Company Conversion, Incorporation, and Certificate Issuance Process

The process of converting a public company into a private company, incorporation requirements, and the issuance of a Certificate of Incorporation are outlined in detail. Key steps include filing a petition, subscriber details, affidavit submission, address requirements, and CIN allocation. Relevant images are included for better understanding.

- Company Conversion

- Incorporation Procedure

- Certificate of Incorporation

- Corporate Identity

- Legal Requirements

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Conversion of Company The Act provides for The Act provides for conversion of public company conversion of public company into a private company and vice versa into a private company and vice versa A private company is converted into a public A private company is converted into a public company either company either by default or by choice by default or by choice in in compliance with the statutory requirements. compliance with the statutory requirements. Once the action for conversion takes place then, Once the action for conversion takes place then, a petition can be filed with the central government a petition can be filed with the central government with the necessary documents for its decision on with the necessary documents for its decision on the matter of conversion

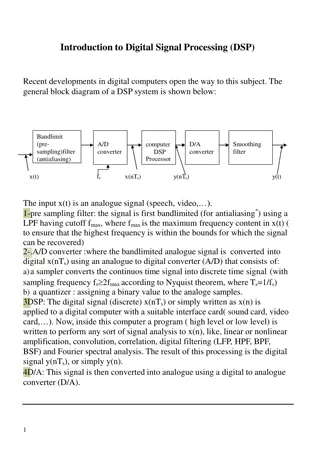

Incorporation of a Company Section 7 of the Companies Act, 2013, details the procedure for incorporation of a company. The Memorandum and Articles of the company. All subscribers have to sign on the memorandum. The person who is engaged in the formation of the company has to give a declaration regarding compliance of all the requirements and rules of the Act. A person named in theArticles also has to sign the declaration. a) Each subscriber to the Memorandum and individuals named as first directors in theArticles should submit an affidavit with the following details:Declaration regarding non-conviction of any offence with respect to the formation, promotion, or management of any company. b) He has not been found guilty of fraud or any breach of duty to any company in the last five years. c) The documents filed with the registrar are complete and true to the best of his knowledge.

Incorporation of a Company Address for correspondence until the registered office is set-up. If the subscriber to the Memorandum is an individual, then he needs to provide his full name, residential address, and nationality along with a proof of identity. If the subscriber is a body corporate, then prescribed documents need to be provided. Individuals mentioned as subscribers to the Memorandum in the Articles need to provide the details specified in the point above along with the Director Identification Number. The individuals mentioned as first directors of the company in the Articles must provide particulars of interests in other firms or bodies corporate along with their consent to act as directors of the company as per the prescribed form and manner.

Issuing the Certificate of Incorporation Once the Registrar receives the information and company registration papers, he registers all information and documents and issues a Certificate of Incorporation in the prescribed form. Corporate Identity Number (CIN) The Registrar also allocates a Corporate Identity Number (CIN) to the company which is a distinct identity for the company. The allotment of CIN is on and from the company s incorporation date. The certificate carries this date.

Advantages of Incorporation Independent corporate existence- the outstanding feature of a company is its independent corporate existence. By registration under the Companies Act, a company becomes vested with corporate personality, which is independent of, and distinct from its members. Acompany is a legal person. Limited liability- limitation of liability is another major advantage of incorporation. The company, being a separate entity, leading its own business life, the members are not liable for its debts. The liability of members is limited by shares; each member is bound to pay the nominal value of shares held by them and his liability ends there.

The decision of the House of Lords in Salomon v. Salomon & Co. Ltd. (1897 AC 22) is an authority on this principle: One Salomon incorporated a company to take over his personal business of manufacturing shoes and boots. The seven subscribers to the memorandum were all his family members, each taking only one share. The Board of Directors composed of Salomon as managing director and his four sons. The business was transferred to the company at 40,000 pounds. S took 20,000 shares of 1 pound each n debentures worth 10,000 pounds. Within a year the company came to be wound up and the state if affairs was like this: Assets- 6,000 pounds; Liabilities- Debenture creditors-10,000 pounds, Unsecured creditors- 7,000 pounds. It was argued on behalf of the unsecured creditors that, though the co was incorporated, it never had an independent existence. It was S himself trading under another name, but the House of Lords held Salomon & Co. Ltd. must be regarded as a separate person from Salomon.

Advantages of Incorporation Perpetual succession- An incorporated company never dies. Members may come and go, but the company will go on forever. During the war all the members of a private company, while in general meeting, were killed by a bomb. But the company survived, not even a hydrogen bomb could have destroyed it (K/9 Meat Supplies (Guildford) Ltd., Re, 1966 (3) All E.R. 320). Common seal- Since a company has no physical existence, it must act through its agents and all such contracts entered into by such agents must be under the seal of the company. The common seal acts as the official seal of the company

Advantages of Incorporation Transferable shares- when joint stock companies were established the great object was that the shares should be capable of being easily transferred. Sec 82 gives expression to this principle by providing that the shares or other interest of any member shall be movable property, transferable in the manner provided by the articles of the company. Separate property- The property of an incorporated company is vested in the corporate body. The company is capable of holding and enjoying property in its own name. No members, not even all the members, can claim ownership of any asset of company s assets.

Advantages of Incorporation Capacity for suits- A company can sue and be sued in its own name. The names of managerial members need not be impleaded. Professional management- A company is capable of attracting professional managers. It is due to the fact that being attached to the management of the company gives them the status of business or executive class.

Disadvantages of Incorporation of a Company Formality and expense- Ongoing Paperwork Difficulty Dissolving Loss of Personal Ownership

Disadvantages of Incorporation of a Company Lifting of the corporate veil : The corporate veil is the term given to the imaginary barrier that separates the company from those who direct it and from those who own it. But there may arise instances where under the shade of this, fraudulent or illegal acts are committed. As artificial persons are incapable of doing anything illegal or fraudulent, the fa ade of the corporate personality have to be removed to identify the persons who are really guilty.

Lifting of the corporate veil The basic concept of the lifting of the corporate veil can be categorized broadly under two categories- Statutory Provisions. Judicial interpretation.

Lifting of the corporate veil Statutory Provisions: Misstatement in Prospectus : Under Section 26 (9), Section 34 and Section 35 of the Act, it is made punishable to furnish untrue or false statements in prospectus of the company. Failure to return application money:- Under Section 39 (3) of the Act, against allotment of securities, if the stated minimum amount has not been subscribed and the sum payable on application is not received within a period of thirty days from the date of issue of the prospectus, then such officers in default are to be fined with an amount of one thousand rupees for each day during which such default continues or one lakh rupees, whichever is less

Misdescription of Companys name:- The name of the company is most important. Usage of approved name entitles the company to enter into contracts and make them legally binding. Thus, if any representative of the company collect bills or sign on behalf of the company, and enter in incorrect particulars of the company, then such persons are to be held personally liable.

Fraudulent conduct:- Under Section 339 of the Act, wherever in case of winding up of the company, it is found that company s name was being used for carrying out a fraudulent activity, the Court is empowered to hold any such person be liable for such unlawful activities, be it director, manager, or any other officer of the company

Inducing persons to invest money in company:- Under Section 36 of the Act, any person who makes false, deceptive, misleading or untrue statements or promises to any other person or conceals relevant data in that cases the person is person is personally liable

Furnishing false statements:- Under Section 448 of the Act, if in any return, report, certificate, statement, prospectus, statement or other document required, any person makes false or untrue statements, or conceals any relevant or material fact, then he is liable under Section 447 of the Act financial

Judicial Pronouncements : Tax Evasion:- It s duty of every earning person to pay respective taxes. Company is no different than a person in eyes of law. If anyone attempts to unlawfully avoid this duty, he is said to be committing an offence. Sir Dinshaw Maneckjee, Re / Commissioner of Income Tax v. Meenakshi Mills Ltd. where the founding person of 4 new private companies, Sir Dinshaw, was enjoying huge dividend and interest income, and in order to evade his tax, he thus found 4 sham companies. His income was credited in accounts of these companies and these amounts were repaid to Sir Dinshaw but in form of a pretended loan. These loans entitled him to have certain tax benefits. It was rather held that purpose of founding these new companies was simple as means of avoiding super-tax

Prevention of fraud/ improper conduct:- It is obvious that no company can commit fraud on it s own. There has to be a human agency involved to commit such acts. Thus, one may make efforts to prevent upcoming frauds. In Gilford Motor Co v. Horne : a company was restrained from acting when its principal shareholder was bound by a restraint covenant and had incorporated a company only to escape the restraint.

Determination of enemy character : In the case Dailmer Co Ltd vs. Continental Tyres & Rubber Co Ltd The facts were such that a Germany based company was incorporated in England to sell tyres manufactures in Germany. The German company had however held the bulk of shares in this English company. As World War I broke out, the English company commenced an action to recover trade debt. The question was brought before House of Lords which decided the case against the claimant, stating that, company is not a real person but a legal entity, it cannot be a friend or an enemy. However, it may assume an enemy character when persons in de facto control of it s affairs are residents of the enemy territory. Thus, the claim was dismissed