Understanding Corporate Veil Piercing in Company Law

Explore the concept of piercing the corporate veil in company law, examining exceptions to limited liability through cases like fraud, single economic entity theory, agency relationships, and statutory pierce. Learn how different legal systems approach corporate veil piercing and its implications on shareholder liability.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Belaynew Ashagrie 1 LECTURE 9 COMPANIES LIMITED BY SHARES 10/6/2024

Mandatory readings 2 Ethiopian Commercial Code of 1960, Arts. 304-509 Fekadu Petros, Ethiopian Company Law, (Amharic), p. 35 et seq, 2012 Endalew Lijalem, The Doctrine of Piercing the Corporate Veil: Its Legal and Judicial Recognition in Ethiopia, Mizan Law Review, Vol. 6 No.1, June 2012 Getahun Seifu, Revisiting Company Law with the Advent of Ethiopia Commodity Exchange (ECX): An Overview, Mizan Law Review, Vol. 4 No.1, March 2010 Tikikile Kumulachew, Regulation of Initial Public Offering of Shares in Ethiopia: Critical Analysis and Challenges, Business Law Series, AAU, Vol. IV, 2011, Nicholas Bourne, Principles of Company Law, 3rd ed., 1998 Belaynew Ashagrie 10/6/2024

Nature of SC 3 Separate legal existence (the Salomon Principle) The legal personality of share companies is separated from its shareholders. The case of Salomon v. Salomon & Co. Ltd [1897] 2. Limited liability (corporate veil or shell) Liabilities are meet only by the assets of the company. (corporate liability, 304(1)) Members shall be liable to the extent of their share, or to the extent of their promise to pay, for their shares. (individual liability, 304(2)) 1. Belaynew Ashagrie 10/6/2024

Piercing the Corporate Veil 4 Exceptions to limited liability/corporate veil: in common law (England) Fraud: when the formation and subsequent existence of a company constitutes a fraudulent abuse of the company To establish a single economic entity: based on two interrelated theories: alter ego and single enterprise theory. E.g. in case of (1) group of companies (parent-subsidiary or sister companies), (2) one-man company On the ground of agency: i.e. in cases where the company is acting as an agent of the shareholders. E.g. holding and subsidiary company. It is usually used for the purpose of liability of tax. 1. 2. 3. Belaynew Ashagrie 10/6/2024

Piercing the Corporate Veil 5 Exceptions of corporate veil: civil law (France) Statutory pierce In case of bankruptcy: managers or persons who used company s property as his own shall be liable if its assets are not sufficient Controlling shareholder(s): who own(s) more than half of the shares of a company Judicial pierce: relates to cases in which valid agreements in restraint of trade was concluded. De facto companies (companies existing in fact without fulfilling the requirements of the law): e.g. If the company members are reduced below the legal minimum (Applied only in case of public limited company- has a minimum of 7 members) 1. 1. 2. 2. 3. Belaynew Ashagrie 10/6/2024

Piercing the Corporate Veil 6 Exceptions of corporate veil: Ethiopia Bankruptcy: Articles 531 and 1160(1) In case of failure of directors to discharge duties diligently: Art. 366, i.e. their failure to preserve the company s assets intact and the resultant insufficiency of the company s assets to meet its liabilities. Upon reduction of members below the legal minimum: Art. 311 1. 2. 3. Belaynew Ashagrie 10/6/2024

Piercing the Corporate Veil 7 4. In group companies: in related companies; i.e. vertically between parent-subsidiary or horizontally in affiliated/sister/sibling companies. E.g. Art. 347 (4), 364 (1), cum. 366. This is so if the parent company is appointed as a director of the subsidiary company. See also Art. 1160 5. In case of trade restraint: Art. 158, Art. 30(1). E.g. when they establish closely held company to evade legal or contractual restraint. Belaynew Ashagrie 10/6/2024

Piercing the Corporate Veil 8 The judicial recognition of piercing the corporate veil in Ethiopia Mosvold (Ethiopia) Ltd. v. The Inland Revenue Department (1965) Feven Zemen et al v. Askalukan Trading PLC and Others 1. 2. Belaynew Ashagrie 10/6/2024

Nature of SC 9 3. Useful for carrying out large business Its basic purpose is to accumulate large capital. Whereas partnerships can t issue share, rather they collect capital from the partners only. 4. Personality of members unimportant. Unlike partnerships, members of the companies may not know to each other (members purchase share from sharemarket and become members, 341. The company may not know the members, 340) SC is an aggregate of capital than persons. (It is intitue pecunea) Belaynew Ashagrie 10/6/2024

Nature of SC 10 5. Separation of ownership and management: The owners, i.e. shareholders of SC may not directly engage in control of the company. Rather, the overall activities and day-to-day functions of the SC is vested up on board of directors who are to be appointed by the shareholders. 6. Capital: The capital of a SC should be fixed in advance. The minimum capital required for SC is 50,000 ETB. (Art. 306) Such capital has to be necessarily divided in to shares irrespective of mode of formation of SC. The par value of each share shall not be less than 10 br. Belaynew Ashagrie 10/6/2024

Nature of SC 11 7. Shares are easily transferable (Arts. 325, 333) Since shares are easily transferable, the number of its shareholders may fluctuate. As a result, there may not be permanent shareholder(s). 8. SC can issue debentures: Since SC needs large capital, in case where there is shortage of capital, it can acquire such capital through issuing debt security, i.e. debenture. Debenture is different from government bond and treasury bill. Issuing debentures is allowed only to SC. Belaynew Ashagrie 10/6/2024

Nature of SC 12 Never die Even if total members of a company perish or disappear in whatever cause, the identity of the company may remain same. Members may change (due to death, bankruptcy, insolvency) but does not affect continuity of the company Belaynew Ashagrie 10/6/2024

Nature of SC 13 Concepts that may be viewed as drawbacks of incorporation Formation formalities and procedures are cumbersome Incorporation requires expenditure Separation of fund and management Social responsibility Belaynew Ashagrie 10/6/2024

Classification of Companies 14 There are various classifications of companies throughout the world. For example, in Anglo- American system companies are grouped as public and private. In Ethiopia companies are grouped as Share Companies and PLCs. PLC in Ethiopia resembles private companies in Anglo-American. PLCs are sometimes known as family companies since the members should know to each other. Belaynew Ashagrie 10/6/2024

Classification of Companies 15 Share companies are found in different countries with different names. For example, In Germany: Stock Corporation (Aktiengebellschaft) In England: public company limited by shares In Belgium: public company limited by shares (societe anonyme) In France: public limited company (societe anonyme) Belaynew Ashagrie 10/6/2024

Classification of Companies under Ethiopian Law 16 Based on manner of incorporation Registered companies: SC and PLC Statutory companies/public enterprises Based on extent of liability Unlimited liability (OP and GP) Limited liability (SC and PLC) Mixed liability (LP) 1. a) b) 2. a) b) c) Belaynew Ashagrie 10/6/2024

Classification of Companies under Ethiopian Law 17 3. Based on the range of minimum membership and capital SC PLC Public enterprises 4. Based on extent of control Holding/parent companies Subsidiary companies a) b) c) a) b) Belaynew Ashagrie 10/6/2024

Classification of Companies under Ethiopian Law 18 5. Based on type of ownership and reporting obligations State owned companies Non-state companies Public: Art. 317 Private: Art. 316 6. Based on place of establishment Local/Domestic companies Foreign companies a) b) a) b) a) b) Belaynew Ashagrie 10/6/2024

Classification of Companies under Ethiopian Law 19 Foreign companies can operate in Ethiopia as: Wholly foreign owned branch company Wholly foreign owned company incorporated in Ethiopia Joint investment with the government or with domestic investor Wholly foreign owned privatized company 1. 2. 3. 4. Belaynew Ashagrie 10/6/2024

Classification of Companies under Ethiopian Law 20 Questions: with regard to the classification of companies under Ethiopian law discussed so far: What is the place of Ethiopian Commodity Exchange (ECX)? What is the place of cooperative societies? 1. 2. Belaynew Ashagrie 10/6/2024

Basic features of ECX 21 Ownership and control mechanisms Membership: Requirements, rights and obligations- individuals, BO, public enterprises, cooperatives Operational management a. b. c. Belaynew Ashagrie 10/6/2024

Characterization of ECX 22 ECX is a commercial entity Non-transfer of profits/dividend to the State Unique public-private shared board of directors structure ECX is a self-regulatory organization ECX is a hybrid-model company Therefore, ECX has both share company and public enterprise features. a. b. c. d. e. Belaynew Ashagrie 10/6/2024

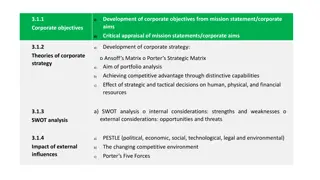

Share companies v Private limited companies 23 SC PLC Requires big capital (>= 50,000) Governed by board of directors Audited annually by external auditor Undertakes annually general meeting and pass resolutions Strict keeping of books and accounts Strict regulation of capital Lower capital required (>= 15,000) No board of directors No external auditor unless its shareholders are more than twenty Not required to undertake general meeting Less stringent requirement of books and accounts Less stringent regulation of capital Belaynew Ashagrie 10/6/2024

Share Companies v Private limited companies 24 Compared with PLCs, the law provides strict provisions that must be complied by SC. It is for two basic reasons: To keep the interest of its shareholders, To keep the interest of third parties who deal with the company. 1. 2. Belaynew Ashagrie 10/6/2024

Discussion Questions 25 What do you think is the development stage of companies in Ethiopia? Do you think that there are sufficient companies in our country which are formed to do business? What are the major legal and practical challenges to establish companies in Ethiopia? Why people fear to establish company? Do you believe that Ethiopia needs reformation of its company regime? Are there any issues related to institutional framework regulating companies in Ethiopia? Do you think that Ethiopia s commitment to join WTO demand legal and institutional reform? 1. 2. 3. 4. 5. 6. 7. Belaynew Ashagrie 10/6/2024

Formation of Share Companies (Incorporation), Art. 312 et seq. 26 Incorporation is the birth of business organizations. However, public enterprises are established by law/regulation. Incorporation of companies requires a rigorous procedure. Belaynew Ashagrie 10/6/2024

Incorporation 27 A SC in Ethiopia can be founded in two ways. 1.Closed company (Art. 316)- shares are not open to the public. The founders themselves subscribe the whole approved and issued capital of the company. 2. Public subscription (Art. 317)- offering shares to the public for subscription in accordance with Arts 318-322. In this case there are procedures to be followed. Preformation stage (like drafting MoA, AoA) then issuing prospectus. Belaynew Ashagrie 10/6/2024

Stages of Incorporation 28 Fixing the capital and the shares; Art. 304 a) Time of payment b) Amount to be paid before registration- at least of the capital c) Contribution in kind- has to be paid before registration, 315 & 339 Partnership agreement/memorandum of association (MoA) and articles of association (AoA) Promotion by promoters Prospectus Minimum number of membership: 5. These are subscribers of SC. All shares of the company has to be subscribed. Registration/publicity 1. 2. 3. 4. 5. 6. Belaynew Ashagrie 10/6/2024

Incorporationcontd 29 MoA v AoA MoA and AoA are public documents. They are interlinked and required to be registered for the formation of the company. Where there is any ambiguity or where the memorandum is silent on any point, the articles may serve to explain or supplement the memorandum. Belaynew Ashagrie 10/6/2024

Incorporationcontd 30 MoA AoA The constitution of the company and defines the scope of its activities. Defines the relation of the company with outside world A supreme document of the company A company can not depart from the provisions contained in its memorandum, and if it does, it would be ultra vires Regulates the internal management of the company. Deal with the rights of the members of the company inter se and also establishes the relationship of the company with the members. Subordinate to the memorandum; it cannot alter or control the memorandum. Any thing done against the provisions of articles, but which is intra virus the memorandum, can be ratified. Belaynew Ashagrie 10/6/2024

Incorporationcontd 31 Founders of Company (Art. 307): founders include persons who: sign on a MoA and subscribe the whole of the capital; sign on the prospectus, bring in contributions in kind or are to be allocated a special share in the profits; initiated or facilitated the formation of the company. Belaynew Ashagrie 10/6/2024

Incorporationcontd 32 Rights of Founders Special share of profit- 310(1) The right to be a member of the company Making contribution in kind Right to be reimbursed expenses of the promotion, 308 Possibility to be appointed as first administrators of the company. Belaynew Ashagrie 10/6/2024

Incorporationcontd 33 Dutiesof Founders Offering shares to the public for subscription and collecting capital; Preparing MoA and AoA; Valuation of in kind contributions; Calling and conducting of meeting of subscribers; To register the company before the Ministry; Entering in to different contracts at the time of its formation; Etc. Belaynew Ashagrie 10/6/2024

Incorporationcontd 34 Liabilities of founders To third parties; Art. 308 and 309 There are two conditions under 308(2) to make founders to relieve from pre-formation liabilities: commitments and expenses necessary for the formation of the company and approved by the general meeting of the subscribers. To subscribers: Art. 312(3), i.e. to repay if the company is failed to register To the company: Art. 309(1) 1. 2. 3. Belaynew Ashagrie 10/6/2024

Incorporationcontd 35 Why the law emphasizes on founders? In order to determine who will be liable if the subscriber is going to be damaged; After the formation of the company, in order to recognize and determine who will be rewarded for his commitment to establish the company. 1. 2. Belaynew Ashagrie 10/6/2024

Incorporationcontd 36 Prospectus is a legal document that usually contains information about the company to be formed and that includes the text of the draft MoA, a summary of the principal provisions of the AoA, the expert report of the valuation of contributions in kind and as provided under Art. 318. Question: is it possible to include other particulars other than those provided under Art. 318? Belaynew Ashagrie 10/6/2024

Shares and Debentures of S.C 37 Shares: It s chose-in-action: a property that one does not actually perceive, as it has no physical existence but a right that can be enforced by legal action. Share can also be perceived as part of the share capital of the company. Article 304 Share may be conceived as the document evidencing membership in the company. Such document is called share certificate. Shares are by nature indivisible. (Art. 328) However, one share may be held jointly by several persons. Par value: shall not be less than 10 br. Prices of shares: is actual price at which shares are to be issued and that must be mentioned in the prospectus. 318(1)(e) Belaynew Ashagrie 10/6/2024

Forms and classes of shares: 38 I. Forms of shares, 325: Registered and Bearer. Registered share: the name of the person is required to appear in the company s register. The owner of a bearer share, for most purposes, is the possessor. All shares shall be registered in the name of the shareholder. Bearer share are prohibited by law, MoA, AoA. II. Classes of shares, 335: ordinary, preferences and dividend. Belaynew Ashagrie 10/6/2024

Forms and classes of shares: 39 Ordinary S. entitle their holder to exercise identical rights, or shares carrying identical obligations. Preference S. may be created either in the MoA or by resolution of an extraordinary general meeting. Dividend S. may be issued to shareholders up on redemption of the ordinary shares. Shareholders whose shares are thus redeemed shall receive dividend shares. NB: all shares of the same class shall have the same par value and the same right, 335(2) Belaynew Ashagrie 10/6/2024

Assignment of Shares 40 Shares mayfreely be transferred. Exceptionally, the law or the company may prohibit the free transfer of a share, 331(1) & (2). In what manner could the assignment of either form of shares be effected? Bearer shares: by delivery, 340(1) Registered shares: only when they are registered in the name of the assignee after the name of the assignor is struck out, 341. Belaynew Ashagrie 10/6/2024

Debentures 41 Debenture is a security issued by the company in order to borrow money from the public (from individuals, banks, lending financial sources). Only S.Cs can issue debentures; other forms of BO including PLCs can t issue debentures. A S.C can issue debentures only when the shareholders have cleared their obligations on the shares. Belaynew Ashagrie 10/6/2024

Debentures 42 Forms of Debentures: may be registered or bearer. Registered D. can be transferred where the necessary registration is completed and when the debenture bond is conveyed to the transferee. Bearer D. transferred when the bond is delivered to the transferee. Classes of Debentures: redeemable or irredeemable Redeemable: may be redeemed by the company pursuant to the terms stipulated in the debentures certificate (bond). Irredeemable: will retain them for the life of the company unless the debentures are transferred to third parties. Debentures may also be convertible or inconvertible Belaynew Ashagrie 10/6/2024

Maintenance of capital 43 Proper valuation of contribution in kind (Art. 315) 1. Whether contribution of shareholders is in kind or in cash the amount of share given will be equal to their contribution. Over evaluation or under evaluation has its own negative consequence on the capital of the company. Art 315 of the Comm C is repealled by Proc. No 376/03 and accordingly of contribution in kind is carried on by the shareholders. Belaynew Ashagrie 10/6/2024

Maintenance of capital 44 2. Payment of the unpaid shares (Art. 344(4), (5) and (6) Where the subscriber or the assignee fail to pay the unpaid shares, the company may sale by auction (4). Wherethesale of shares is not effected, the company can forfeit (5) the shares. In such case, the capital of the company has to be reduced to that extent. Belaynew Ashagrie 10/6/2024

Maintenance of capital 45 3. Working within the limit of the purposes of the company The company has to operate a business within the limit of it purposes as provided for in the memorandum of association. Doing out of its purposes will bring danger to the capital of the company. Belaynew Ashagrie 10/6/2024

Maintenance of capital 46 4. Repurchase of shares: In principle, repurchase of shares by the company is prohibited. However, with certain exception it is possible that the company may repurchase its shares. In Ethiopia, these exceptions includes: In the case of redemption (337) and amortization of capital (483) In case when the company forfeit as per Art. 344(5) and withdrawal of shareholders as per Art. 463 Repurchase as per Arts. 332 (when shareholders meeting authorized) Pre-emption right as per Art. 333 (paid from reserve funds) a. b. c. d. Belaynew Ashagrie 10/6/2024

Maintenance of capital 47 Art. 344 Company shall not grant advances nor make loans on its shares A company shall not grant advances on its own shares, nor make loans to enable third parties to acquire shares. Belaynew Ashagrie 10/6/2024

Maintenance of capital 48 5. Cross-holding (Art. 344) Cross-holding in many jurisdictions is not a prohibited act. However, cross-holding is regulated through disclosure of cross-holding. Art. 344(1) Where ten per cent or more of the capital of one company is held by a second company, the first company may not hold shares in the second company. Accordingly, the law imposes on the companies a duty to disclose the percentage of cross-holding. Belaynew Ashagrie 10/6/2024

Maintenance of capital 49 6. Distribution of profits (Art. 456-460) The main prohibition in relation to distribution of profits that intends to maintain the capital of the company is on payment of profit. Profit will not be paid from among the capital of the company. Rather profit has to paid from net profit shown in the approved balance sheet. (Art. 458(1)) Payment of dividend in the absence of profit is punishable criminally and civilly. (458(2)) Belaynew Ashagrie 10/6/2024