (9000 Crs. Scheme) Dispute resolution between States & ICs Innovation Inadequate Institutional Framework 03 States have limited technical capabilities for IT system & Insurance analytics & execution PMU Facilitation & IT Experts deployment Limited Technical Capabilities with States 04

Interventions Interventions for Implementation for Implementation

Opening doors to Universal Coverage of Farmers under Scheme AP is 1st state to adopt universal Coverage MH has announced from Kharif 2023 Pro-Farmer Initiatives undertaken in PMFBY NCIP for Enrollment, Crop Loss Intimation and Tracking Claim Status Disbursement of claim directly into Farmers Accounts Development of Krishi Rakshak Helpline & Portal for Farmers Grievance Redressal & Query Resolution 13

e-claim settlement Direct payment of claims into Farmers Account Information through SMS Tracking of Claim status on NCIP Real-time monitoring of claim settlement by the States/UTs Automatic Penalty on delay Digi-Claim Module for Disbursement of Claims of PMFBY PFMS NCIP 14 Insurance Company Eligible Farmer

Technology Adoption (Yes-Tech, WINDS & CROPIC) for Objective Crop Damage & Loss Assessment Expenditure support to States Min. Threshold of Tech Driven data Incentivization for Yield Estimation through CCE App & Crop Health Monitoring State/UTs specific Initiatives Undertaken in PMFBY NCIP for Auto-Administration, Subsidy Payment, monitoring Claim Settlement and Penalty for Delay Historical Yield Data for Risk Analysis for Tendering Increase in Central Subsidy contribution to 90% for Himalayan States to promote Insurance Coverage Alternate Risk Participation Models in addition to PMFBY 16

Milestones & Implementation Update State to be assisted with setting-up PMUs More number of States and Insurers Comprehensive Communication & Capacity Building plans in place Fostering Product Sandbox & Innovation 05 Technology enabled Crop Yield Assessment Models Approved State can choose from any of the approved technologies Incentivization for use of Mobile based CCEs Photo-Analytics Pilot initiated 03 Stakeholders Enhancement of NCIP Alternate Risk Models Approved Profit & loss sharing (0-350) Cup & Cap (60:130) Cup & Cap (80:110) 01 YES-TECH, WINDS & CROPIC Digi-Claim Module Krishi Rakshak Helpline Land records integration of 6 States, while, Haryana, UP and HP are pipeline NCIP to be only Source of Truth Subsidy Management 04 System Integration with all stakeholders in pipeline Alternate Risk Sharing Mechanism Premium payment through Escrow Account before Enrolment. Central Share Delinking Approved 02

Expectations from States Publishing the Tenders ASAP to leverage Early Bird s Advantage YESTECH Implementation for major crops across states from Kharif 2023 WINDS Setting up Network for AWS & ARGs for Hyper-local Weather Data CROPIC--Crop Damage Assessment through Crop Photo-analytics State & UTs Already Published & Closed: KR & CG Average Premium Reduction is 15% & 6% respectively J&K, TP & AS existing Bids are valid till 2024 Rest of the States & UTs: Tenders yet be Published PMFBY Tender Publishing & Bid Status States & UTs to ensure All major Crops are notified and Tenders for PMFBY are called before the ensuing Climatic Impact becomes Obvious & Lead to High Premiums:

Expectations from States Implementation of YESTECH & WINDS Selection of MITR & Discussions for Roll-out Selection of Crops & Districts for YESTECH Selection of Technology Implementation Partner (TIP) for YESTECH through open Tender Preparation for Technology Implementation Selection of Winds Implementation Partners (WIP) for WINDS through open Tender Onboarding of TIPs & WIP and rollout before the inception of Kharif 2023